Track Refund Status > Post-Login

How can I track the status of refund on the GST Portal, after logging into the GST Portal?

-

Tracking Refund Application

-

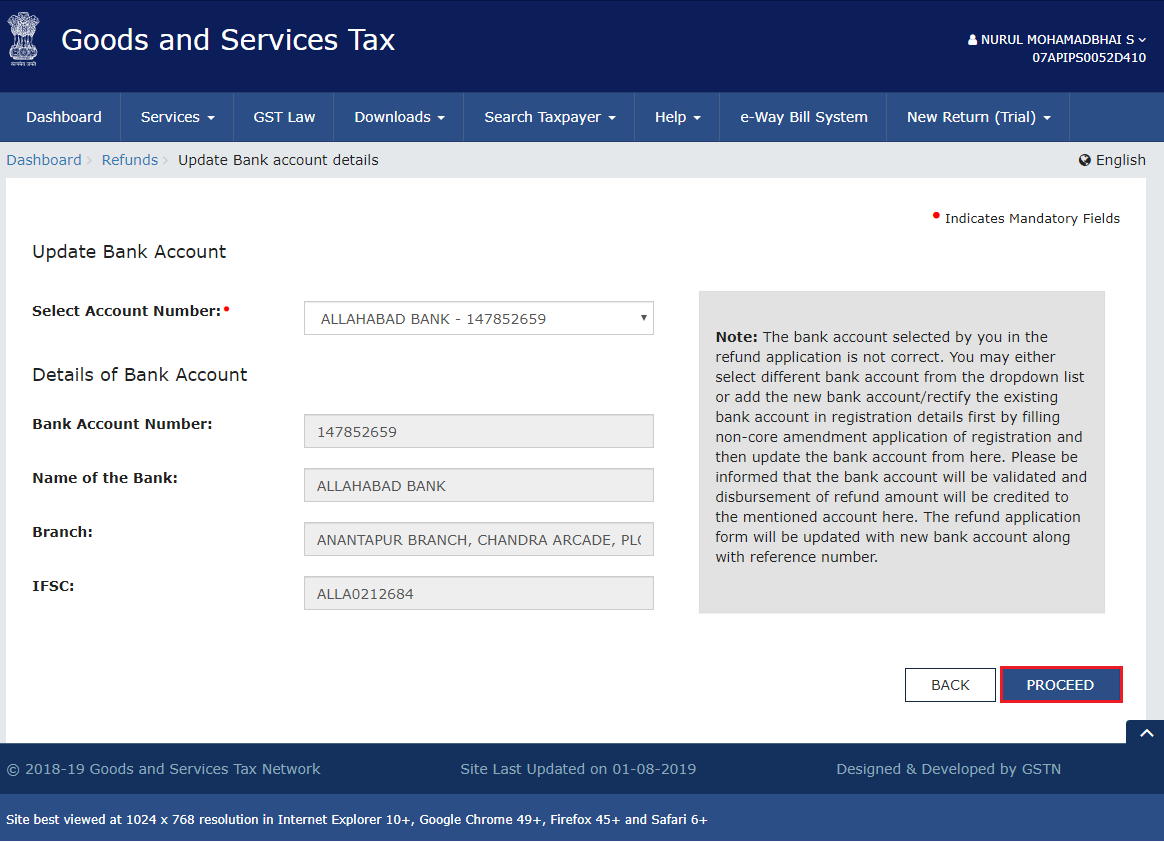

Updating Bank Account

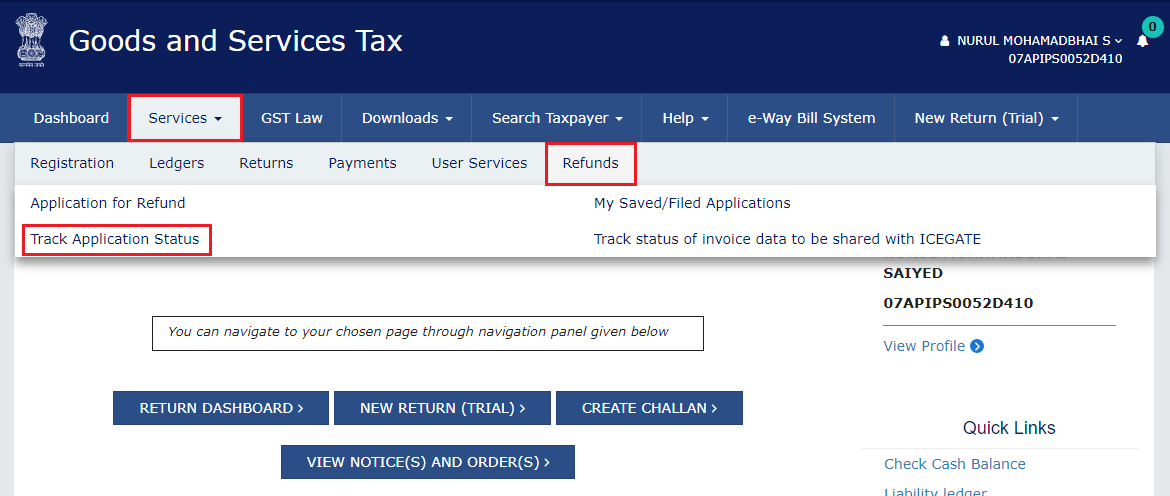

1) To track your submitted refund application, login to the GST Portal and navigate to Services > Refunds > Track Application Status command.

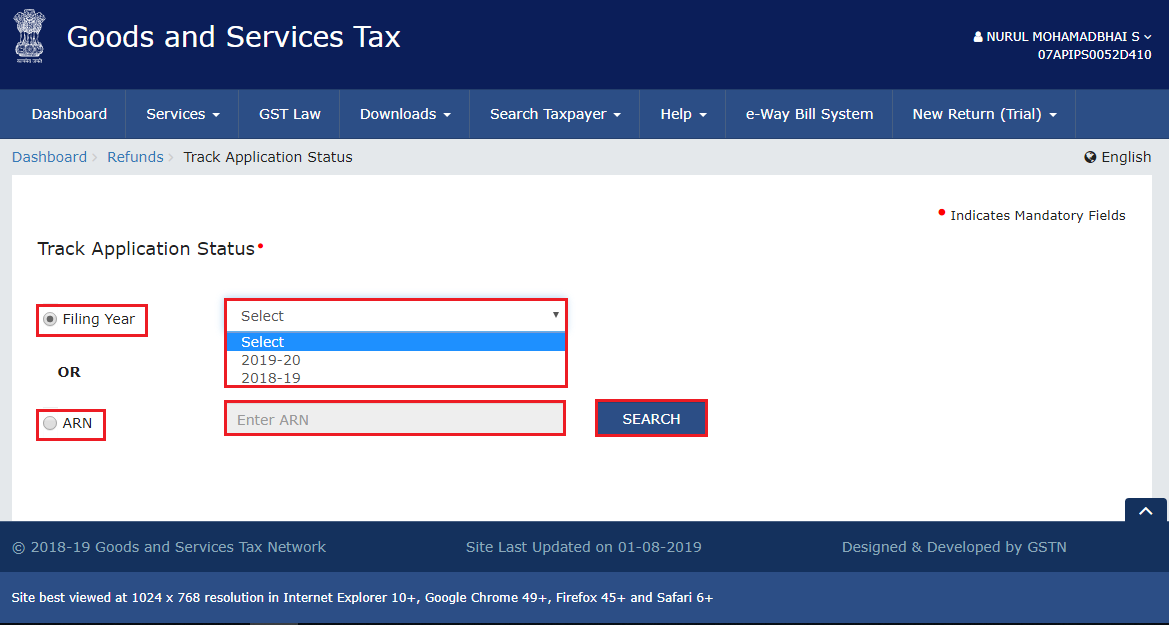

2) Track Application Status page is displayed. Select the Filing Year from the drop-down list or enter the ARN & then click the SEARCH button.

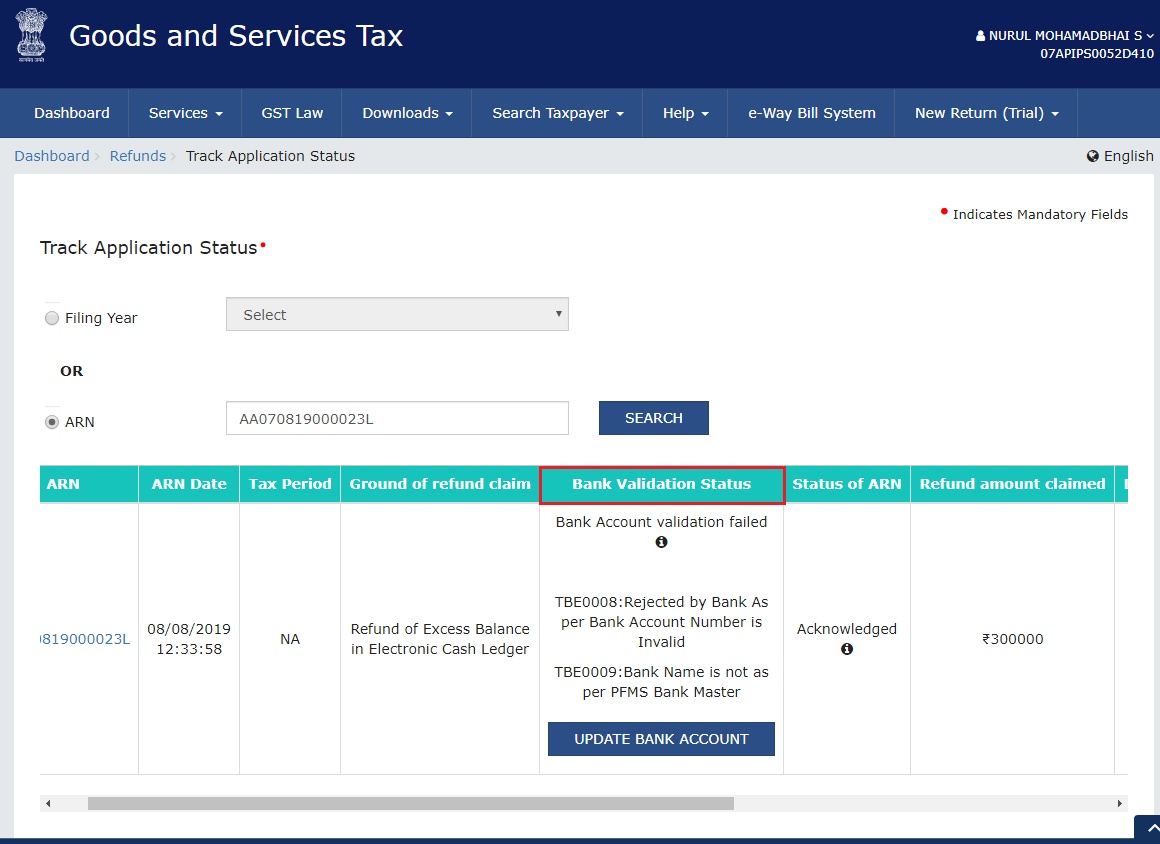

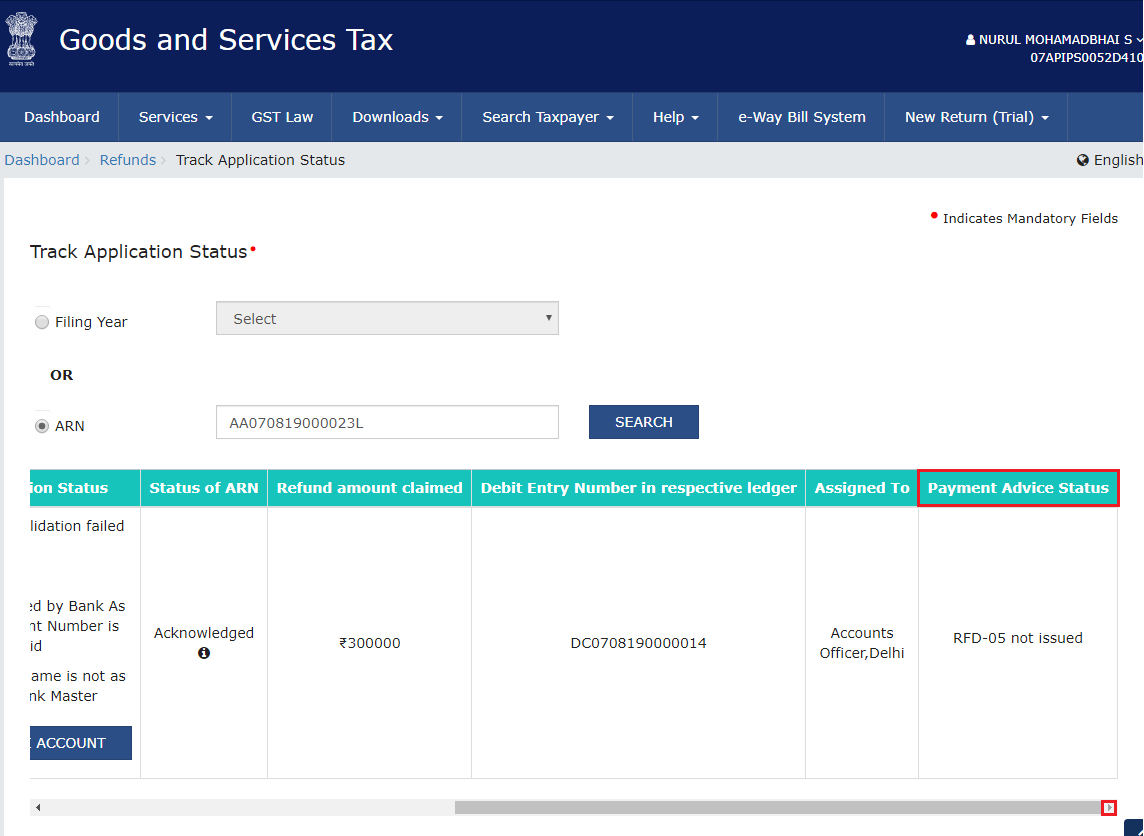

3) The search results are displayed.

a) Use the scroll bar and move to the right, to view further details related to the search criteria.

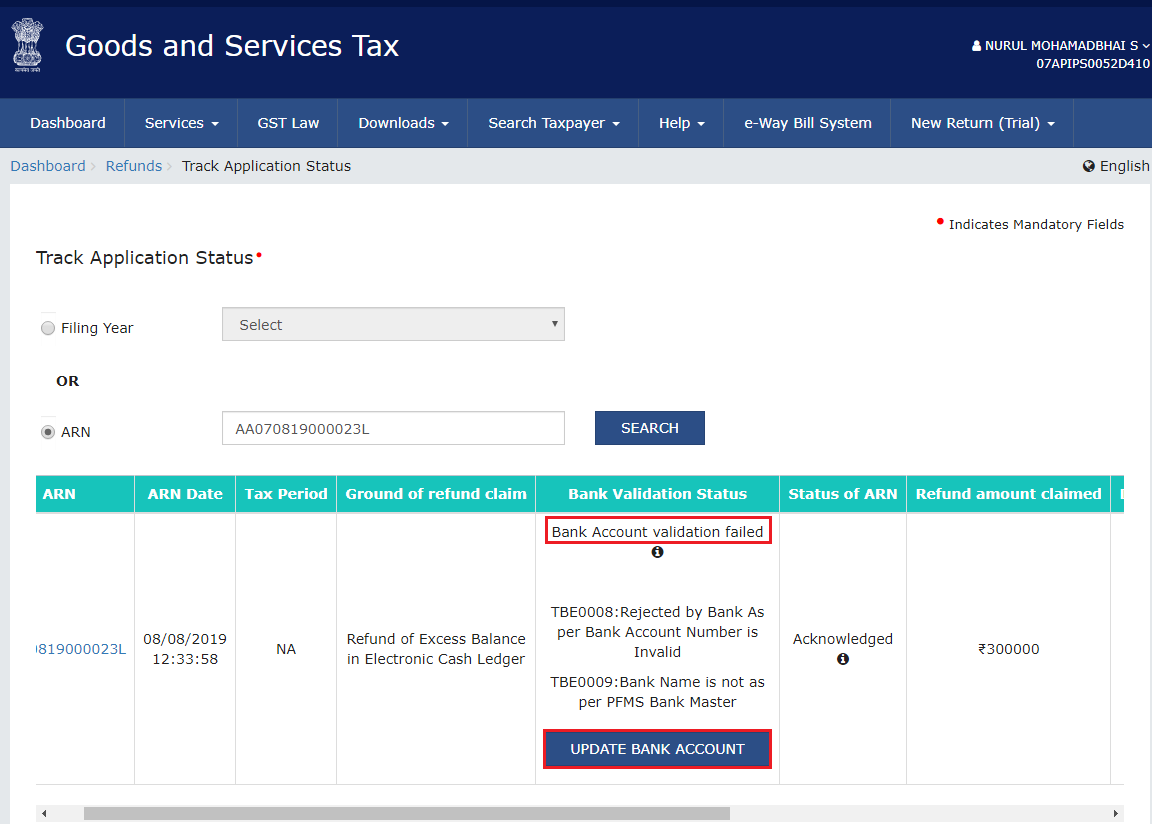

4) In case, the status of the Bank Account validation has failed, you can update your Bank Account details. Click on UPDATE BANK ACCOUNT.

Note: Taxpayer will receive SMS and e-mail on their registered e-mail ID and Mobile number, in case, Bank Account validation has failed on the GST Portal.

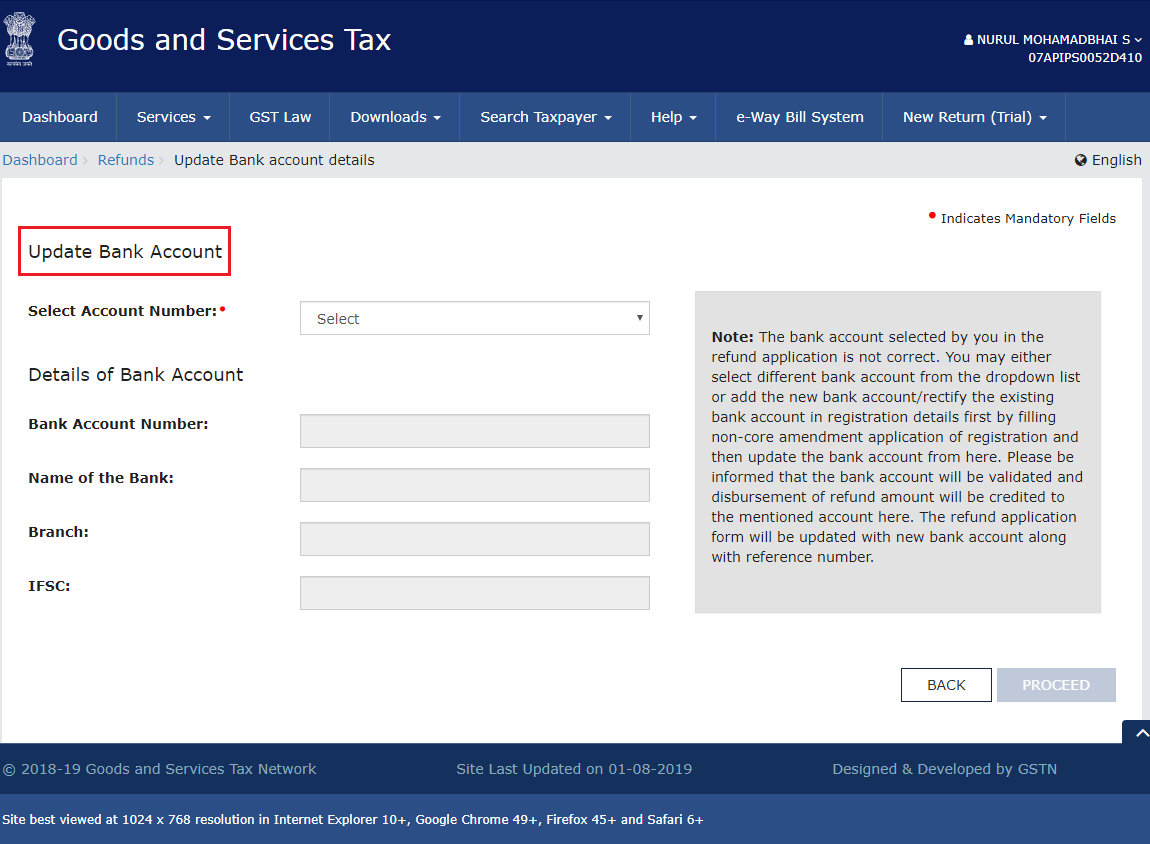

5) Update Bank Account page is displayed.

Note:

-

You can either select different Bank account from the drop-down list or add the new Bank account/ rectify the details for existing bank account by filing the non-core amendment application of registration and then update the Bank account from here. Click here to know more about filing the non-core amendment application of registration.

-

Bank account will be validated again and disbursement of refund amount will be credited to the account selected here. The refund application form will be updated with new Bank account along with reference number.

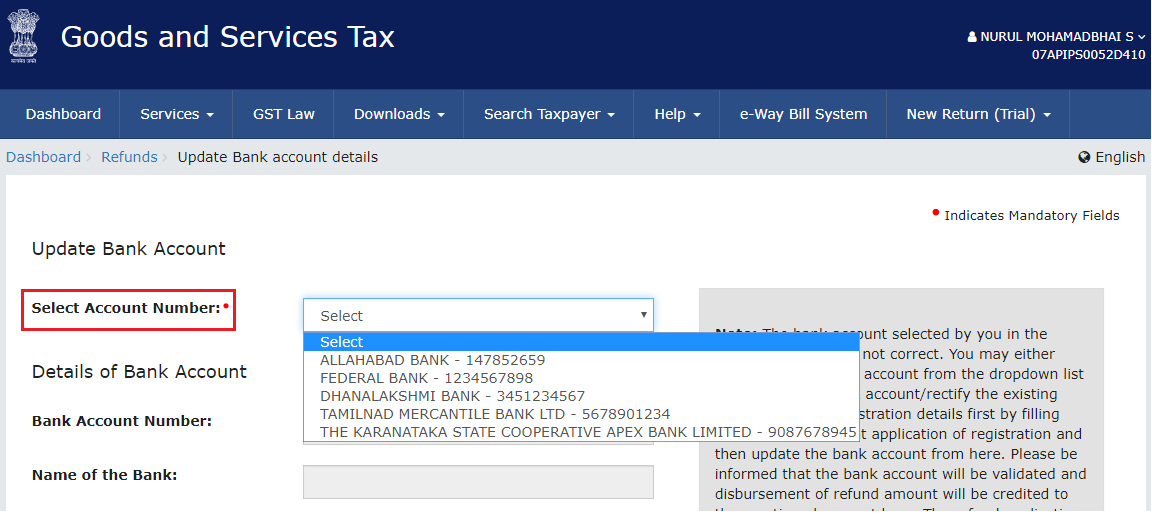

6) To add the new Bank account number, select Account Number from the drop-down list.

7) The details of selected Bank Account is auto-populated. Click PROCEED.

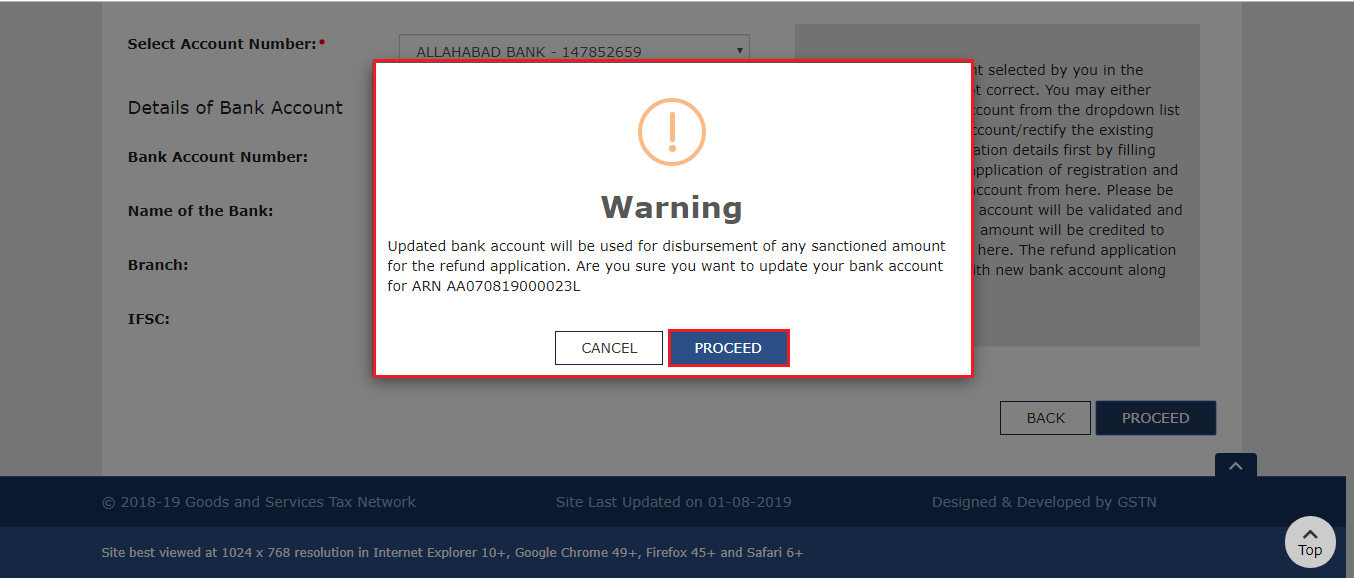

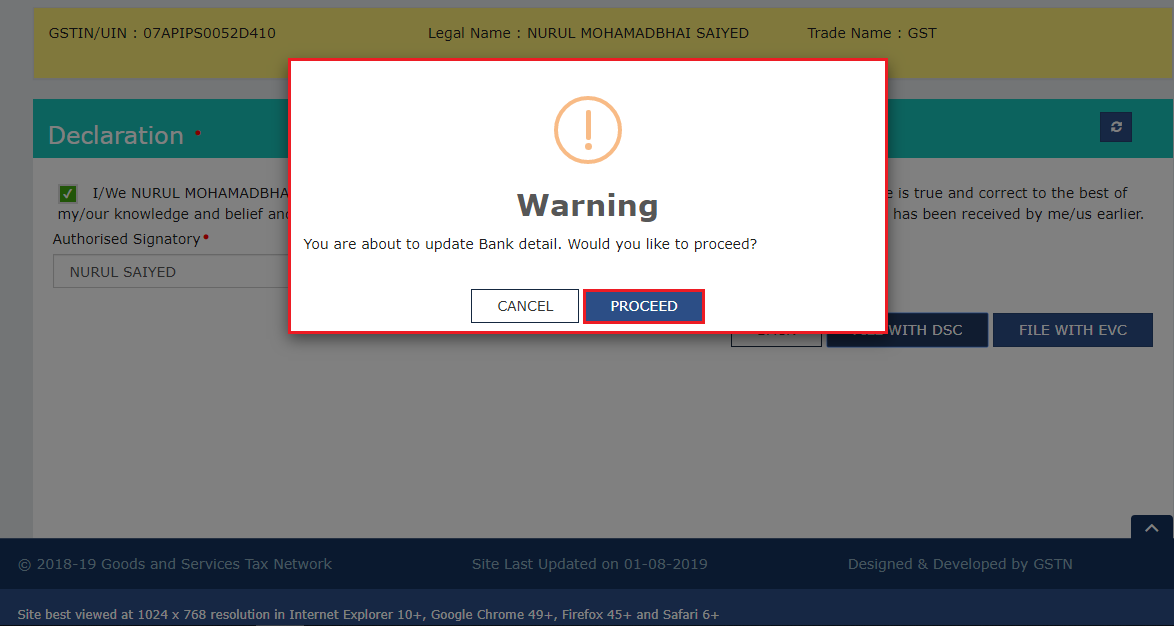

8) A Warning pop-up will appear. Click PROCEED to update the Bank Account details.

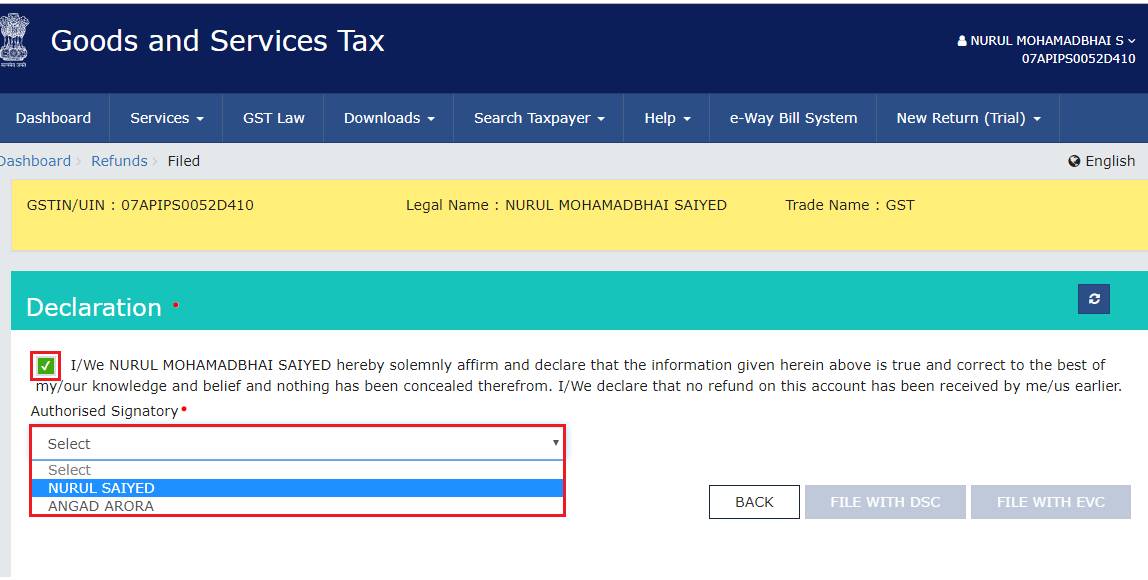

9) Select the check box appearing on the Declaration page. Select the Authorised Signatory from the drop-down list.

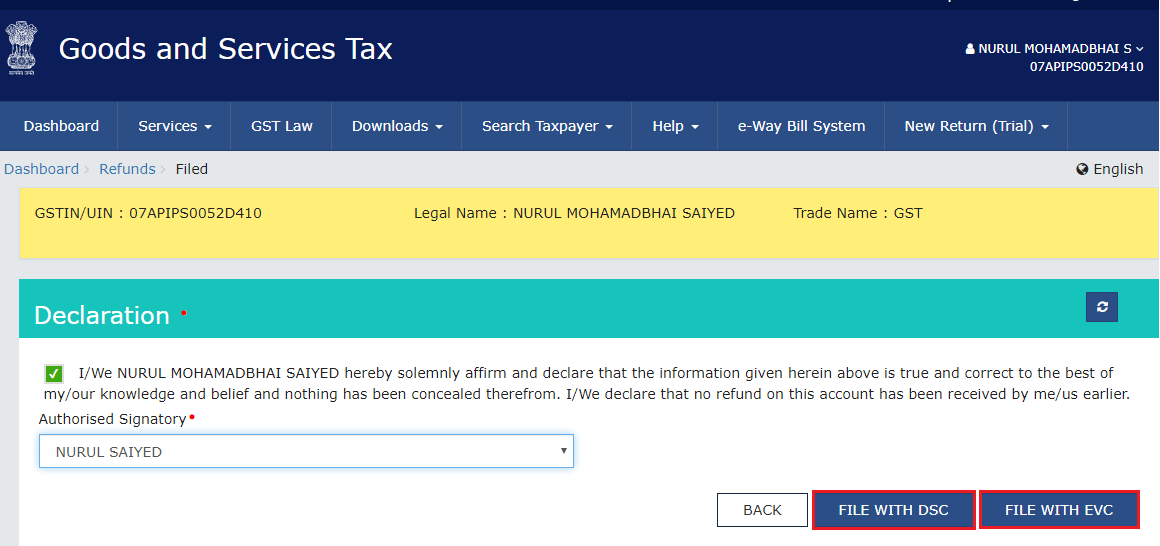

10) Click FILE WITH DSC or FILE WITH EVC to proceed.

11) Click PROCEED.

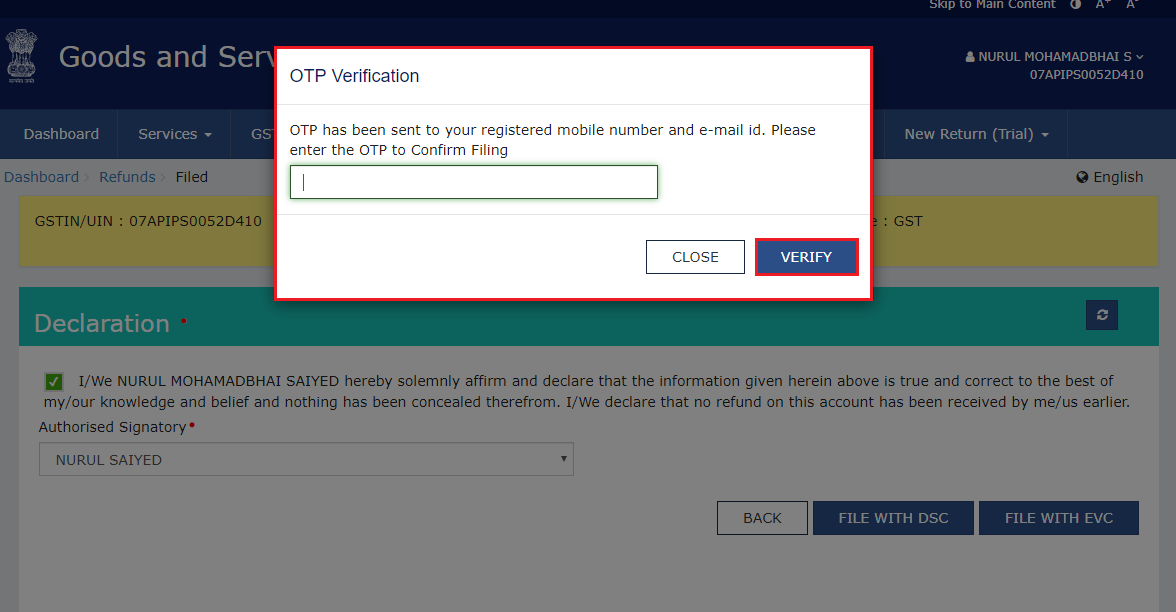

12) Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VERIFY button.

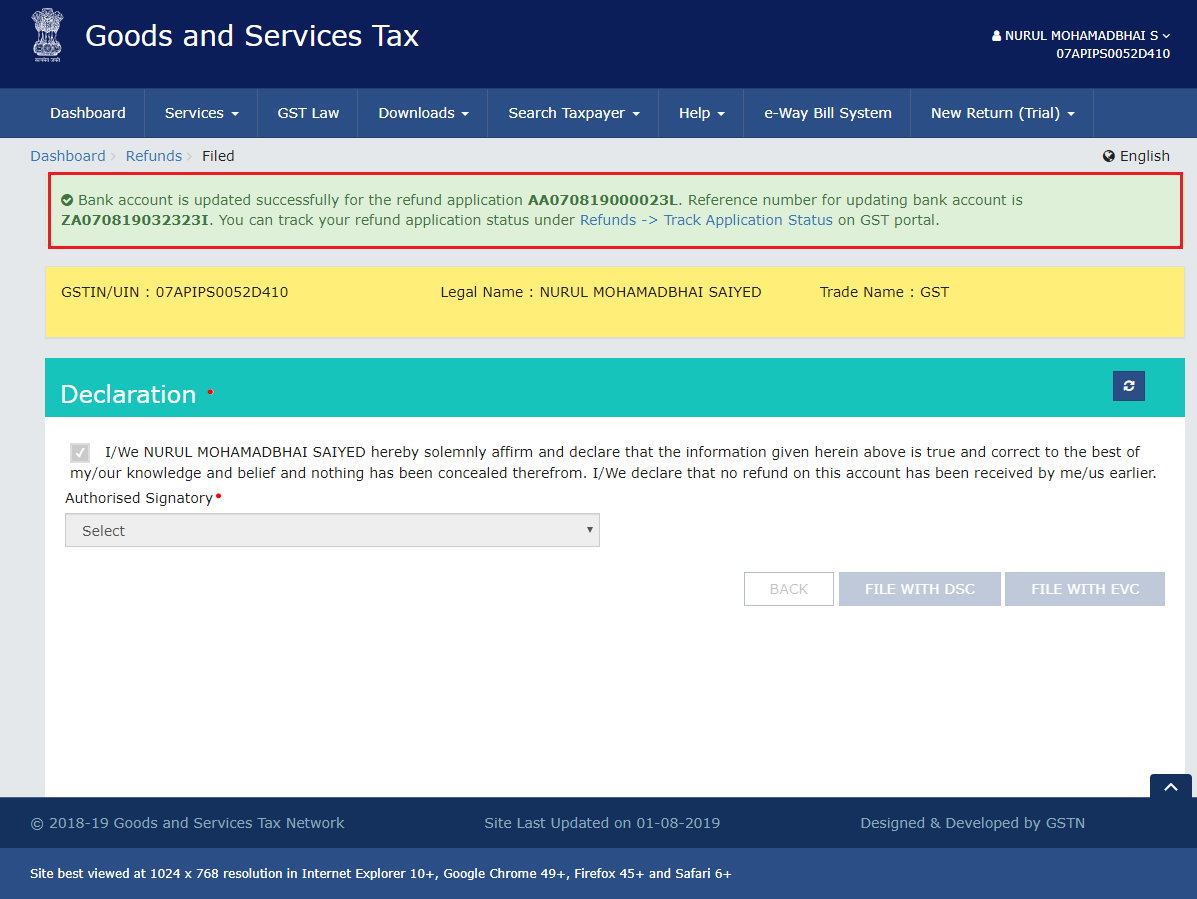

13) A success message is displayed that Bank Account is updated successfully for the refund application.

Note: Taxpayer will receive SMS and e-mail on their registered e-mail ID and Mobile number, in case, Bank Account validation is successfully verified on the GST Portal.