Error in Autopopulation of GSTR-1 from E-Invoices

February 23, 2021Many taxpayers have come across a discrepancy between the auto populated e-Invoicing data in GSTR-1 and the actual e-Invoicing data. Goods and Services Tax Network (GSTN) has issued an advisory in this regard.

Certain notified taxpayers have been issuing invoices after obtaining Invoice Reference Number (IRN) from Invoice Registration Portal (IRP) (commonly referred as ‘e-invoices’). Details from the reported e-invoices are being auto-populated in respective tables of GSTR-1. Update on the same was last published on last published on 11/1/2021.

In the above update, it was informed that while pulling the e-invoice data into GST System, details of some invoices were not getting populated into GSTR-1. Troubleshooting has been done and efforts to correct this inadvertent gap are still on. Complete data pull is likely to take some more time.

Hence, taxpayers are hereby advised not to wait for the complete auto-population, and instead proceed with preparation and filing of GSTR-1 (by the due date), based on actual data as per their records.

Resolution

In light of the above, reconciling the autopopulated details GSTR-1 with actual books of accounts and uploading the differences is not a useful activity. We recommend that taxpayer’s

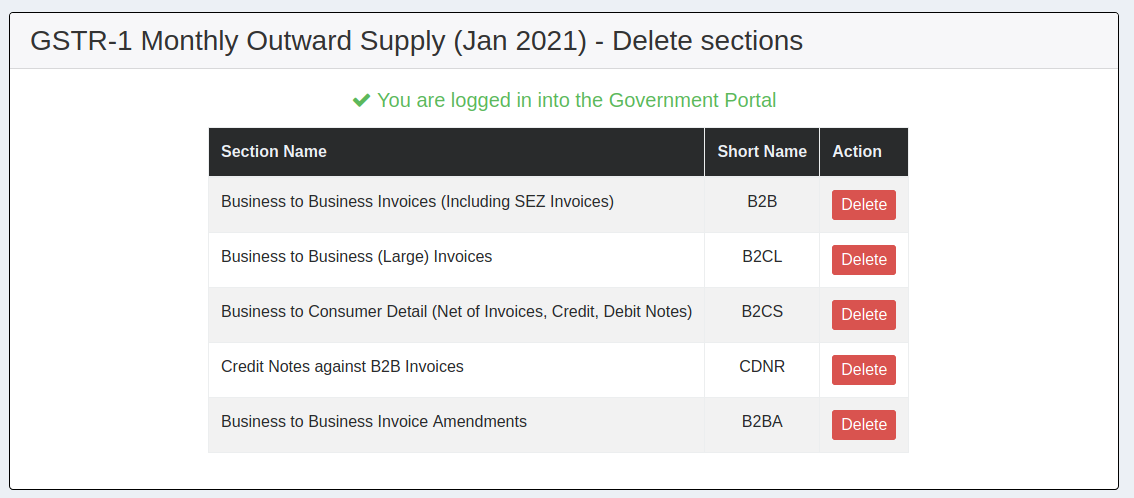

- Clear their GSTR-1 sections (B2B Invoices, Credit Notes, and Export Invoices)

- Upload their GSTR-1 details as per their normal practice

- File the GSTR-1 return

How GSTZen helps in this regard

GSTZen provides an option to clear various sections of GSTR-1. You may use this from the GSTR-1 page of GSTZen.

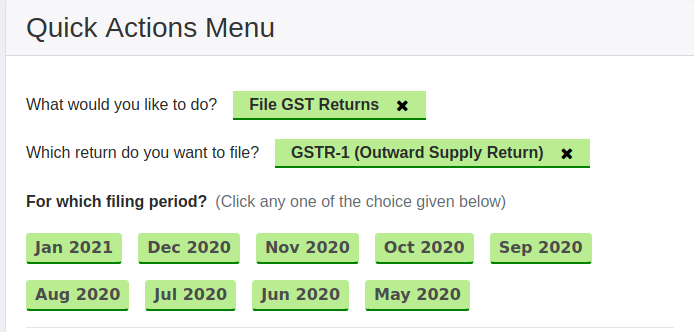

1) Open the GSTR-1 Return for the relevant period from GSTZen’s Quick Action menu.

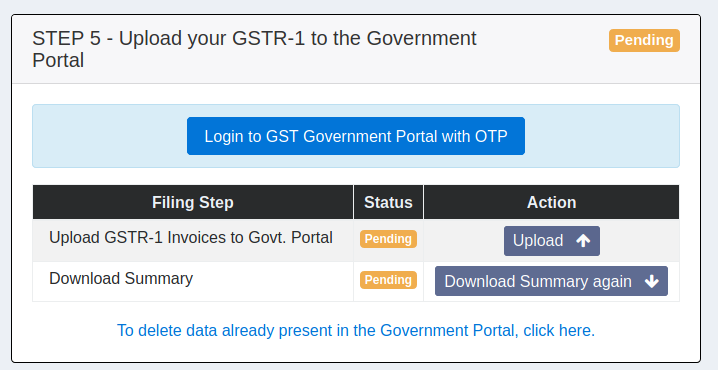

2) Navigate to STEP 5 – Upload your GSTR-1 to the Government Portal

Choose the option to delete data already present in the Government portal.

3) Delete the sections as appropriate and proceed with filing