Filing Application for Withdrawal of Summary Assessment Order and Tracking the Status of the Subsequent Proceedings u/s 64

How can I file an application for Withdrawal of Summary Assessment Order and track the status of the subsequent proceedings u/s 64?

To file an application for Withdrawal of Summary Assessment Order and track the Status of the subsequent proceedings u/s 64, perform following steps:

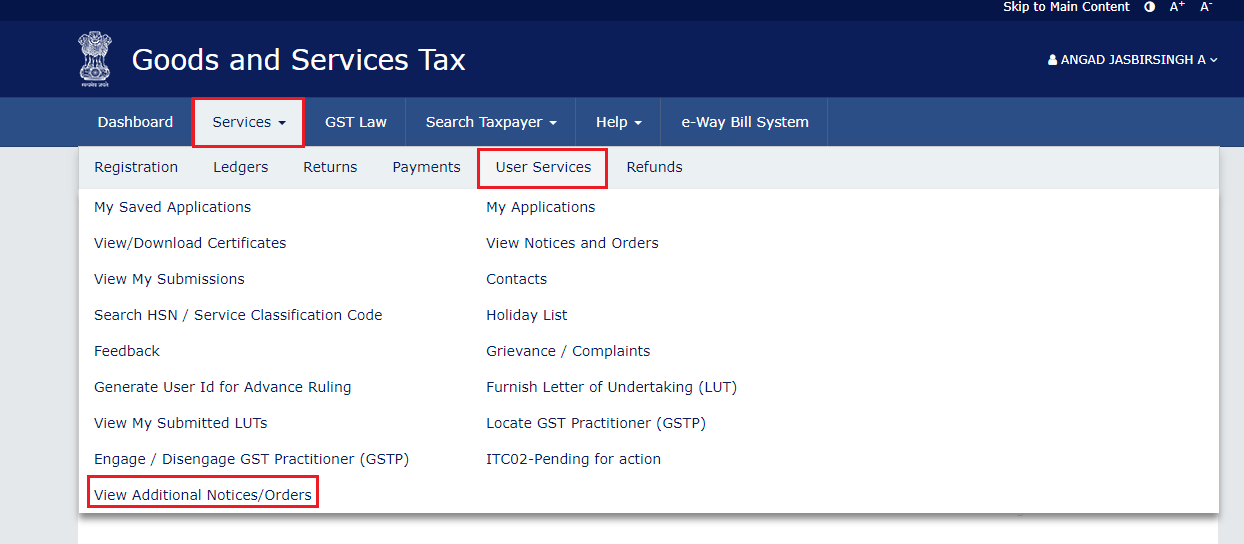

A. Navigate to View Additional Notices/Orders page to view Order for creation of demand issued against your application by Adjudicating or Assessing Authority (A/A)

B. Download Order for Summary Assessment

C. File a Withdrawal Application (Form GST-ASMT-17) on the GST Portal and send to the Additional Commissioner (AC)/Joint Commissioner (JC)

D. View Acceptance/Rejection Order issued against your application by AC/JC

B. Download Order for Summary Assessment

To download order for summary assessment, perform following steps:

1) Navigate to View Additional Notices/Orders page.

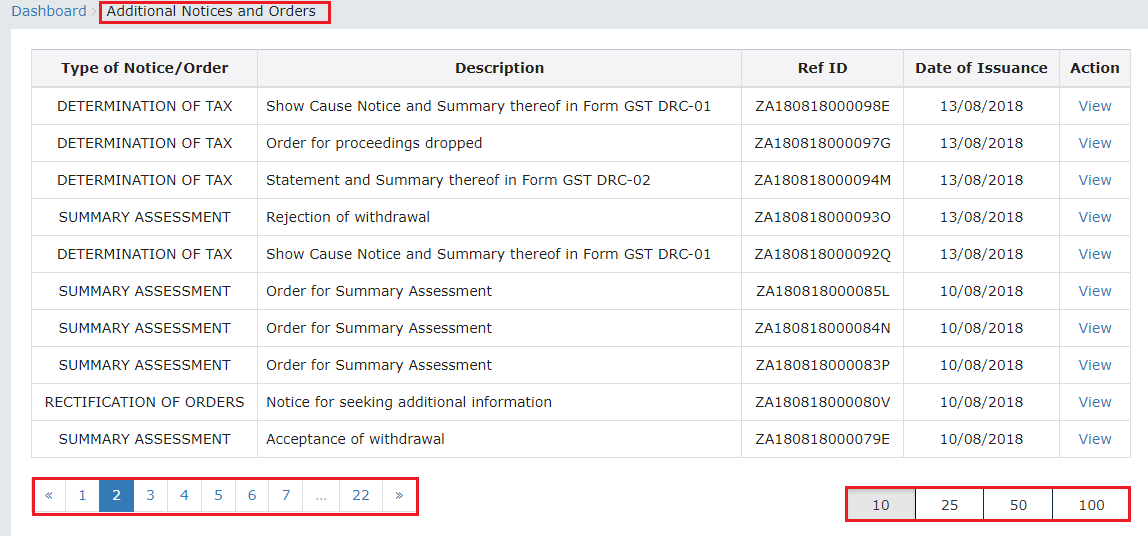

2) Additional Notices and Orders page is displayed. All orders/notices are displayed in descending order. Using the Navigation buttons provided below, search for the Summary Order you want to download.

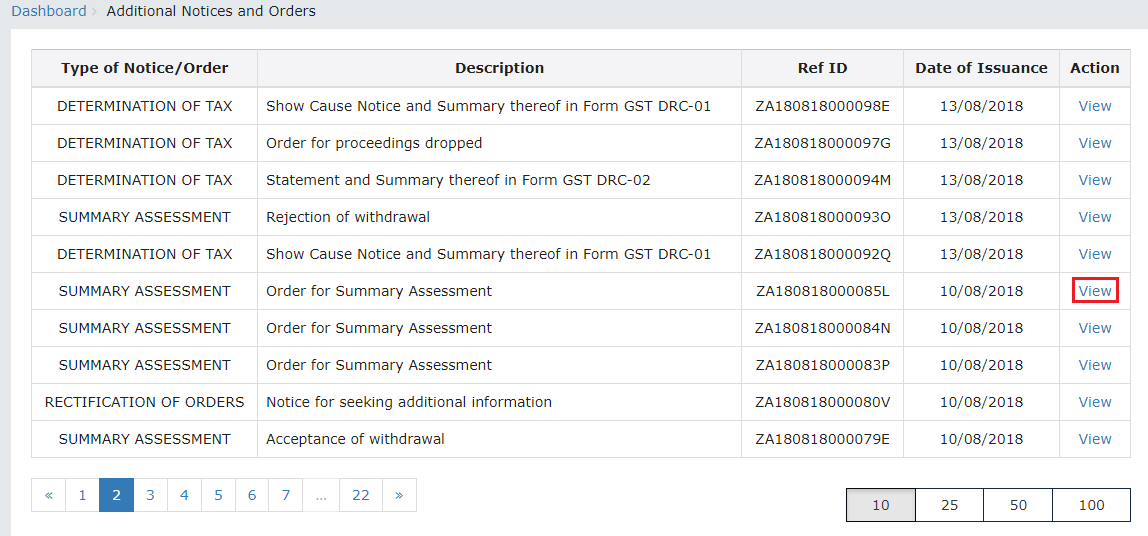

3) In the “Action” field of the Summary Order, click the View hyperlink.

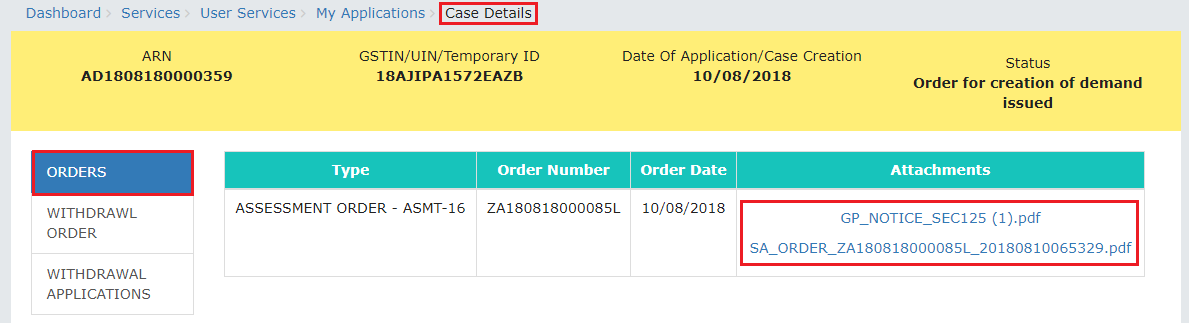

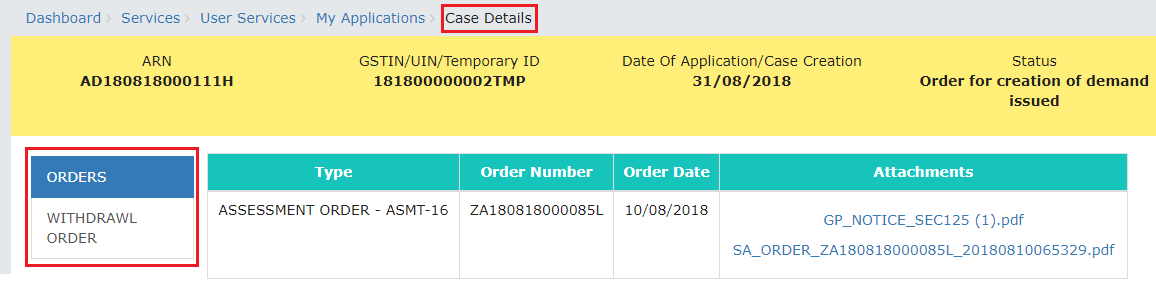

4) Case Details page is displayed. The ORDERS tab is selected by default. This tab displays order for creation of demand issued against the ARN/Case ID.

5) Click the document name(s) in the Attachments section of the table to download the issued Order.

Note: Only two tabs—ORDERS and WITHDRAWL ORDER— are available on the screen of a Temp ID holder as shown in the image below.

C. File a Withdrawal Application (Form GST-ASMT-17) on the GST Portal

To file an application for Withdrawal against an Order issued for Summary Assessment on the GST Portal, perform following steps:

Note: In case you have a temp id, you will not be able to file the form on the GST Portal. However, you may send your application offline to the AC/JC.

1) On the Case Detail page of that particular application, click the WITHDRAWAL APPLICATIONS tab. This tab displays the applications you have filed. Click APPLY FOR WITHDRAWAL and select Application for withdrawal of summary assessment order from the drop-down.

Note: Currently, Status of the ARN/Case is “Order for creation of demand issued”. It will change once you file the application.

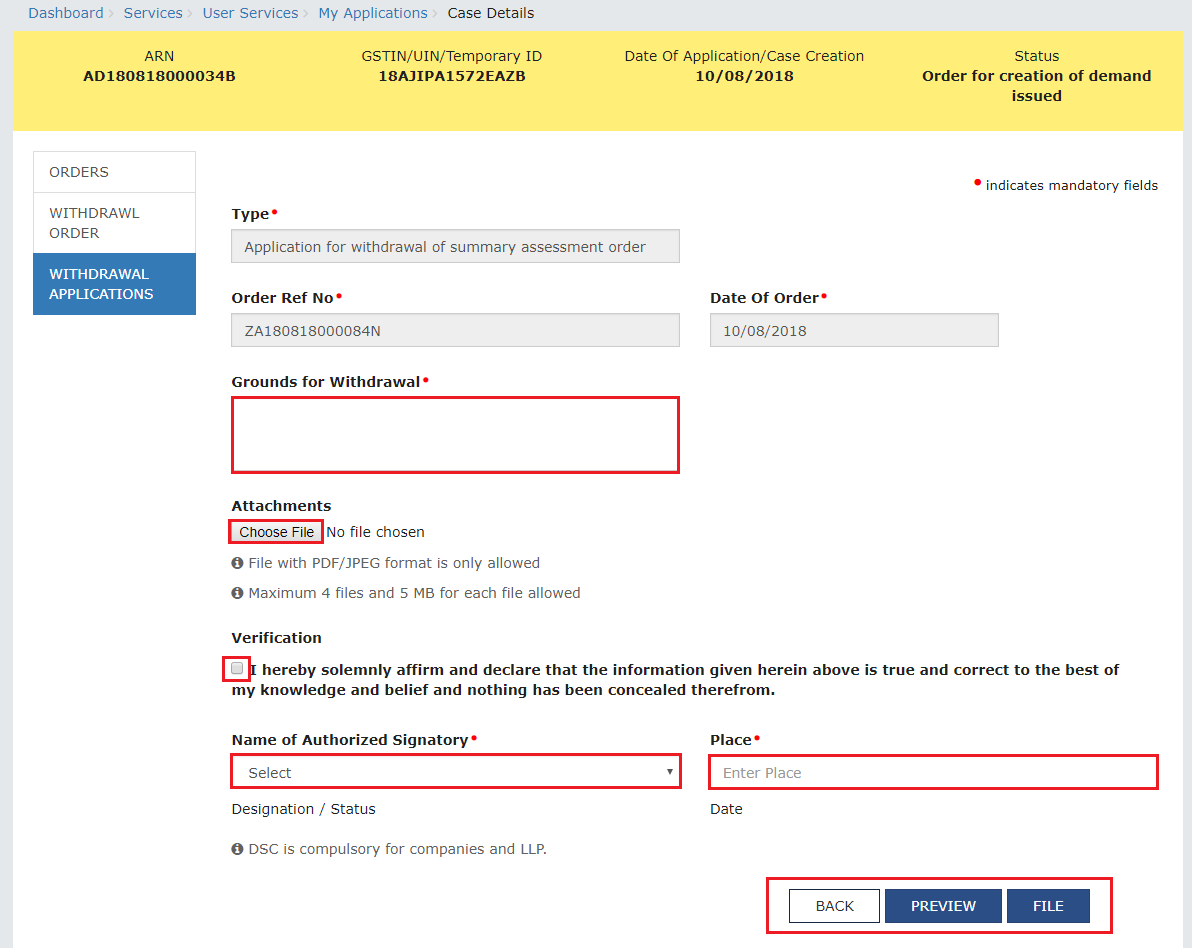

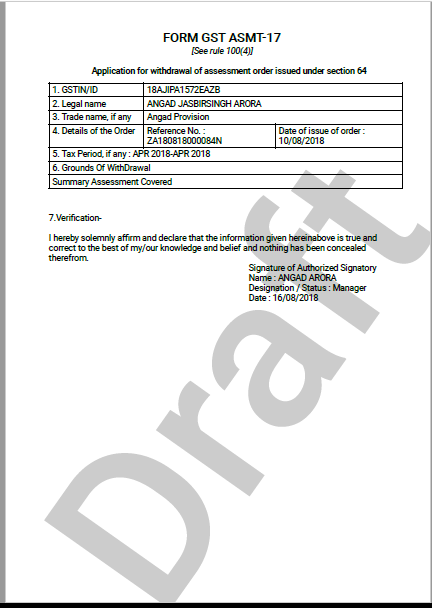

2) Application for withdrawal of summary assessment order page is displayed. The fields Type, Order Ref No, Date of Order are auto-populated. To go to the previous page, click BACK.

a. In the Grounds for Withdrawal field, enter reasons for filing this application.

b. Click Choose File to upload the document(s) related to this case, if any. This is not a mandatory field.

c. Enter Verification details. Select the declaration check-box, select name of the authorized signatory and enter the name of the place where you are filing this application.

d. Click PREVIEW to download and review your application. Once you are satisfied, click FILE.

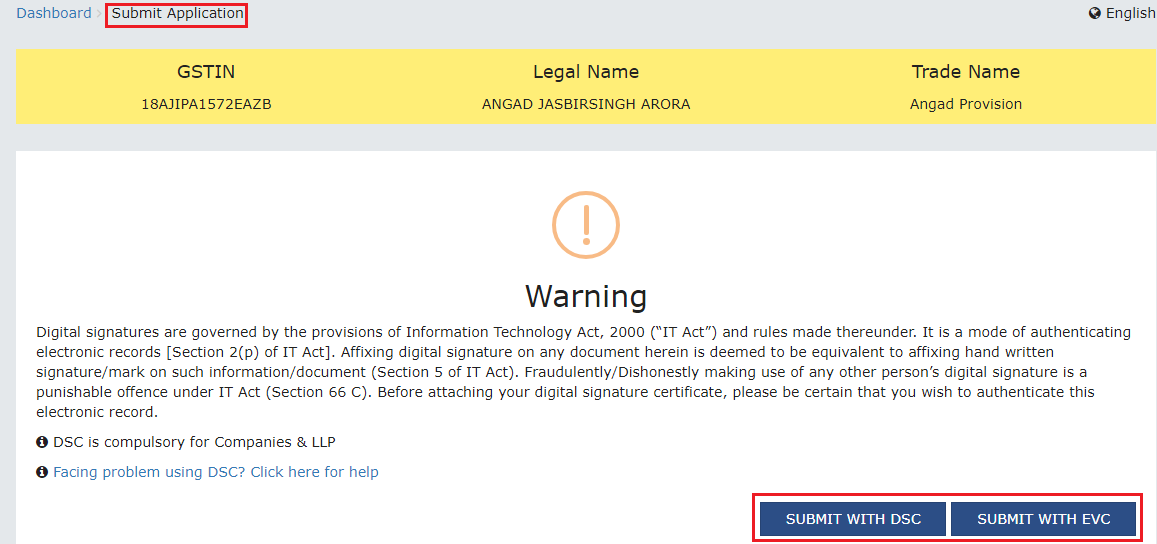

3) Submit Application page is displayed. Click SUBMIT WITH DSC or SUBMIT WITH EVC.

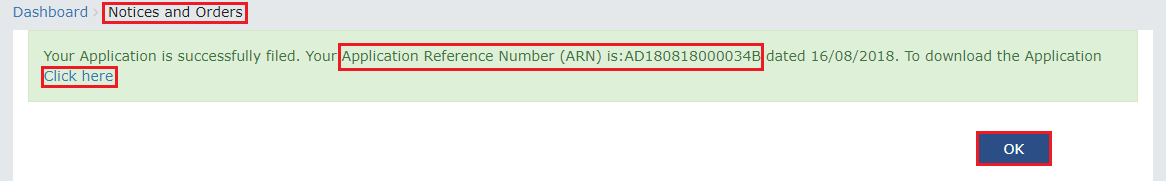

4) Notices and Orders page is displayed with the generated ARN. To download the filed application, click the Click here hyperlink or click OK.

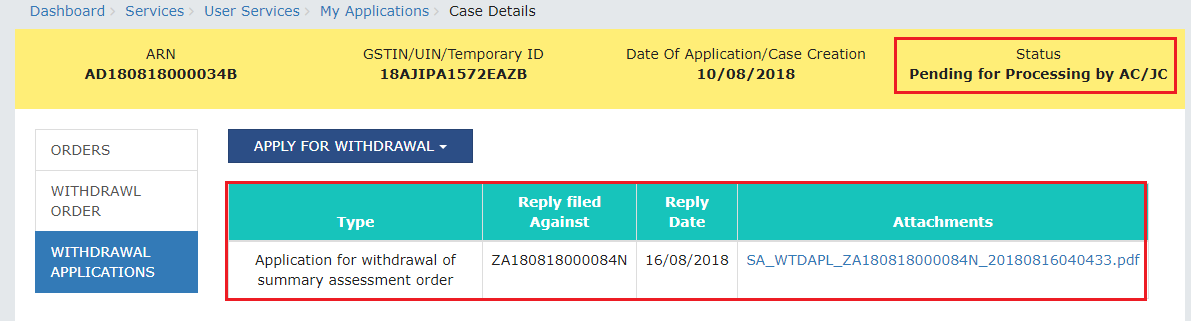

5) The updated WITHDRAWAL APPLICATIONS tab is displayed, with the record of the filed application and the Status updated to “Pending for Processing by AC/JC”. You can also click the documents attached in the Attachments section of the table to download them.

6) Additionally, the following actions take place on the GST Portal after the issue of the Order.

-

Acknowledgement of the filed application is sent to the concerned taxpayer via email id and SMS.

-

Dashboard of A/A and AC/JC is updated with the record of the filed application. A/A and AC/JC can view it from Dashboard > Summary Assessment > Case Detail > WITHDRAWAL APPLICATIONS.

D. View Acceptance/Rejection Order

To view orders related to acceptance or rejection of Withdrawal application you have filed, perform following steps:

1) Navigate to View Additional Notices/Orders page to view Order issued against your application and open the “Case Details” page.

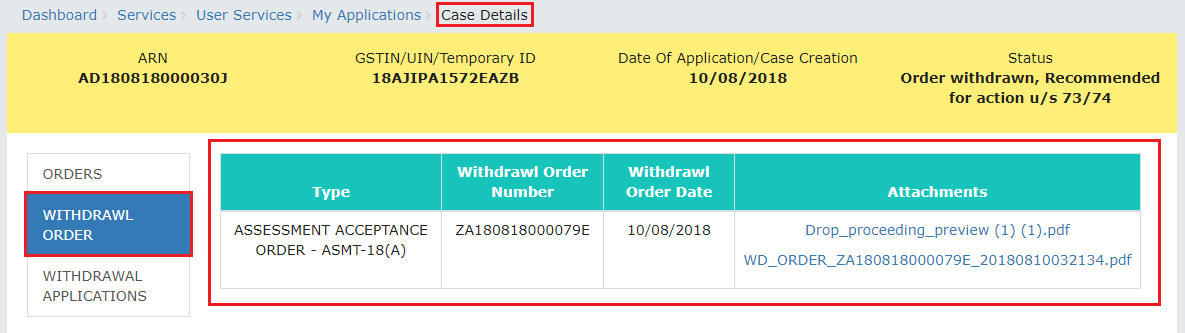

2) On the Case Details page of that particular application, click the WITHDRAWL ORDER tab. This tab displays the Withdrawal orders related to acceptance or rejection of Withdrawal application you have filed.

Note 1:

(a) In case of issue of ASSESSMENT ACCEPTANCE ORDER – ASMT-18(A):

-

Intimation of the issue of order is sent to the concerned Taxpayer/Temp ID holder via email id and SMS.

-

Dashboard of the Taxpayer/Temp ID holder is updated with the record of the issued Order and they can view it from the following navigation: Services > User Services > View Additional Notices/Orders > View > Case Details > WITHDRAWL ORDER

-

The original order framed u/s 64(1) is withdrawn and demand gets updated in Electronic Liability Register (a credit entry is passed into the Liability Register reversing the demand and DCR is updated accordingly).

(b) In case of issue of ASSESSMENT REJECTION ORDER – ASMT-18(R):

-

Intimation of the issue of order is sent to the concerned taxpayer via email id and SMS.

-

Dashboard of the Taxpayer is updated with the record of the issued Order and they can view it from the following navigation: Services > User Services > View Additional Notices/Orders > View > Case Details > WITHDRAWL ORDER

-

The matter stand adjudicated and the issued “Order for Creation of Demand” is confirmed. There will be no change in the demand created originally.

Note 2: In the case of rejection of an offline application filed by a Temp ID holder, no action will take place on the GST Portal. Intimation of rejection will be sent to the taxpayer offline by AC/JC.

2) Click the document name(s) in the Attachments section of the table to download the issued Order.