Manage User Permissions

GSTZen will give you an option to assign different users to different business entities and control what rights they have through Permissions management. Permissions can be given at PAN level and at GSTIN level. The permissions are applicable both for the process of return filing and for generating e-invoices. GSTZen allows the administrator to limit the ability of the users to access the data of other PANs or GSTINs as he may see fit i.e. the user will only be able to access the data for the PANs or GSTINs he is given access to. There are three levels of permissions that can be assigned to the user

- Reader – Has read only permission. Cannot make any modifications.

- Writer – Role with write permission. Can create or upload invoices.

- Generator – Can create/cancel e-invoices and eway bills

- Filer – Can sign and file returns. Can modify mapping for creating e-invoices through excel.

Steps for assigning roles at PAN level

- Log-in to your GSTZen account

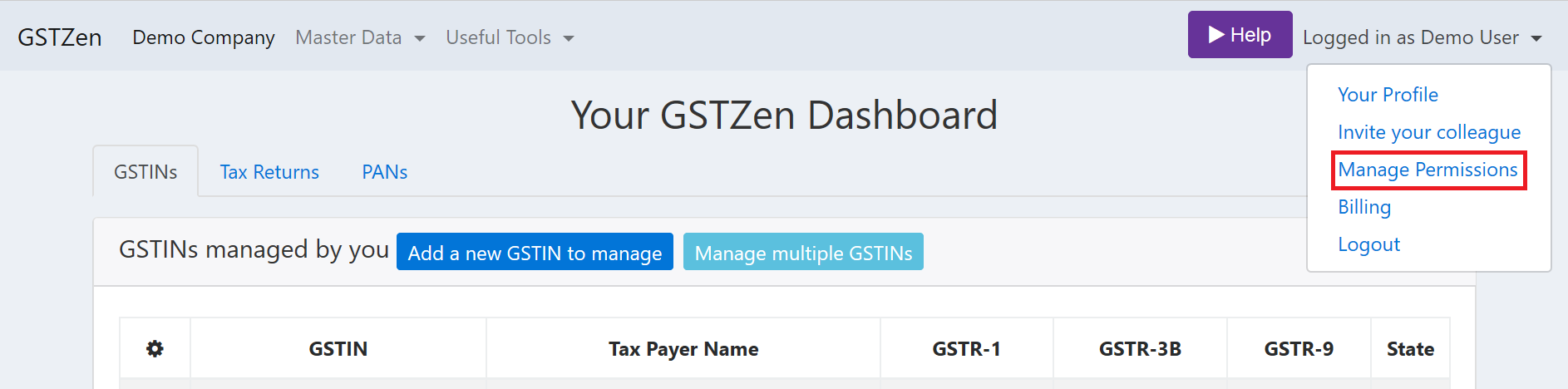

- On the top-right corner, click on Logged in as

- Click on Manage Permissions

- The list of PAN numbers and users in the GST Zen portal is listed under Permissions Management

- Click on Manage

- Click on Add Role to User Note: Filer – Can sign and file Tax returns Writer – Can save Invoice, Payments, Credit/Debit notes,etc Generator – Can create/cancel e-invoices and eway bills Reader – Can view all pages but cannot change data

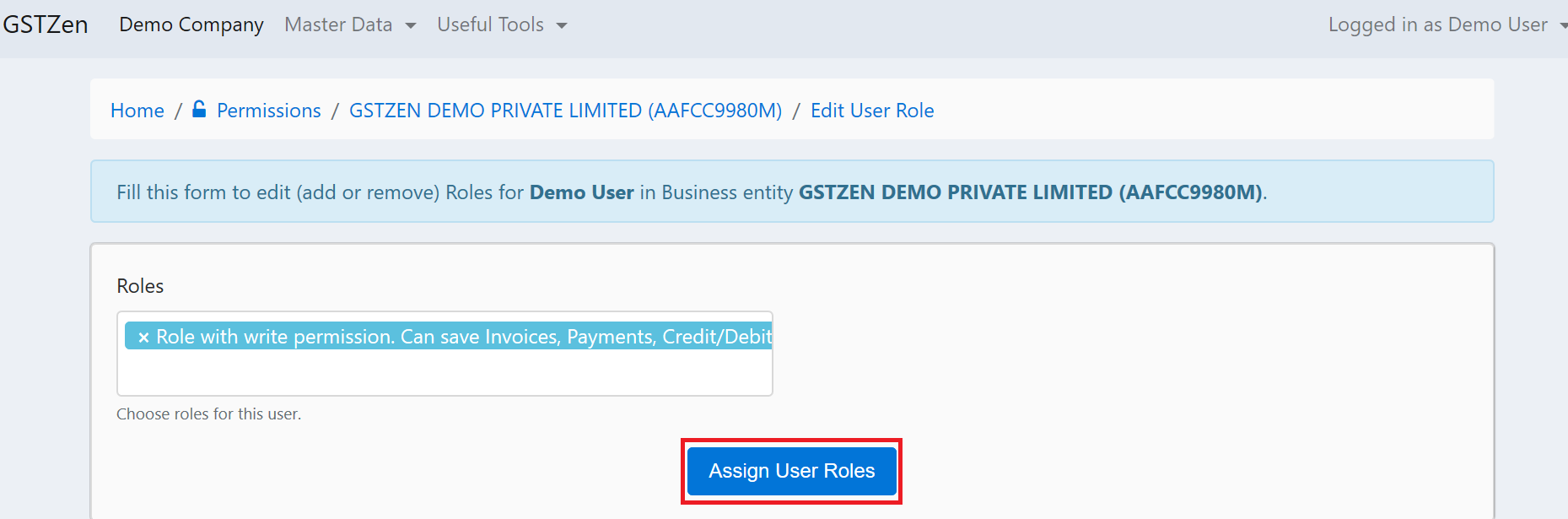

- Choose the User and Roles

- Click on Assign User Roles

Manage User Permissions

Assign User Roles

Steps for assigning roles at GSTIN level

- Log-in to your GSTZen account

- Select the GSTIN

- Click on Manage besides the GSTIN and select Manage Permissions.

- Click on Add Role to User

- Choose the User and Roles

- Click on Assign User Roles

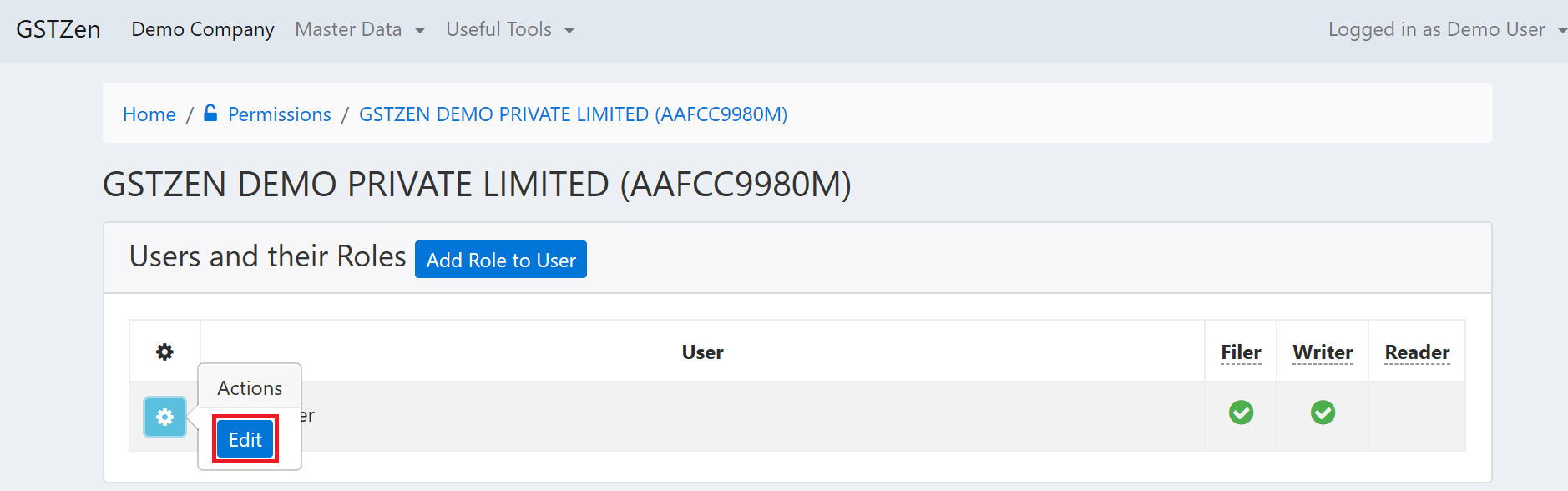

Edit permissions

Users can always edit the permission settings after they are set. Here are the instructions on how to edit permissions.

- Click on the settings button next to the User

- Click Edit

- Add or Remove roles for the user

- Click on Assign User Roles

Edit User Permissions