Integrated Tax Notifications (Rate)

IGST Notification rate 02/2017

| Title | Integrated Goods and Services Tax Act, 2017 (13 of 2017), the Central Government, on the recommendations of the Council, hereby notifies the rate of the integrated tax. |

| Number | 02/2017 |

| Date | 28-06-2017 |

| Download | |

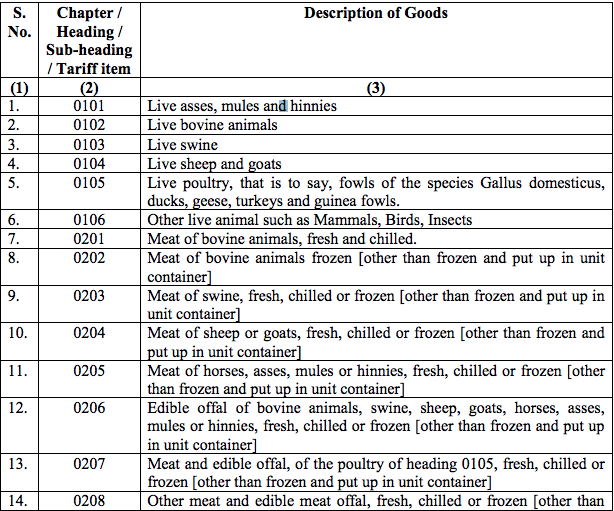

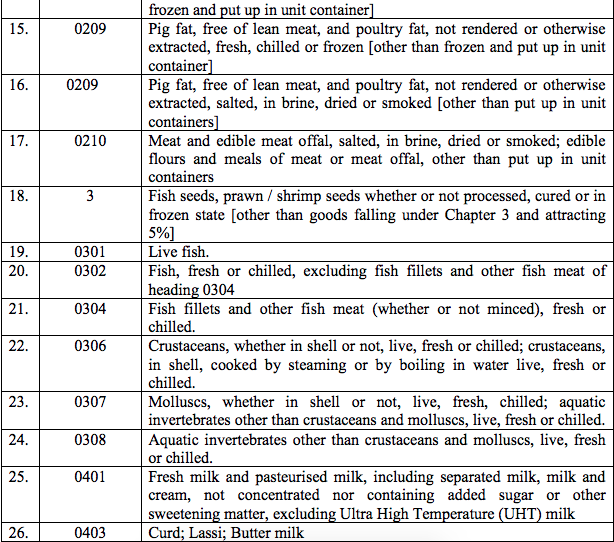

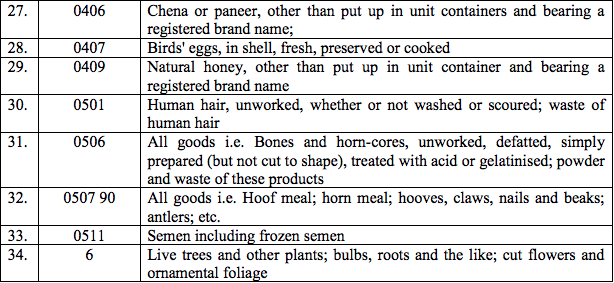

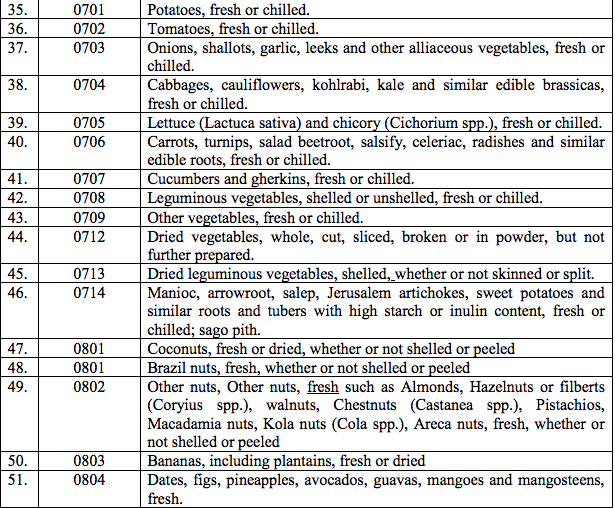

1) In exercise of the powers conferred by sub-section (1) of section 6 of the Integrated Goods and Services Tax Act, 2017 (13 of 2017), the Central Government, being satisfied that it is necessary in the public interest so to do, on the recommendations of the Goods and Services Tax Council, hereby exempts inter-State supplies of goods, the description of which is specified in column (3) of the Schedule appended to this notification, falling under the tariff item, sub-heading, heading or Chapter, as the case may be, as specified in the corresponding entry in column (2) of the said Schedule, from the whole of the integrated tax leviable thereon under section 5 of the Integrated Good and Services Tax Act, 2017 (13 of 2017).

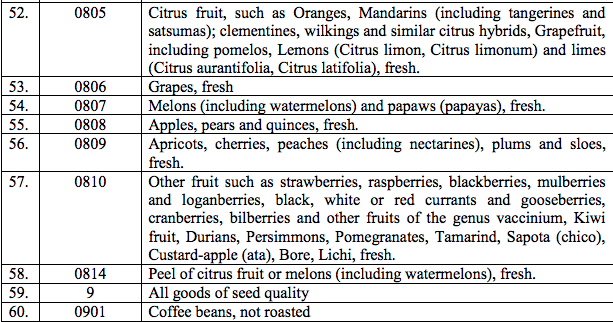

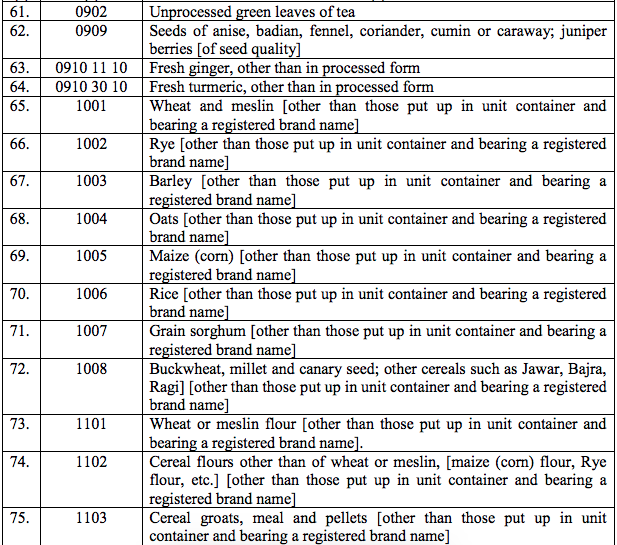

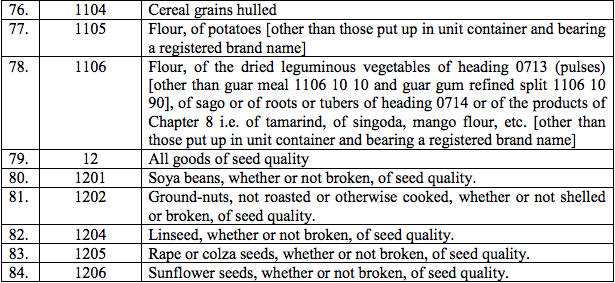

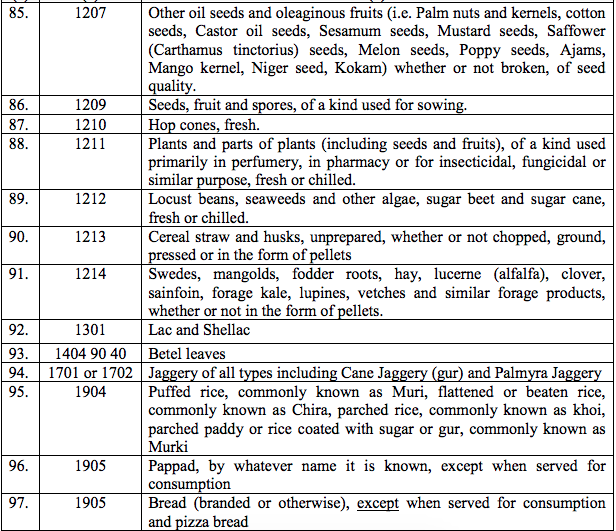

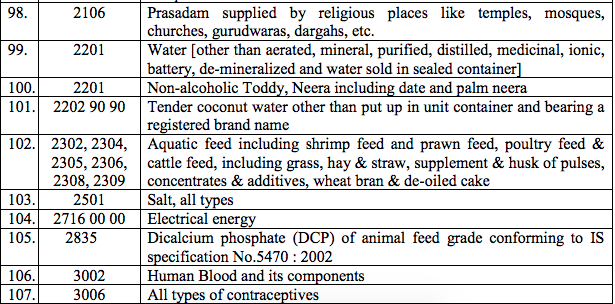

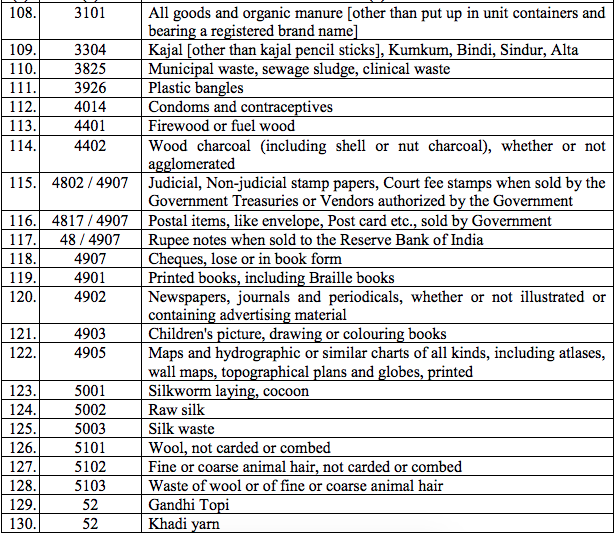

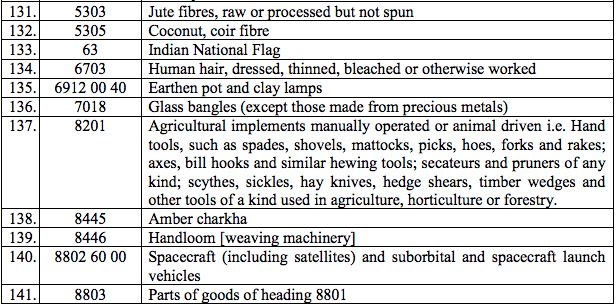

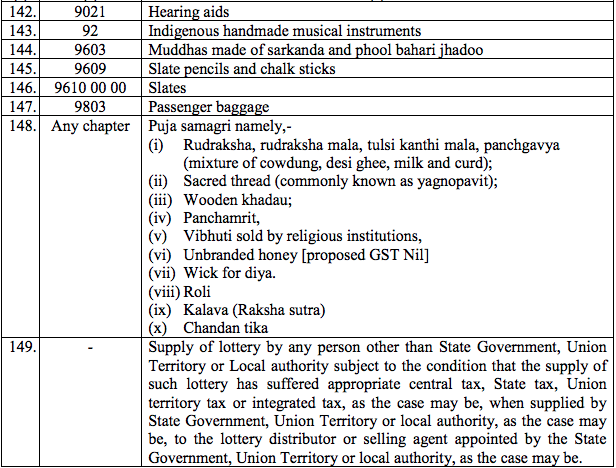

Schedule

Explanation.- For the purposes of this Schedule,-

(i) The phrase “unit container” means a package, whether large or small (for example, tin, can, box, jar, bottle, bag, or carton, drum, barrel, or canister) designed to hold a predetermined quantity or number, which is indicated on such package.

(ii) The phrase “registered brand name” means brand name or trade name, that is to say, a name or a mark, such as symbol, monogram, label, signature or invented word or writing which is used in relation to such specified goods for the purpose of indicating, or so as to indicate a connection in the course of trade between such specified goods and some person using such name or mark with or without any indication of the identity of that person, and which is registered under the Trade Marks Act, 1999.

(iii) “Tariff item”, “sub-heading” “heading” and “Chapter” shall mean respectively a tariff item, heading, sub-heading and Chapter as specified in the First Schedule to the Customs Tariff Act, 1975 (51 of 1975).

(iv) The rules for the interpretation of the First Schedule to the said Customs Tariff Act, 1975, including the Section and Chapter Notes and the General Explanatory Notes of the First Schedule shall, so far as may be, apply to the interpretation of this notification.

2) This notification shall come into force with effect from the 1st day of July, 2017.