File GSTR 3B through GSTZen

GSTR 3B

Any business that is liable to file GSTR 1, GSTR 2 and GSTR 3 should mandatorily submit Form GSTR 3B on a monthly basis. While filing GSTR 3B, tax payable has to be paid through challans in banks or online payment.

Issues Taxpayers face while claiming Input Tax Credit

- Supplier may not have reported the invoice in GSTR 2A

- Supplier may have reported invoice late

- If there is an Amendment, you would need to consider the final amount

- You have to exclude invoices under reverse charge

- You have to exclude invoices where the Place of Supply is different from your own

- Mark eligible and ineligible credits and report the details in correct tables of GSTR 3B

- Reconcile GSTR 2A with Purchase Register and take credit on unreconciled invoices

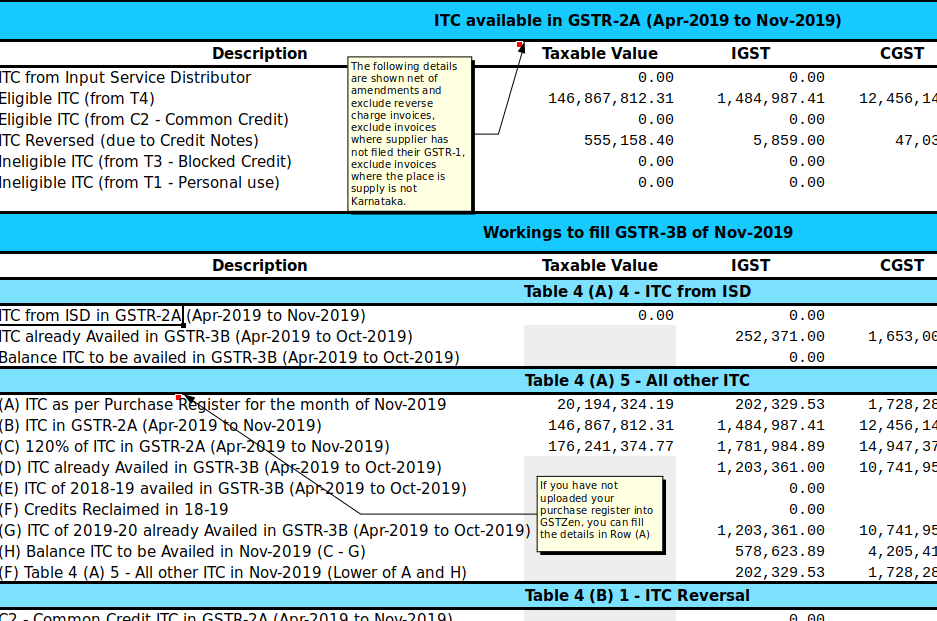

Through GSTZen's Advanced Purchase Reconciliation Dashboard, you can Take action on your GSTR 2A and Track status of your ITC all from GSTZen's Excel Report. This system enables you to be aware of your ITC compliance and take charge accordingly.

GSTZen also calculates GSTR 3B values from GSTR 2A, making it easier for you to fill in your GSTR 3B form. Here's a sample of the GSTR 3B working excel.

How to file GSTR 3B through GSTZen?

- Upload your invoices into GSTZen

- Download GSTR 2A and GSTR 3B details from the Government Portal

- Run GSTZen Intelligent Matcher

- Download and Review Advanced Reconciliation Report

- Fill the GSTR 3B Form

- Upload your GSTR 3B to the Government Portal and Create Challan, Make Payment, Offset Liability, and File Return