GSTR4 Offline Tool: An Overview

The Excel based GSTR4 Offline Tool is designed to help taxpayer to prepare their GSTR4 return offline.

Details for following sections of GSTR4 return can be added by taxpayer using the Offline Tool:

- Worksheet 4A&B (B2B) – Inward supplies received from a registered supplier (including attracting reverse charge).

- Worksheet 5A (B2BA) – Amendment of Inward Supplies received from a registered supplier (including attracting reverse charge).

- Worksheet 4C(B2BUR) – Inward supplies received from unregistered supplier

- Worksheet 5A (B2BURA) – Amendment of Inward supplies received from unregistered supplier

- Worksheet 4D(IMPS) – Import of services

- Worksheet 5A(IMPSA) – Amendment of Import of services.

- Worksheet 5B(CDNR) – Debit Notes/Credit Notes (for registered)

- Worksheet 5C(CDNRA) – Amendment of Debit Notes/Credit Notes (for registered)

- Worksheet 5B (CDNUR) – Debit Notes/Credit Notes (for unregistered)

- Worksheet 5C(CDNURA) – Amendment of Debit Notes/Credit Notes (for Unregistered)

- Worksheet 6(TXOS) -Tax on outward supplies made (Net of advance and goods returned)

- Worksheet 7(TXOSA) – Amendments of Tax on outward supplies made (Net of advance and goods returned)

- Worksheet 8A(AT) – Advance amount paid for reverse charge supplies in the tax period

- Worksheet 8A-II(ATA) – Amendment of Advance amount paid for reverse charge supplies in the tax period

- Worksheet 8B(ATADJ) – Advance amount on which tax was paid in earlier period but invoice has been received in the current period

- Worksheet 8B-II(ATADJA) – Amendment of Advance amount on which tax was paid in earlier period but invoice has been received in the current period

NOTE: Table 5B. Debit Notes/ Credit Notes [original)] has been divided in two sub-sections Debit Notes / Credit Notes received from Registered and Unregistered person for ease of data entry

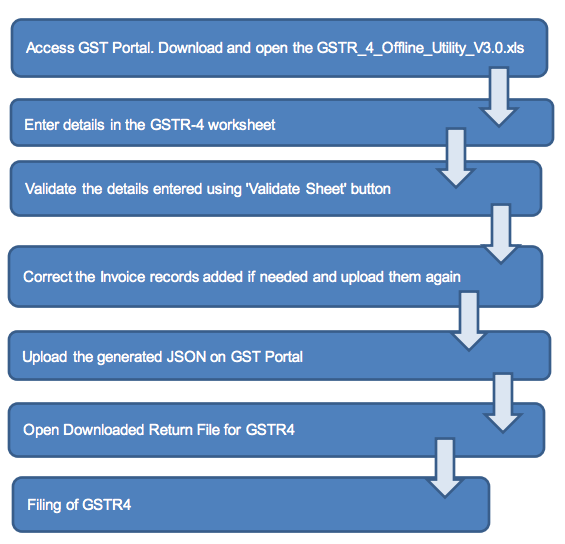

Downloading GSTR4 Offline Tool and Uploading GSTR4 details