Integrated Tax Notifications (Rate)

IGST Notification rate 01/2017

| Title | Integrated Goods and Services Tax Act, 2017 (13 of 2017), the Central Government, on the recommendations of the Council, hereby notifies the rate of the integrated tax. |

| Number | 01/2017 |

| Date | 28-06-2017 |

| Download | |

1) In exercise of the powers conferred by sub-section (1) of section 5 of the Integrated Goods and Services Tax Act, 2017 (13 of 2017), the Central Government, on the recommendations of the Council, hereby notifies the rate of the integrated tax of-

(i) 5 per cent. in respect of goods specified in Schedule I,

(ii) 12 per cent. in respect of goods specified in Schedule II,

(iii) 18 per cent. in respect of goods specified in Schedule III,

(iv) 28 per cent. in respect of goods specified in Schedule IV,

(v) 3 per cent. in respect of goods specified in Schedule V, and

(vi) 0.25 per cent. in respect of goods specified in Schedule VI appended to this notification (hereinafter referred to as the said Schedules), that shall be levied on inter-State supplies of goods, the description of which is specified in the corresponding entry in column (3) of the said Schedules, falling under the tariff item, subheading, heading or Chapter, as the case may be, as specified in the corresponding entry in column (2) of the said Schedules.

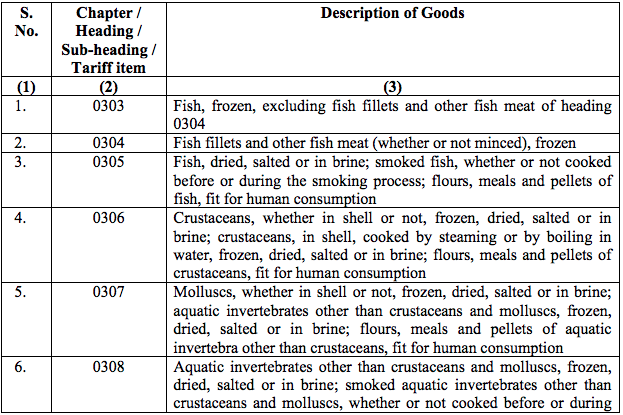

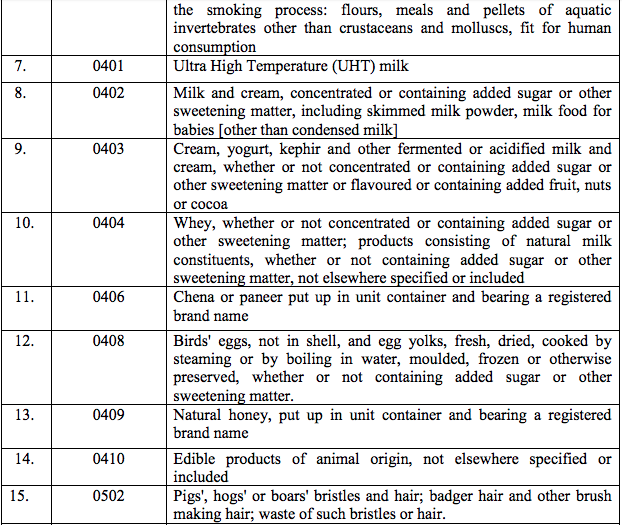

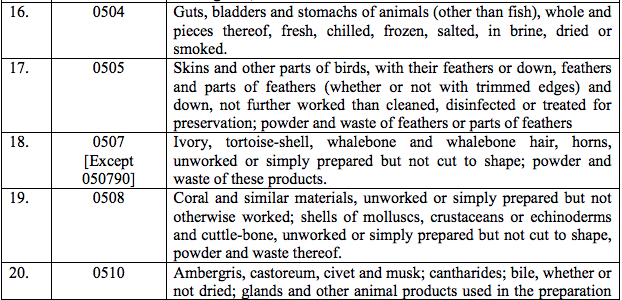

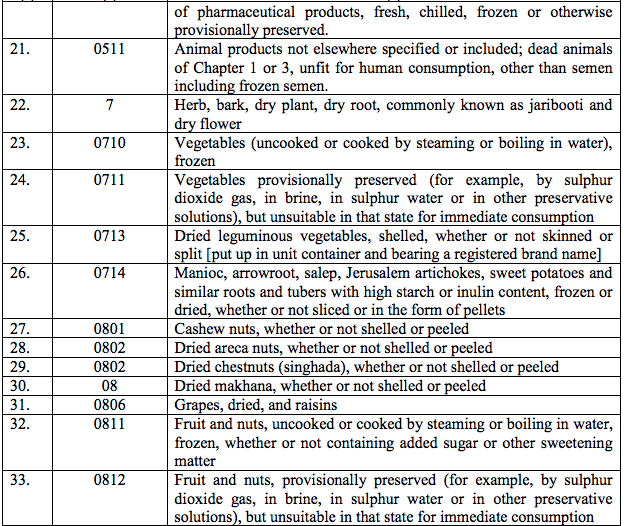

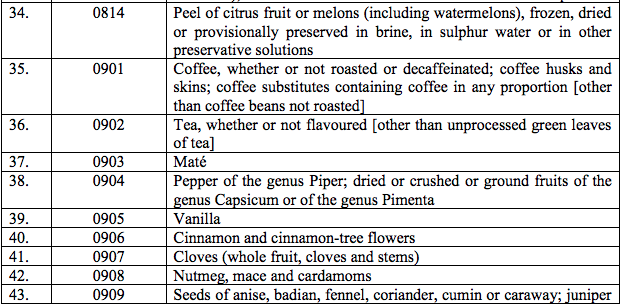

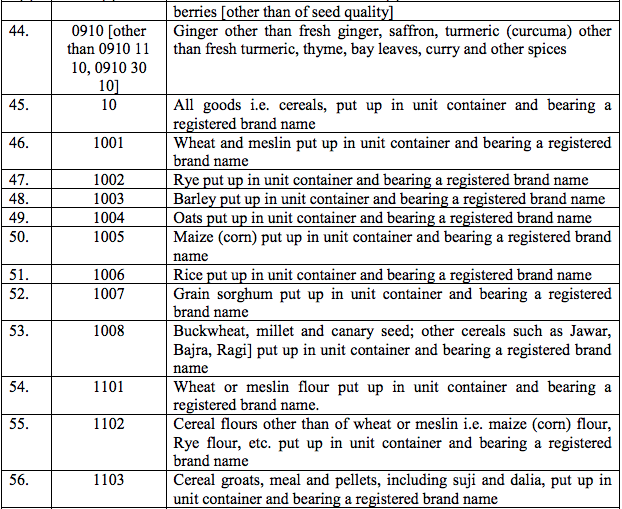

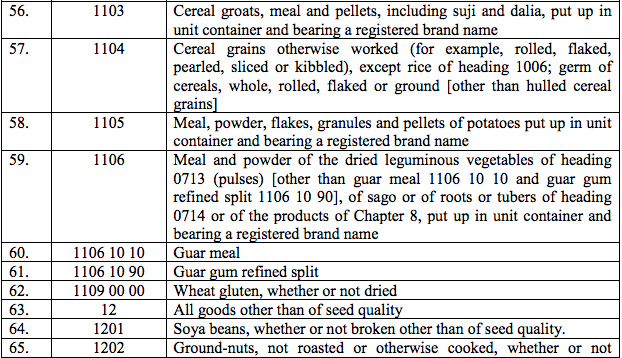

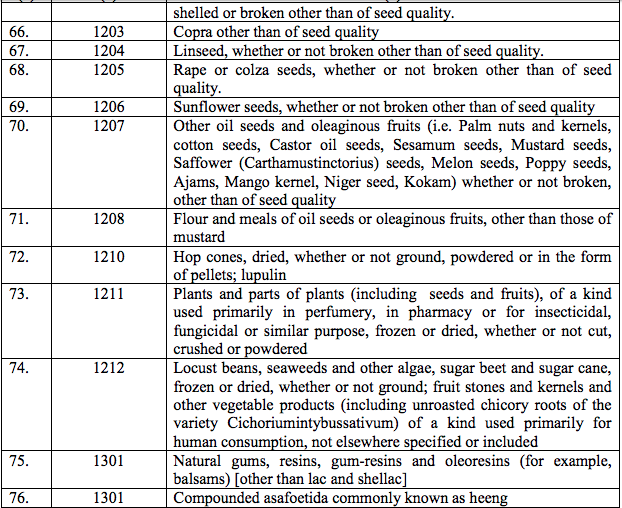

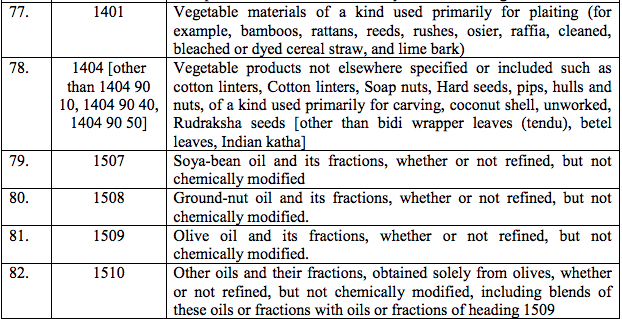

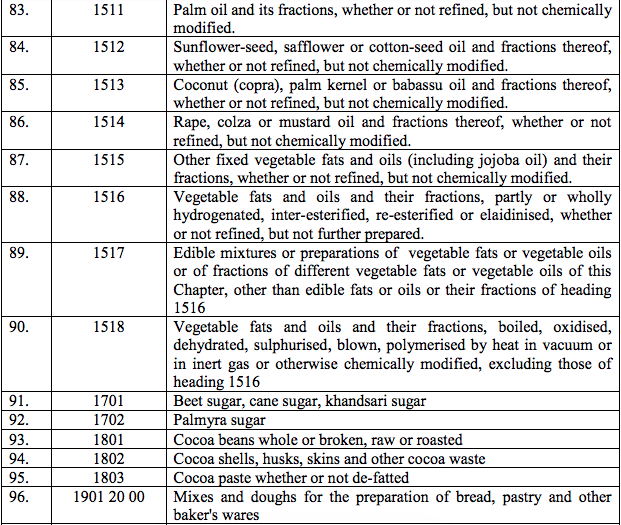

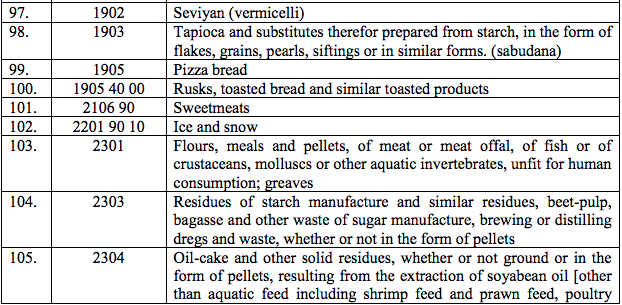

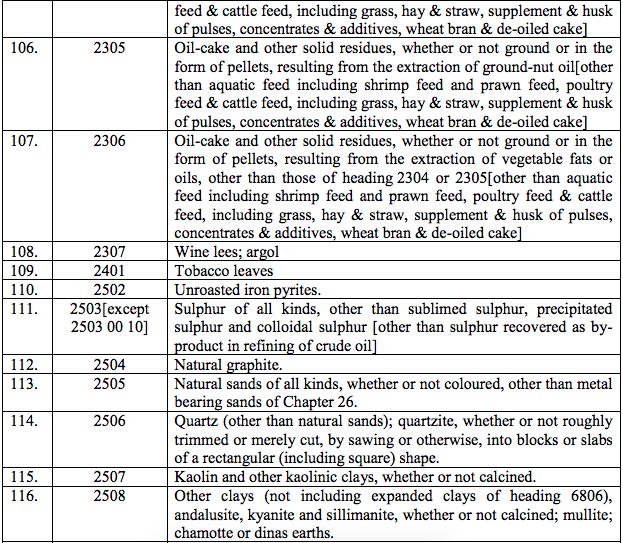

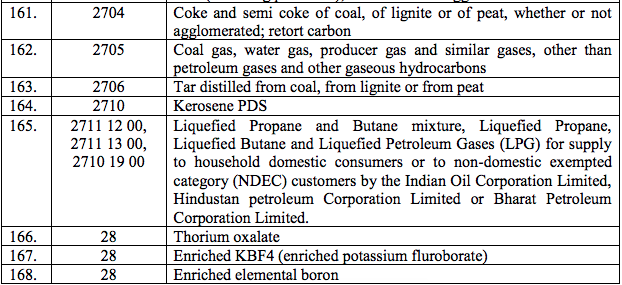

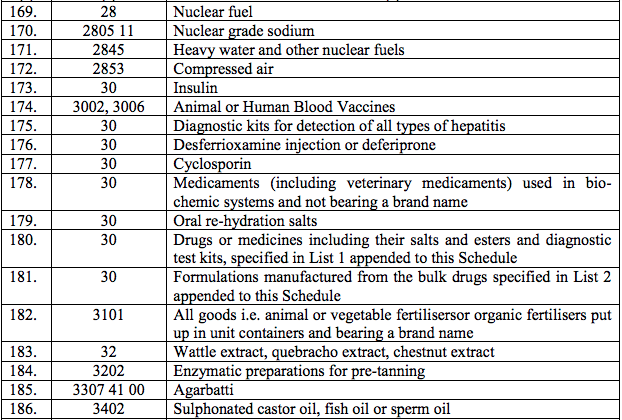

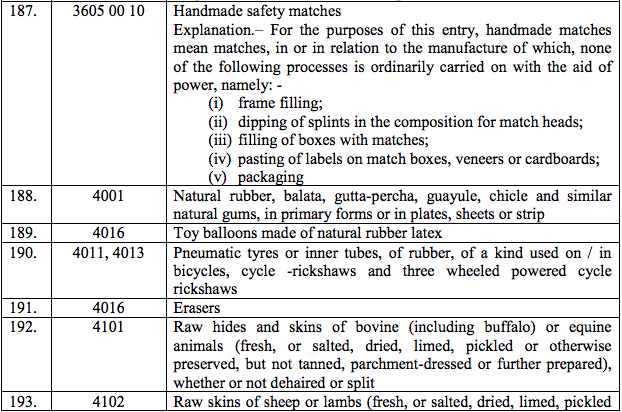

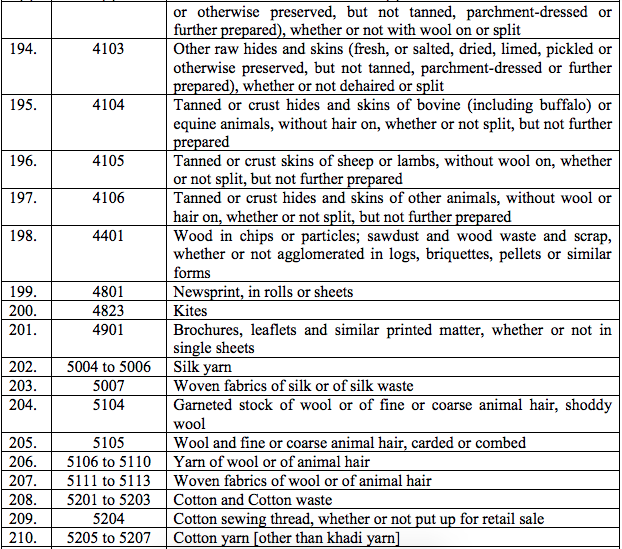

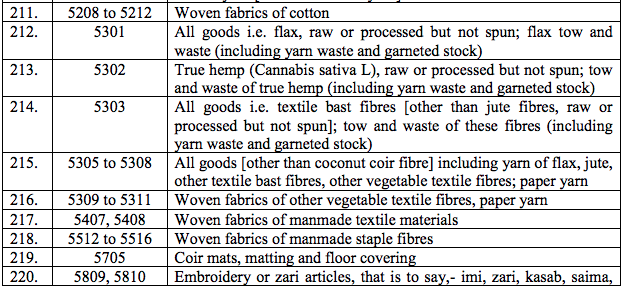

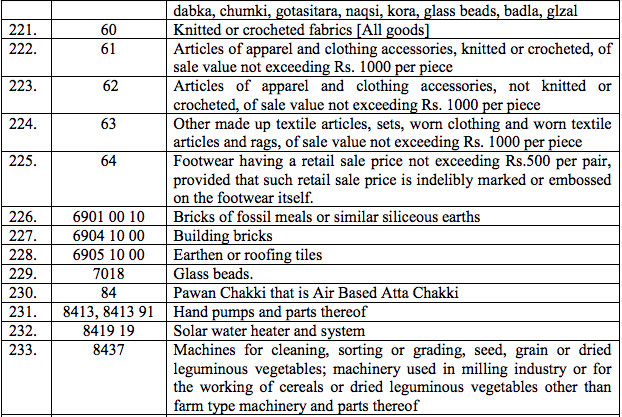

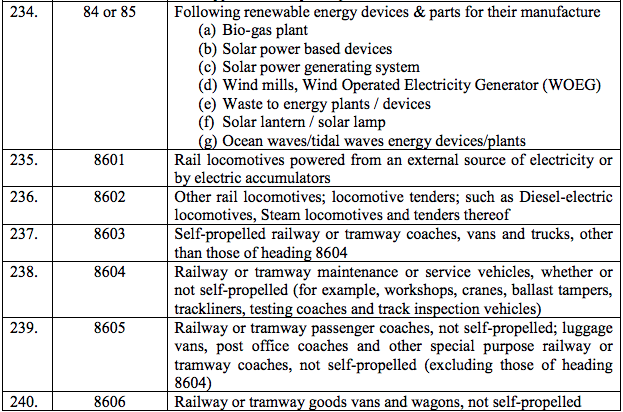

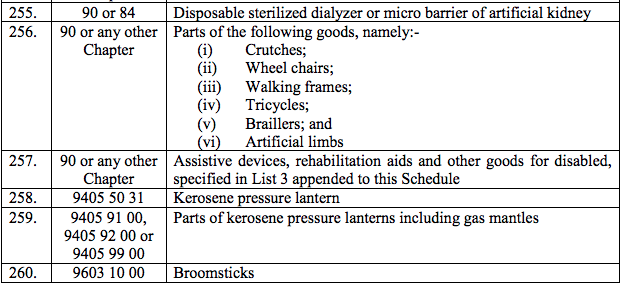

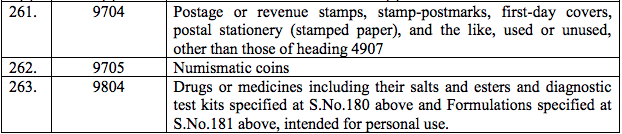

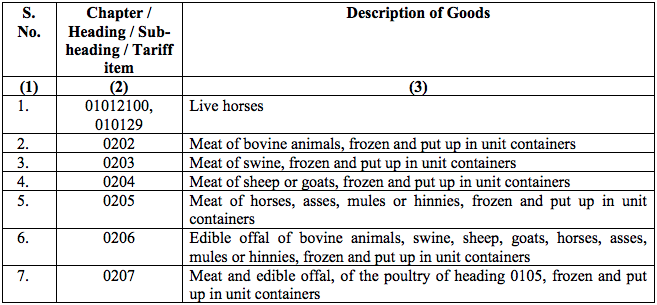

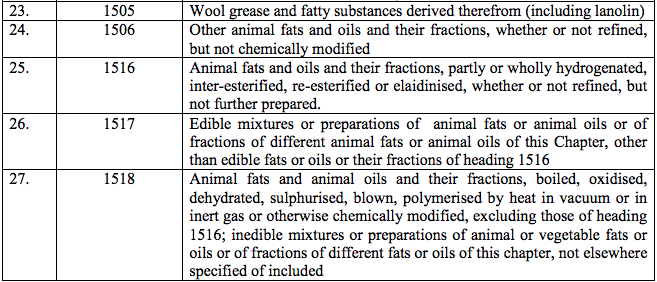

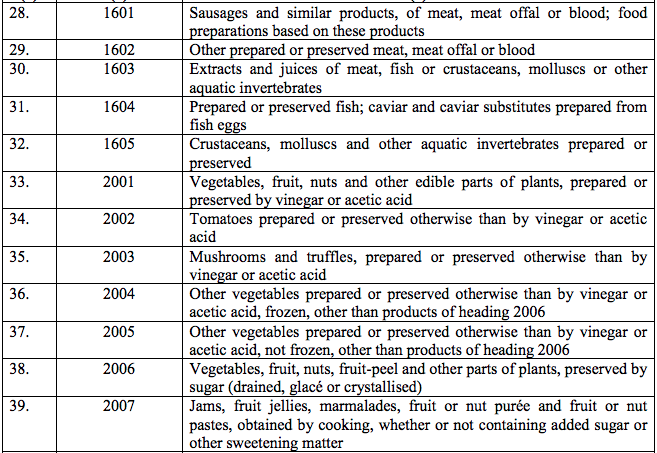

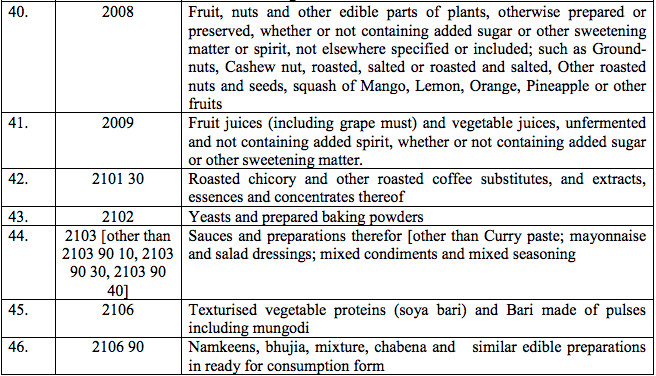

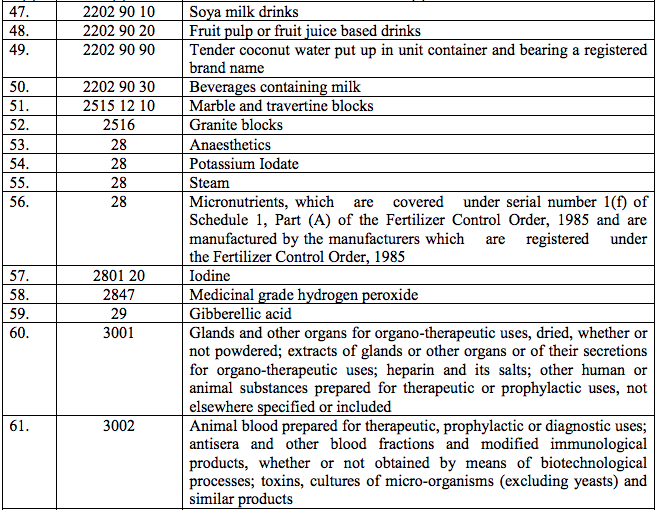

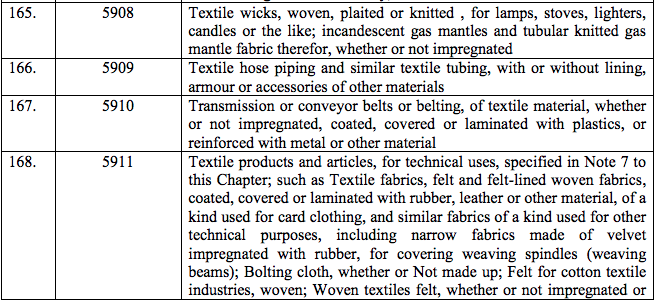

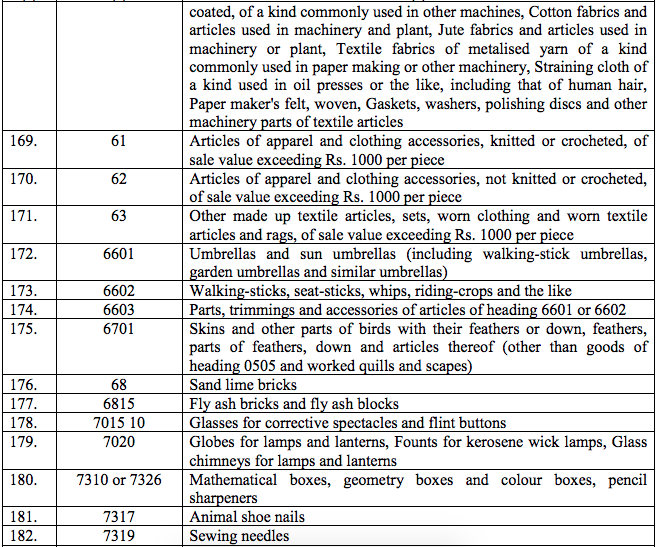

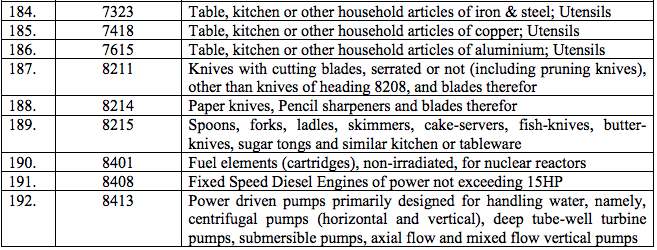

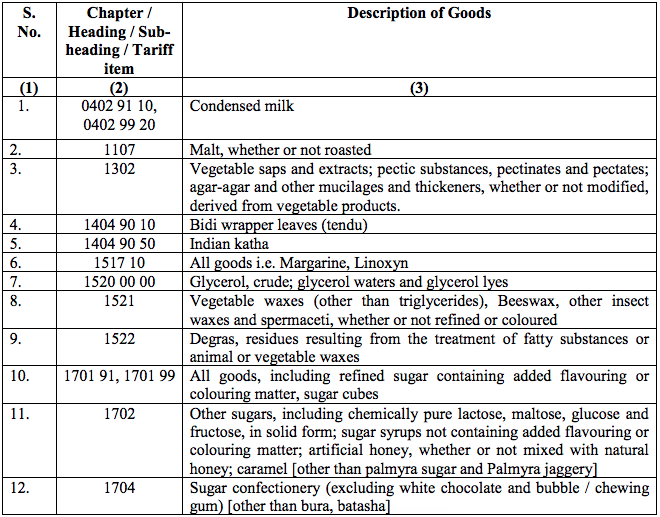

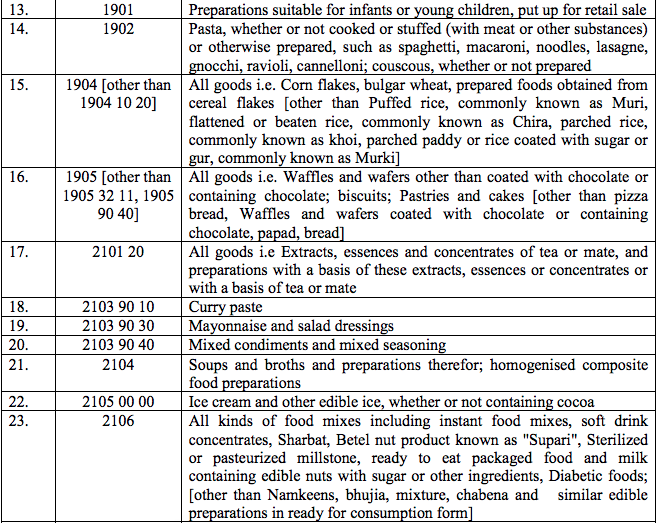

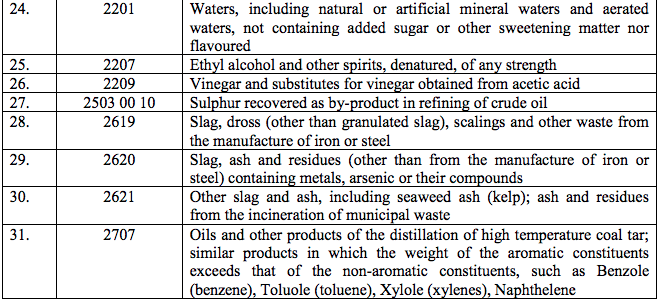

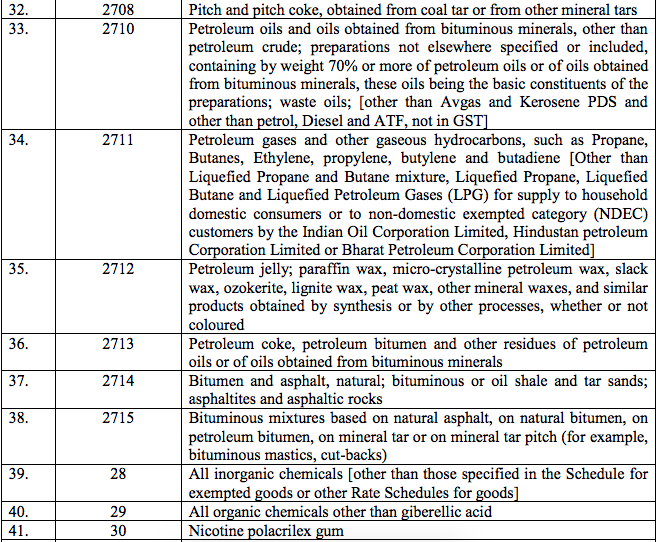

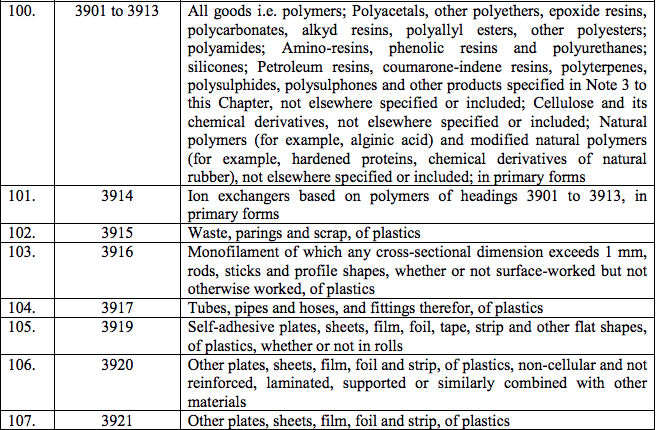

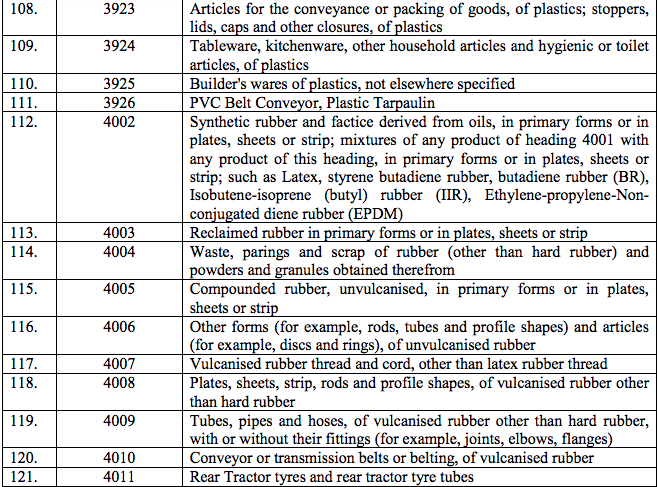

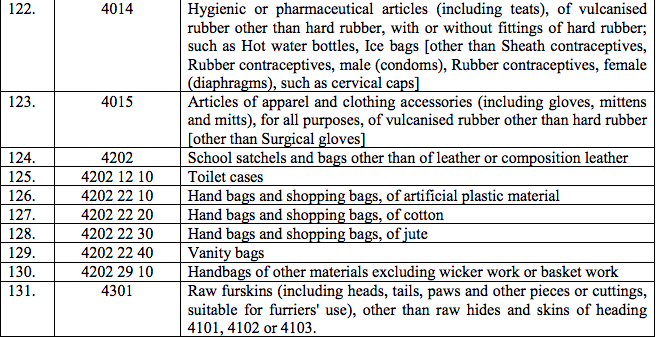

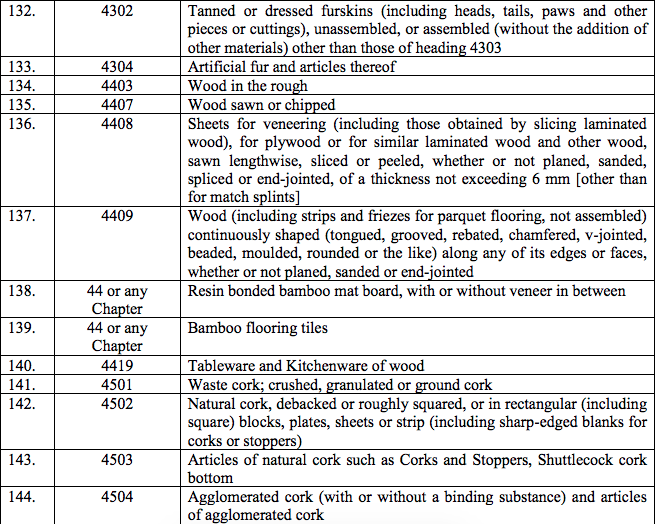

Schedule I – 5%

List 1 [See S.No.180 of the Schedule I]

(1) Amikacin

(2) Amphotericin-B

(3) Amrinone

(4) Aprotinin

(5) Baclofen

(6) Bleomycin

(7) Busulphan

(8) BCG vaccine, Iopromide, Iotrolan

(9) Chlorambucil

(10) Chorionic Gonadotrophin

(11) Clindamycin

(12) Cyclophosphamide

(13) Dactinomycin

(14) Daunorubicin

(15) Desferrioxamine

(16) Dimercaprol

(17) Disopyramide phosphate

(18) Dopamine

(19) Eptifibatide

(20) Glucagon

(21) Hydroxyurea

(22) Isoprenaline

(23) Isoflurane

(24) Lactulose

(25) Lomustine

(26) Latanoprost

(27) Melphalan

(28) Mesna

(29) Methotrexate

(30) MMR (Measles, mumps and rubella) vaccine

(31) Mustin Hydrochloride

(32) Pancuronium Bromide

(33) Praziquantel

(34) Protamine

(35) Quinidine

(36) Sodium Cromoglycate spin caps and cartridges

(37) Sodium Hyalauronatesterile 1% and 1.4% solution

(38) Somatostatin

(39) Strontium Chloride (85Sr.)

(40) Thioguanine

(41) Tobramycin

(42) TetanusImmunoglobin

(43) Typhoid Vaccines:

(a) VI Antigen of Salmonella Typhi, and

(b) Ty2la cells and attenuated non-pathogenic strains of S.Typhi

(44) Tretinoin

(45) Tribavirin / Ribavirin

(46) Urokinase

(47) Ursodeoxycholic Acid

(48) Vancomycin

(49) Vasopressin

(50) Vecuronium Bromide

(51) Zidovudine

(52) 5-Fluorouracil

(53) Pegulated Liposomal Doxorubicin Hydrochloride injection

(54) Ketoanalogue preparation of essential amino acids

(55) Pergolide

(56) Kit for bedside assay of Troponin-T

(57) Solution for storing, transporting, flushing donor organs for transplant

(58) Miltefosine

(59) Milrinone Lactate

(60) Methoxy Isobutile Isonitrile (MIBI)

(61) Haemophilus Influenzae Type b Vaccine

(62) Mycophenolate Sodium

(63) Verteporfin

(64) Daclizumab

(65) Ganciclovir

(66) Drotrecoginalfa (activated)

(67) Eptacogalfa activated recombinant coagulation factor VIIa

(68) Muromonab CD3

(69) Japanese encephalitis vaccine

(70) Valganciclovir

(71) Low molecular weight heparin

(72) Efavirenz

(73) Emtricitabine;

(74) Azathioprine;

(75) Antinomycin D;

(76) Cytosine Arabinoside (Cytarabine);

(77) Vinblastine Sulphate

(78) Vincristine;

(79) Eurocollins Solution;

(80) Everolimus tablets/dispersible tablets;

(81) Poractant alfa

(82) Troponin-I whole blood test kit;

(83) Blower/mister kit for beating heart surgery;

(84) Fluoro Enzyme Immunoassay Diagnostic kits.

(85) Tablet Telbivudine

(86) Injection Exenatide

(87) DTaP-IPV-Hibor PRP-T combined Vaccine

(88) Pneumococcal-7 Valent Conjugate Vaccine(Diphtheria CRM197 Protein)

(89) Injection Thyrotropin Alfa

(90) Injection Omalizumab.

(91) Abatacept

(92) Daptomycin

(93) Entacevir

(94) Fondaparinux Sodium

(95) Influenza Vaccine

(96) Ixabepilone

(97) Lapatinib

(98) Pegaptanib Sodium injection

(99) Suntinib Malate

(100) Tocilizumab

(101) Agalsidase Beta

(102) Anidulafungin

(103) Capsofungin acetate

(104) Desflurane USP

(105) Heamostatic Matrix with Gelatin and human Thrombin

(106) Imiglucerase

(107) Maraviroc

(108) Radiographic contrast media (Sodium and Meglumine ioxitalamate, Iobitridol and Sodium and meglumine ioxaglate)

(109) Sorafenib tosylate

(110) Varenciline tartrate

(111) 90 Yttrium

(112) Nilotinib

(113) Pneumococcal acchride Conjugate vaccine adsorbed 13-valent suspension for injection

(114) Micafungin sodium for injection

(115) Bevacizumab

(116) Raltegravir potassium

(117) Rotavirus Vaccine (Live Oral Pentavalent)

(118) Pneumococcal Polysaccharide Vaccine

(119) Temsirolimus Concentrate for infusion for injection

(120) Natalizumab

(121) Octreotide

(122) Somatropin

(123) Aurothiomalate Sodium

(124) Asparaginase

(125) Agglutinating Sera

(126) Anti-Diphtheria Normal Human Immunoglobulin

(127) Anti-human lymophocyte immunoglobulin IV

(128) Anti-human thymocyte immunoglobulin IV

(129) Anti-Pertussis Normal Human Immunoglobulin

(130) Anti-Plague serum

(131) Anti-Pseudomonas Normal Human Immunoglobulin

(132) Basiliximab

(133) Beractant Intra-tracheal Suspension

(134) Blood group sera

(135) Botulinum Toxin Type A

(136) Burn therapy dressing soaked in gel

(137) Bovine Thrombin for invitro test for diagnosis in Haemorrhagic disorders

(138) Bovine Albumin

(139) Bretyleum Tossylate

(140) Calcium Disodium Edetate

(141) Carmustine

(142) Cesium Tubes

(143) Calcium folinate

(144) Cholestyramine

(145) Christmas Factor Concentrate (Coagulation factor IX prothrombin complex concentrate)

(146) Cobalt-60

(147) Corticotrophin

(148) Cyanamide

(149) Diagnostic Agent for Detection of Hepatitis B Antigen

(150) Diagnostic kits for detection of HIV antibodies

(151) Diphtheria Antitoxin sera

(152) Diazoxide

(153) Edrophonium

(154) Enzyme linked Immunoabsorbent Assay kits [ELISA KITS]

(155) Epirubicin

(156) Fibrinogen

(157) Floxuridine

(158) Flucytosin

(159) Flecainide

(160) Fludarabine Phosphate

(161) Foetal Bovine Serum (FBS)

(162) Gadolinium DTPA Dimeglumine

(163) Gallium Citrate

(164) Gasgangrene Anti-Toxin Serum

(165) Goserlin Acetate

(166) Hepatitis B Immunoglobulin

(167) Hexamethylmelamine

(168) Hydralazine

(169) Idarubicine

(170) Idoxuridine

(171) Immuno assay kit for blood Fibrinogen degradation product for direct estimation for diagnostic test in D.I.C.

(172) Inactivated rabies vaccine [Human diploid cell]

(173) Inactivated rabies vaccine [Vero-cell]

(174) Intravenous amino acids

(175) Intravenous Fat Emulsion

(176) Iopamidol

(177) Iohexol

(a) Indium(III) inbleomycin

(b) Indium113 Sterile generator and elution accessories

(c) Indium113 in brain scanning kit

(d) Indium113 in liver scanning kit

(178) Iscador, CLIA diagnostic kits

(179) Levodopa with benserazine

(180) Lenograstim

(181) Meningococcoal A and C combined vaccine with diluant solvent

(182) Methicillin

(183) Metrizamide Inj with diluant

(184) Monocomponent insulins

(185) Mycophenolate Mofetil

(186) Normal Human plasma

(187) Normal Human immunoglobulin

(188) Nuclear magnetic resonance contrast agent

(189) Normal Human serum Albumin

(190) Penicillamine

(191) Pentamidine

(192) Penicillinase

(193) Poliomyelitis vaccine (inactivated and live)

(194) Potassium Aminobenzoate

(195) Porcine Insulin Zinc Suspension

(196) Prednimustine

(197) Porcine and Bovine insulin

(198) Purified Chick Embryo Cell Rabies Vaccine

(199) Pyridostigmine

(200) Pneumocystis cariniiI F kits

(201) Prostaglandin E1 (PGE1)

(202) Radio-immunoassay kit for hormones (T3, T4, TSH Insulin, Glucogen, Growth Hormone, Cortisol, L. H., FSH and Digoxin)

(203) Radioisotope TI 201

(a) Rabbit brains thromboplastin for PT test

(b) Reagent for PT tests (c) Human Thrombin for TT tests

(204) Rabies immune globulin of equine origin

(205) Sevoflurane

(206) Recuronium Bromide

(207) Septopal beads and chains

(208) Sodium Arsenate

(209) Freeze Dried Form of Human Follicle Stimulating and Luteinising Hormones

(210) Solution of Nucleotides and Nucliosides

(211) Specific Desensitizing Vaccine

(212) Sterile Absorbable Haemostat for control of surgical vessel bleeding

(213) Strontium SR-89 Chloride

(214) Suxamethonium Chloride

(215) Selenium-75

(216) Teicoplanin

(217) Tetrofosmin

(218) Ticarcillin

(219) Tranexamic Acid

(220) Tocainide

(221) Tri-iodothyronine

(222) Triethylene Tetramine

(223) Thrombokinase

(224) Teniposide

(225) Trans-1-diamino cyclohexane Oxalatoplatinum

(226) Ticarcillin Disodium and Potassium Clavulanate combination

(227) Vindesin Sulphate

(228) X-ray diagnostic agents, the following:-

(a) Propylidone

(b) Ethyliodophenylundecylate

(c) Iodipammide methyl glucamine

(d) Lipidollutra fluid

(e) Patentblue

(f) Zalcitabine

(229) Zoledronic Acid

(230) Anti-Haemophilic Factors Concentrate (VIII and IX)

List 2 [See S.No.181 of the Schedule I]

(1) Streptomycin

(2) Isoniazid

(3) Thiacetazone

(4) Ethambutol

(5) Sodium PAS

(6) Pyrazinamide

(7) Dapsone

(8) Clo- fazamine

(9) Tetracycline Hydrochloride

(10) Pilocarpine

(11) Hydrocortisone

(12) Idoxuridine

(13) Acetazolamide

(14) Atro- pine

(15) Homatroprn

(16) Chloroquine

(17) Amodiaquine

(18) Quinine

(19) Pyrimethamine

(20) Sulfametho pyrezine

(21) Diethyl Carbamazine

(22) Arteether or formulation of artemisinin.

List 3 [See S.No.257 of the Schedule I]

(A) (1) Braille writers and braille writing instruments

(2) Hand writing equipment Braille Frames, Slates, Writing Guides, Script Writing Guides, Styli, Braille Erasers

(3) Canes, Electronic aids like the Sonic Guide

(4) Optical, Environmental Sensors

(5) Arithmetic aids like the Taylor Frame (arithmetic and algebra types), Cubarythm, Speaking or Braille calculator

(6) Geometrical aids like combined Graph and Mathematical Demonstration Board, Braille Protractors, Scales, Com- passes and Spar Wheels

(7) Electronic measuring equipment, such as calipers, micrometers, comparators, gauges, gauge blocks Levels, Rules, Rulers and Yardsticks

(8) Drafting, Drawing aids, tactile displays

(9) Specially adapted clocks and watches

(B) (1) Orthopaedic appliances falling under heading No. 90.21 of the First Schedule

(2) Wheel chairs falling under heading No. 87.13 of the First Schedule

(C) Artificial electronic larynx and spares thereof

(D) Artificial electronic ear (Cochlear implant)

(E) (1) Talking books (in the form of cassettes, discs or other sound reproductions) and large-print books, braille embossers, talking calculators, talking thermometers

(2) Equipment for the mechanical or the computerized production of braille and recorded material such as braille computer terminals and displays, electronic braille, transfer and pressing machines and stereo typing machines

(3) Braille paper

(4) All tangible appliances including articles, instruments, apparatus, specially designed for use by the blind

(5) Aids for improving mobility of the blind such as electronic orientation and obstacle detectbn appliance and white canes

(6) Technical aids for education, rehabilitation, vocational training and employment of the blind such as Braille typewriters, braille watches, teaching and learning aids, games and other instruments and vocational aids specifically adapted for use of the blind

(7) Assistive listening devices, audiometers

(8) External catheters, special jelly cushions to prevent bed sores, stair lift, urine collection bags

(9) Instruments and implants for severely physically handicapped patients and joints replacement and spinal instru- ments and implants including bone cement.

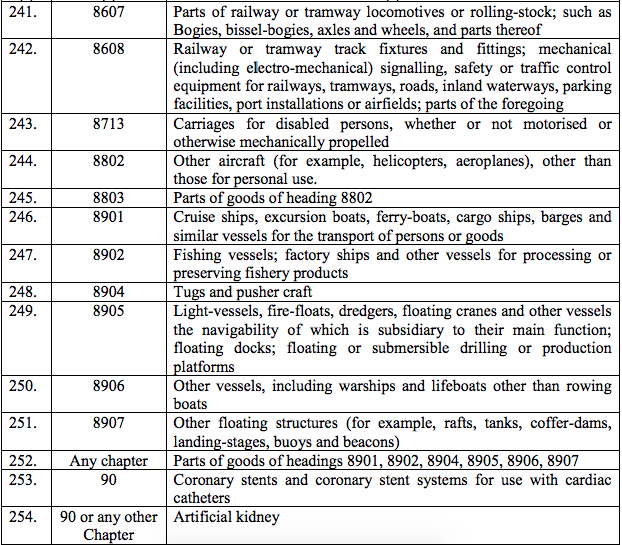

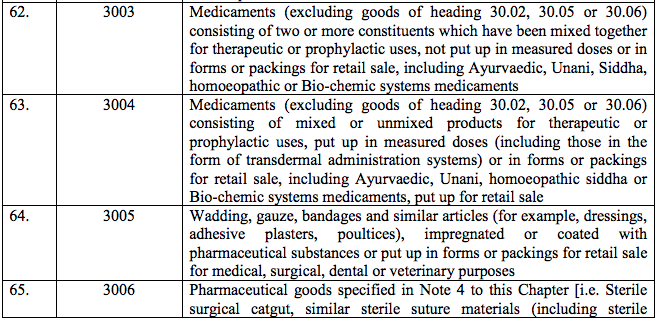

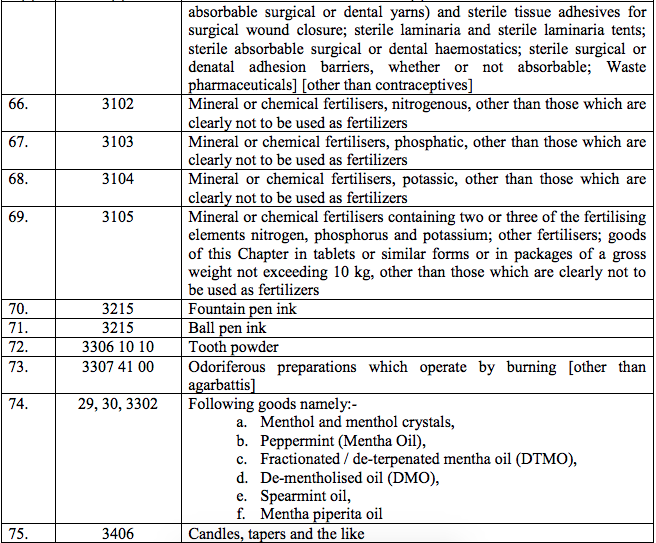

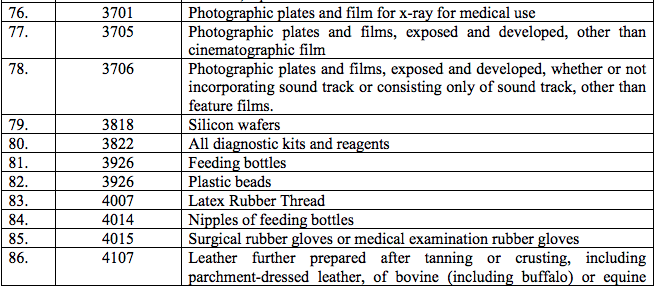

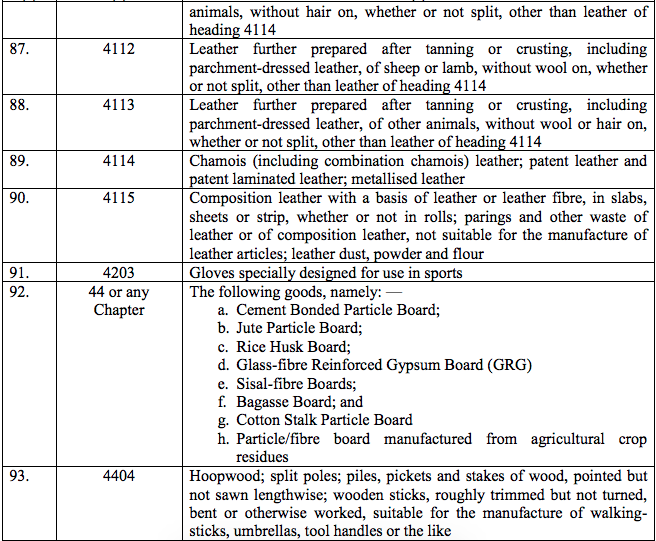

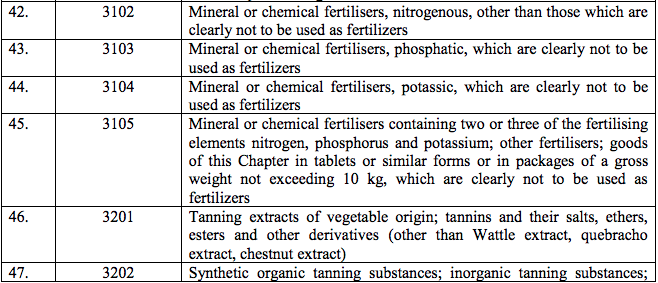

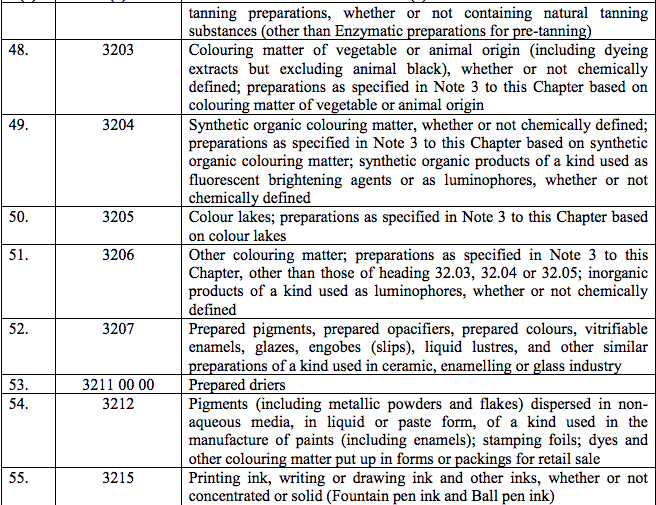

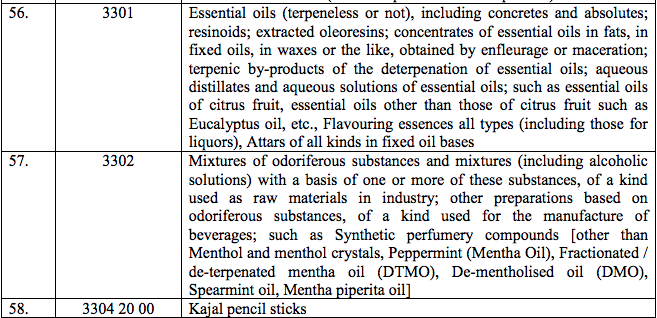

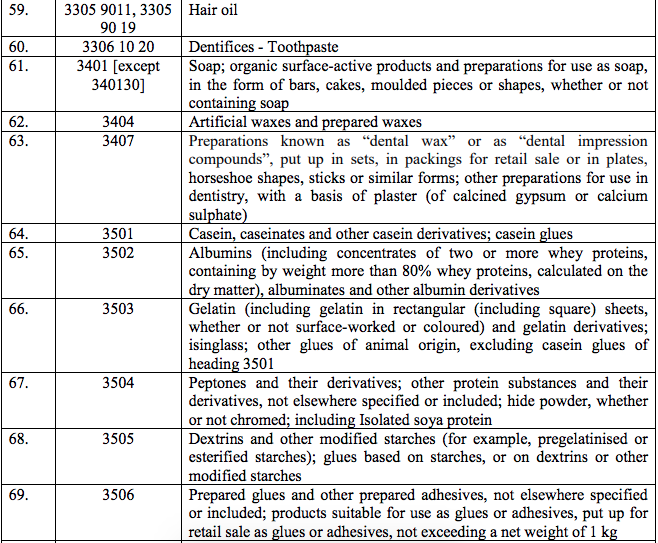

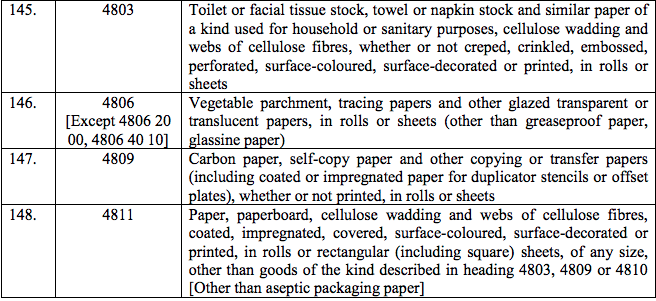

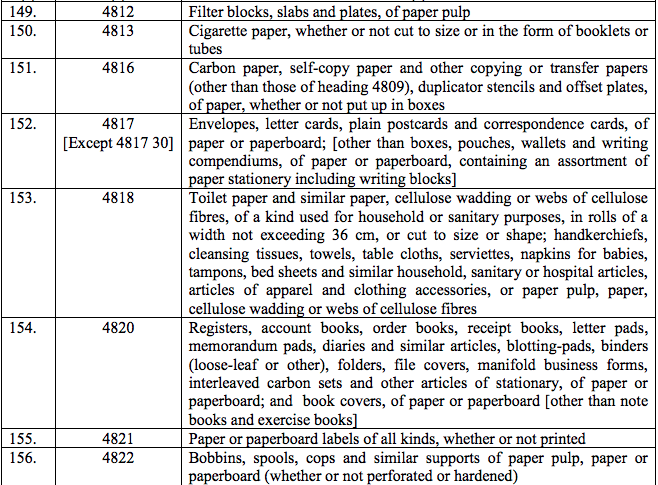

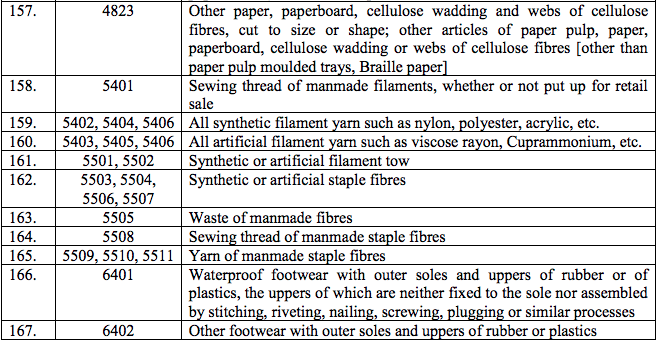

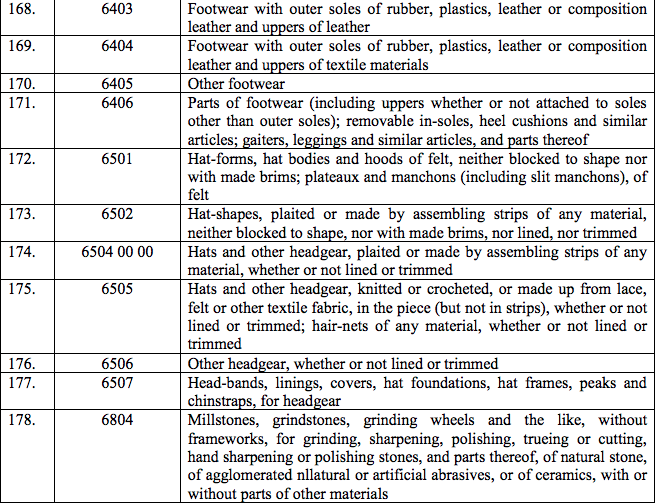

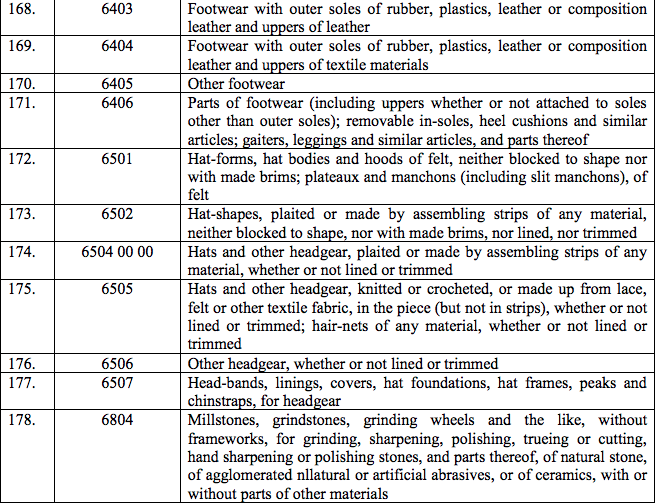

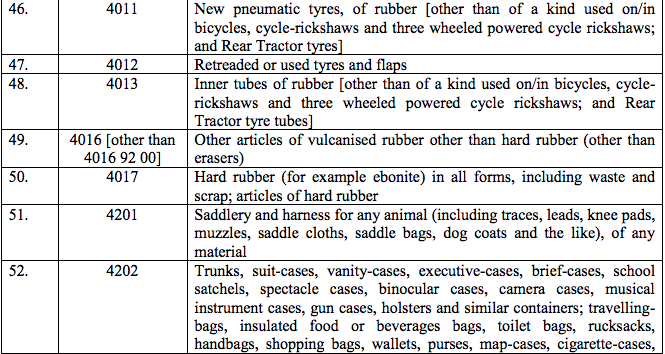

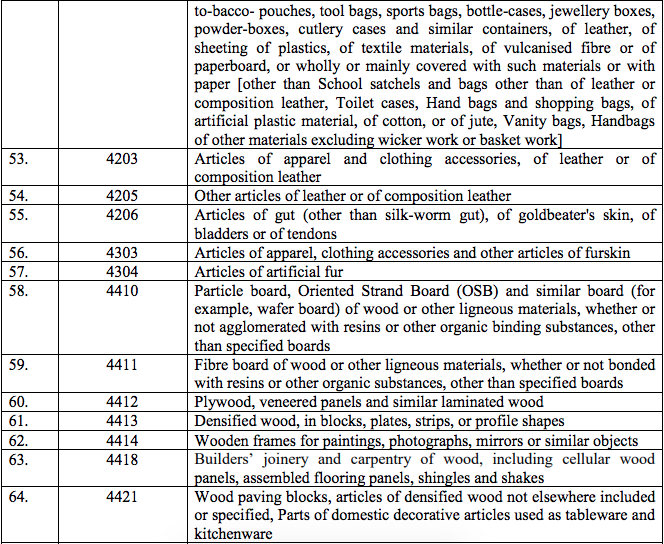

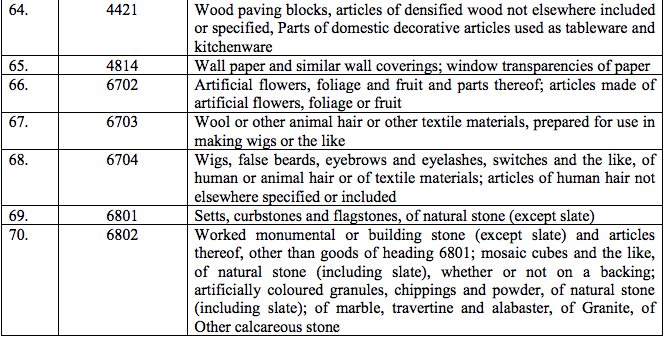

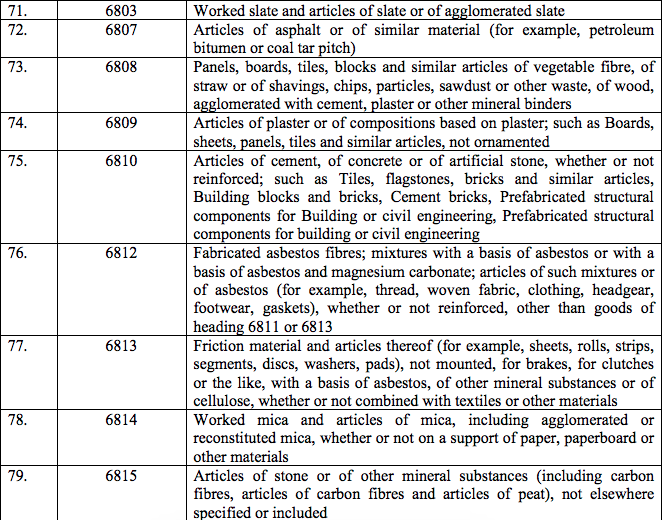

Schedule II – 12%

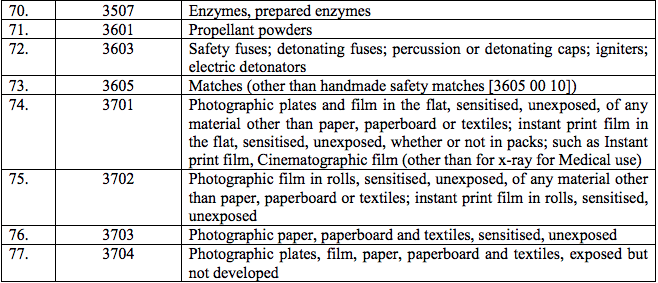

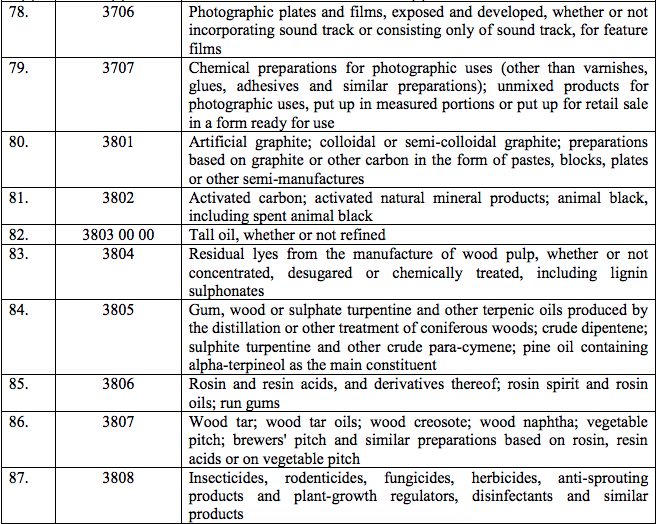

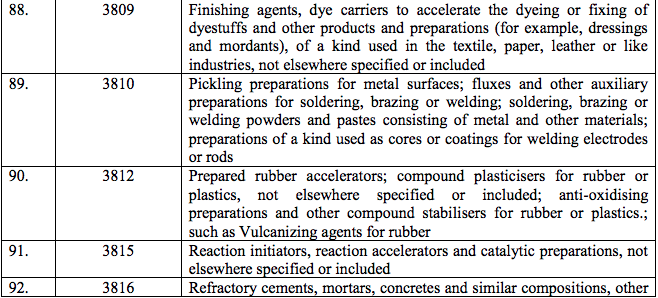

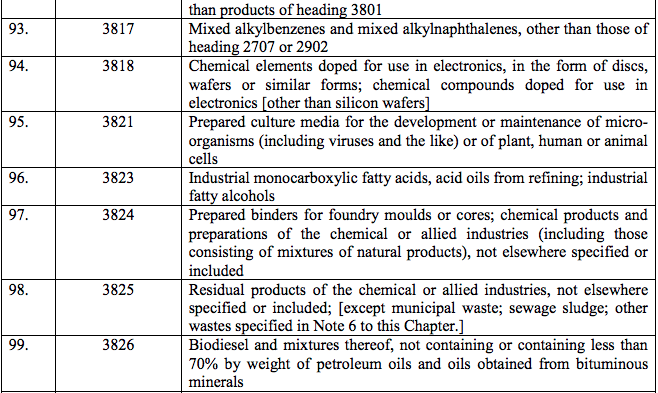

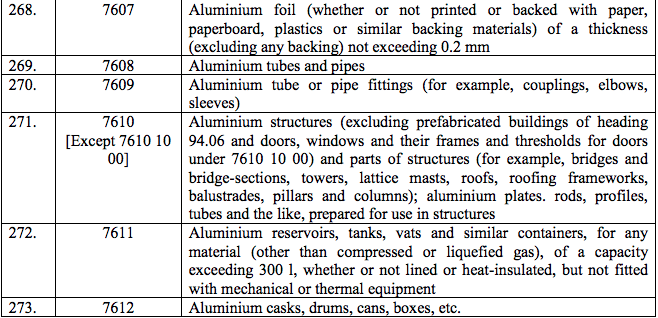

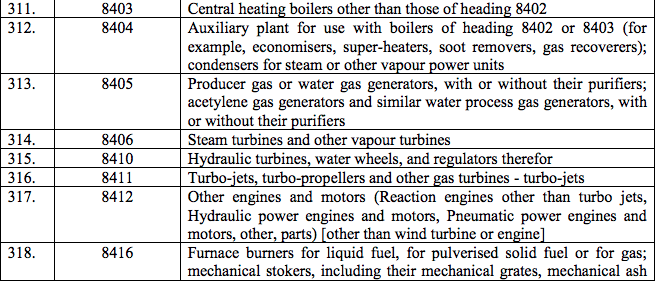

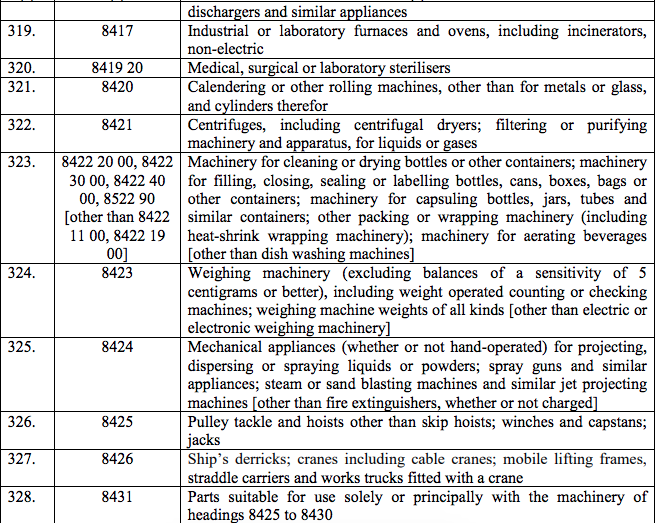

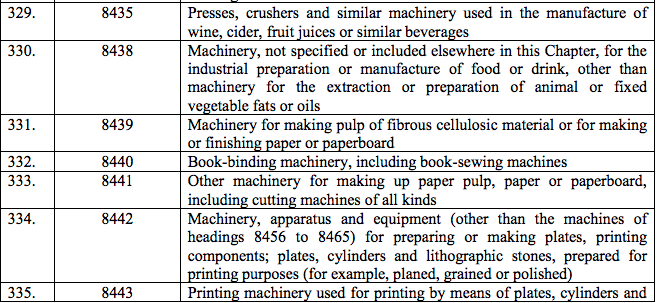

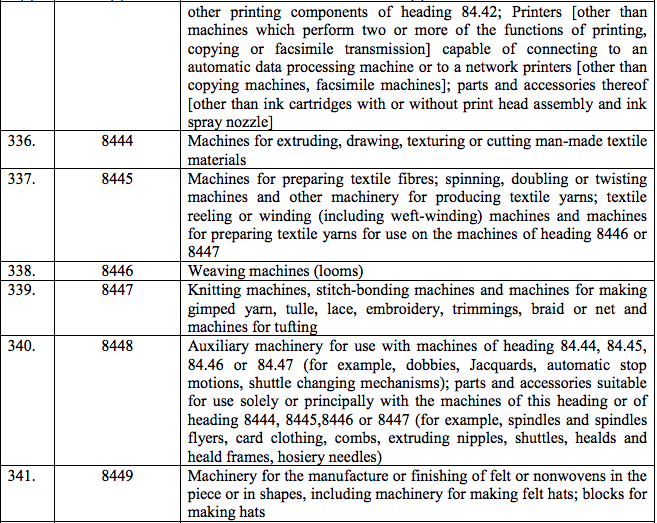

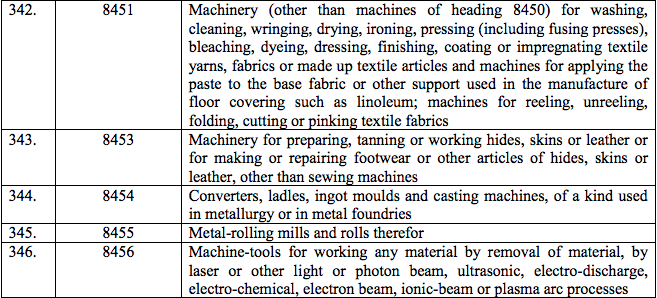

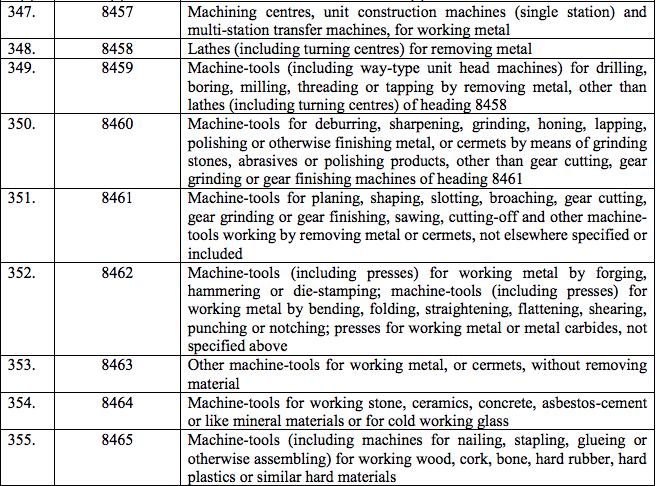

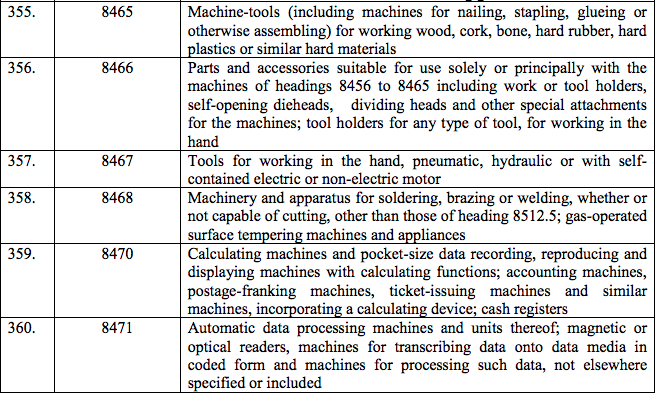

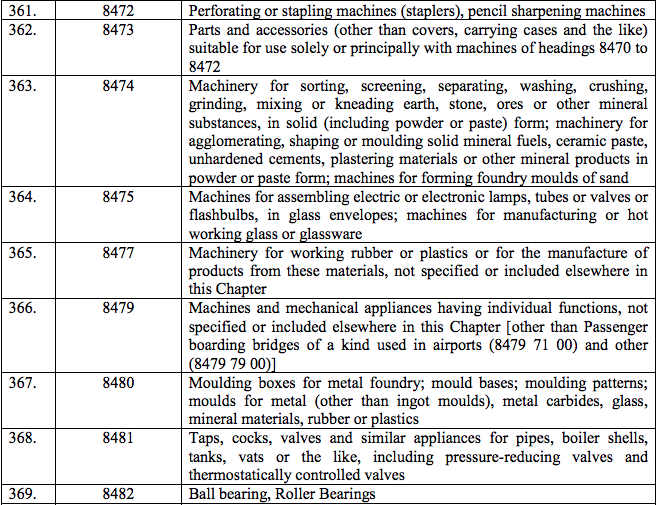

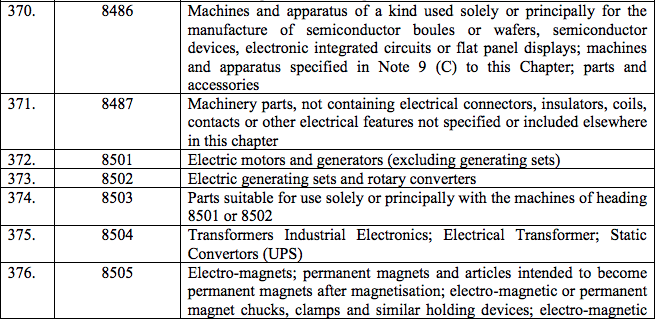

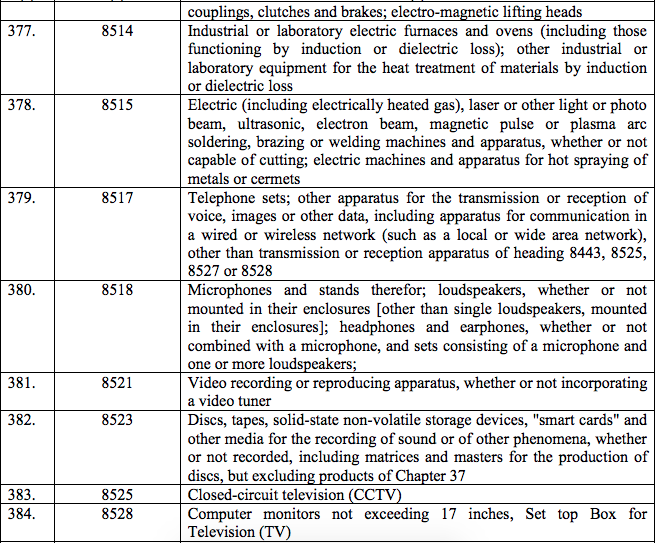

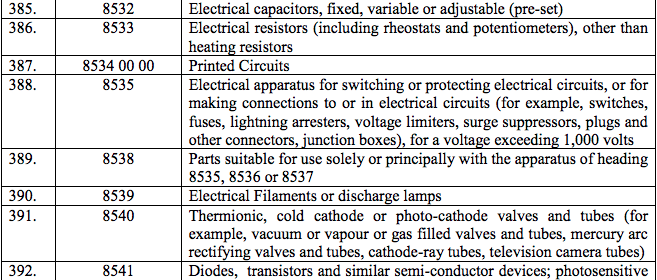

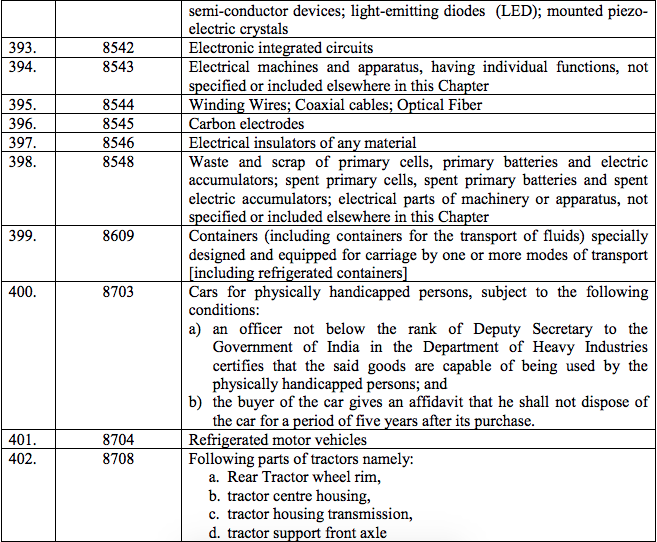

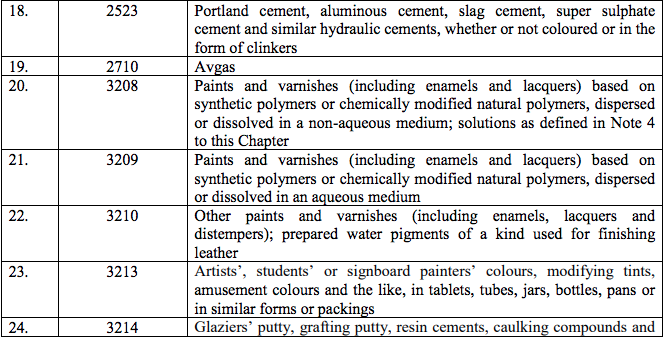

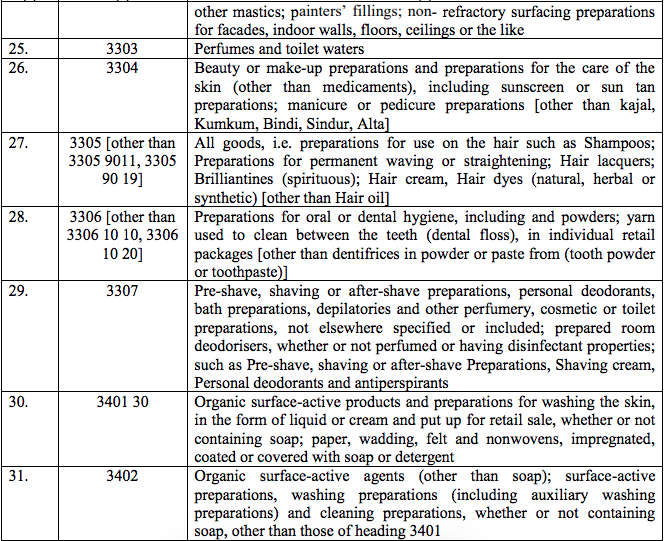

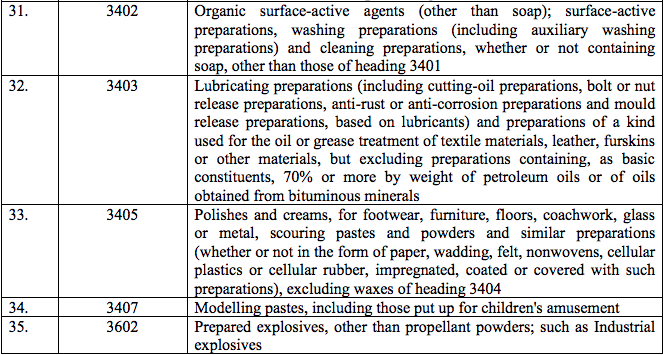

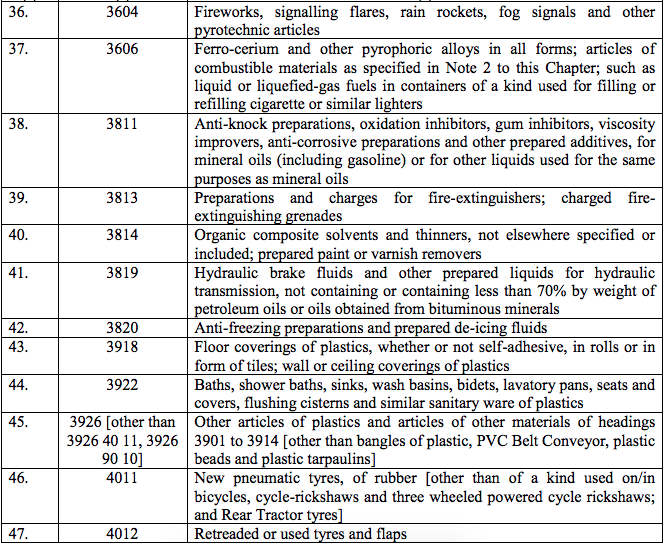

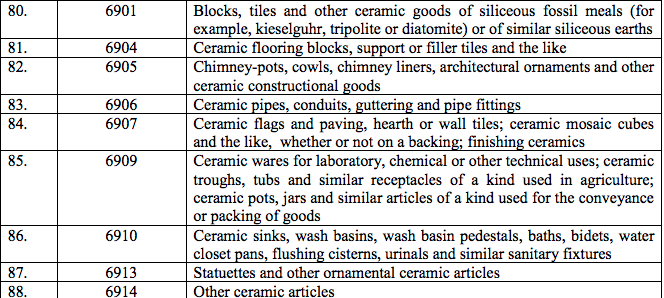

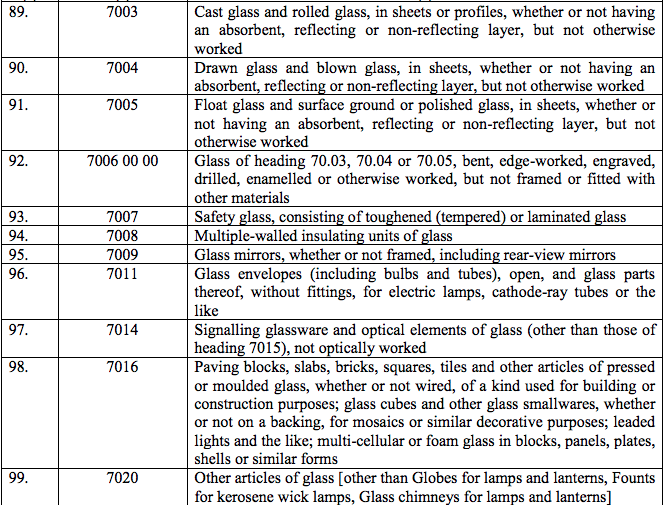

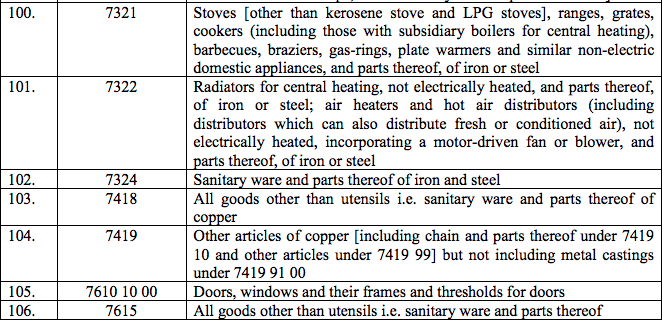

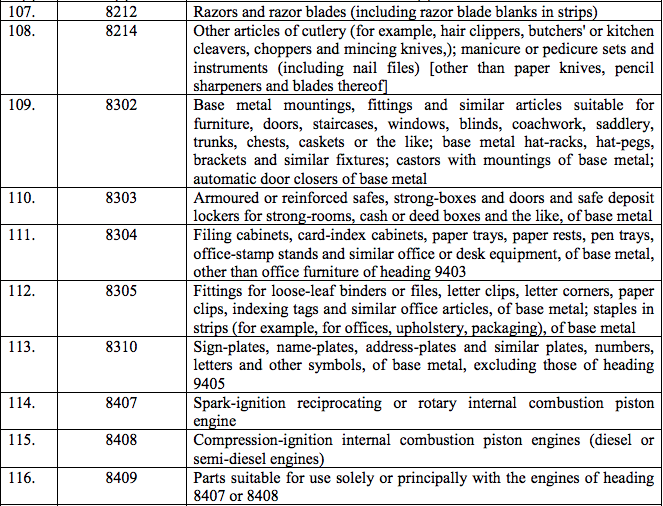

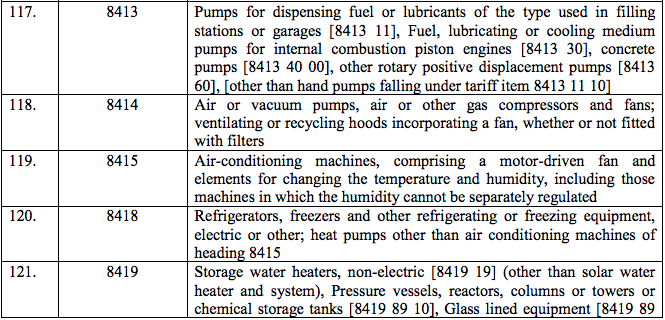

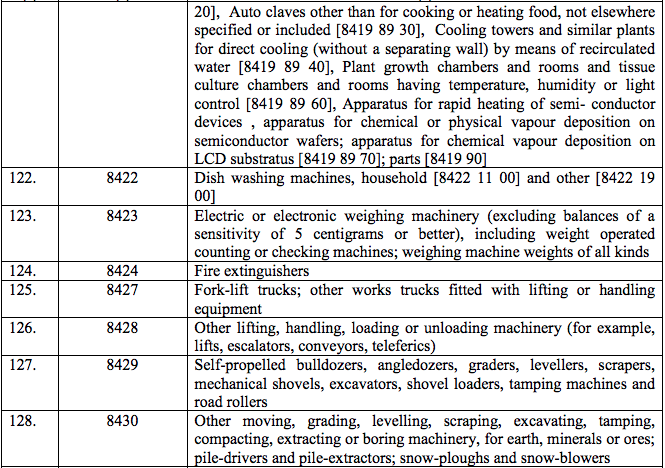

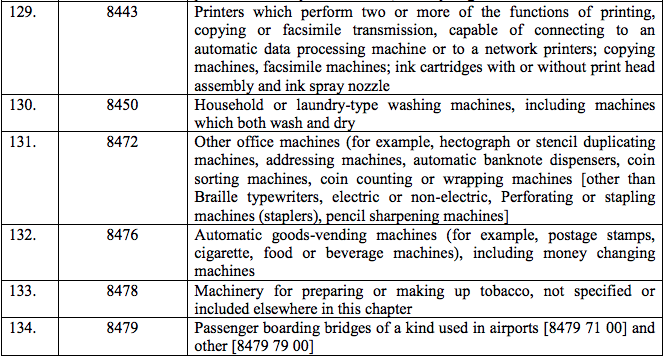

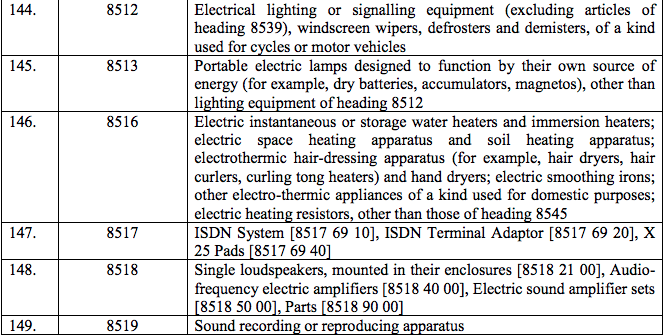

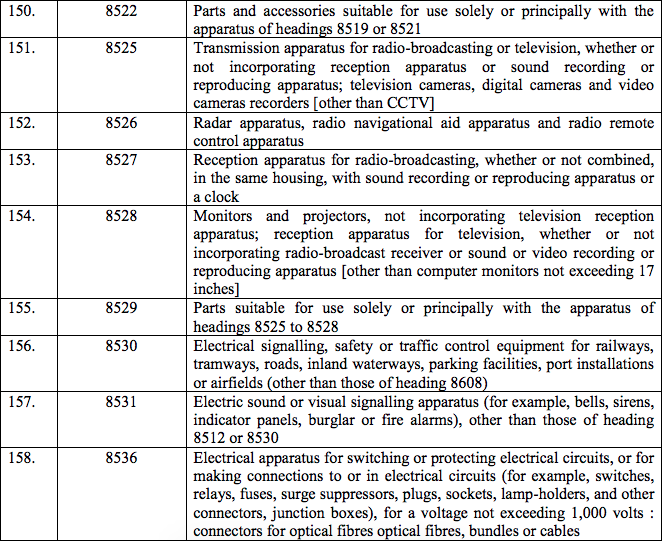

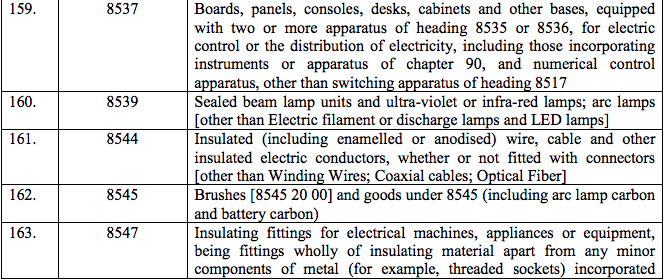

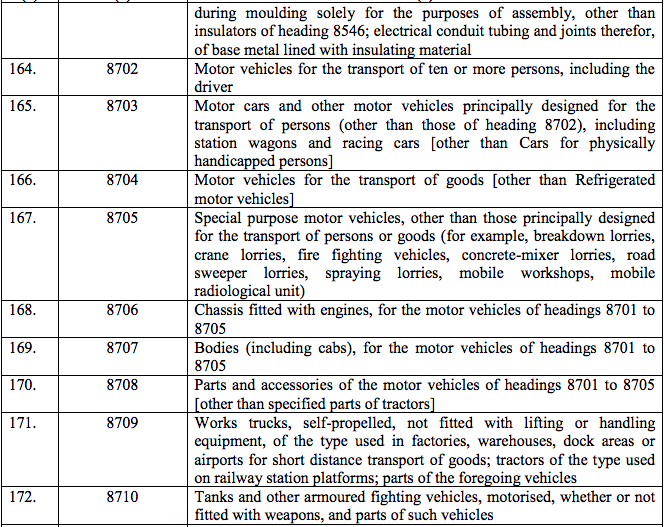

Schedule III – 18%

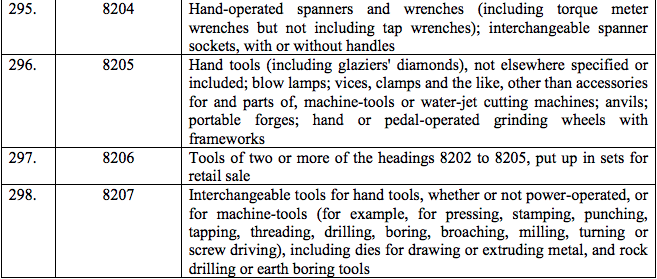

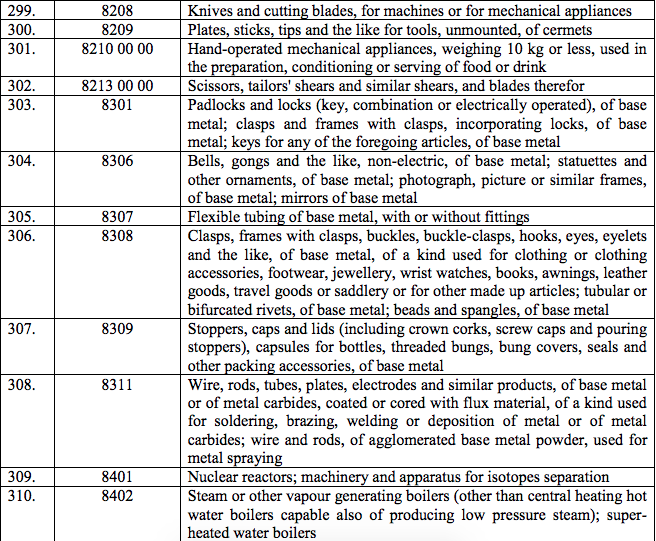

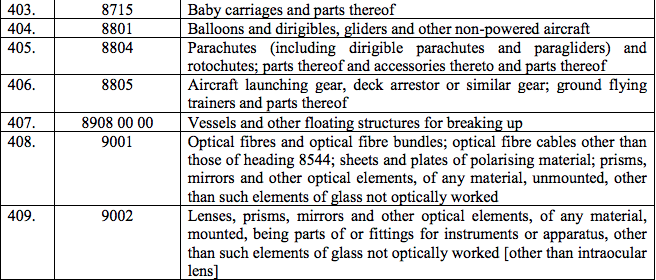

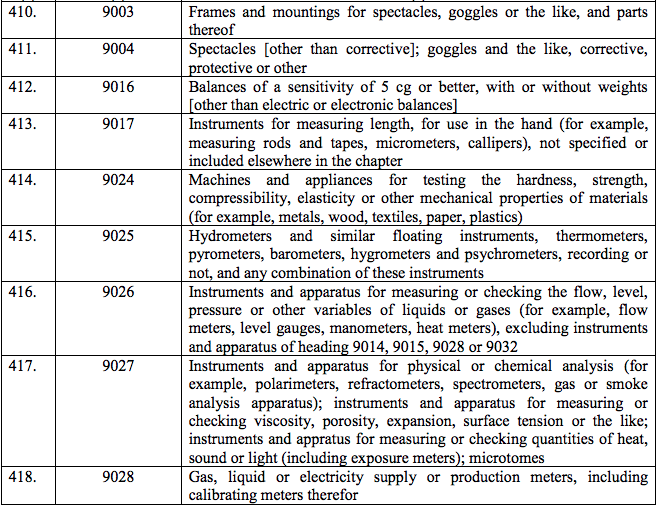

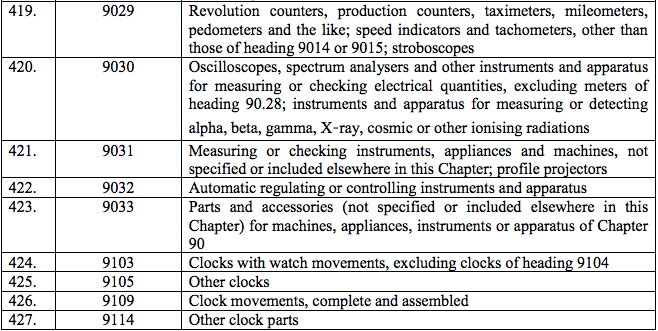

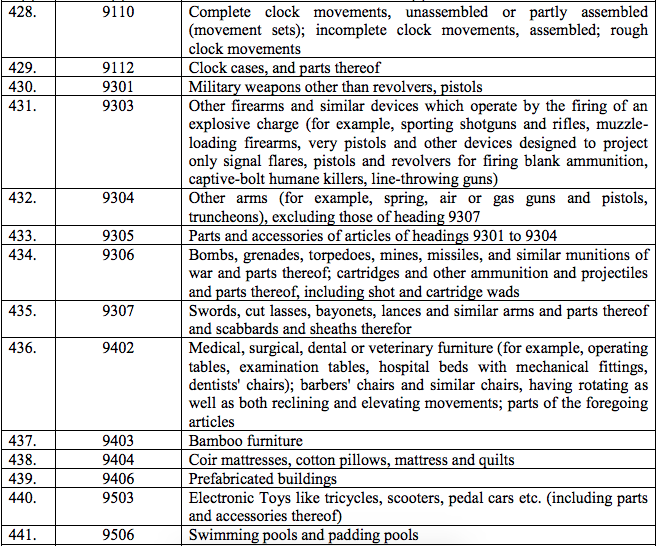

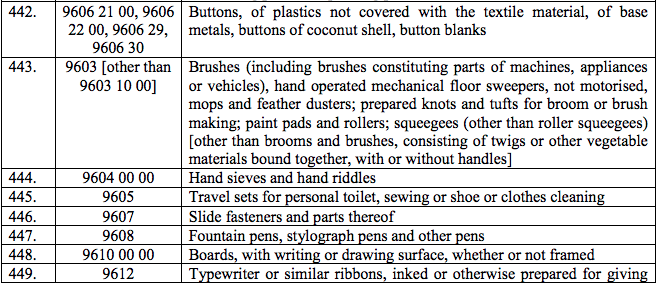

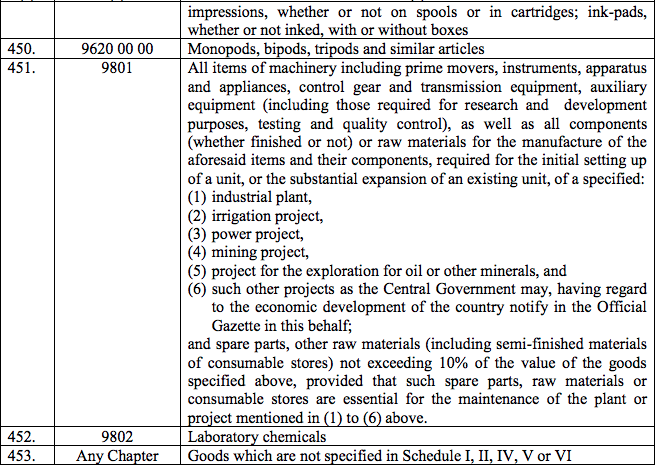

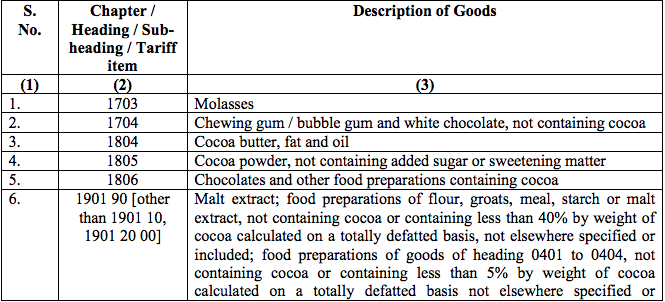

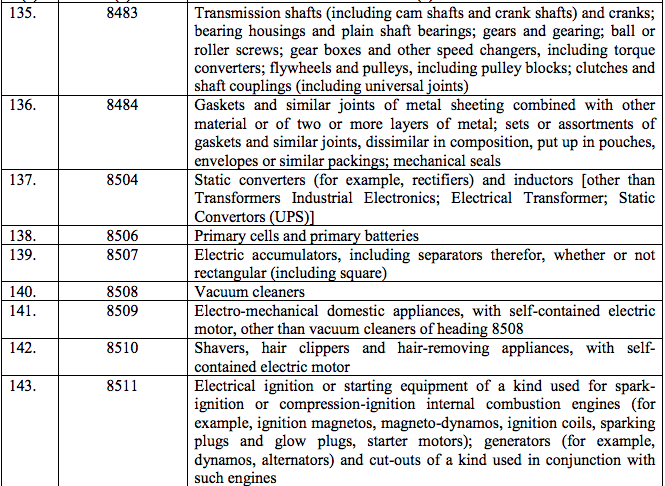

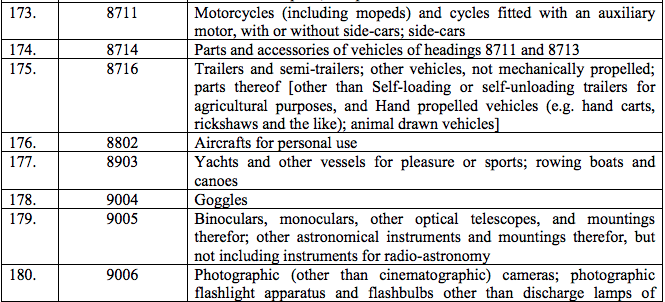

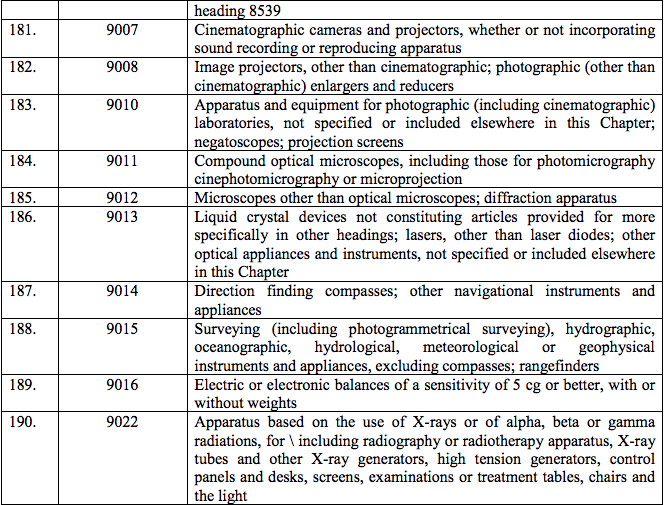

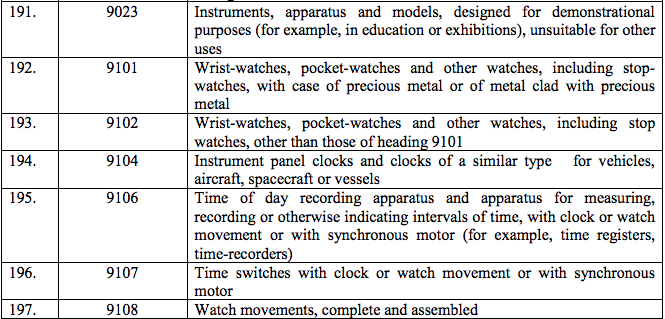

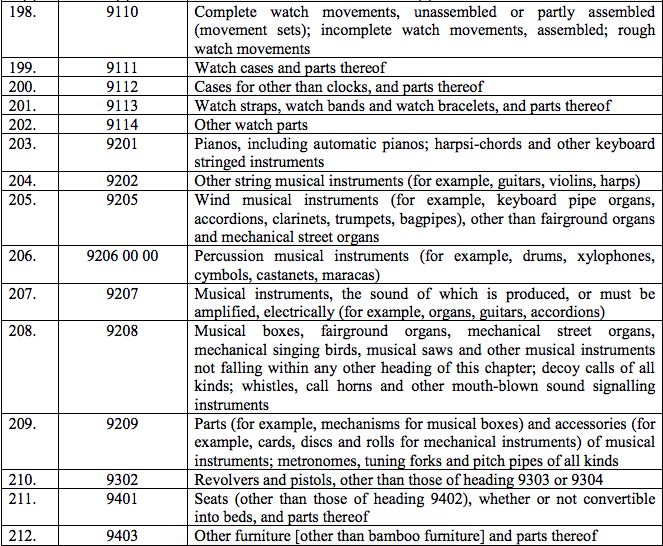

Schedule IV – 28%

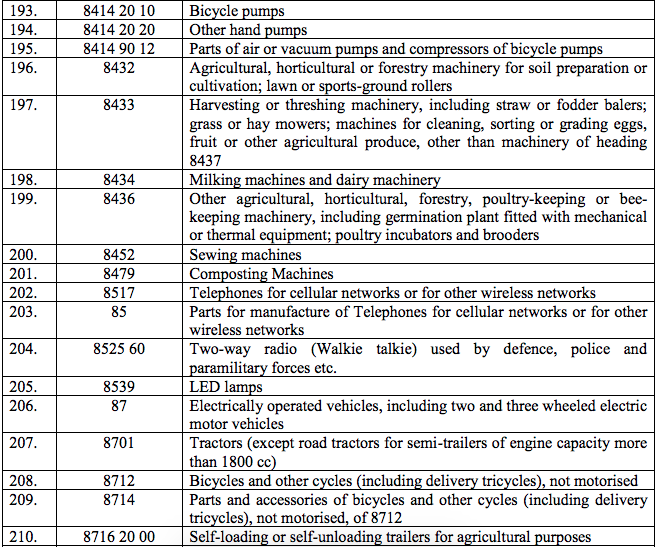

Schedule V – 3%

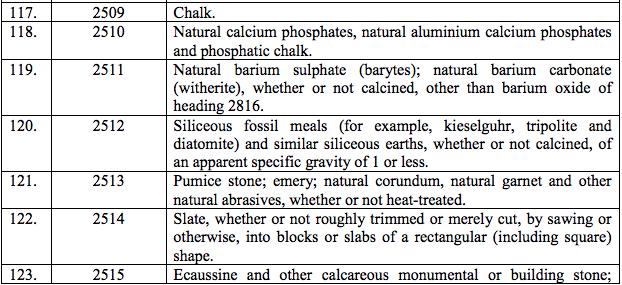

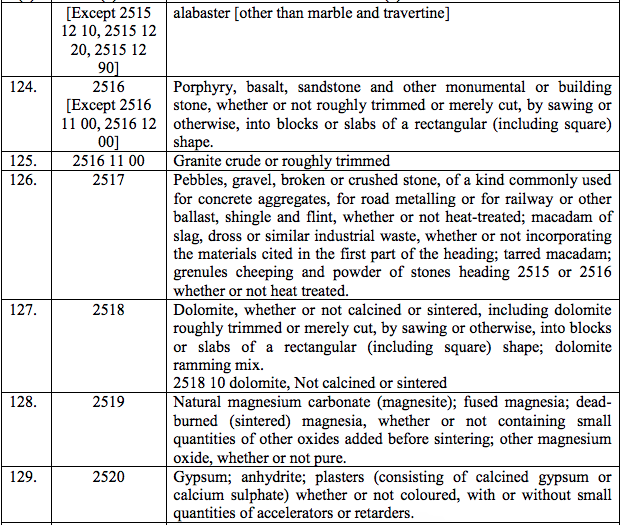

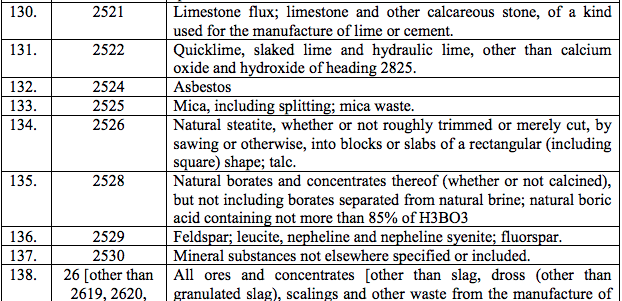

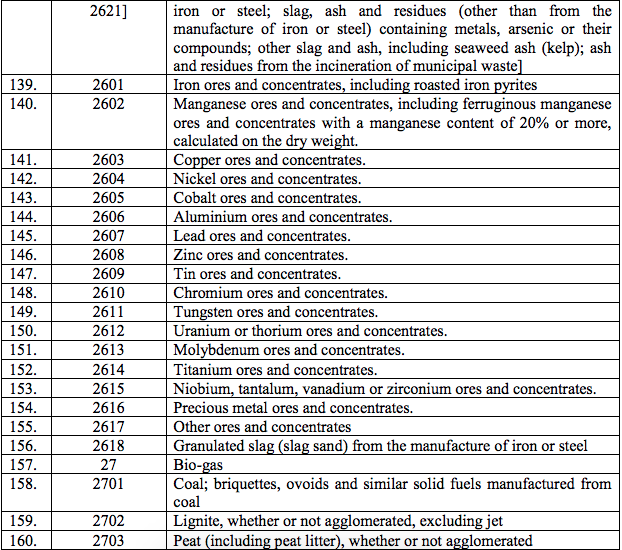

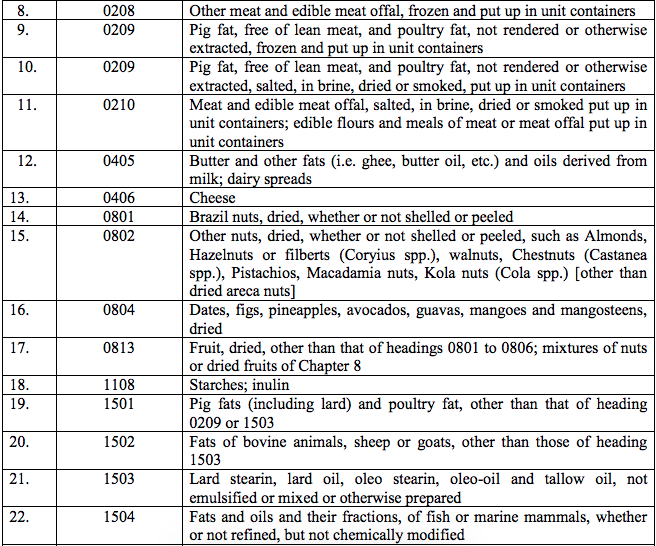

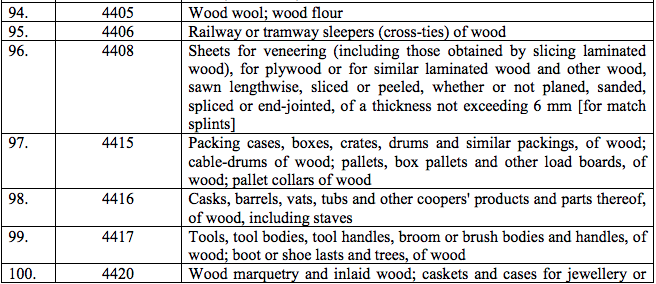

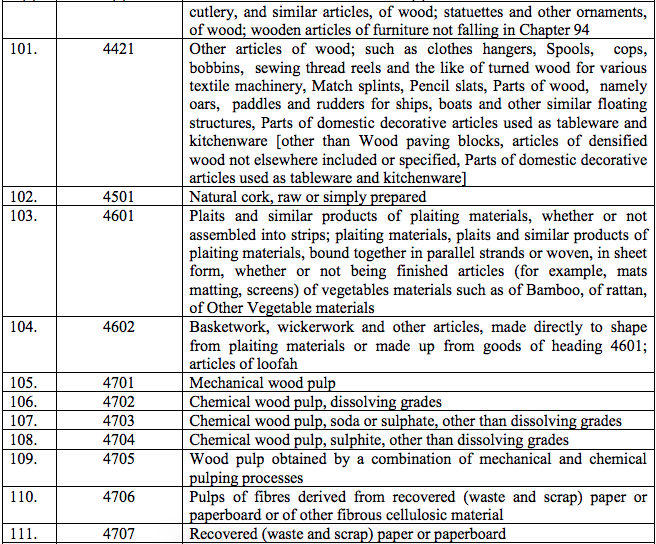

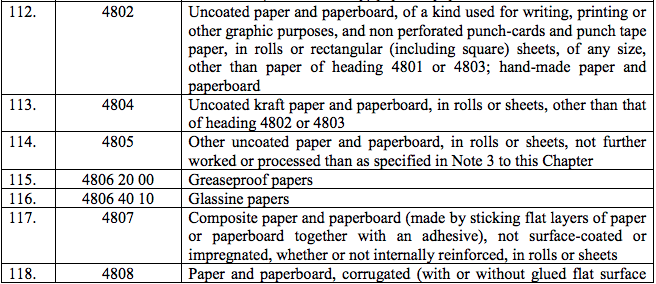

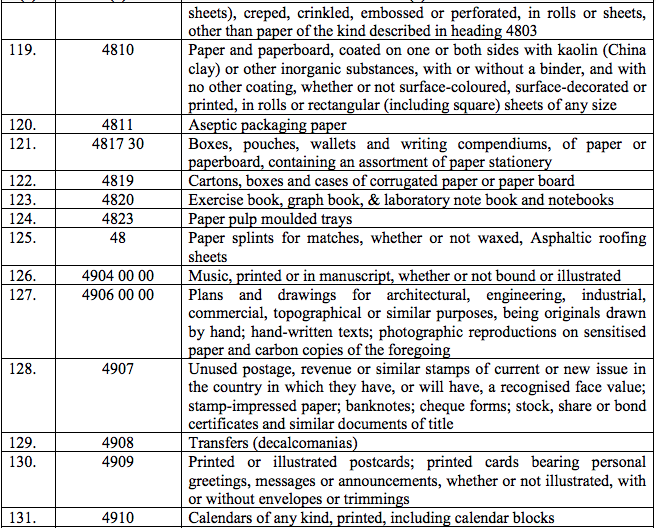

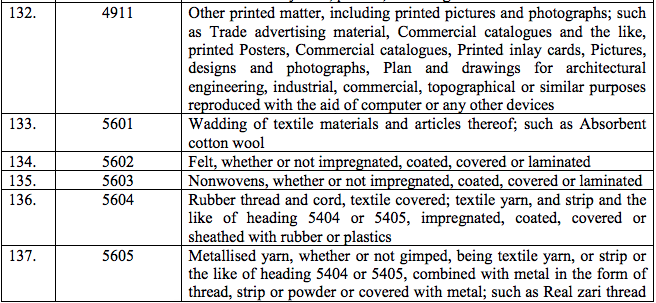

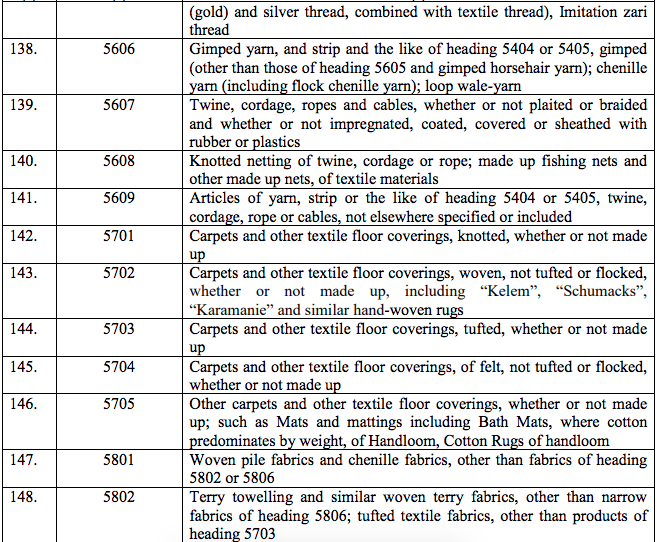

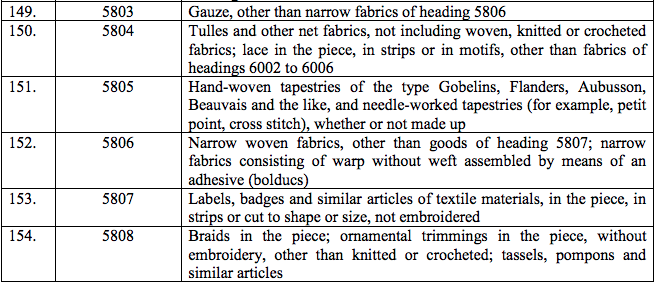

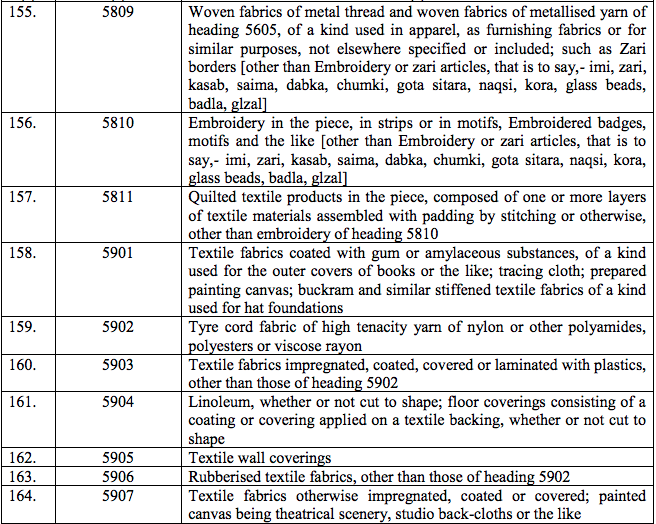

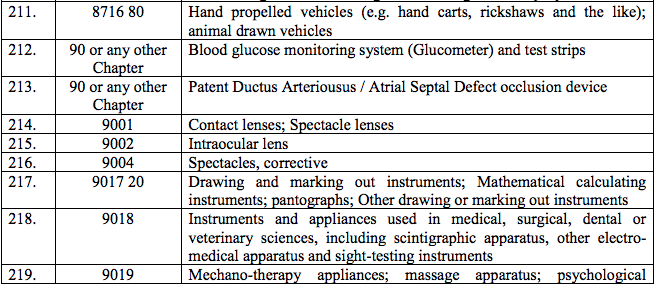

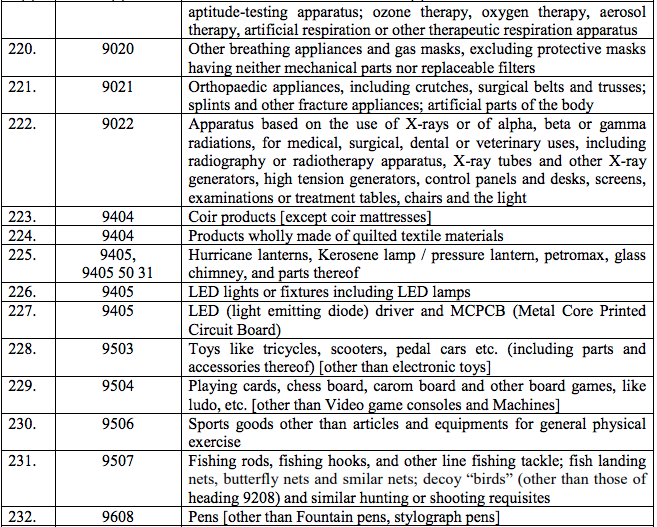

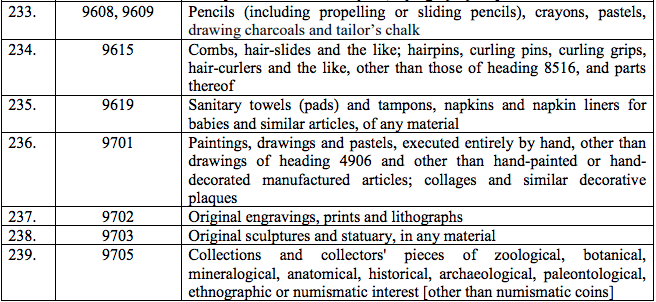

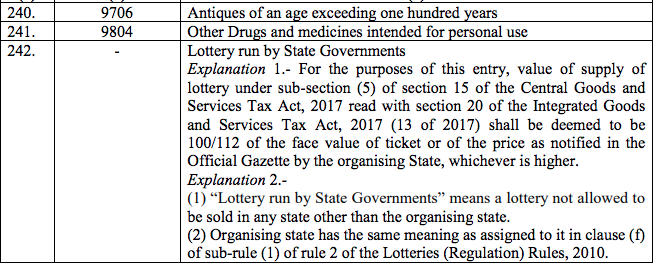

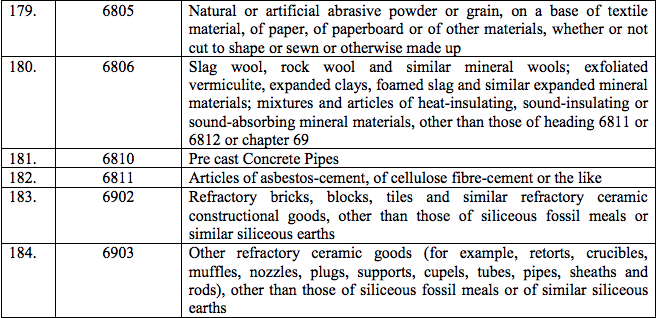

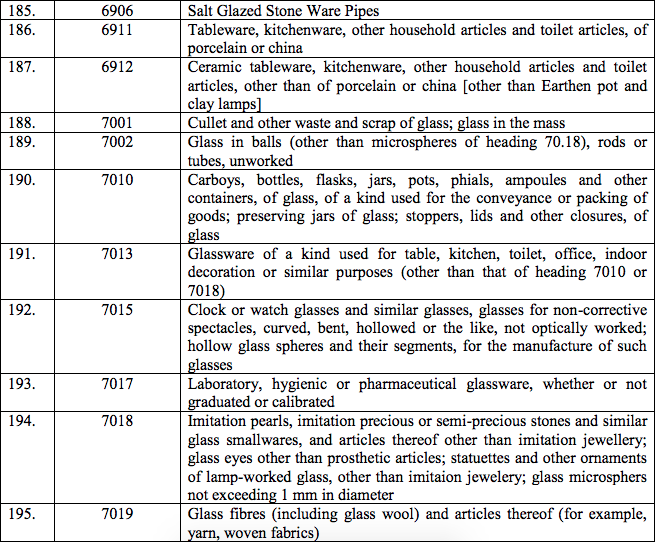

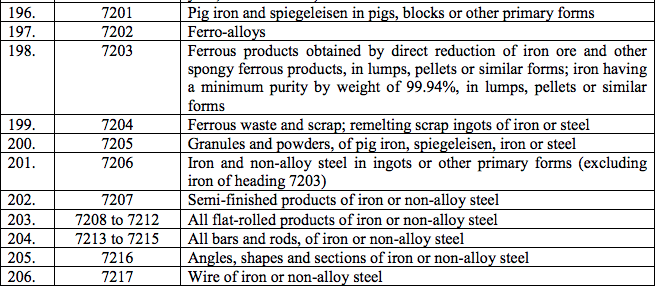

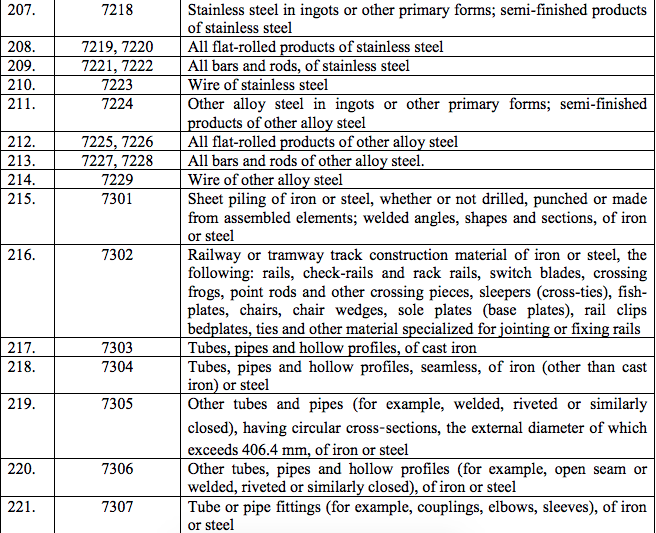

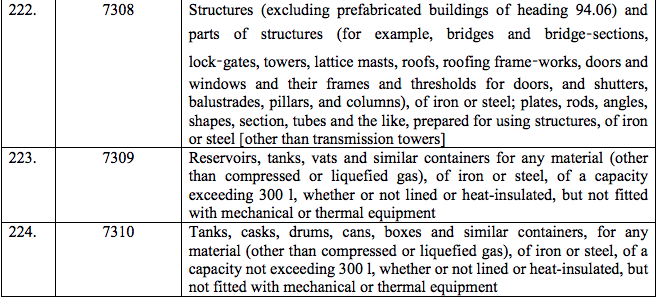

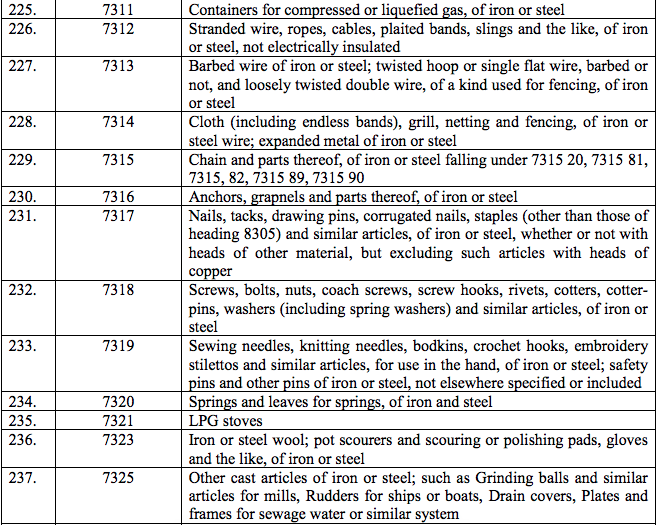

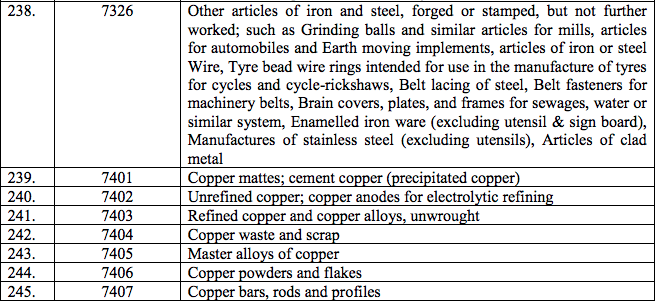

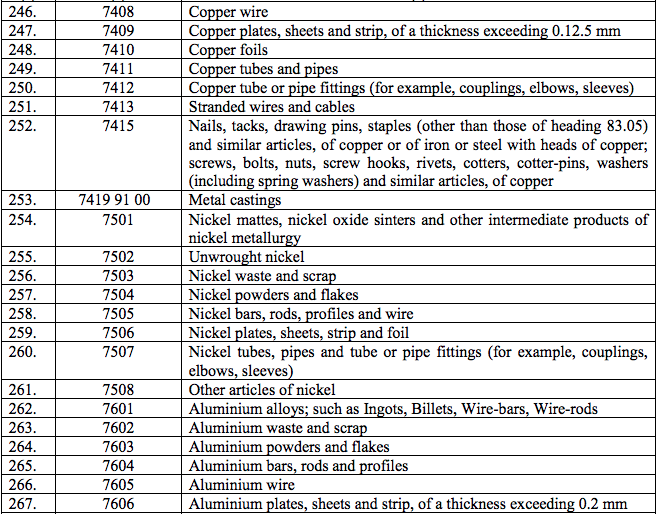

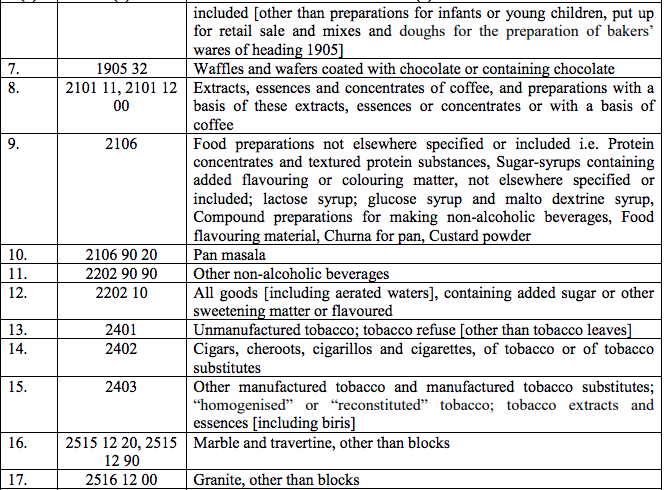

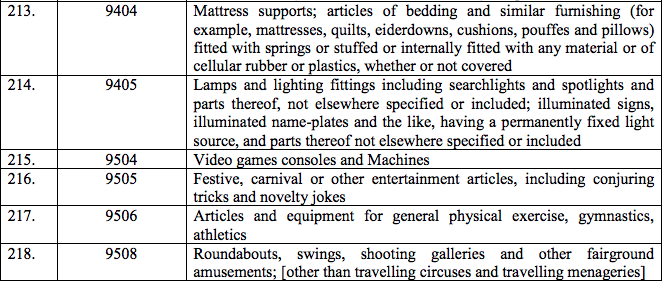

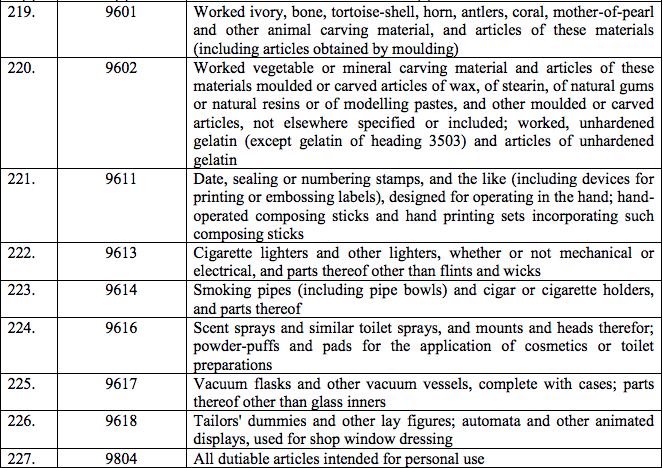

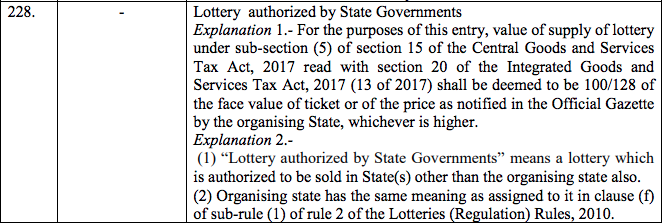

| S.No. | Chapter / Heading /Sub-heading /Tariff item | Description of Goods |

|---|---|---|

| (1) | (2) | (3) |

| 1. | 7101 | Pearls, natural or cultured, whether or not worked or graded but not strung, mounted or set; pearls, natural or cultured, temporarily strung for convenience of transport |

| 2. | 7102 | Diamonds, whether or not worked, but not mounted or set [other than Non-Industrial Unworked or simply sawn, cleaved or bruted] |

| 3. | 7103 | Precious stones (other than diamonds) and semi-precious stones, whether or not worked or graded but not strung, mounted or set; ungraded precious stones (other than diamonds) and semi-precious stones, temporarily strung for convenience of transport [other than Unworked or simply sawn or roughly shaped] |

| 4. | 7104 | Synthetic or reconstructed precious or semi-precious stones, whether or not worked or graded but not strung, mounted or set; ungraded synthetic or reconstructed precious or semi-precious stones, temporarily strung for convenience of transport [other than Unworked or simply sawn or roughly shaped] |

| 5. | 7105 | Dust and powder of natural or synthetic precious or semi-precious stones |

| 6. | 7106 | Silver (including silver plated with gold or platinum), unwrought or in semi-manufactured forms, or in powder form |

| 7. | 7107 | Base metals clad with silver, not further worked than semi-manufactured |

| 8. | 7108 | Gold (including gold plated with platinum) unwrought or in semimanufactured forms, or in powder form |

| 9. | 7109 | Base metals or silver, clad with gold, not further worked than semimanufactured |

| 10. | 7110 | Platinum, unwrought or in semi-manufactured forms, or in powder form |

| 11. | 7111 | Base metals, silver or gold, clad with platinum, not further worked than semi-manufactured |

| 12. | 7112 | Waste and scrap of precious metal or of metal clad with precious metal; other waste and scrap containing precious metal or precious metal compounds, of a kind used principally for the recovery of precious metal. |

| 13. | 7113 | Articles of jewellery and parts thereof, of precious metal or of metal clad with precious metal |

| 14. | 7114 | Articles of goldsmiths’ or silversmiths’ wares and parts thereof, of precious metal or of metal clad with precious metal |

| 15. | 7115 | Other articles of precious metal or of metal clad with precious metal |

| 16. | 7116 | Articles of natural or cultured pearls, precious or semi-precious stones (natural, synthetic or reconstructed) |

| 17. | 7117 | Imitation jewellery |

| 18. | 7118 | Coin |

Schedule VI – 0.25%

| S.No. | Chapter / Heading / Sub-heading / Tariff item | Description of Goods |

|---|---|---|

| (1) | (2) | (3) |

| 1. | 7102 | Diamonds, non-industrial unworked or simply sawn, cleaved or bruted |

| 2. | 7103 | Precious stones (other than diamonds) and semi-precious stones, unworked or simply sawn or roughly shaped |

| 3. | 7104 | Synthetic or reconstructed precious or semi-precious stones, unworked or simply sawn or roughly shaped |

Explanation. – For the purposes of this Schedule,-

(i) The phrase “unit container” means a package, whether large or small (for example, tin, can, box, jar, bottle, bag, or carton, drum, barrel, or canister) designed to hold a predetermined quantity or number, which is indicated on such package.

(ii) The phrase “registered brand name” means brand name or trade name, that is to say, a name or a mark, such as symbol, monogram, label, signature or invented word or writing which is used in relation to such specified goods for the purpose of indicating, or so as to indicate a connection in the course of trade between such specified goods and some person using such name or mark with or without any indication of the identity of that person, and which is registered under the Trade Marks Act, 1999.

(iii) “Tariff item”, “sub-heading” “heading” and “Chapter” shall mean respectively a tariff item, sub-heading, heading and chapter as specified in the First Schedule to the Customs Tariff Act, 1975 (51 of 1975).

(iv) The rules for the interpretation of the First Schedule to the Customs Tariff Act, 1975 (51 of 1975), including the Section and Chapter Notes and the General Explanatory Notes of the First Schedule shall, so far as may be, apply to the interpretation of this notification.

2) This notification shall come into force with effect from the 1st day of July, 2017.