Form GST REG-26

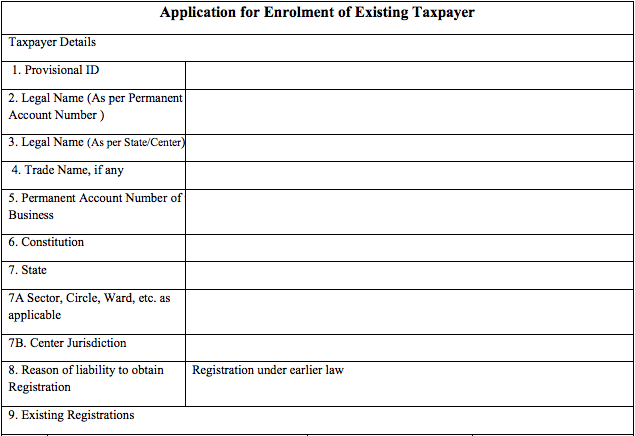

Application for Enrolment of Existing Taxpayer

Instructions for filing of Application for enrolment

1) Every person, other than a person deducting tax at source or an Input Service Distributor, registered under an existing law and having a Permanent Account Number issued under the Income-tax Act,1961 (Act 43 of 1961) shall enroll on the common portal by validating his email address and mobile number.

2) Upon enrolment under clause (a), the said person shall be granted registration on a provisional basis and a certificate of registration in FORM GST REG-25,incorporating the Goods and Services Tax Identification Number there in, shall be made available to him on the common portal:

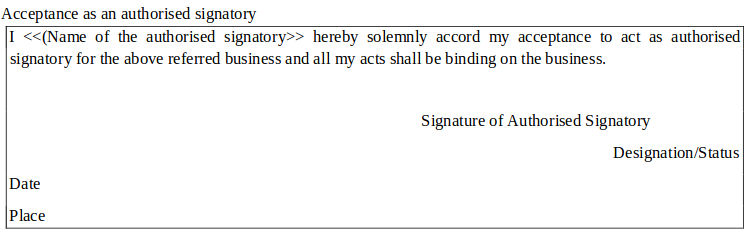

3) Authorisation Form:-

For each Authorised Signatory mentioned in the application form,Authorisationor copy of Resolution of the Managing Committee or Board of Directors to be filed in the following format:

Declaration for Authorised Signatory (Separate for each signatory)

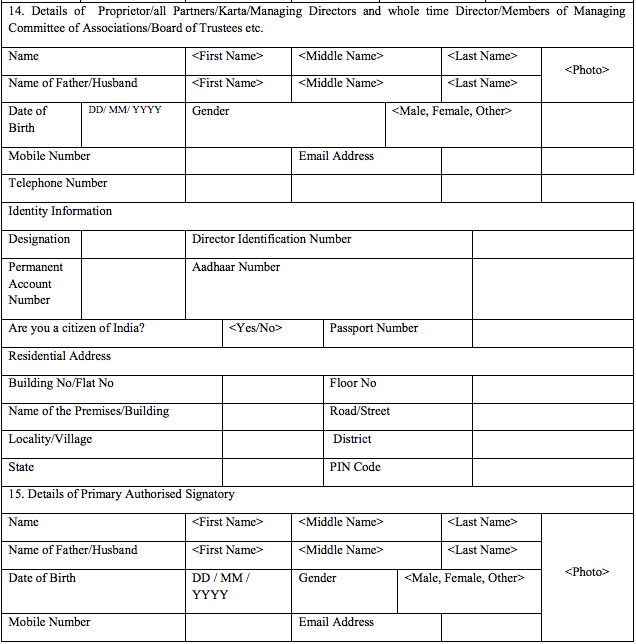

(Details of Proprietor/all Partners/Karta/Managing Directors and whole time Director/Members of Managing Committee of Associations/Board of Trustees etc)

1) ( Name of theProprietor/all Partners/Karta/Managing Directors and whole time Director/Members ofManaging Committee of Associations/Board of Trustees etc )

2)

3)

hereby solemnly affirm and declare that (name of the authorisedsi gatory) to act as an authorised siatory for the business (Goods and Services Tax Identification Number Name of the Business) for which application for registration is being filed/ is registered under the Central Goods and Service Tax Act,2017.

All his actions in relation to this business will be binding on me/ us.

Signatures of the persons who are Proprietor/all Partners/Karta/Managing Directors and whole time Director/Members of Managing Committee of Associations/Board of Trustees etc.

| S. No. | Full Name | Designation/Status | Signature |

|---|---|---|---|

| 1. | |||

| 2. |

Instructions for filing online form

-

Enter your Provisional ID and password as provided by the State / Commercial Tax / Central Excise/Service Tax Department for log in on the GST Portal.

-

Correct Email address and Mobile number of the Primary Authorised Signatory are to be provided.

-

The Email address and Mobile Number would be filled as contact information of the Primary Authorised Signatory.

-

E mail and Mobile number to be verified by separate One Time Passwords. Taxpayer shall change his user id and password after first login.

-

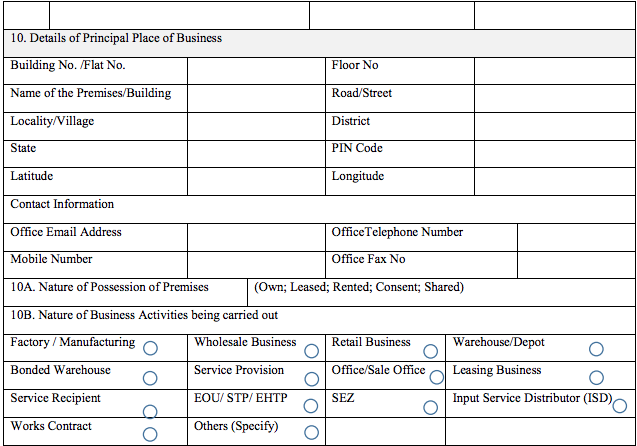

Taxpayer shall require to fill the information required in the application form related details of Proprietor/all Partners/Karta/Managing Directors and whole time Director/Members of Managing Committee of Associations/Board of Trustees, Principal Place of Business and details in respect Authorised signatories.

-

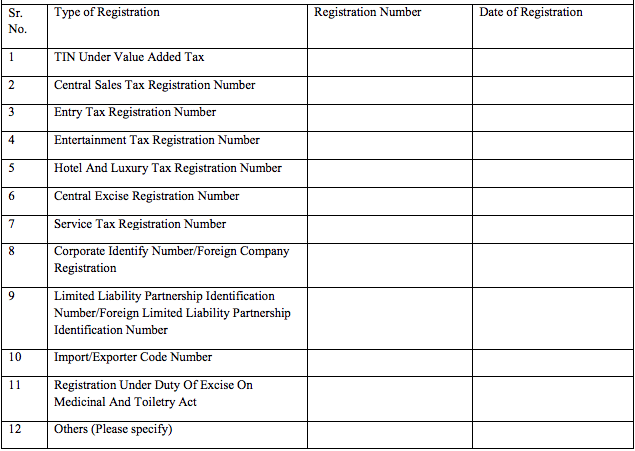

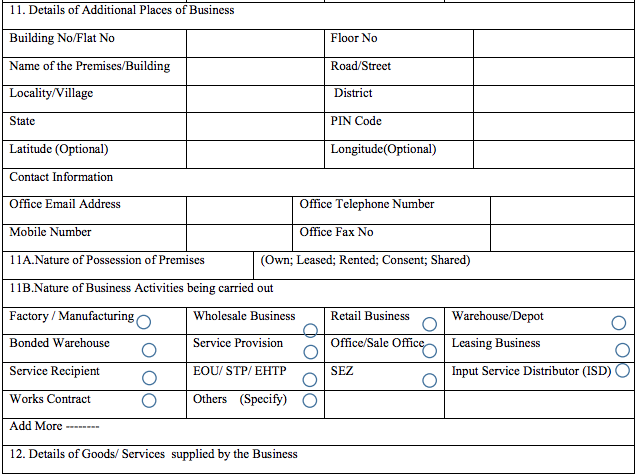

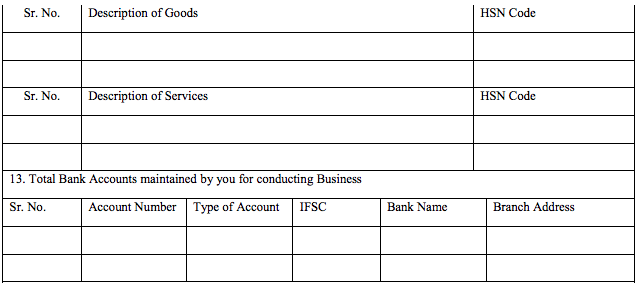

Information related to additional place of business, Bank account, commodity in respect of goods and services dealt in (top five) are also required to be filled.

-

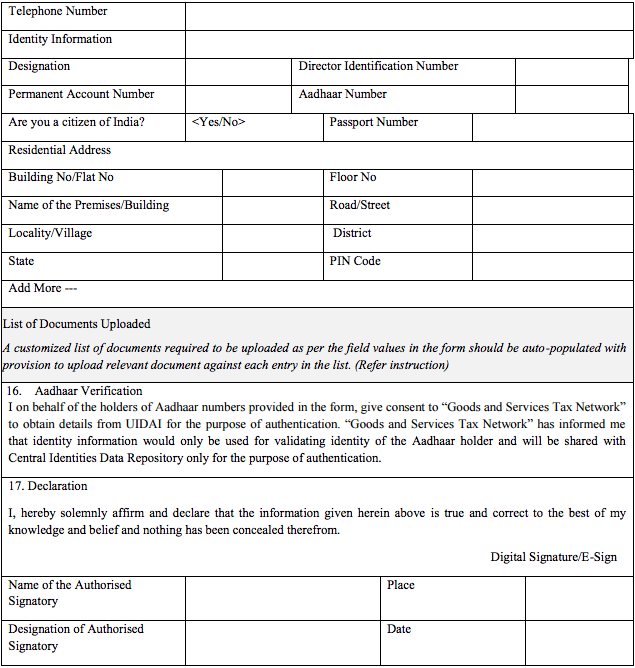

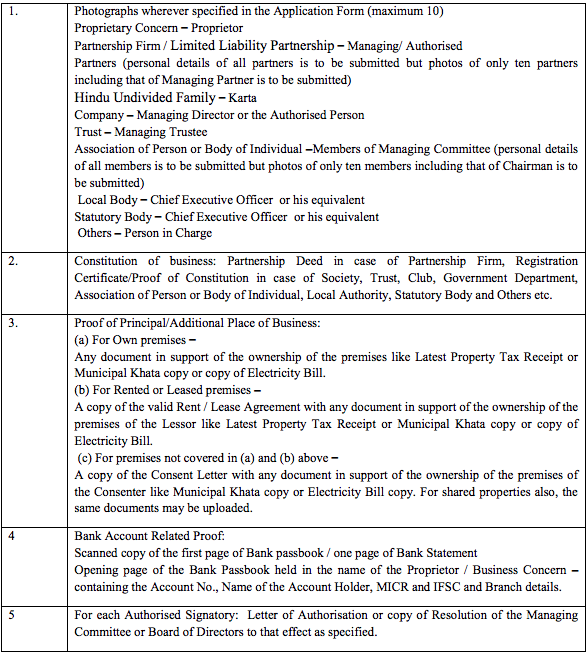

Applicant need to upload scanned copy of the declaration signed by the Proprietor/all Partners/Karta/Managing Directors and whole time Director/Members of Managing Committee of1 Associations/Board of Trustees etc. in case he/she declares a person as Authorised Signatory as per Annexure specified.Documents required to be uploaded as evidence are as follows:-

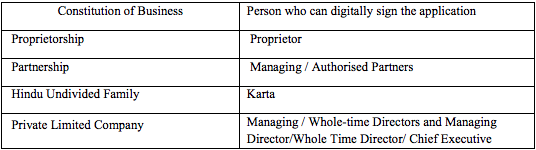

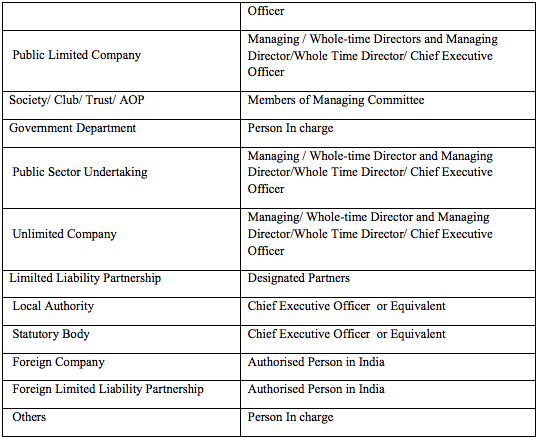

- After submitting information electronic signature shall be required. Following person can electronically sign application for enrolment:-

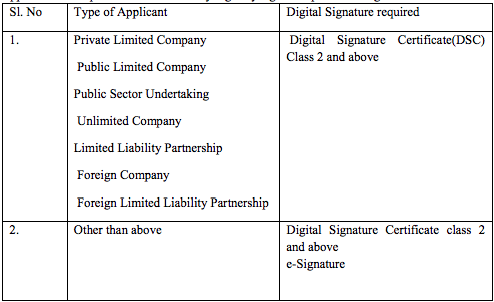

- Application is required to be mandatorily digitally signed as per following :

Note :-

1) Applicant shall require to register their DSC on common portal.

2) e-Signature facility will be available on the common portal for Aadhar holders.

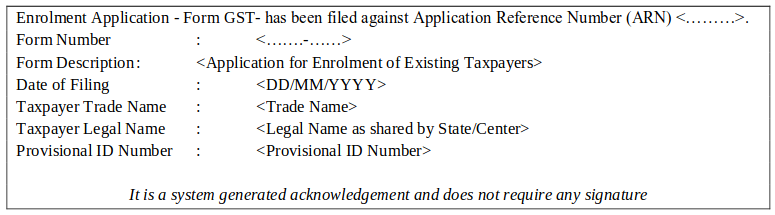

All information related to Permanent Account Number, Aadhaar, Director Identification Number, Challan Identification Number, Limited Liability Partnership Identification Number shall be online validated by the system and Acknowledgment Reference Number will be generated after successful validation of all the filled up information.

Status of the online filed Application can be tracked on the common portal. 198

1) Authorised signatory should not be minor. 2) No fee is applicable for filing application for enrolment.