What is the cost of generating the report?

Year-to-date Consolidated GST Reports with GSTZen

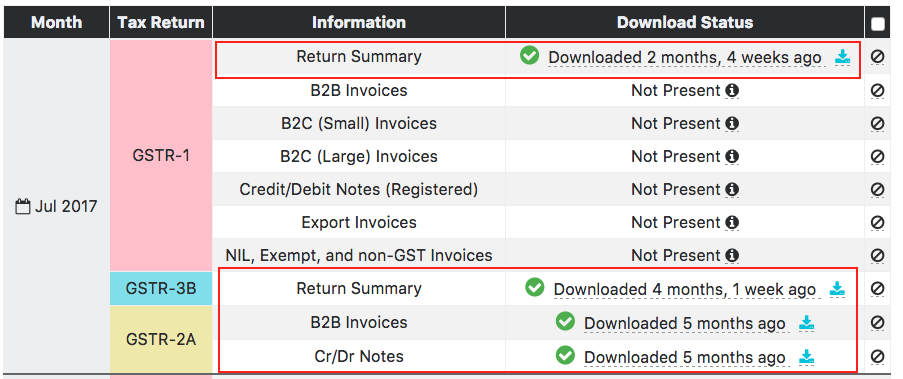

For a taxpayer with less than 200 Invoices per month, the cost of the report for 2017-18 is Rs. 45 (Rupees Forty Five). GSTZen charges you for data transfer to and from the government portal. The cost per data transfer is Rs 1.25. The number of data transfers needed to get data for a month is 4 (1 call for GSTR-1 Summary, 1 call for GSTR-3B Summary, 1 call for GSTR-2A Invoices, and 1 call for GSTR-2A Credit/Debit Notes). The number of data transfer for the year 2017-18 is 9 months x 4 per month = 36 data transfers.

If you want to generate the report only for a particular quarter, the cost will be Rs 15 (Rupees Fifteen).

What is the cost of generating the report?

GSTZen does not charge any amount for producing/viewing the XLSX report. GSTZen charges you for data transfer to and from the Government Portal. The cost per data transfer is 1.25 and the total cost depends on the number of data transfers. The following examples show costs for a Tax Payer with less than 200 invoices a month. For additional invoices add 1 Paisa per Invoice.

Report with summary data alone – Minimum Cost

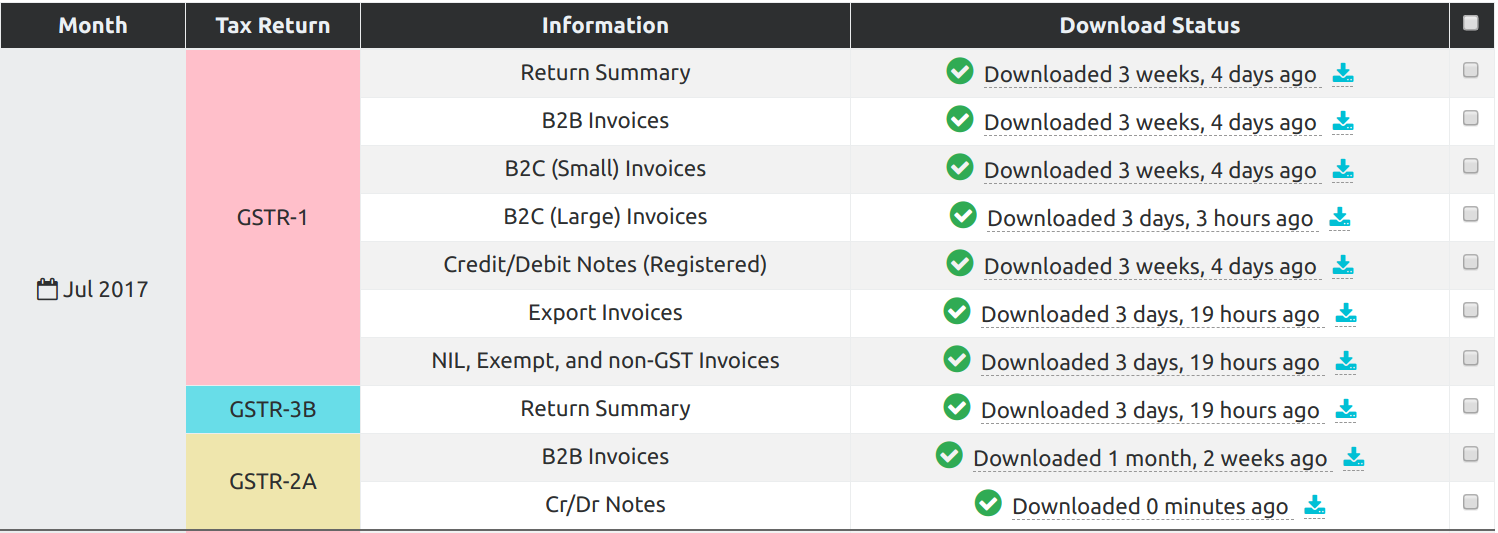

The data transfer cost per month is = 1.25 * 4 = 5 (approx)

For 9-month period Jul 2017 to Mar 2018, the number of calls is 9 * 4 = 36 Calls, costing 36 * 1.25 = 45. Total cost including OTP request from Government Portal = 50 (approx)

Report with detailed information from all sections of the returns – Maximum Cost

The data transfer cost per month is = 1.25 * 10 = 12.5 (approx)

For 9-month period Jul 2017 to Mar 2018, the number of calls is 9 * 10 = 90 Calls, costing 90 * 1.25 = 112.5. Total cost including OTP request from Government Portal = 120 (approx)

Your Books vs GSTR-1 Reconciliation with GSTZen

What is the cost of generating the report?

GSTZen does not charge any amount for producing/viewing the XLSX report. GSTZen charges you for data transfer to and from the Government Portal. The cost per data transfer is 1.25 and the total cost depends on the number of data transfers. The following examples show costs for a Tax Payer with less than 200 invoices a month. For additional invoices add 1 Paisa per Invoice. To know more about please click here

To know How to make payment to your wallet, please click here

GSTR-2A Reconciliation with GSTZen

What is the cost of generating the report?

GSTZen does not charge any amount for producing/viewing the XLSX report. GSTZen charges you for data transfer to and from the Government Portal. The cost per data transfer is 1.25 and the total cost depends on the number of data transfers. The following examples show costs for a Tax Payer with less than 200 invoices a month. For additional invoices add 1 Paisa per Invoice. To know more about please click here

To know How to make payment to your wallet, please click here