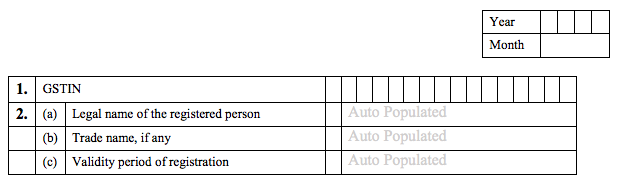

Form GSTR-5

Return for Non-resident taxable person

- Form GSTR-5

- Return for Non-resident taxable person

- FORM GSTR-5 PDF link

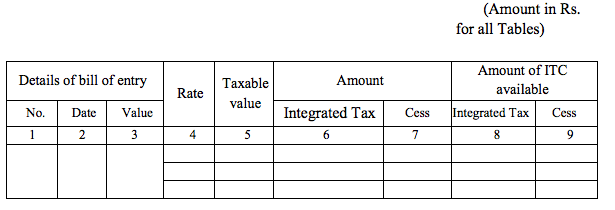

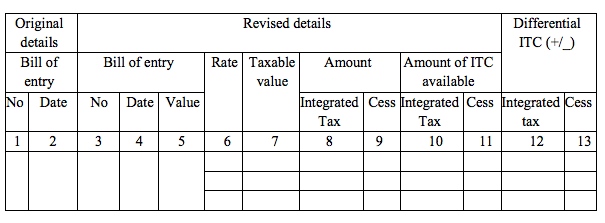

- 3. Inputs/Capital goods received from Overseas (Import of goods)

- 4. Amendment in the details furnished in any earlier return

- 5. Taxable outward supplies made to registered persons (including UIN holders)

- 6. Taxable outward inter-State supplies to un-registered persons where invoice value is more than Rs 2.5 lakh

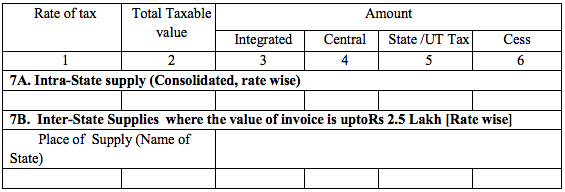

- 7. Taxable supplies (net of debit notes and credit notes) to unregistered persons other than the supplies mentioned at Table 6

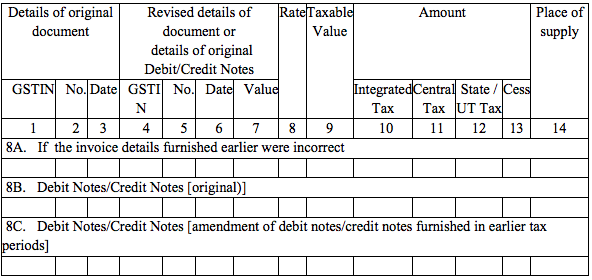

- 8. Amendments to taxable outward supply details furnished in returns for earlier tax periods in Table 5 and 6 [including debit note/credit notes and amendments there of]

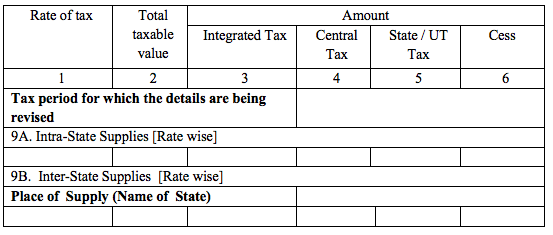

- 9. Amendments to taxable outward suppliesk top/gstr-5-table-8.png unregistered persons furnished in returns for Earlier tax periods in Table 7

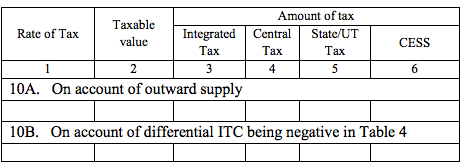

- 10. Total tax liability

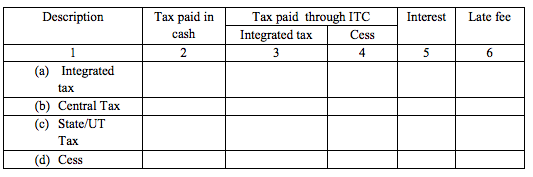

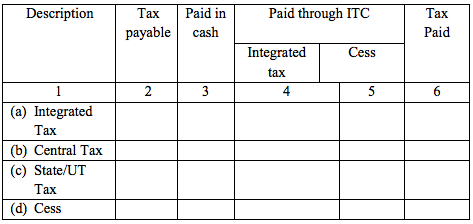

- 11. Tax payable and paid

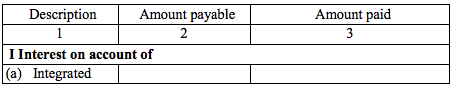

- 12. Interest, late fee and any other amount payable and paid

- 13.Refund claimed from electronic cash ledger

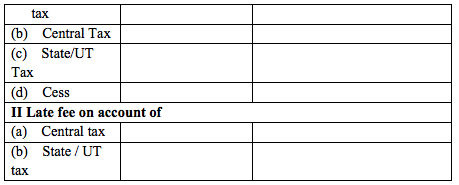

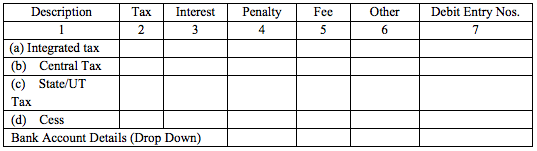

- 14.Debit entries in electronic cash/credit ledger for tax/interest payment [to be populated after payment of tax and submissions of return]

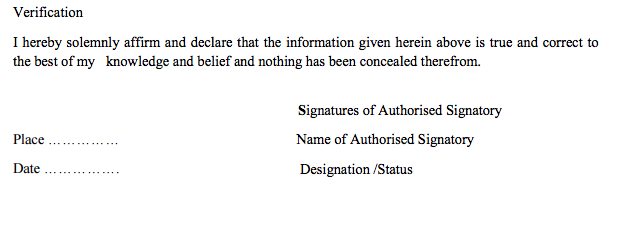

- Return for Non-resident taxable person

FORM GSTR-5 PDF link

Instructions

1) Terms used:

GSTIN: Goods and Services Tax Identification Number

UIN: Unique Identity Number

UQC: Unit Quantity Code

HSN: Harmonized System of Nomenclature

POS: Place of Supply (Respective State)

B to B: From one registered person to another registered person

B to C: From registered person to unregistered person

2) GS-5 is applicable to nonresident taxableperson and it is a monthly return.

3) The details in GSTR5 should be furnished by 20thof the month succeeding therelevant tax period or within 7 days from the last date of the registration whichever isearlier.

3. Inputs/Capital goods received from Overseas (Import of goods)

-

consists of details of import of goods, bill of entry wise and taxpayer has to specify the amount of ITC eligible on such import of goods.

-

Recipient to provide for Bill of Entry information including six digits port code and seven digits bill of entry number.

4. Amendment in the details furnished in any earlier return

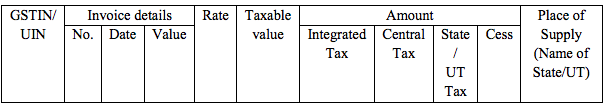

5. Taxable outward supplies made to registered persons (including UIN holders)

6. Taxable outward inter-State supplies to un-registered persons where invoice value is more than Rs 2.5 lakh

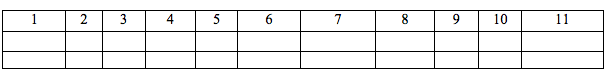

For all B to C supplies (whether inter-State or intra-State) where invoice value is up to Rs. 2,50,000/- State-wise summary of supplies shall be filed in

7. Taxable supplies (net of debit notes and credit notes) to unregistered persons other than the supplies mentioned at Table 6

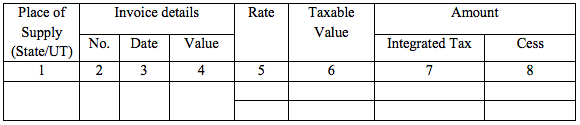

8. Amendments to taxable outward supply details furnished in returns for earlier tax periods in Table 5 and 6 [including debit note/credit notes and amendments there of]

Table 8 consists of amendments in respect of-i.B2B outward supplies declared in the previous tax period;i―B2C interState invoices where invoice value is more than 2.5 lakhs‖ reportedin the previous tax period; andiiiOriginal Debit and credit note details and its amendments.

9. Amendments to taxable outward suppliesk top/gstr-5-table-8.png unregistered persons furnished in returns for Earlier tax periods in Table 7

10. Total tax liability

11. Tax payable and paid

12. Interest, late fee and any other amount payable and paid

13.Refund claimed from electronic cash ledger

14.Debit entries in electronic cash/credit ledger for tax/interest payment [to be populated after payment of tax and submissions of return]