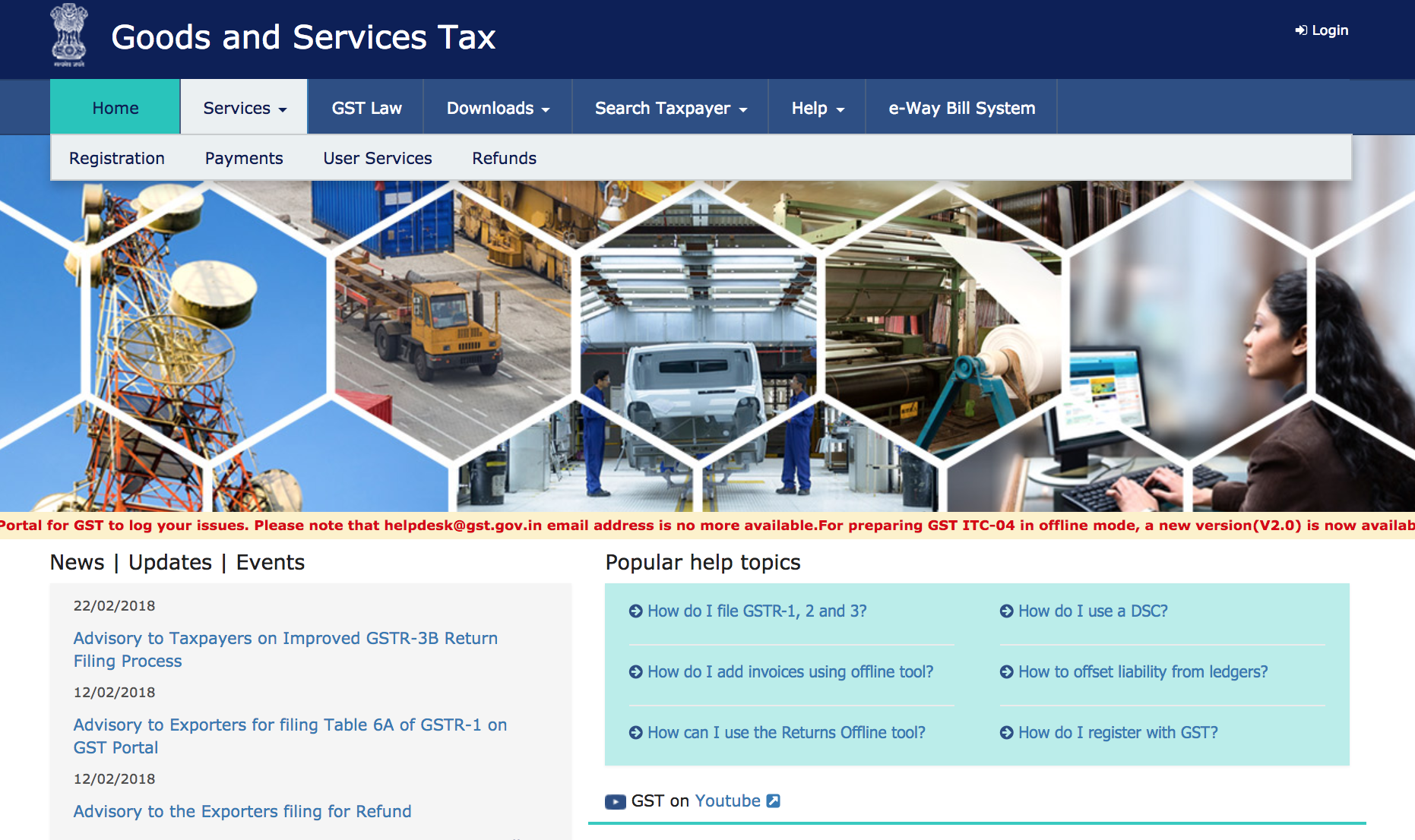

GST Common Portal

The GST common portal known as GSTN facilities in GST registration, GST Return Filing and other services relevant to taxpayer registered under GST.

GSTN Common Portal

Primary services offered by GST Common Portal

-

Registration – Anyone willing to register under GST can use this service

-

Payments – Typically used for creating Challans and tracking payments

-

User Services – Users can search HSN/SAC code, grievance redressal, locate GSP and so on

-

Refund – Track refund status

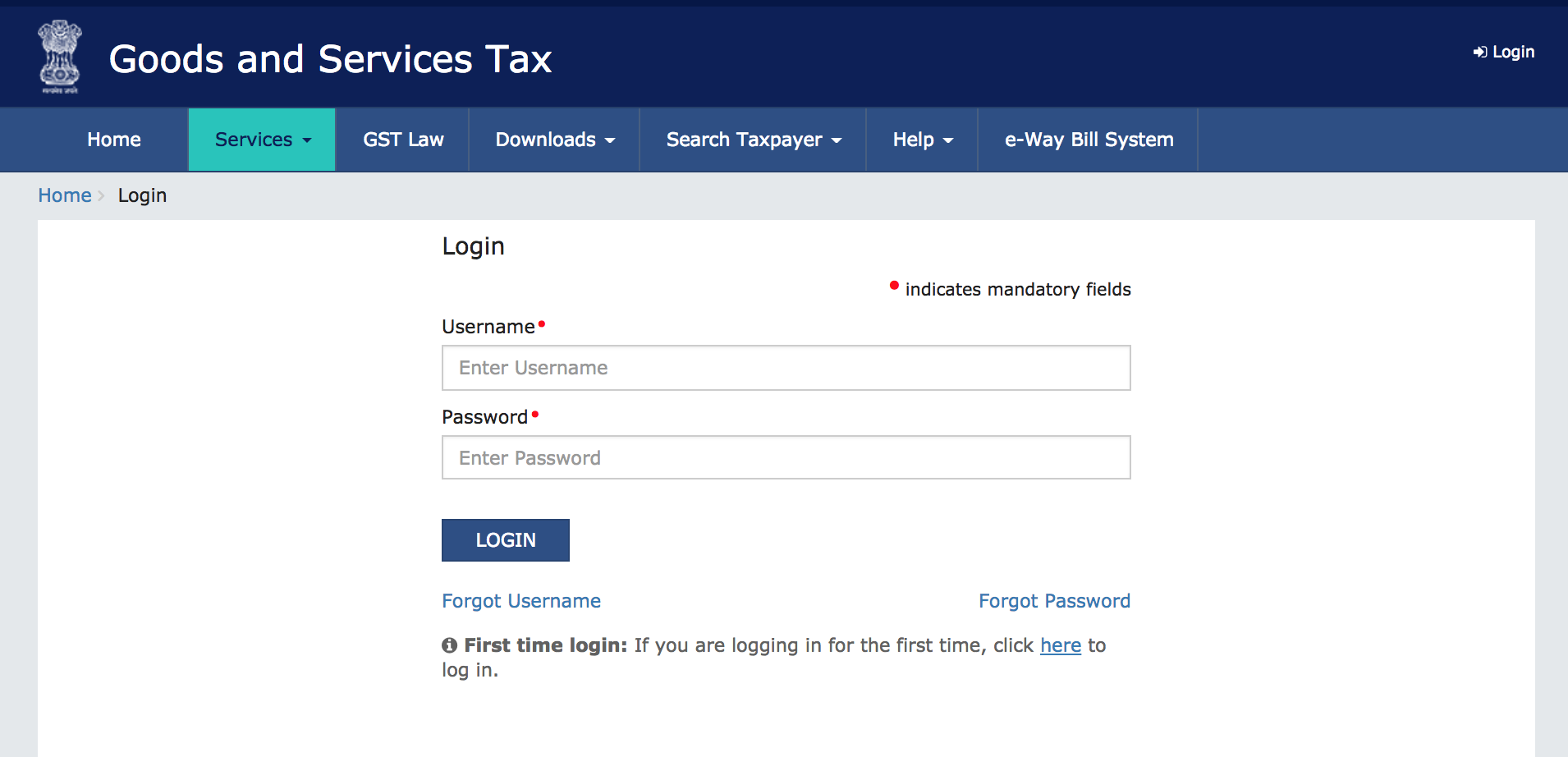

Link to GST Common Portal Login

GST Common Portal Login Page

Services GSTN offers to a registered GST tax payer

Once a user logs in, these are some of the major services available.

-

Application for Registration for Normal Taxpayer, ISD, Casual Dealer

-

Application for GST Practitioner

-

Opting for Composition Scheme (GST CMP 02)

-

Stock intimation for Composition Dealers (GST CMP 03)

-

Opting out of Composition Scheme (GST CMP 04)

-

Filing GST Returns

-

Payment of GST

-

Claim Refund of excess GST paid (RFD 01)

-

Transition Forms (TRAN 1, TRAN 2, TRAN 3)

-

Viewing E-Ledgers

-

Other than the above changing core and non-core fields, users can also browse through notices issued, File ITC forms, Engage / Disengage GST Practitioner through the GST Common Portal

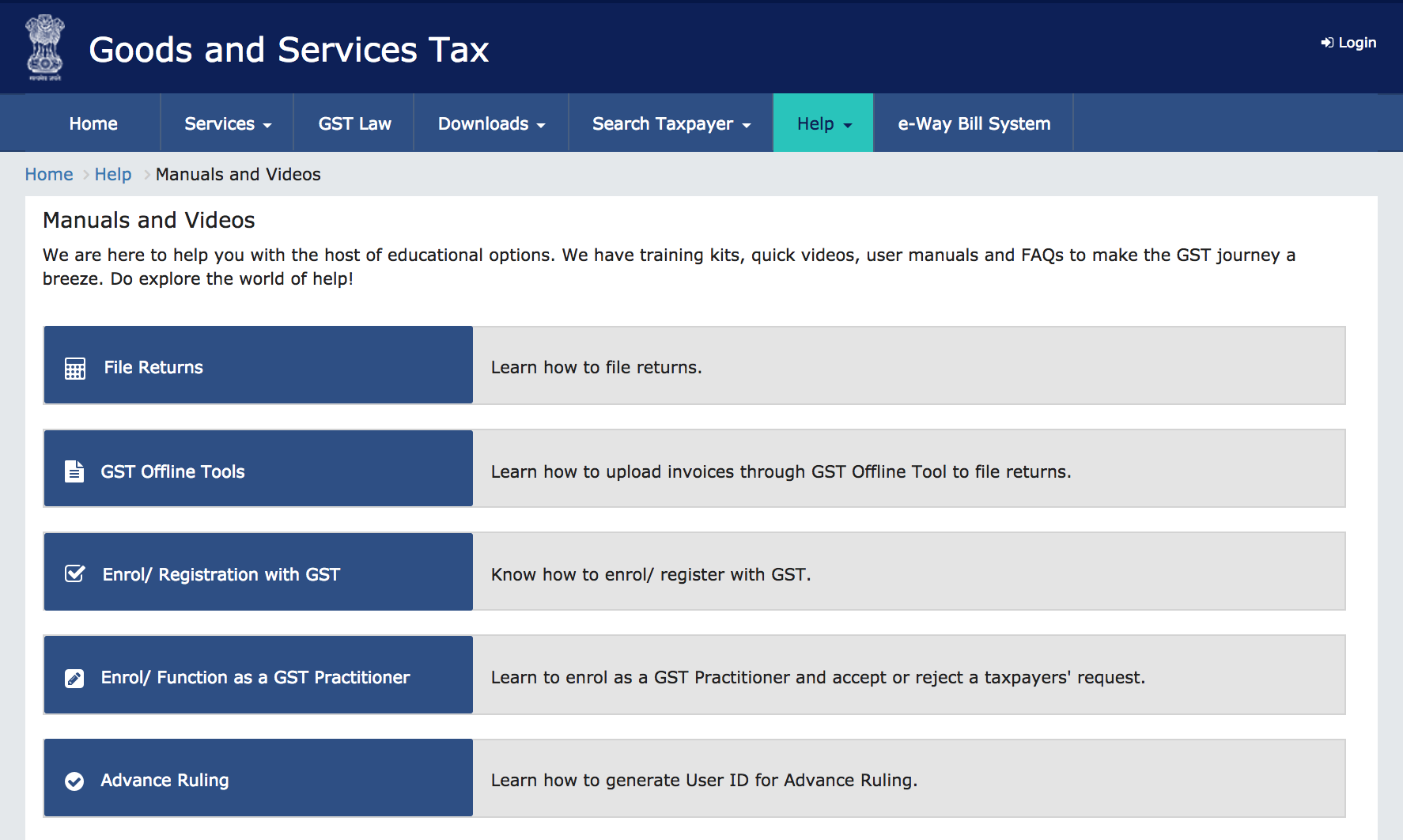

Apart from the above, the GST Common Portal has a Help section where anyone can access information relevant to GST. The highlight of the help section is the library of useful videos and manuals on GST including training kits, etc.

GST Common Portal Help section

The GST Common Portal also has an access to E-Way Bill System. However, they are not the development agency for the same. E-Way Bill system has been developed by National Informatics Centre, India. To know more about E-Way Bills please read our article on E-Way Bill article.