[FORM GST ASMT – 15

[See rule 100(2)]

Reference No.: Date:

To

_______________ (GSTIN/ID)

_______________ Name

_______________ (Address)

Tax Period: F.Y.:

SCN reference no.: Date:

Act/Rules Provisions:

Assessment order under section 63

Preamble – << standard >>

The notice referred to above was issued to you to explain the reasons for continuing to conduct business as an un-registered person, despite being liable to be registered under the Act.

OR

The notice referred to above was issued to you to explain the reasons as to why you should not pay tax for the period …………… as your registration has been cancelled under subsection (2) of section 29 with effect from———

Whereas, not reply was filled by you or your reply was duly considered during proceedings held on ——— date(s).

On the basis of information available with the department / record produced during proceedings, the amount assessed and payable by you is as under:

Introduction:

Submission, if any:

Conclusion (to drop proceedings or to create demand):

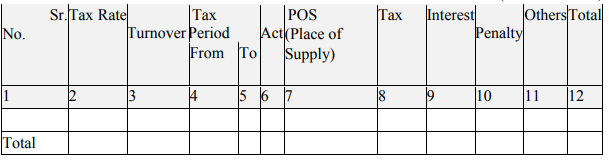

Amount assessed and payable:

(Amount in Rs.)

Please note that interest has been calculated up to the date of passing the order. While making payment, interest for the period between the date of order and the date of payment shall also be worked out and paid along with the dues stated in the order.

You are hereby directed to make the payment by <<date>> failing which proceedings shall be initiated against you to recover the outstanding dues.

Signature

Name

Designation

Jurisdiction

Address

Note –

- Only applicable fields may be filled up.

- Column nos. 2, 3, 4 and 5 of the above Table i. e. tax rate, turnover and tax period are not mandatory.

- Place of Supply (POS) details shall be required only if demand is created under IGST Act.]1