Form GSTR-5A

FORM GSTR-5A PDF link

Details of supplies of online information and database access or retrieval services by a person located outside India made to non-taxable 1[persons in India online recipient (as defined in Integrated Goods and Services Tax Act, 2017) and to registered persons in India]

- GSTIN of the supplier-

- (a) Legal name of the registered person – (b) Trade name, if any –

- Name of the Authorised representative in India filing the return –

- 2

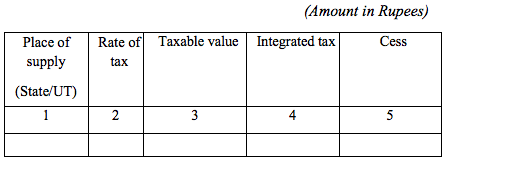

[Period: Month – Year –Period: Month-______ Year-4(a) ARN:4(b) Date of ARN:”;] - Taxable outward supplies made to 3[

consumersnon-taxable online recipient] in India

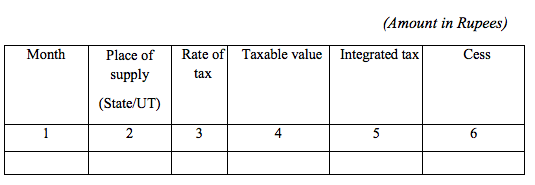

5A. Amendments to taxable outward supplies to non-taxable 4[persons online recipient] in India

5[5B. Taxable outward supplies made to registered persons in India, other than non-taxable online recipient, on which tax is to be paid by the said registered person on reverse charge basis]

(Amount in Rupees)

]

]

6[5C. Amendments to the taxable outward supplies made to registered persons in India, other than non-taxable online recipient, on which tax is to be paid by the said registered persons on reverse charge basis.

(Amount in Rupees)

]

]

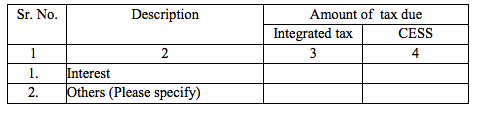

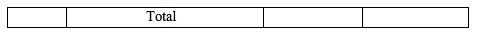

6. Calculation of interest, penalty or any other amount

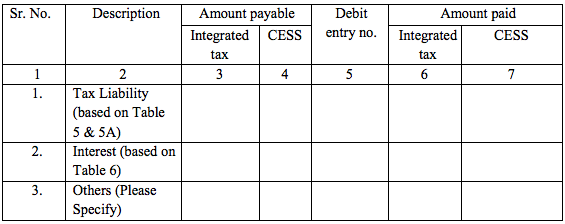

7. Tax, interest, late fee and any other amount payable and paid

1. Substituted vide Notification No.38/2023 -CT dated 04-08-2023

2.Substituted vide Notification No.38/2023 -CT dated 04-08-2023

3.Substituted vide Notification No.38/2023 -CT dated 04-08-2023

4.Substituted vide Notification No.38/2023 -CT dated 04-08-2023

5.Inserted vide Notification No.38/2023 -CT dated 04-08-2023

6.Inserted vide Notification No.38/2023 -CT dated 04-08-2023