GSTR 9 and GSTR 9C forms simplified and due dates extended

In the CGST Notification – 56/2019, the Central Board of Indirect Taxes & Customs (CBIC) has made changes to the GSTR 9 and GSTR 9C form and extended their due dates for both financial years 2017-18 and 2018-19. In hope that these changes along with the extended due dates will help Tax Payers file their GSTR 9 and GSTR 9C forms with ease and in time.

GSTR 9 and GSTR 9C due dates extended

The current due date to file GSTR 9 and GSTR 9C for the financial year 2017-18 was November 30th 2019 and due date for the financial year 2018-19 was 31st December 2019.

As on 14th November 2019, the government has extended the due dates to file GSTR 9 and GSTR 9C for the financial year 2017-18 to 31st December 2019 and the due date for the financial year 2018-19 is moved to 31st March 2020.

Simplified GSTR 9 and GSTR 9C forms

The (CBIC) has simplified the GSTR 9 and GSTR 9C forms in this notification.

Changes in GSTR 9 form:

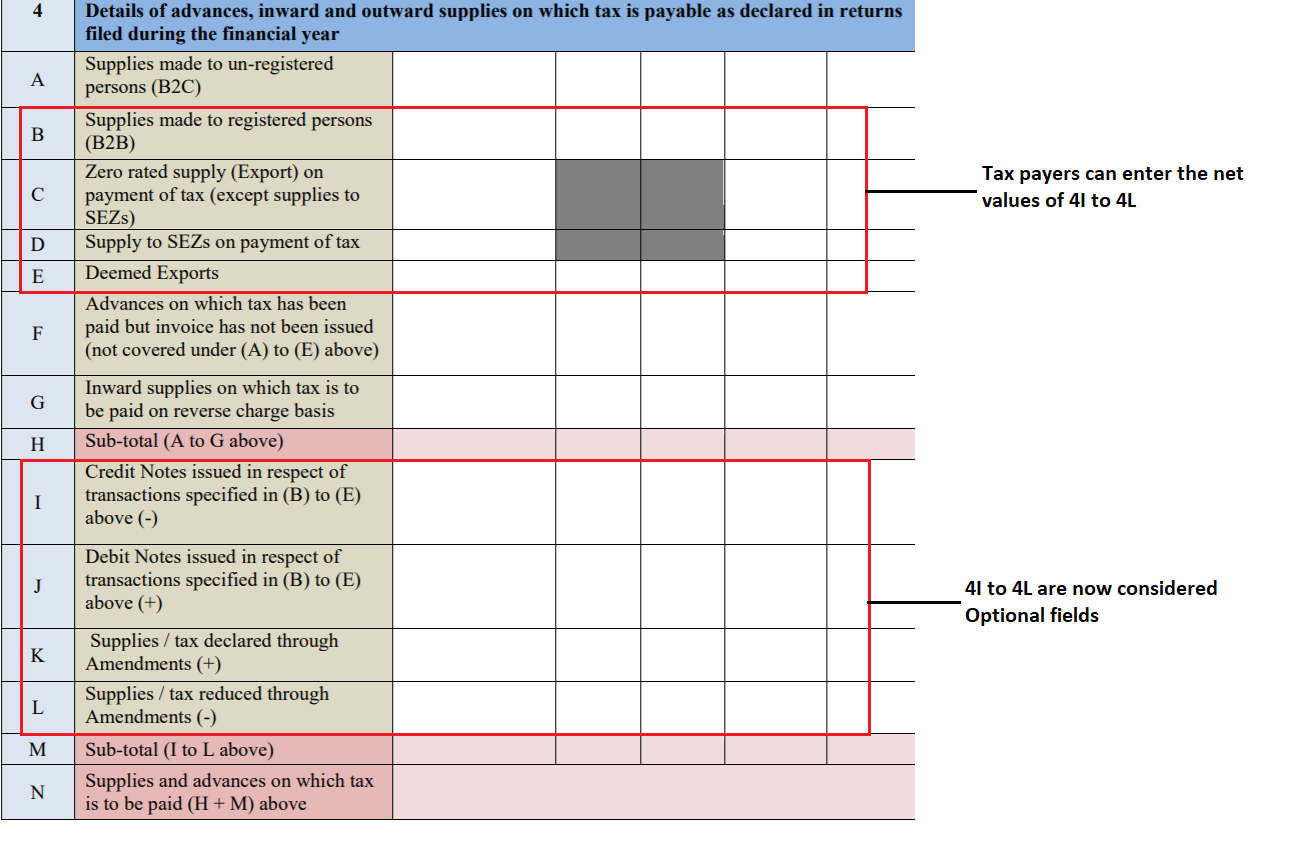

- Tables 4I to 4L are now optional fields. Tax payers can now report 4B to 4E values net of Credit/Debit notes and Amendments.

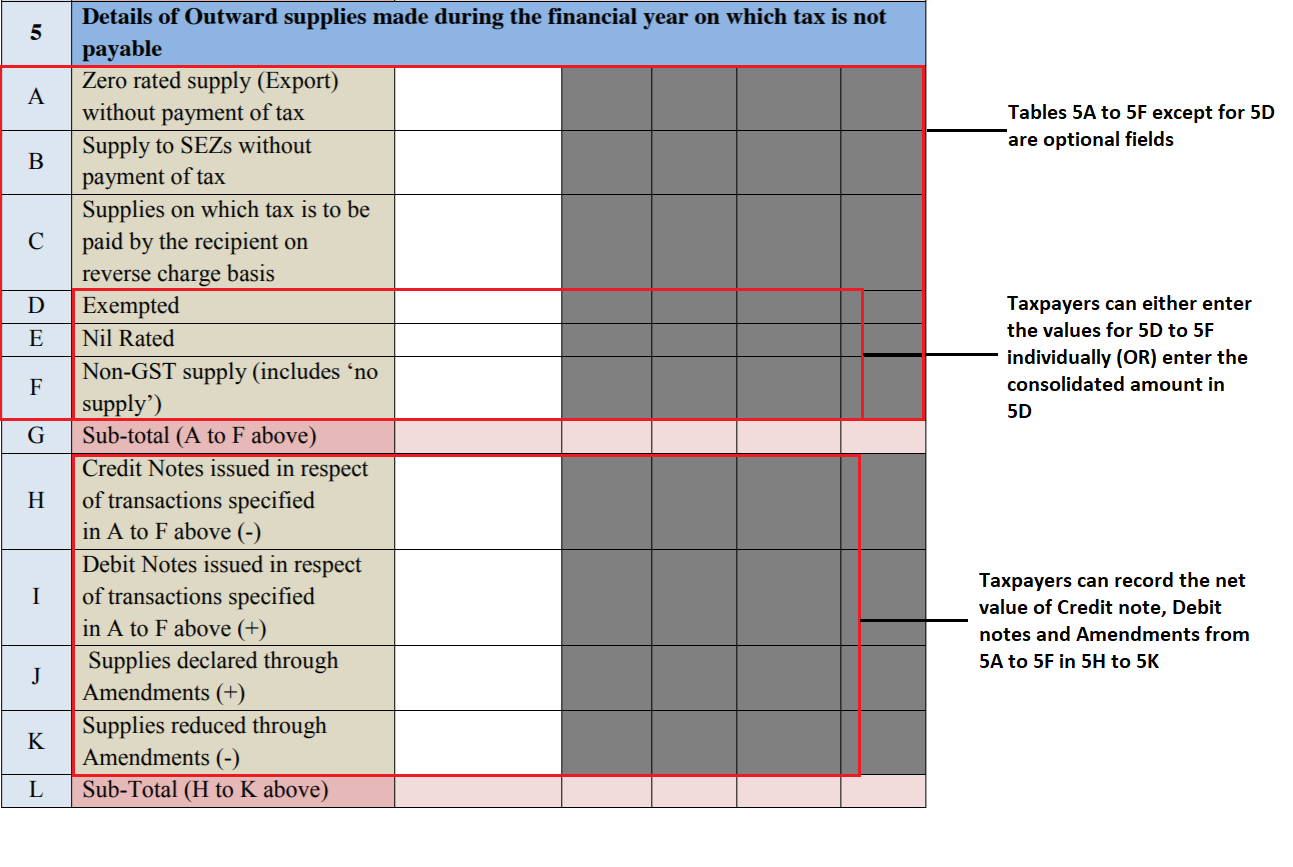

- Tax payers can either enter the values for tables 5D to 5F individually (OR) enter the Consolidated amount for all the rows in 5D. Tax Payers can report rows 5A to 5F net of Credit/Debit Notes and Amendments. Rows 5H to 5K are optional.

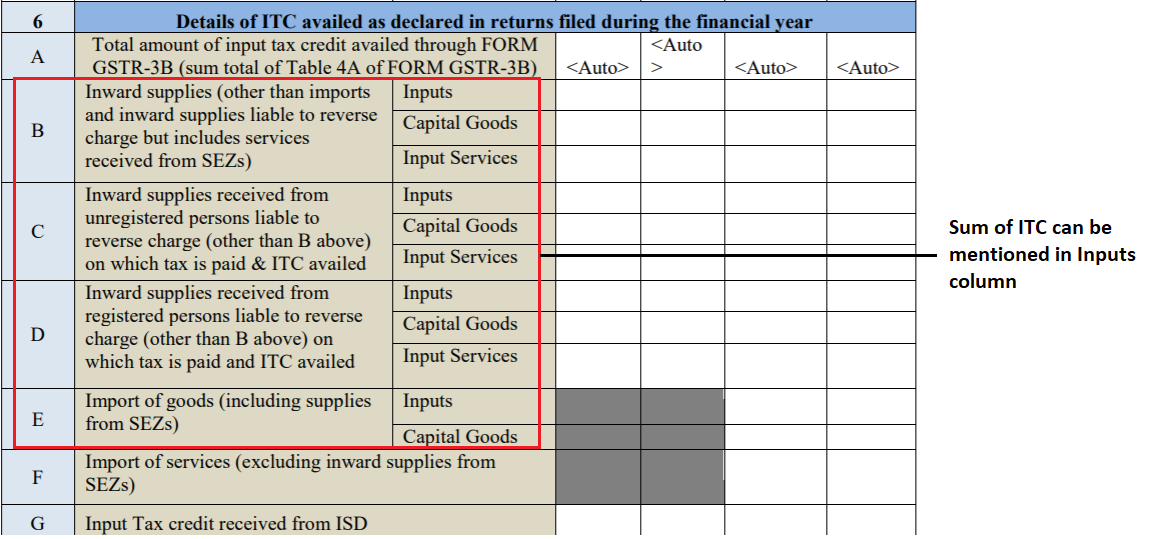

- Instead of reporting the breakup of input tax credit as inputs, capital goods and input services in tables 6B to 6E, tax payers can now report the entire input tax credit under the inputs row only. Also, tax payers can report table 6C and 6D separately, or, report the consolidated details of both tables in Table 6D.

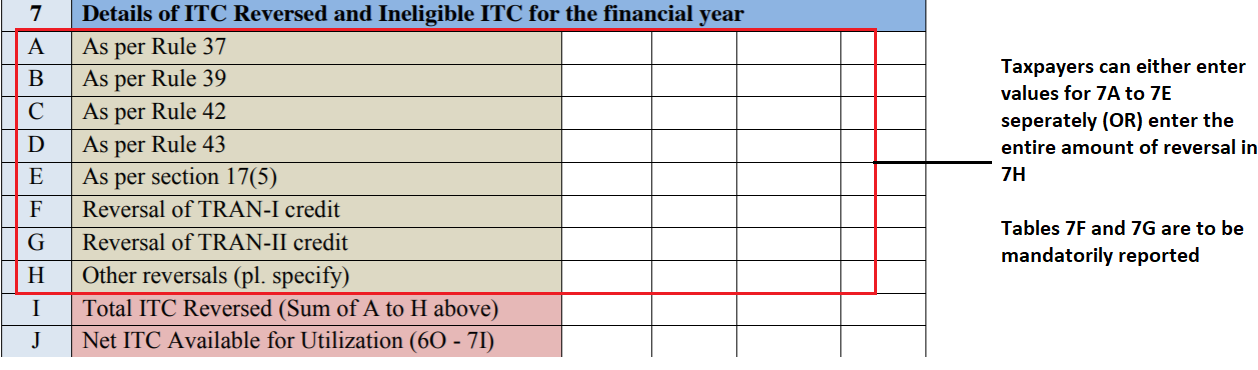

- For Tables 7A to 7E, tax payers can either report their reversal amounts separately (OR) report the entire amount in table 7H. However, it is mandatory to report Table 7F and 7G.

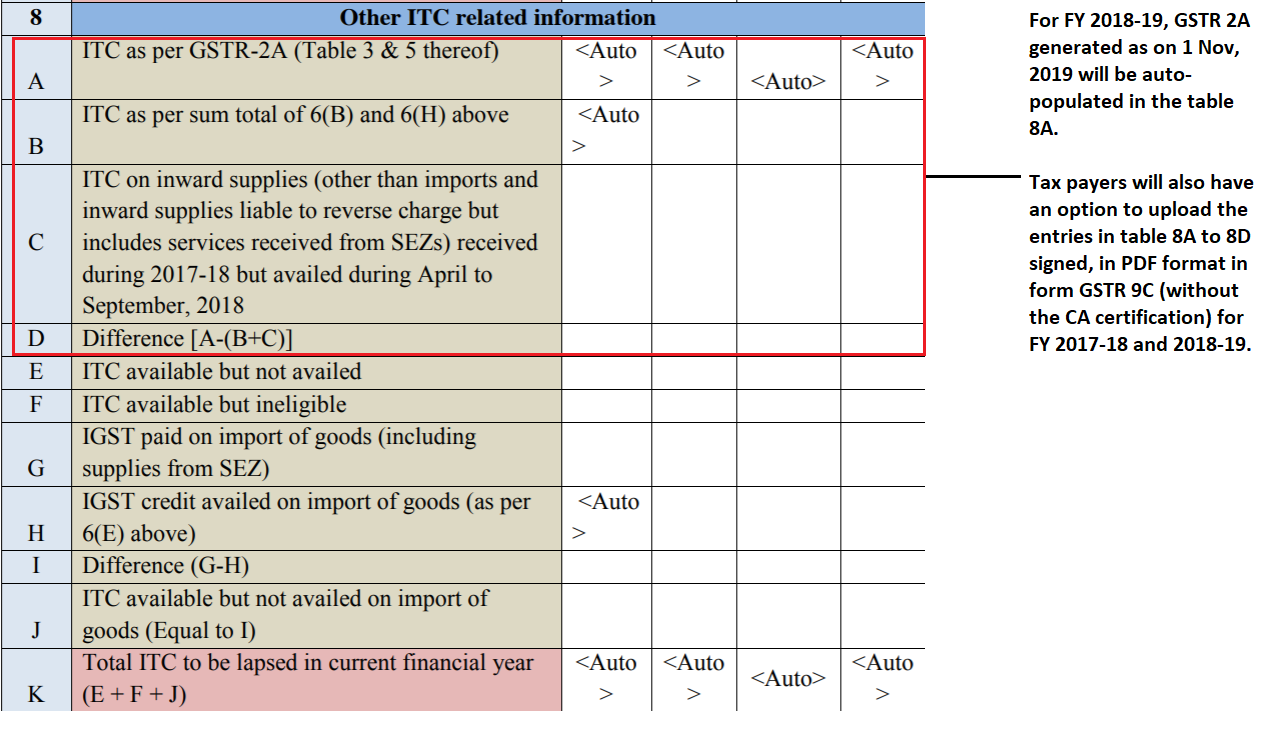

- For FY 2018-19, the form GSTR 2A generated as on 1st November, 2019 will be auto-populated in the table 8A. Tax payers will also have an option to upload the details for the entries in table 8A to 8D signed, in PDF format in form GSTR-9C (without the CA certification) for FY 2017-18 and 2018-19.

-

For FY 2018-19, aggregate value of input tax credit availed on all inward supplies received during April 2018 to March 2019 but credit on which was availed between April 2019 to September 2019 should be declared in table 8C.

-

For FY 2018-19, details of amendments to any of the supplies already declared in the returns of the previous financial year but such amendments were furnished in table 9A, table 9B and table 9C of form GSTR 1 of April 2019 to September 2019 needs to be declared in table 10 and 11.

-

For FY 2018-19, aggregate value of reversal of ITC which was availed in the previous financial year but reversed in returns filed for the months of April 2019 to September 2019 shall be declared in table 12. Table 4B of form GSTR 3B may be used for filling up these details. For FY 2017-18 and 2018-19, table 12 is optional.

-

For FY 2018-19, details of ITC for goods or services received in the previous financial year but ITC for the same was availed in returns filed for the months of April 2019 to September 2019 needs to be recorded in table 13. Table 4A of form GSTR 3B may be used for filling up these details. However, any ITC which was reversed in the FY 2018-19 but was reclaimed in FY 2019-20, shall be furnished in the annual return for FY 2019-20. For FY 2017-18 and 2018-19, the tax payer can consider this table optional.

-

Tables 15A to 15G, 16A to 16C, 17 and 18 are optional going forward.

Changes in GSTR 9C form:

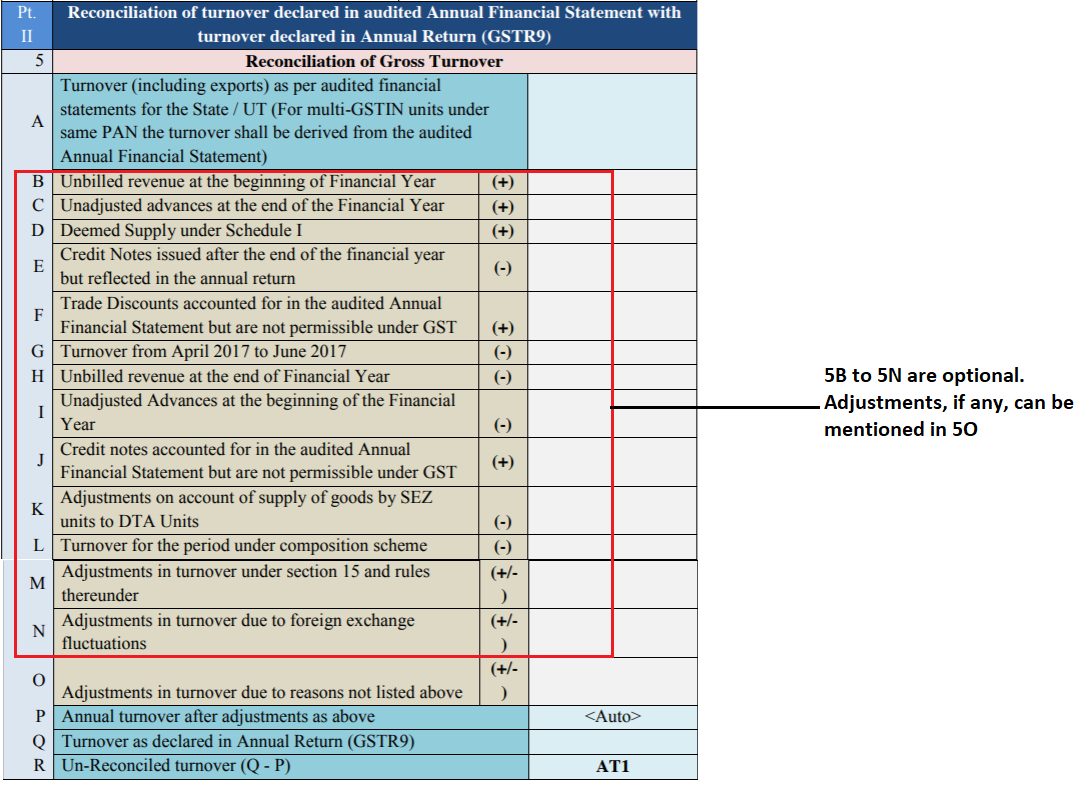

- Tables 5B to 5N are now optional. Any adjustments you may have, can be mentioned in the table 5O.

-

Tables 12B and 12C are now optional.

-

Tax payer can consider the table 14 optional.