CGST Circular 198/2023

| Title | Clarification on issue pertaining to e-invoice |

| Number | 198/2023 |

| Date | 17.07.2023 |

| Download |

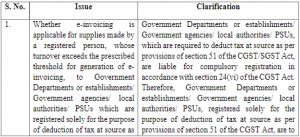

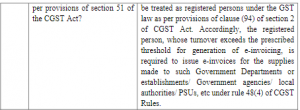

Representations have been received seeking clarification with respect to applicability of e-invoice under rule 48(4) of Central Goods and Services Tax Rues, 2017 (hereinafter referred to as “CGST Rules”) w. r. t supplies made by a registered person, whose turnover exceeds the prescribed threshold for generation of e-invoicing, to Government Departments or establishments/Government agencies/local authorities/PSUs registered solely for the purpose of deduction of tax at source as per provision of section 51 of the Central Goods and Services Tax Act, 2017 (hereinafter referred to as “CGST Act”).

2. In order to clarify the issue and to ensure uniformity in the implementation of the provisions of law across the field formations, the Board, in exercise of its powers conferred by section 168 (1) of the CGST Act, hereby clarifies the issue as under:

3. It is requested that suitable trade notices may be issued to publicize the contents of this Circular.

4. Difficulty, if any, in implementation of this Circular may please be brought to the notice of the Board. Hindi version would follow.