Form GST PMT–01

This Form was made and amended vide the following notifications • Central Tax Notification No. 60/2018 (dated 30th October 2018)

Form GST PMT-01 PDF link

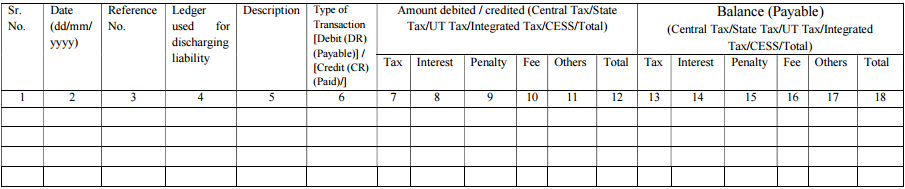

Electronic Liability Register of Registered Person

(Part–I: Return related liabilities)

(To be maintained at the Common Portal)

GSTIN –

Name (Legal) – (Trade name, if any)

Tax Period –

Act –Central Tax/State Tax/UT Tax/Integrated Tax/CESS /All

(Amount in Rs.)

Note –

- All liabilities accruing due to return and payments made against the same will be recorded in this ledger.

- Under description head – liabilities due to opting for composition, cancellation of registration will also be covered in this part. Such liabilities shall be populated in the liability register of the tax period in which the date of application or order falls, as the case may be.

- Return shall be treated as invalid if closing balance is positive. Balance shall be worked out by reducing credit (amount paid) from the debit (amount payable).

- Cess means cess levied under Goods and Services Tax (Compensation to States) Act, 2017.