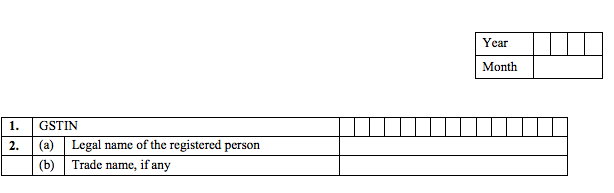

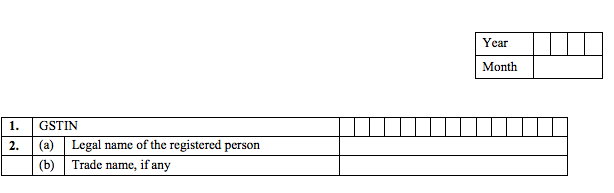

Form GSTR-6

Return for input service distributor

- Form GSTR-6

- Return for input service distributor

- FORM GSTR-6 PDF link

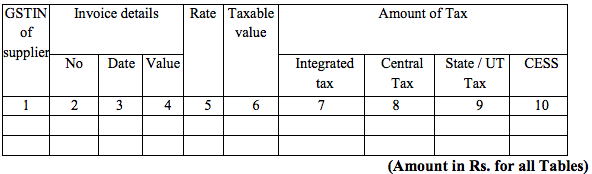

- 3. Input tax credit received for distribution

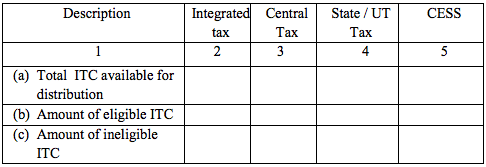

- 4. Total ITC/Eligible ITC/Ineligible ITC to be distributed for tax period (From Table No. 3)

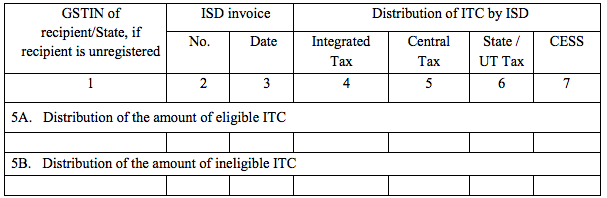

- 5. Distribution of input tax credit reported in Table 4

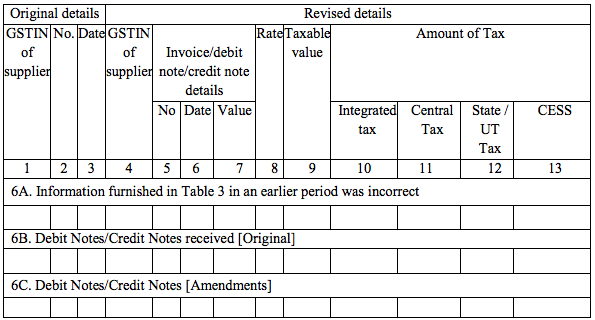

- 6.Amendments in information furnished in earlier returns in Table No. 3

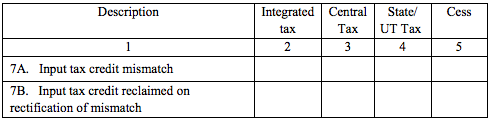

- 7. Input tax credit mis-matches and reclaims to be distributed in the tax period

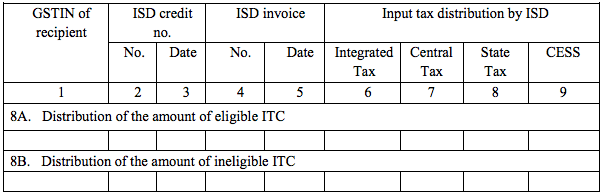

- 8. Distribution of input tax credit reported in Table No. 6 and 7 (plus / minus)

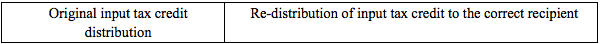

- 9. Redistribution of ITC distributed to a wrong recipient (plus / minus)

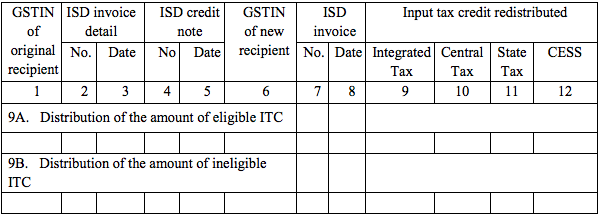

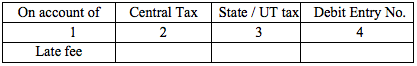

- 10. Late Fee

- 11. Refund claimed from electronic cash ledger

- Return for input service distributor

FORM GSTR-6 PDF link

Instructions:-

1) Terms Used :-

- GSTIN :- Goods and Services Tax Identification Number

- ISD :- Input Service Distributor

- ITC:- Input tax Credit.

2) GSTR:-6 can only be filed only after 10 th of the month and before 13 th of the month succeeding the tax period.

3) ISD details will flow to Part B of GSTR- 2A of the Registered Recipients Units on filing of GSTR- 6.

4 ) ISD will not have any reverse charge supplies. If ISD wants to take reverse charge supplies, then in that case ISD has to separately register as Normal taxpayer.

5) ISD will have late fee and any other liability only.

6) ISD has to distribute both eligible and ineligible ITC to its Units in the same tax period in which the inward supplies have been received.

7) Ineligible ITC will be in respect of supplies made as per Section 17(5).

8) Mismatch liability between GSTR-1 and GSTR-6 will be added to ISD and further ISD taxpayer has to issue ISD credit note to reduce the ITC distributed earlier to its registered recipients units.

3. Input tax credit received for distribution

4. Total ITC/Eligible ITC/Ineligible ITC to be distributed for tax period (From Table No. 3)

5. Distribution of input tax credit reported in Table 4

6.Amendments in information furnished in earlier returns in Table No. 3

7. Input tax credit mis-matches and reclaims to be distributed in the tax period

Table 7 in respect of mismatch liability will be populated by the system.

8. Distribution of input tax credit reported in Table No. 6 and 7 (plus / minus)

9. Redistribution of ITC distributed to a wrong recipient (plus / minus)

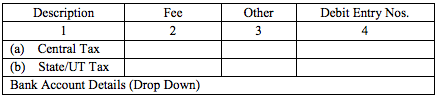

10. Late Fee

11. Refund claimed from electronic cash ledger

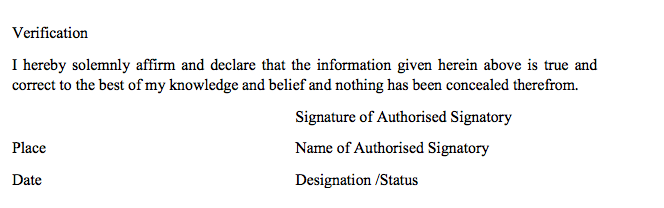

Refund claimed from cash ledger through Table 11 will result in a debit entry in electronic cash ledger