Following-up and Taking Action in Revision Order Proceedings

How can I follow-up and take actions in Revision Order Proceedings initiated against my case?

To follow-up and take actions in Revision Order Proceedings initiated against your case, perform following steps:

A. View Additional Notices/Orders page to view Notices and Orders issued against you by Revisional Authority and File/View Reply

B. View/download issued Order page to view Orders and Submit Rectification request against the Revision Order

A. View Additional Notices/Orders and to View/File Reply

To view issued Notices and Orders, perform following steps:

-

Access the www.gst.gov.in URL. The GST Home page is displayed.

-

Login to the portal with valid credentials.

-

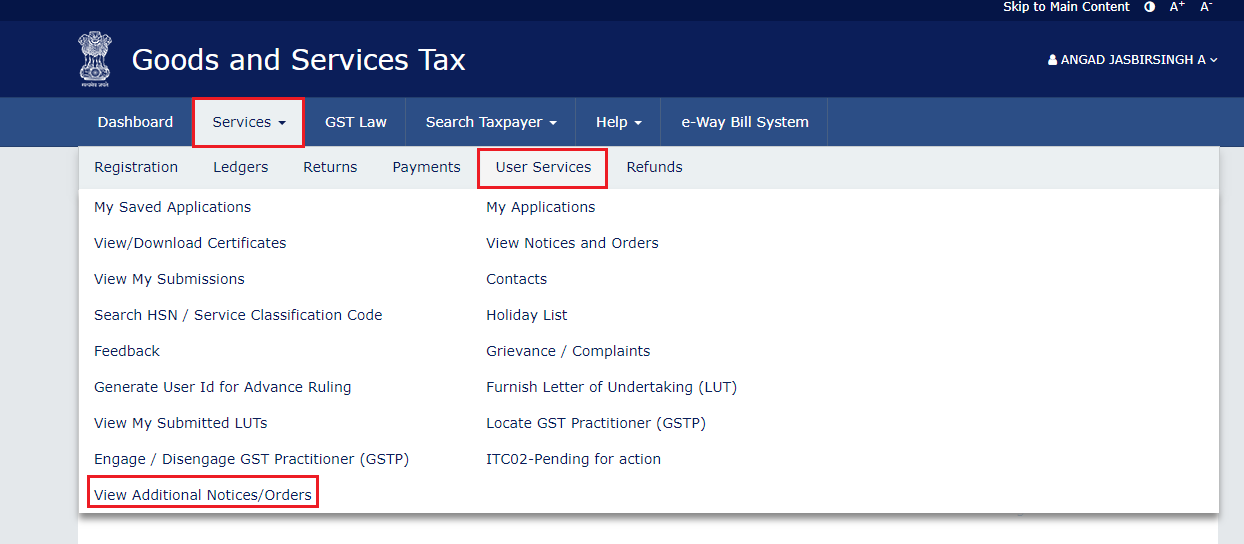

Dashboard page is displayed. Click Dashboard > Services > User Services > View Additional Notices/Orders

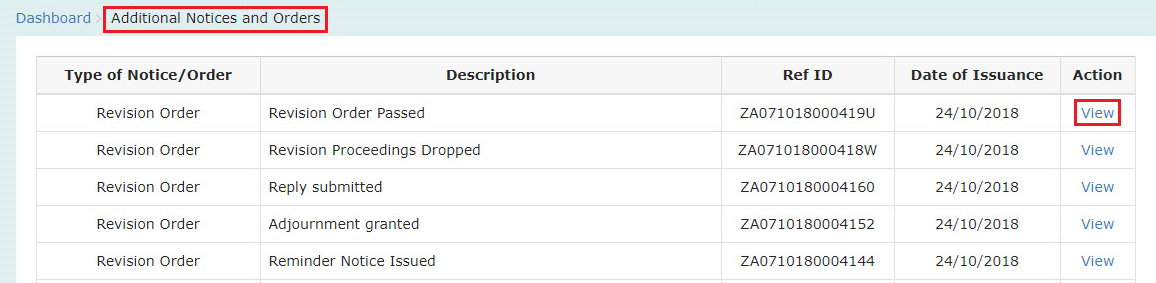

- Additional Notices and Orders page is displayed. Click the View hyperlink to go to the Case Details screen of the issued Notice/Order.

Note: All orders/notices are displayed in descending order. You can search for the orders/notices you want to view using the Navigation buttons provided below.

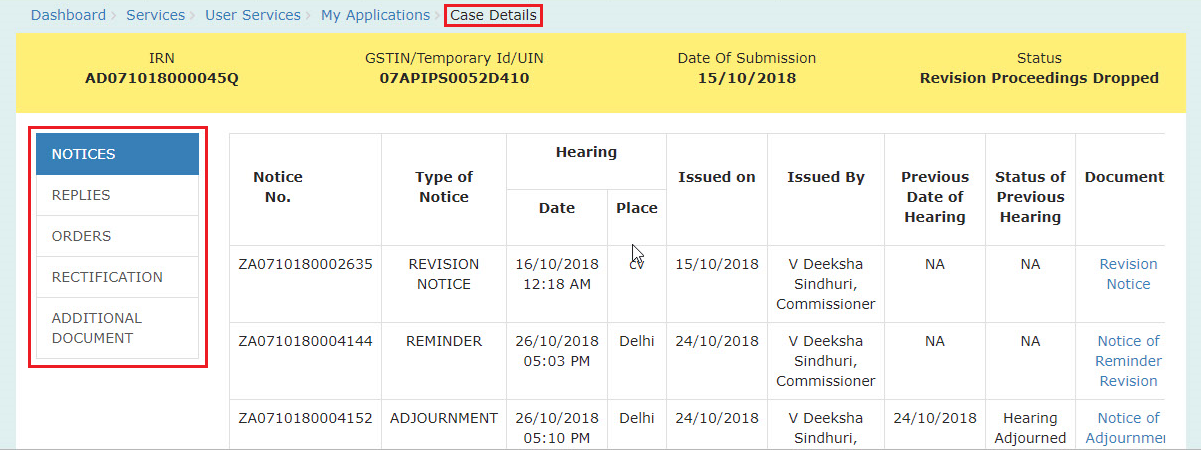

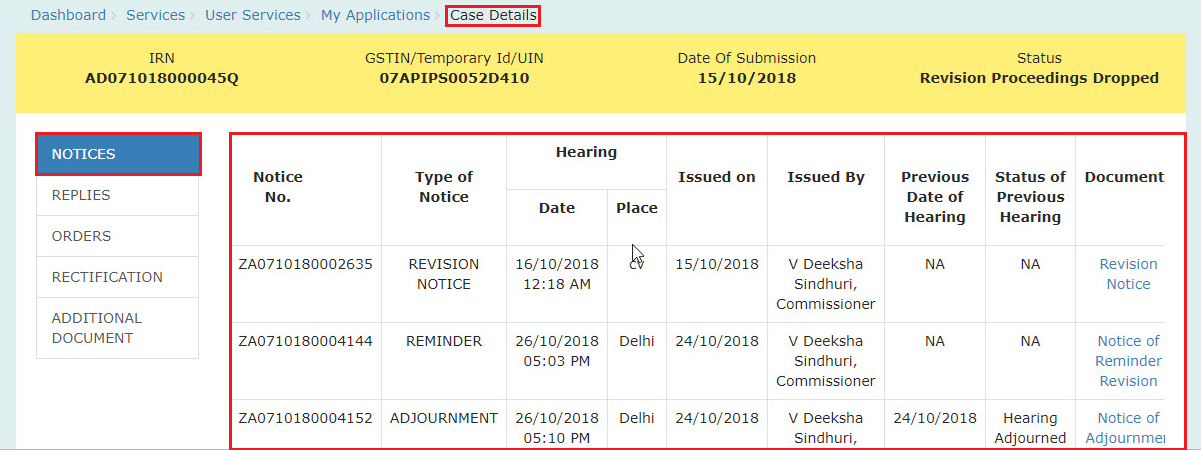

- Case Details page is displayed. The NOTICES tab is selected by default. This tab displays all the notices (Revision Notice/Reminder/Adjournment) issued to you.

Note: Click the tabs provided on the left hand side of the page to view more details about each tab.

- To view issued Notices and file your reply, Click the document name(s) in the Document section of the table to download into your machine and view them.

- Scroll to the right and click the Reply hyperlink in the Notice table against which you want to file the Reply.

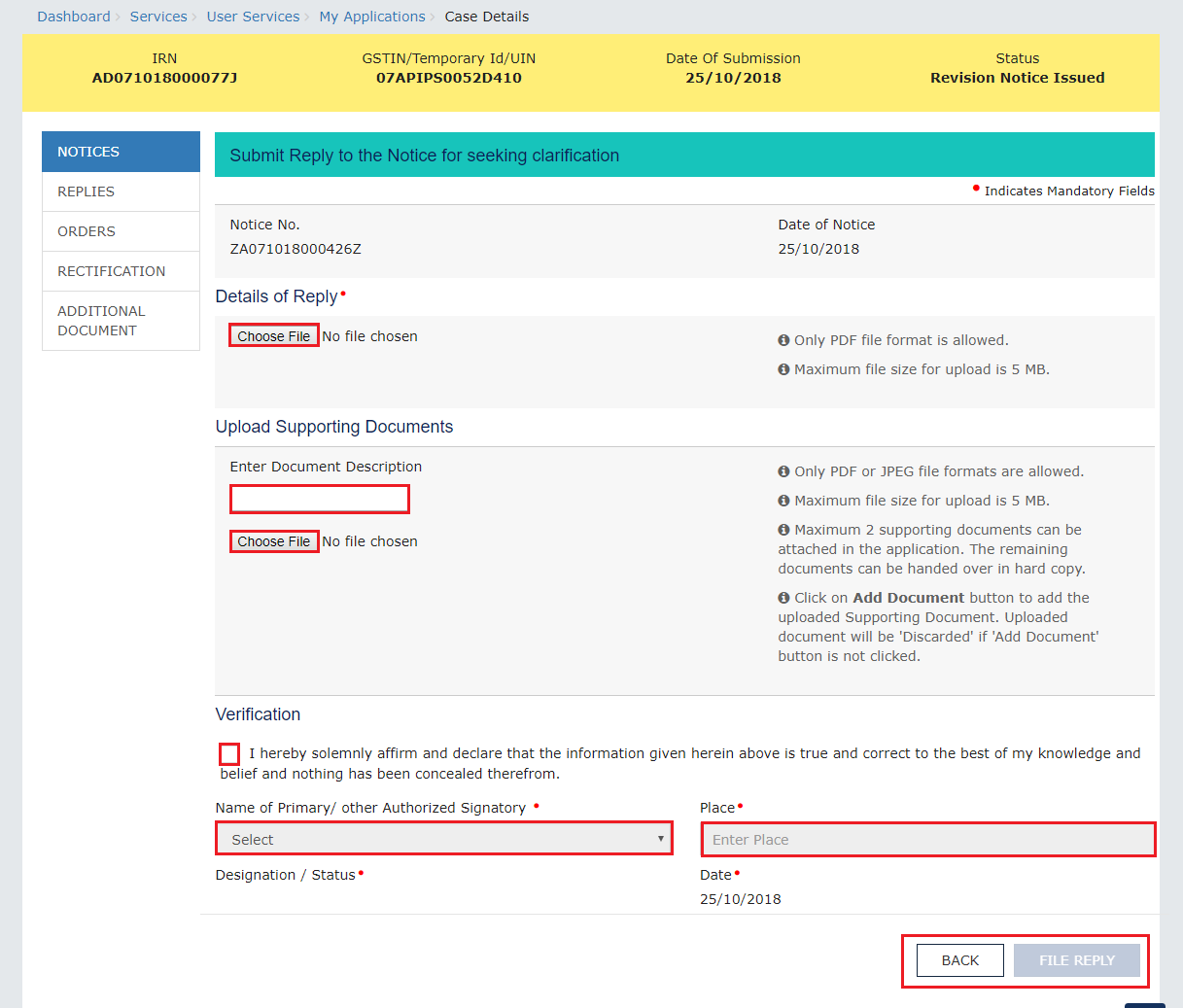

- The Reply screen gets displayed. Click BACK to go back to the previous screen or enter data in the displayed fields as mentioned in the following steps:

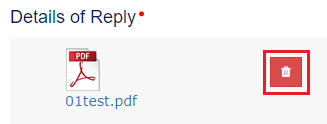

- a. You can prepare the reply to the notice offline with the following information: Counter reply and Reliefs being claimed. Then, in the Details of Reply field, click the Choose File button to upload the prepared reply document(s). You can delete the uploaded document by clicking the trash-bin icon and upload again.

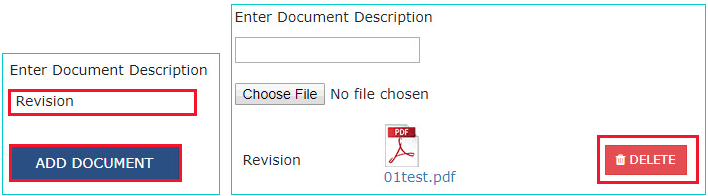

- b. If required, you can also upload supporting documents in the Upload Supporting Documents field. This is not a mandatory field. Enter document description and click the Choose File button. ADD DOCUMENT button gets displayed. Click it to upload the document(s) from your machine related to this revision notice. You can delete the uploaded document by clicking the DELETE button and upload again.

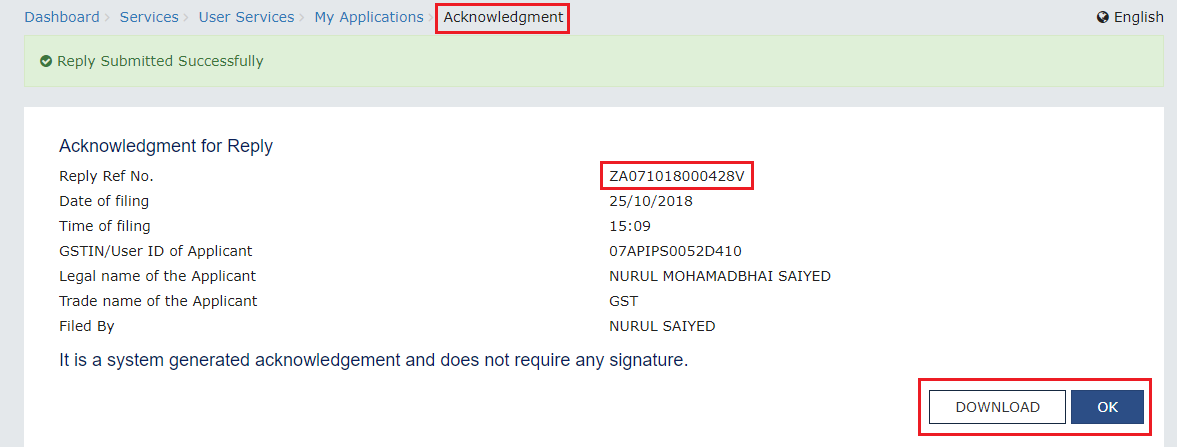

- Click the FILE REPLY button. Click the PROCEED button and click SUBMIT WITH DSC or SUBMIT WITH EVC. Success message is displayed, with the generated Reply Reference Number, which will be sent to your registered email ID and mobile as well. Click DOWNLOAD to download the acknowledgement or click OK.

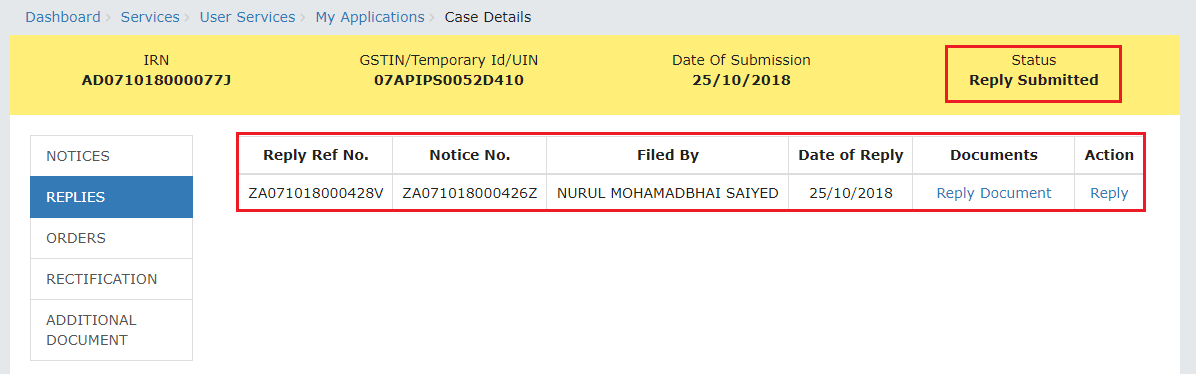

- The updated Replies tab is displayed with the filed Reply and the Status gets changed to “Reply Submitted”.

- To view or download the filed replies, click the document name(s) in the Documents section of the table to download into your machine and view them

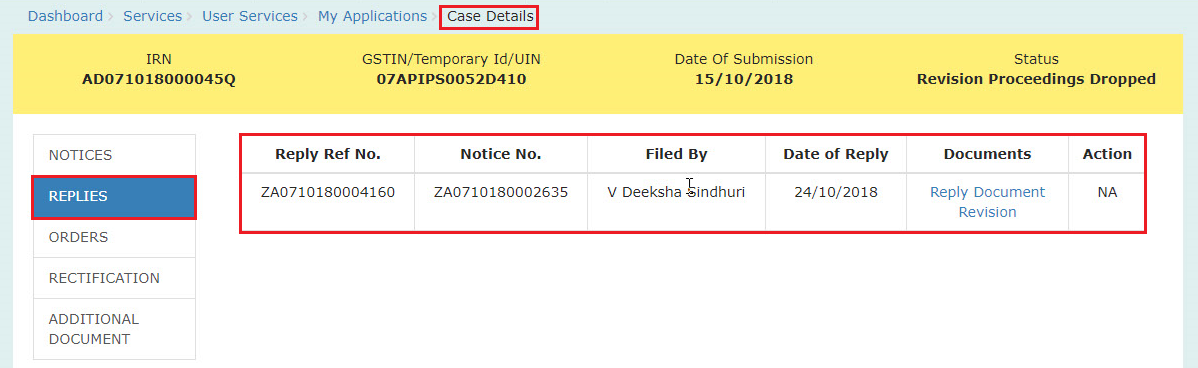

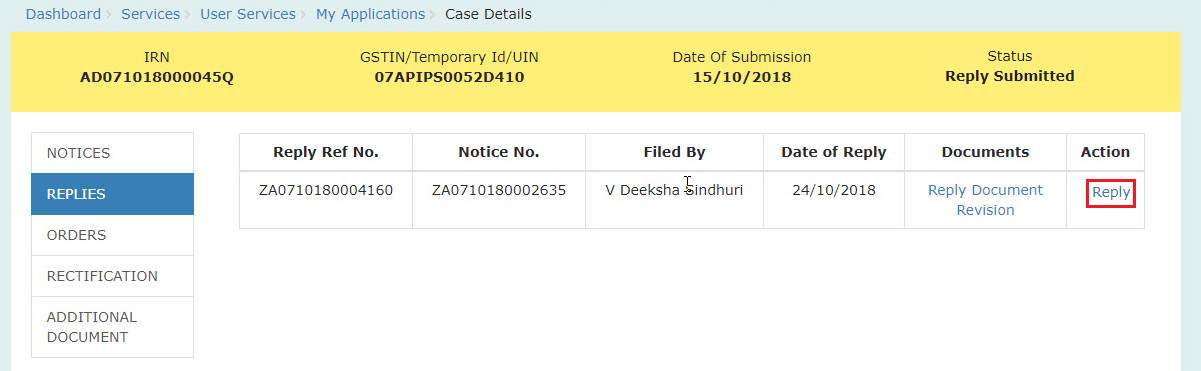

- To file counter-reply against the Reply filed by the Tax Official, on the Case Details page of that particular IRN, select the REPLIES tab and click the “Reply” hyperlink. Fill in the required details as explained earlier.

Note: Once you have filed counter-reply, following actions also take place on the GST Portal:

-

Your Dashboard gets updated with the record of the filed Counter-reply and the Status gets changed to “Reply Submitted”.

-

Dashboard of the Tax Officials is also updated with the record of the filed Reply.

-

Intimation of the Filed Reply is sent to the taxpayer on his/her registered email ID and mobile.

B. View/download Issued Order and Submit Rectification Request against the Revision Order

To download order issued against your case, perform following steps:

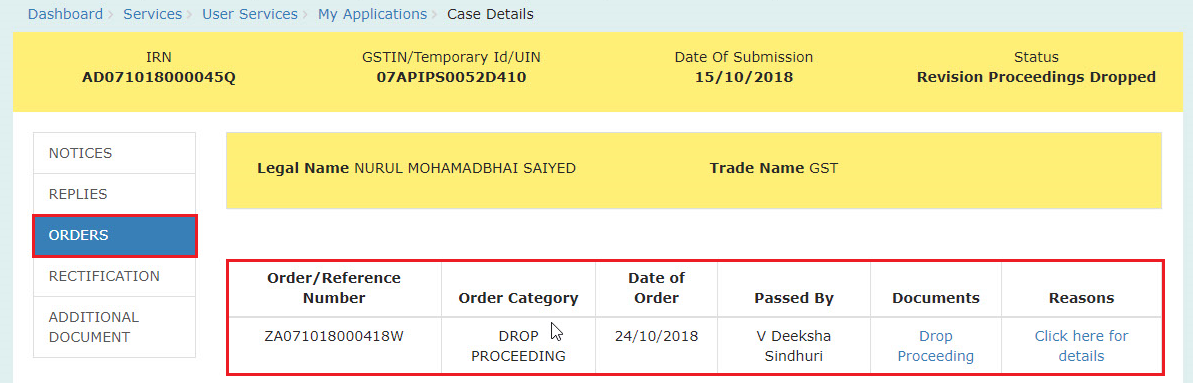

- On the Case Details page of that particular IRN, click the ORDERS tab. This tab provides you an option to view the issued order, with all its attached documents, in PDF mode.

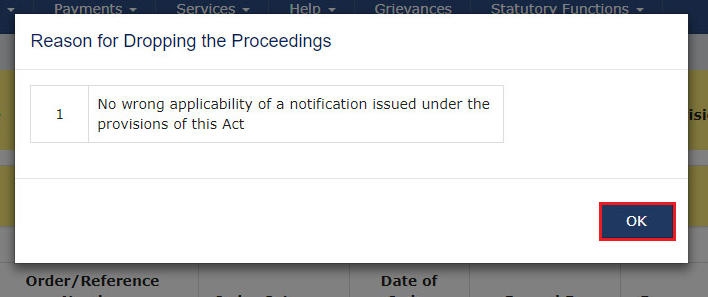

- Click the document name(s) in the Documents section of the table to download into your machine and view them. Click the Click here for details hyperlink in the displayed Order. Following popup is displayed. Click OK to close the popup.

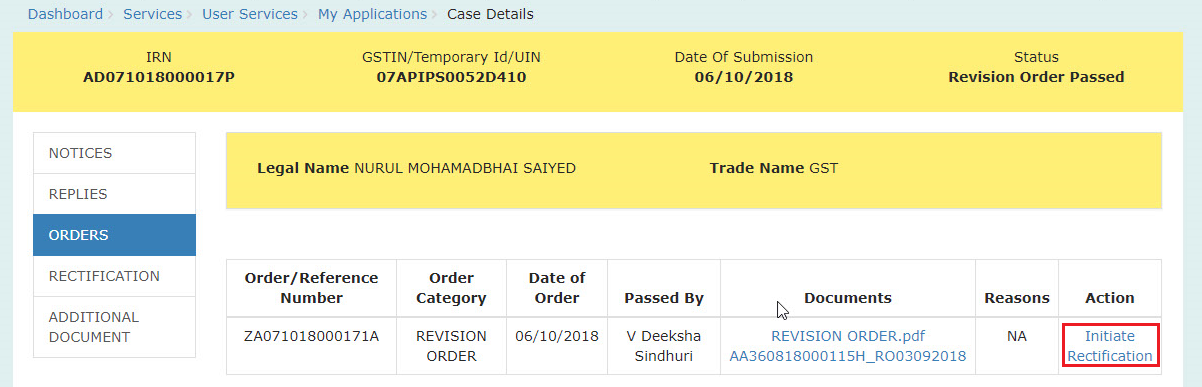

- To submit Rectification Request against the Revision Order issued to you by the Revisional Authority, select the ORDERS tab and click the “Initiate Rectification” link.

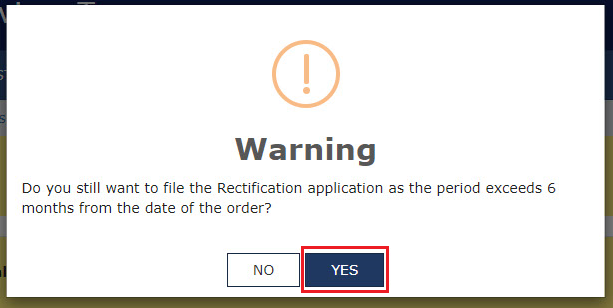

Note: In case you are filing Rectification after 6 months of the Date of the issued Revision Order, you will see the following popup. Click YES to continue.

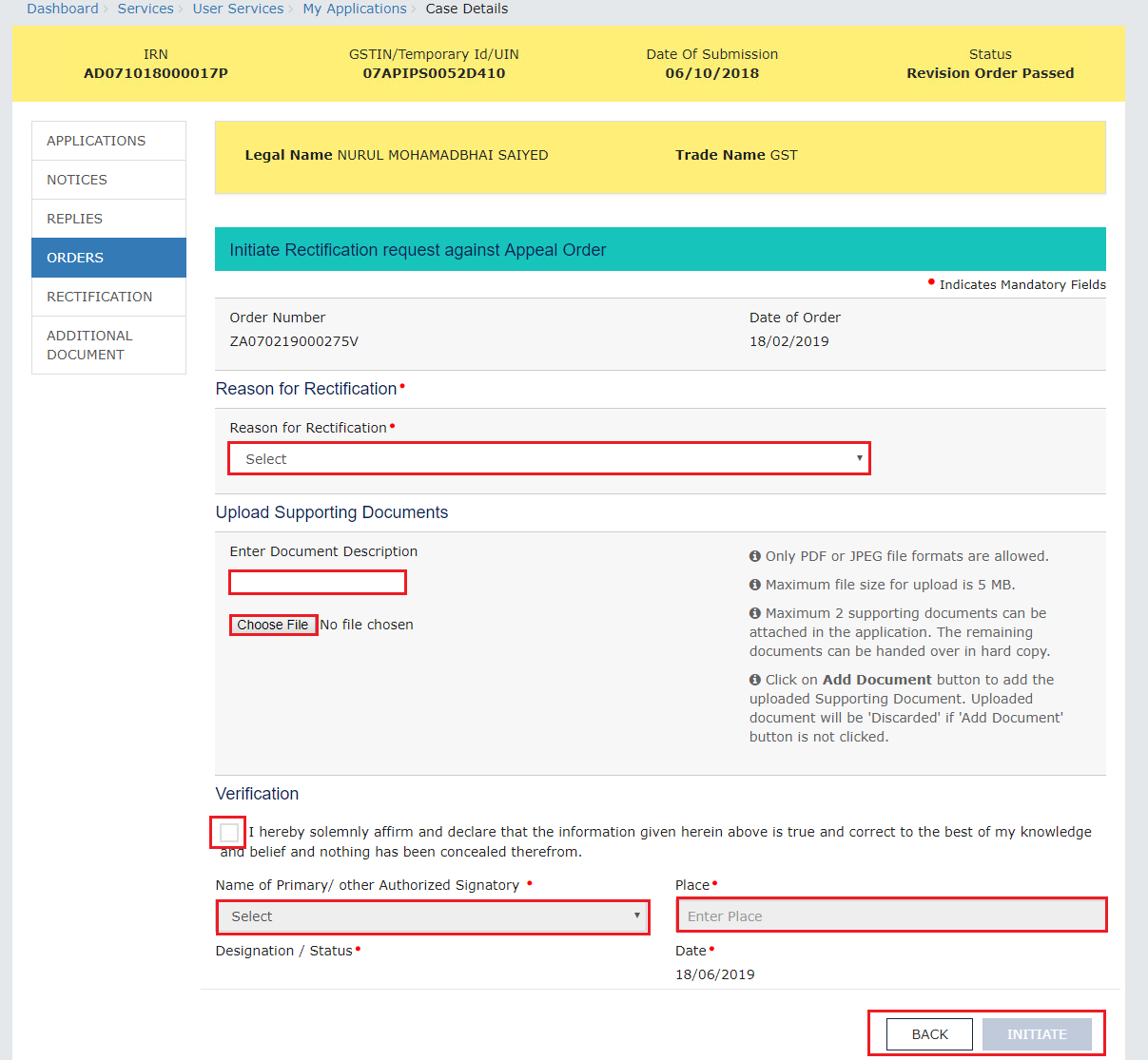

- “Initiate Rectification” page gets displayed. Click BACK to go to the previous page or follow the steps mentioned below. Click the INITIATE button and then click the PROCEED button. Then click SUBMIT WITH DSC or SUBMIT WITH EVC

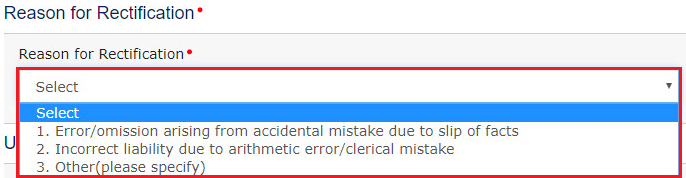

- a. Select the reason for rectification from the drop-down list.

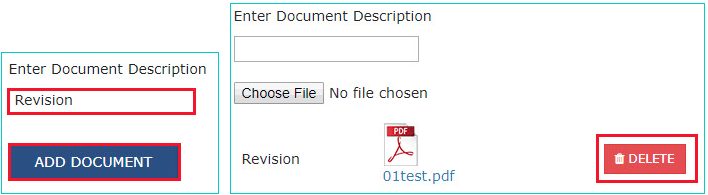

- b.If required, you can also upload supporting documents in the Upload Supporting Documents field. This is not a mandatory field. Enter document description and click the Choose File button. ADD DOCUMENT button gets displayed. Click it to upload the document(s) from your machine related to your Rectification request. You can delete the uploaded document by clicking the DELETE button.

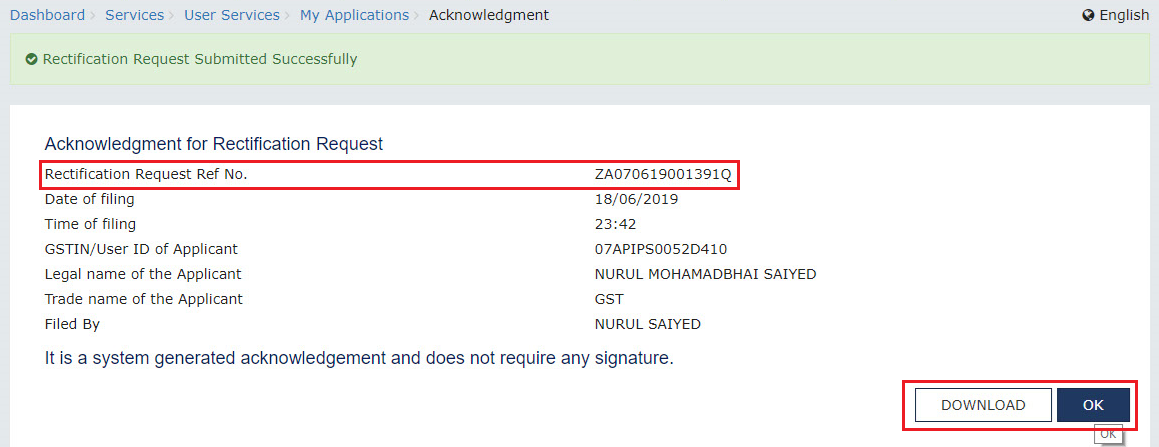

- Success message is displayed, with the generated Rectification Reference Number, which will be sent to your registered email ID and mobile as well. Click DOWNLOAD to download the acknowledgement or click OK.

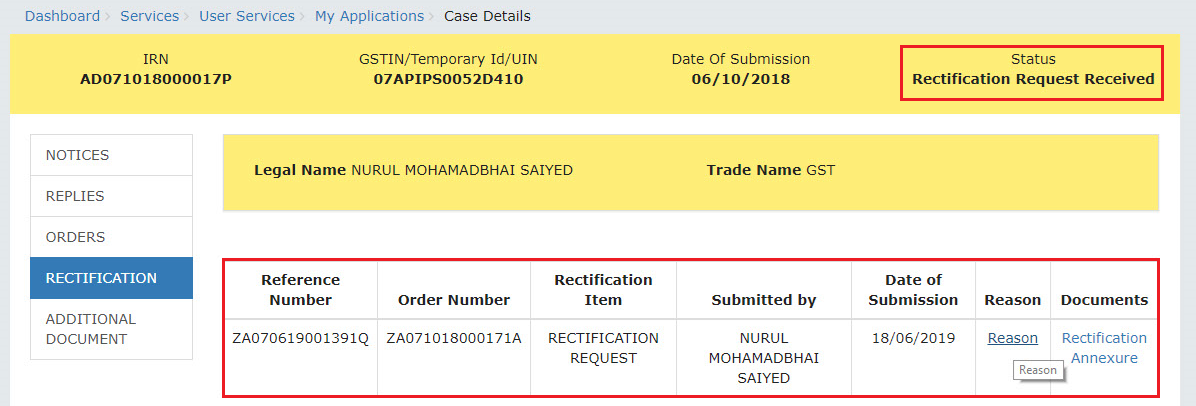

- On clicking the OK button, the updated RECTIFICATION tab is displayed with the submitted request and the Status gets changed to “Rectification Request Submitted”.

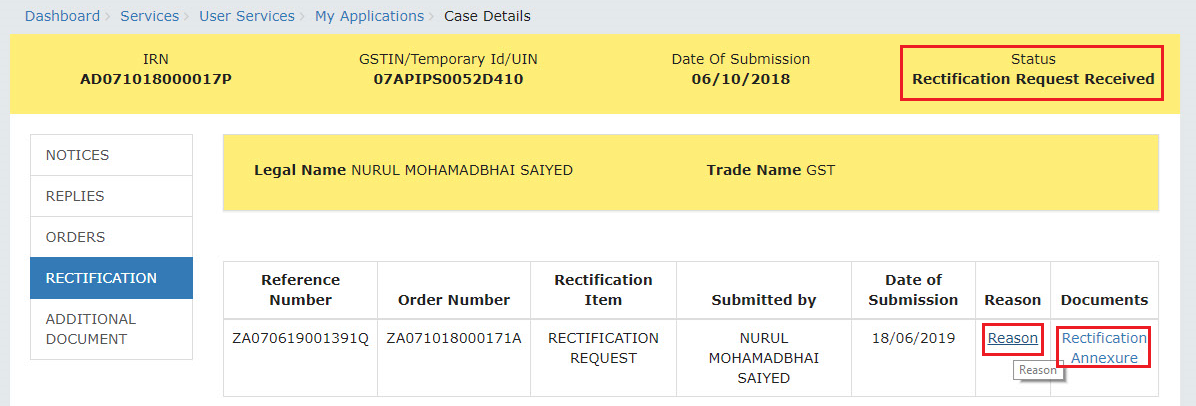

- From “Documents” column of the table, uploaded supported documents can be downloaded by you. Click them to download them into your machine. Similarly, from “Reason” column of the table, the reason selected for submitting rectification request can be viewed by clicking the “Reason” hyperlink.

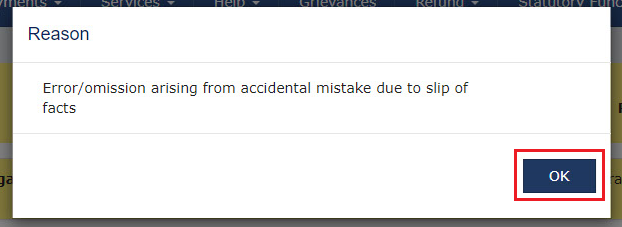

- On clicking the “Reason” hyperlink, a popup gets displayed. Click OK to close it.

Note:

Once you submit the Rectification Request, Revisional Authority will examine and take one of the following actions:

-

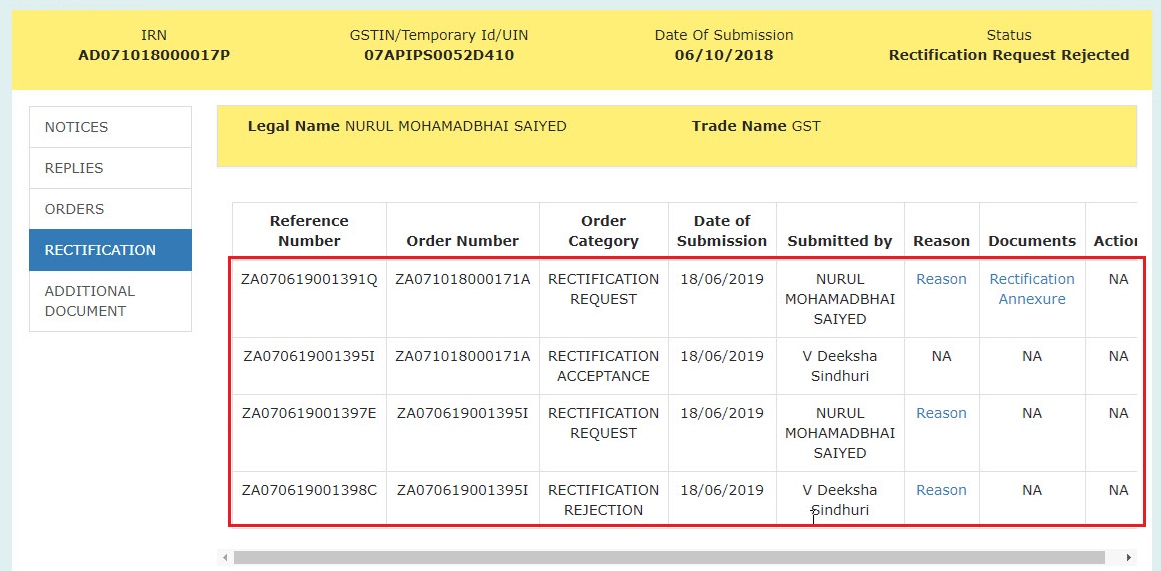

Accept Rectification Request: In this case you can view the acceptance in the “RECTIFICATIONS” tab. However, the Rectification Order passed against your request will be available in the “ORDERS” tab.

-

Reject Rectification Request: In this case you can view the rejection details in the “RECTIFICATIONS” tab.

-

To view or download the Rectification Requests submitted by you or the Tax Officials, select the RECTIFICATION tab. This tab displays the submitted or Rejected or Accepted Rectification Requests submitted by you or the Tax Officials.

-

From “Documents” column of the table, you can download the uploaded supported documents, if available. Click them to download them into your machine. Similarly, from “Reason” column of the table, the reason selected for submitting or rejecting rectification request can be viewed by clicking the “Reason” hyperlink.

-

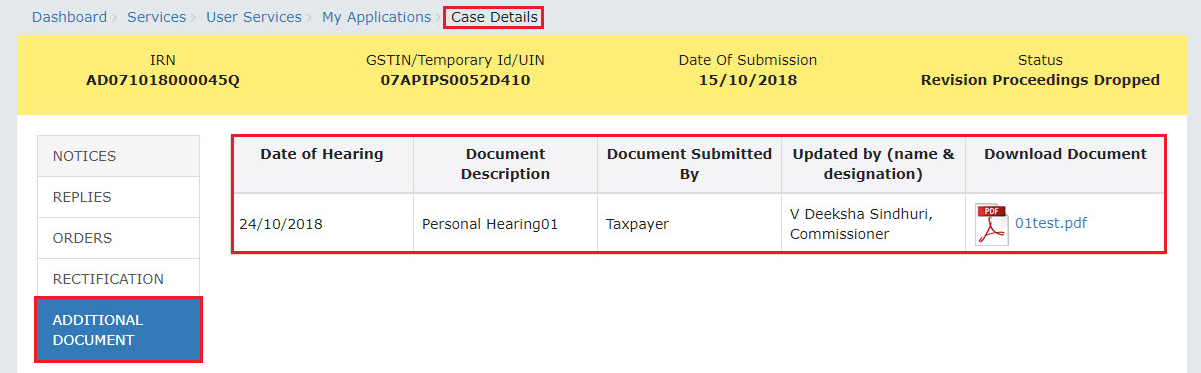

To view documents related to the Revision Proceedings, perform following steps, on the Case Details page of that particular IRN, select the ADDITIONAL DOCUMENT tab. This tab displays documents submitted physically by the parties during the hearing. Click the document name(s) in the Download Document section of the table to download into your machine and view them.