CGST Circular 199/2023

| Title | Clarification regarding taxability of services provided by an office of an organisation in one State to the office of that organisation in another State, both being distinct persons |

| Number | 199/2023 |

| Date | 17.07.2023 |

| Download |

Various representations have been received seeking clarification on the taxability of activities performed by an office of an organisation in one State to the office of that organisation in another State, which are regarded as distinct persons under section 25 of Central Goods and Services Tax Act, 2017 (hereinafter referred to as ‘the CGST Act’). The issues raised in the said representations have been examined and to ensure uniformity in the implementation of the law across the field formations, the Board, in exercise of its powers conferred under section 168(1) of the CGST Act hereby clarifies the issue in succeeding paras.

2. Let us consider a business entity which has Head Office (HO) located in State-1 and a branch offices (BOs) located in other States. The HO procures some input services e.g. security service for the entire organisation from a security agency (third party). HO also provides some other services on their own to branch offices (internally generated services).

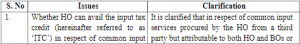

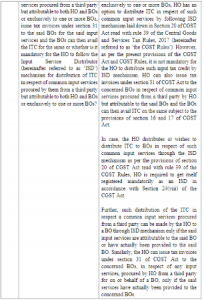

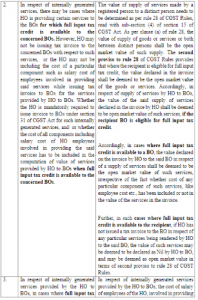

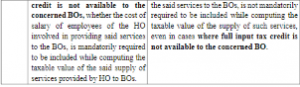

3. The issues that may arise with regard to taxability of supply of services between distinct person in terms of sub-section (4) of section 25 of the CGST Act are being clarified in the Table below:-

4. It is requested that suitable trade notices may be issued to publicize the contents of this circular.

5. Difficulty if any, in the implementation of this circular may be brought to the notice of the Board. Hindi version would follow.