Form GST REG-10

Application for registration of person supplying online information and data base access or retrieval services from a place outside India to a person in India, other than a registered person.

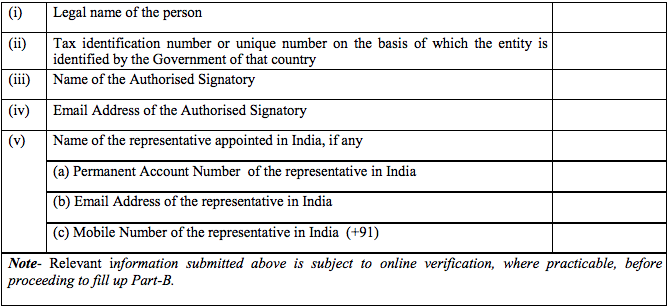

PART-A

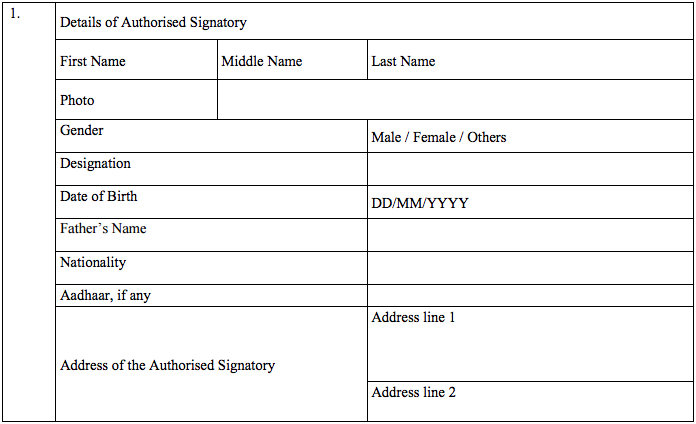

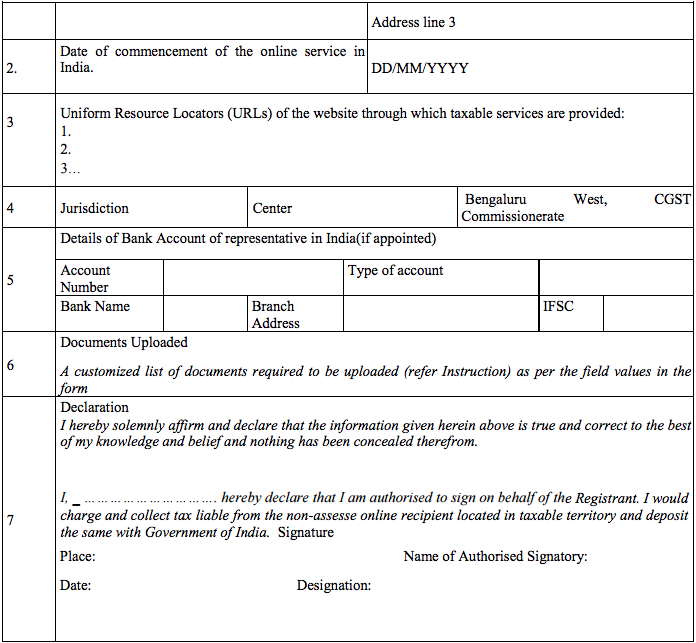

PART-B

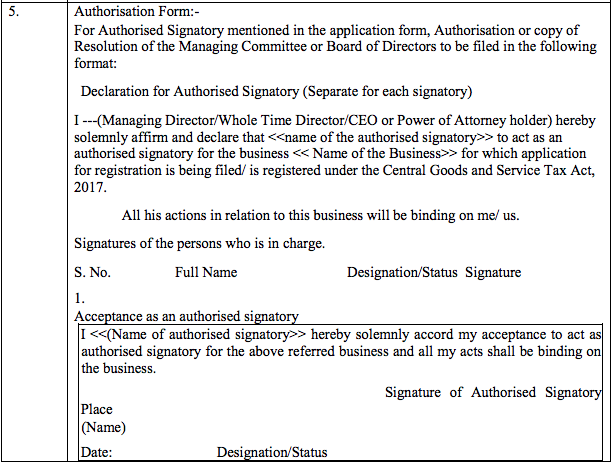

Note: Applicant will require to upload declaration (as per under mentioned format) along with scanned copy of the passport and photograph.

List of documents to be uploaded as evidence are as follows:-

| 1 |

Proof of Place of Business of representative in India, if any:

|

| 2 |

Proof of :

Scanned copy of the passport of the Non -resident tax payer with VISA details. In case of

Company/Society/LLP/FCNR/ etc. person who is holding power of attorney with

authorisation letter. Scanned copy of Certificate of Incorporation if the Company is registered outside India or in India Scanned copy of License is issued by origin country Scanned copy of Clearance certificate issued by Government of India |

| 3 | Bank Account Related Proof: Scanned copy of the first page of Bank passbook / one page of Bank Statement Opening page of the Bank Passbook held in the name of the Proprietor / Business Concern – containing the Account No., Name of the Account Holder, MICR and IFSC and Branch details. |

| 4 | Scanned copy of documents regarding appointment as representative in India, if applicable |

Instructions

1.If authorised signatory is not based in India, authentication through digital signature certificate shall not be mandatory for such persons. The authentication will be done through Electronic Verification Code (EVC).

2.Appointed representative in India shall have the meaning as specified under section 14 of Integrated Goods and Services Tax Act, 2017.