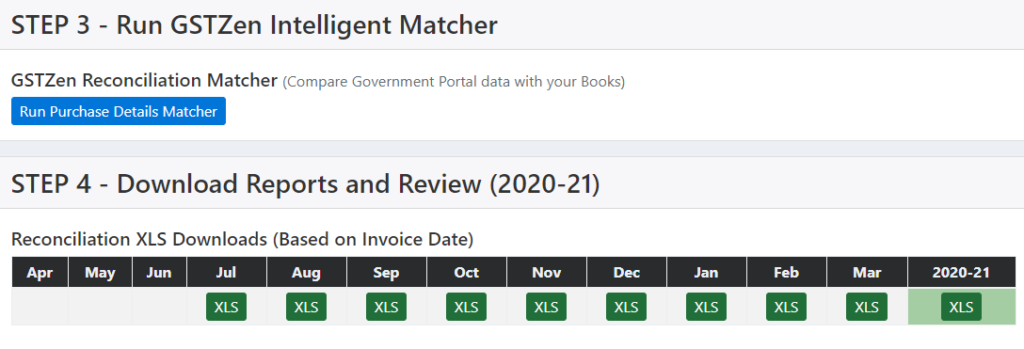

GSTR 2B reconciliation in excel format download – Step 4 of GSTR 2B reconciliation

- Click on the XLS file you want to download

- You may now review the report that you downloaded.

Download GSTR 2B Report and Review

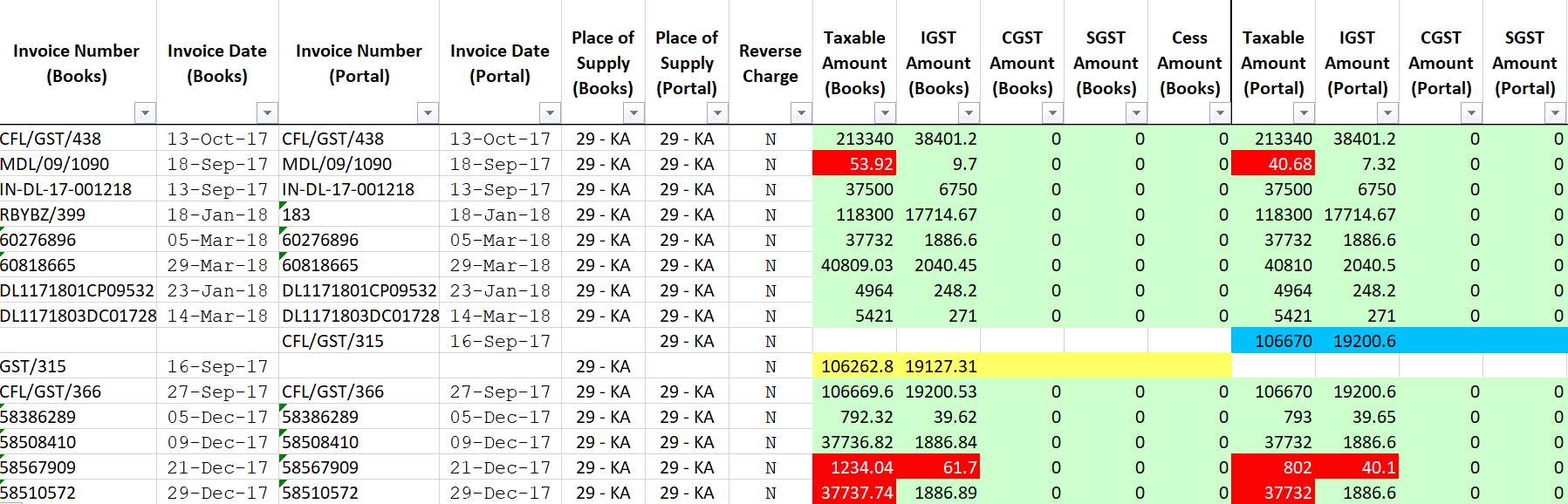

How to use GSTR 2B reconciliation report

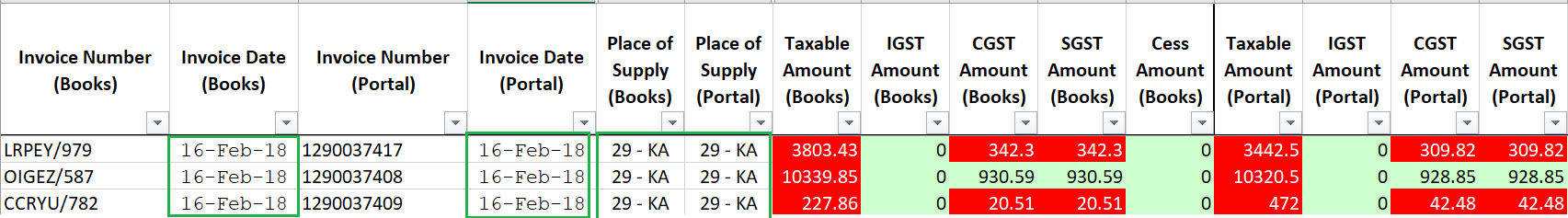

GSTZen will colour code the reconciliation report for your convenience:

- Yellow – Invoice present in GSTZen but not uploaded to Government Portal by Supplier

- Blue – Invoice uploaded to Government Portal by Supplier but missing in GSTZen

- Red – Difference (> 10 Rupees) between data in Government Portal and GSTZen

- Green – Invoice values in Government Portal and GSTZen match

GSTZen Intelligent Matcher Colour Code

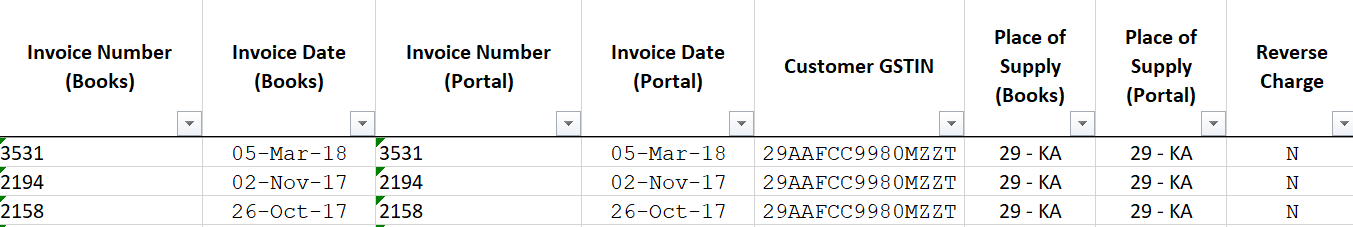

GSTZen will show how strong the Invoice match is:

- Exact match – All data points are at an exact match

GSTZen Intelligent Matcher – Exact Match

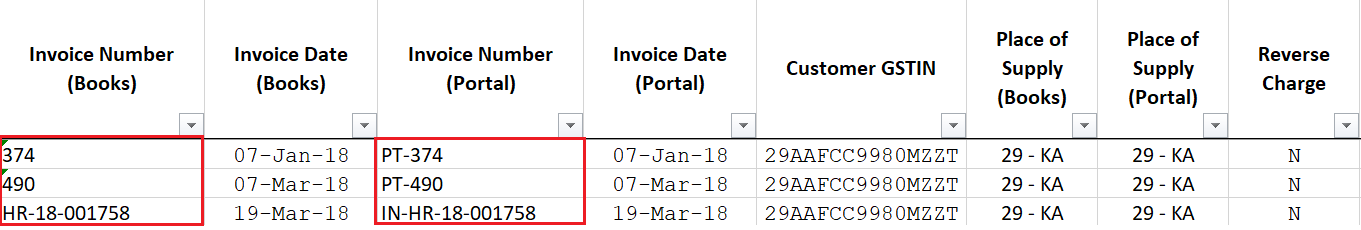

- Strong match – In this example, all data points match except for the minimal difference invoice number between Books and Government Portal

GSTZen Intelligent Matcher – Strong Match

- Weak match – In this example, the Invoices are matched though the Invoice numbers are not an exact match

GSTZen Intelligent Matcher – Weak Match