e-Invoicing System Concept

Starting 1st April 2020, the GST Council started phased introduction of E-invoicing or Electronic Invoicing to report Business to Business (B2B) invoices to GST System.

Since there was never a standard for e-invoice, a standard for the same was finalized after consulting with trade/industry bodies as well as ICAI after keeping the draft in a public place. Having a standard is a must to ensure complete operability of e-Invoices across the entire GST eco-system so that e-Invoices generated by one software can be read by any other software, thereby eliminating the need for fresh data entry. Machine readability and uniform interpretation is the key objective of this initiation. This is also important for reporting the details to GST System as part of the Return. Apart from the GST System, the adoption of a standard will also ensure that an e-Invoice a seller shares with any agent in the whole business eco-system can be read by all machines and eliminate data entry errors.

GST Council approved the standard of e-Invoice in its 37th meeting held on 20th Sept 2019. The standard along with schema is published on the GST portal. It is common for standards to raise confusion and thus, there is an explanation document present in common man’s language. Also, there are a lot of myths or misconceptions about e-Invoice. The current document is in an attempt to clear the air about the concept of e-Invoice. The document covers how e-Invoice operates and its basics. The document also contains FAQs that answer the questions raised by people who responded to the draft e-Invoice standard. It is expected that the document will also be useful for the taxpayers, tax consultants, and software companies to adopt the designed standard.

e-Invoicing system

- Taxpayers will create e-Invoice on their own accounting/billing/ERP System

-

The e-Invoice, as prepared, will be reported on Invoice Reference Portals (IRP)

-

e-Invoicing portal will generate unique Invoice Reference Number (IRN) which will be attached on the e-Invoice and system will digitally sign the same and return to the taxpayer (supplier) as well as the recipient.

-

The e-Invoicing portal will also generate a QR code containing the unique IRN along with some important parameters of the invoice like GSTIN of supplier and buyer, invoice number, date, invoice value, total tax amount, and HSN code of the major item.

-

QR code will enable Offline verification using Mobile App.

-

Multiple Invoice Reference Number Portals (IRP) to ensure uninterrupted availability. To start with, NIC will be the first Registrar. Based on the experience of the trial more registrars will be added.

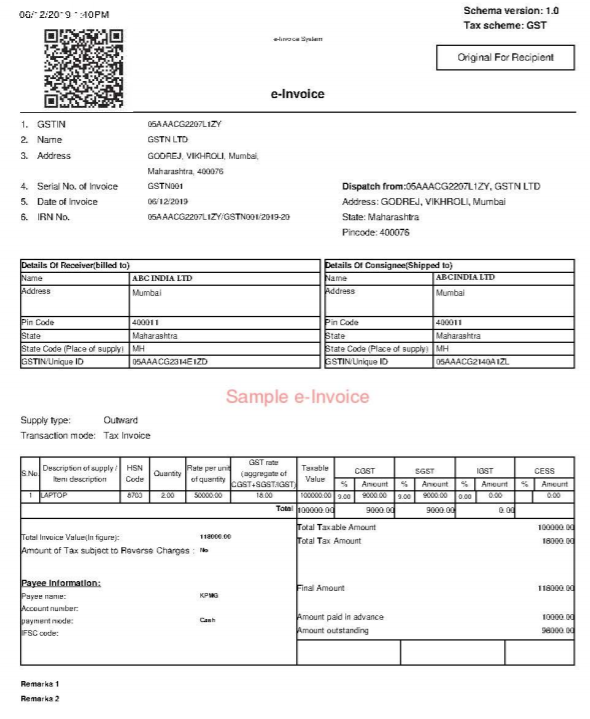

e-Invoice Sample