TRAN-1 Offline Tool

An Overview

-

To facilitate the furnishing of records in short-time, an easy to use TRAN-1 Offline Tool has been made available for preparation of TRAN-1 in download section of GST portal. All the details can be added in offline mode and later uploaded on GST portal to furnish the TRAN-1.

-

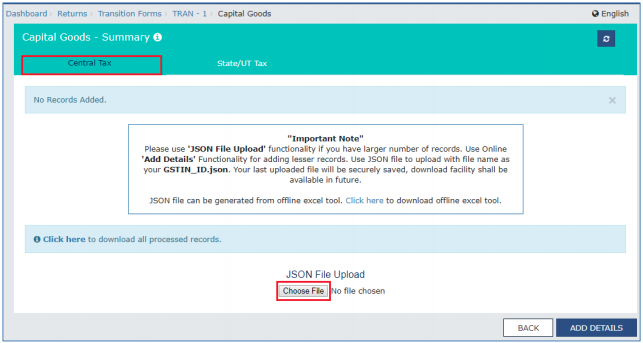

You can use ‘JSON File Upload’ functionality if you have larger number of records. Use JSON file to upload with file name as your GSTIN_ID.json.

-

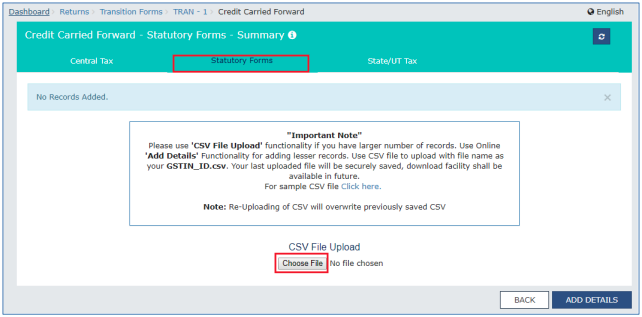

You can use ‘CSV File Upload’ functionality if you have larger number of records. Use CSV file to upload with file name as your GSTIN_ID.csv.

-

Your last uploaded file will be securely saved, download facility shall be available in future.

Downloading the TRAN-1 Offline Tool

Downloading the TRAN-1 Offline Tool is a one-time activity, however, it may require an update in future if the Tool is updated at the GST Portal. Please check the version of the offline utility used by you with the one available for download on the GST Portal at regular intervals.

To download and install the TRAN-1 Offline Tool to prepare the TRAN-1 offline, perform the following steps:

You can download the TRAN-1 Offline Tool from the Portal without login to the GST Portal.

1) Access the https://www.gst.gov.in/ URL.

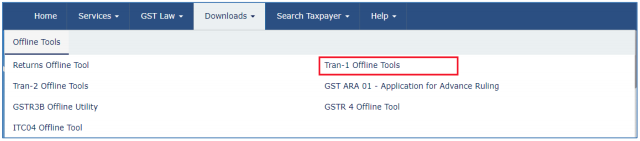

2) The GST Home page is displayed. Click the Downloads > Offline tools > TRAN-1 5(b) CSV template.

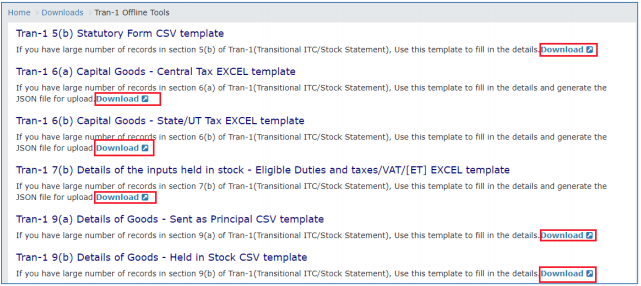

3) Click the Download link for the section to be downloaded.

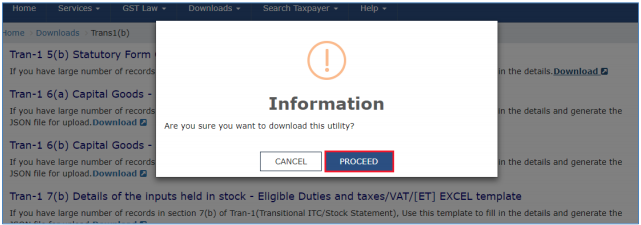

4) Click the PROCEED button.

The download of the TRAN-1 Offline Tool usually takes 2-3 minutes to download depending on the Internet speed.

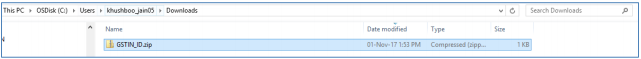

5) Browse and select the location where you want to save the downloaded files.

In some machines, depending on your browser settings, the files are downloaded in the folder Downloads on your machine.

Installation of the TRAN-1 Offline Tool

Once the download of the TRAN-1 Offline Tool is complete, you need to unzip these downloaded files on your machine.

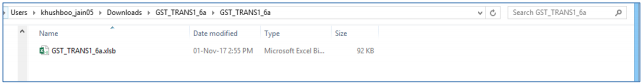

1) Unzip the downloaded files and extract the files from the downloaded zip folder. Zip folder consists of the csv and excel file as shown in the screenshot below.

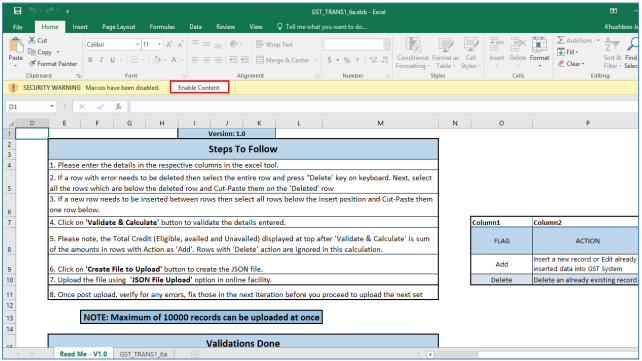

2) Double click the Excel or CSV file.

3) Click the Enable Content button in the excel sheet.

Prepare details using TRAN-1 Offline Tool

Please ensure that you download the latest version of TRAN-1 Offline Tool from the GST portal. https://www.gst.gov.in/download/returns

TRAN-1 Offline Tool has 6 downloadable templates:

Tran-1 5(b) Statutory Form CSV template: If you have large number of records in section 5(b) of Tran-1(Transitional ITC/Stock Statement), you can use this template to fill in the details.

Tran-1 6(a) Capital Goods – Central Tax EXCEL template: If you have large number of records in section 6(a) of Tran-1(Transitional ITC/Stock Statement), you can use this template to fill in the details and generate the JSON file for upload.

Tran-1 6(b) Capital Goods – State/UT Tax EXCEL template: If you have large number of records in section 6(b) of Tran-1(Transitional ITC/Stock Statement), you can use this template to fill in the details and generate the JSON file for upload.

Tran-1 7(b) Details of the inputs held in stock – Eligible Duties and taxes/VAT/[ET] EXCEL template: If you have large number of records in section 7(b) of Tran-1(Transitional ITC/Stock Statement), you can use this template to fill in the details and generate the JSON file for upload.

Tran-1 9(a) Details of Goods – Sent as Principal CSV template: If you have large number of records in section 9(a) of Tran-1(Transitional ITC/Stock Statement), you can use this template to fill in the details.

Tran-1 9(b) Details of Goods – Held in Stock CSV template: If you have large number of records in section 9(b) of Tran-1(Transitional ITC/Stock Statement), you can use this template to fill in the details.

Let us understand how to upload details using the Excel and CSV Template.

Upload Details using the CSV Template

Below CSV templates are available to upload data for below section of TRAN-1.

Tran-1 5(b) Statutory Form CSV template: To fill in the details for 5(a), 5(b), 5(c) – Amount of tax credit carried forward tile > Statutory Tab in TRAN-1.

Tran-1 9(a) Details of Goods – Sent as Principal CSV template: To fill in the details for 9(a), 9(b)

Details of goods sent to job-worker and held in his stock on behalf of principal under section 141 tile > Sent as Principal tab.

Tran-1 9(b) Details of Goods – Held in Stock CSV template: To fill in the details for 9(a), 9(b) – Details of goods sent to job-worker and held in his stock on behalf of principal under section 141 tile > Held in Stock tab.

Let us take an example where you need to upload the data using the Tran-1 5(b) Statutory Form CSV template.

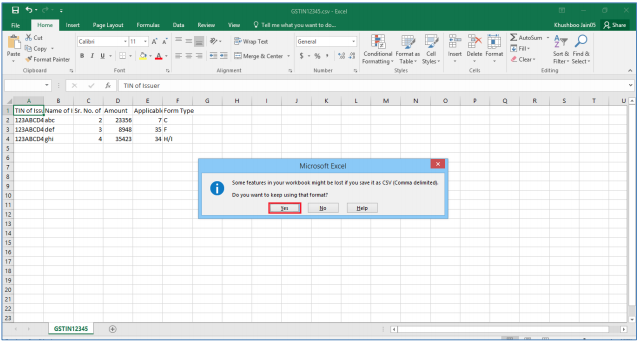

1) Launch the Tran-1 5(b) Statutory Form CSV template and navigate to Excel worksheet.

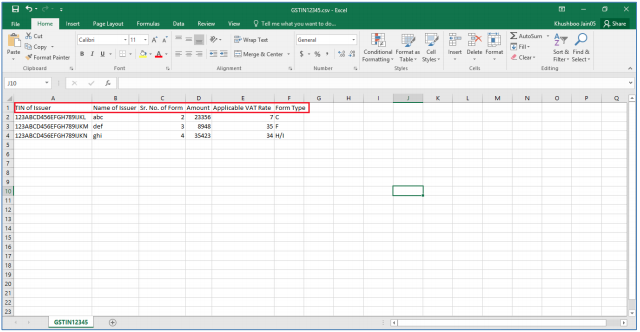

2) Enter the details in the excel sheet under respective columns.

3) After entering the details, click the SAVE button.

The CSV file is saved.

4) Access the https://gst.gov.in/ URL. The GST Home page is displayed.

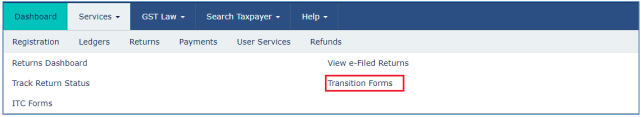

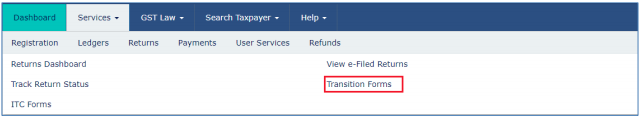

5) Click the Services > Returns > Transition Forms command.

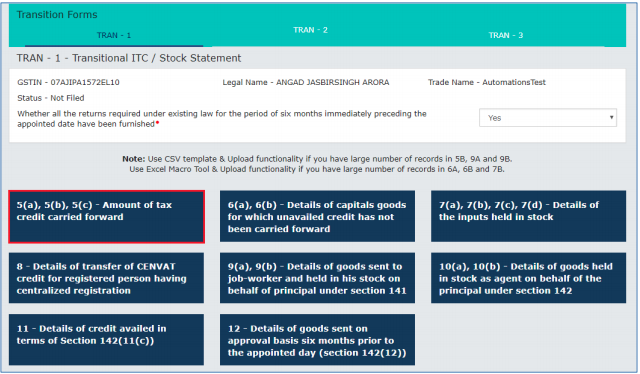

The TRAN – 1 – Transitional ITC / Stock Statement page is displayed.

6) Click the 5(a), 5(b), 5(c) – Amount of tax credit carried forward tile.

7) Click the Statutory Forms Tab.

8) Click the Choose File button.

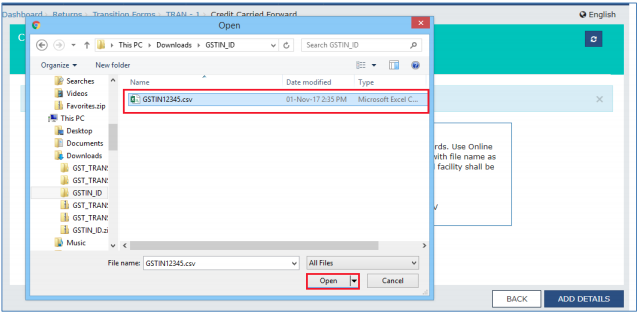

9) Browse and navigate the CSV file to be uploaded from your computer. Click the Open button.

10) A success message is displayed. The uploaded CSV file would be validated and processed. In case of validation failure upon processing; errors if any would be shown on the GST Portal.

Similarly, you can upload data for Tran-1 9(a) Details of Goods – Sent as Principal CSV template and Tran-1 9(b) Details of Goods – Held in Stock CSV template.

Upload Details using the Excel Template

-

Tran-1 6(a) Capital Goods – Central Tax EXCEL template: To fill in the details and generate the JSON file for upload for 6A, 6B – Details of capitals goods for which unavailed credit has not been carried forward tile > Central Tax tab.

-

Tran-1 6(b) Capital Goods – State/UT Tax EXCEL template: To fill in the details and generate the JSON file for upload for 6A, 6B – Details of capitals goods for which unavailed credit has not been carried forward tile > State/UT Tax tab.

-

Tran-1 7(b) Details of the inputs held in stock – Eligible Duties and taxes/VAT/[ET] EXCEL template: To fill in the details and generate the JSON file for upload for 7(a), 7(b), 7(c), 7(d) – Details of the inputs held in stock tile > 7b-Eligible Duties and taxes/VAT/[ET] tab.

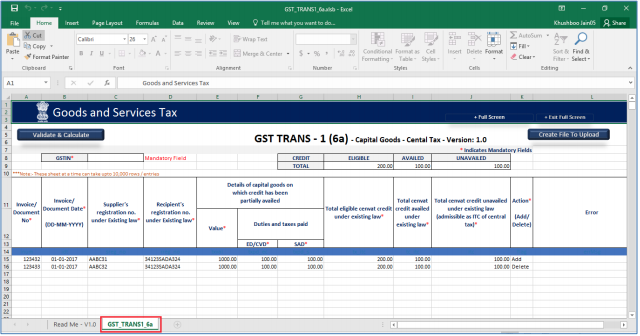

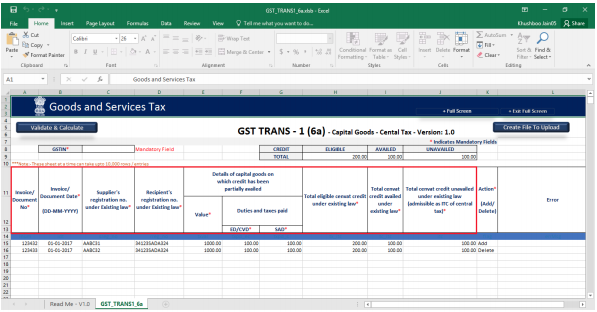

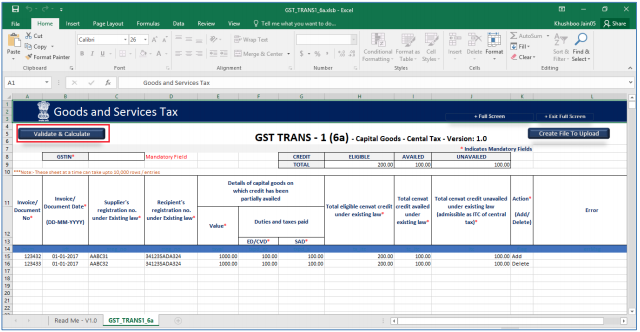

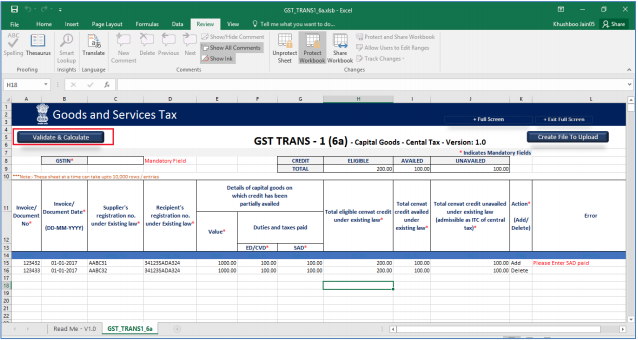

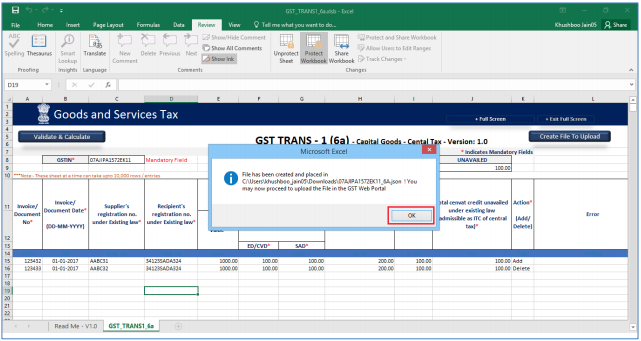

Let us take an example where you need to upload the data using the Tran-1 6(a) Capital Goods – Central Tax EXCEL template.

1) Launch the Tran-1 6(a) Capital Goods – Central Tax EXCEL template and navigate to worksheet.

2) Navigate to worksheet GST_TRANS1_6a.

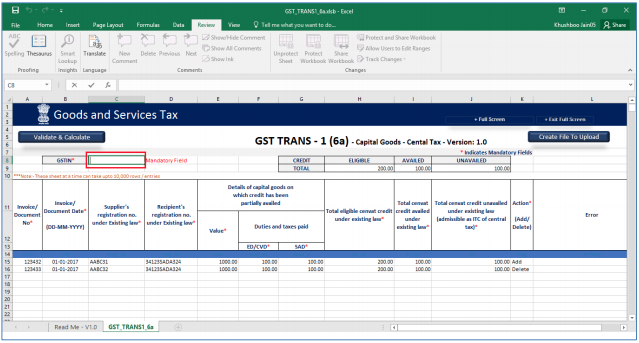

3) In the GSTIN field, enter the GSTIN.

4) Enter the details in the respective columns in the excel tool.

Recipient’s registration no. should be a valid registration number available in Amendments of Registration Non-Core Fields in Registration Service under any Central Tax Registration Number category.

Add: Insert a new record or Edit already inserted data into GST System

Delete: Delete an already existing record.

If a new row needs to be inserted between rows, then select all rows below the insert position and Cut-Paste them one row below.

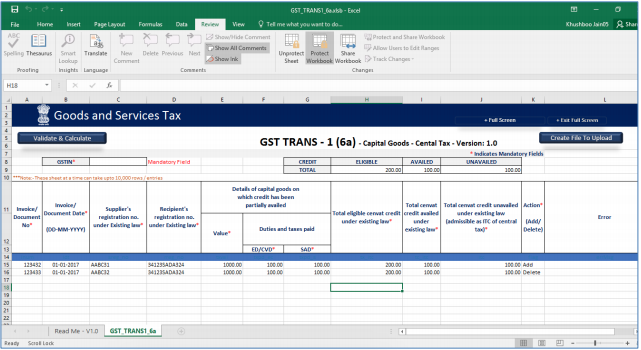

5) Once all details are entered, click the Validate & Calculate Sheet button to validate the worksheet.

(Total Unavailed Credit = Total Available Credit – Total Availed Credit) is calculated on click of ‘Validate & Calculate’ Button and the value should not be less than zero and greater than the calculated value.

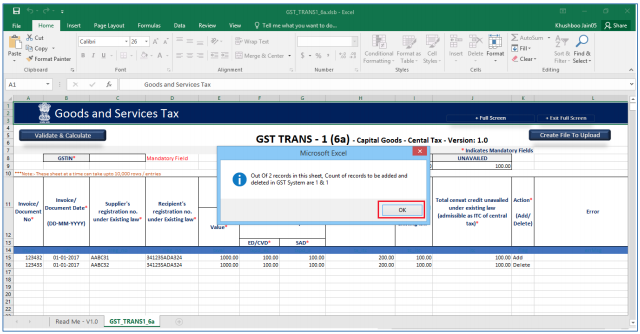

In case of successful validation:

6) A message is displayed with count of records to be added and deleted in GST Portal. Click the OK button.

If a row with error needs to be deleted, then select the entire row and press “Delete’ key on keyboard. Next, select all the rows which are below the deleted row and Cut-Paste them on the ‘Deleted’ row.

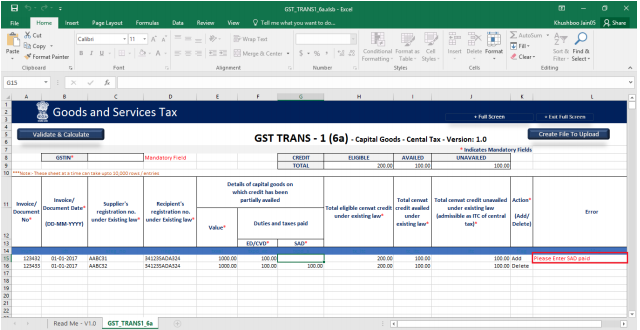

In case of unsuccessful validation:

7) Errors are shown in the Error Column.

8) Once all errors are rectified, click the Validate & Calculate Sheet button to validate the worksheet.

9) The error column is blank showing the row is validated.

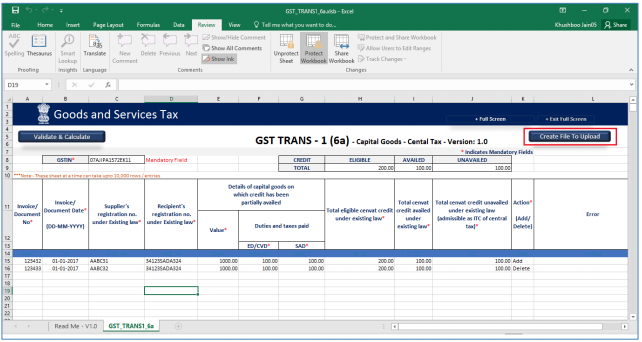

Generate JSON file using ‘Generate File to Upload’ button

10) Click the Generate File to Upload button to generate JSON for upload on GST Portal.

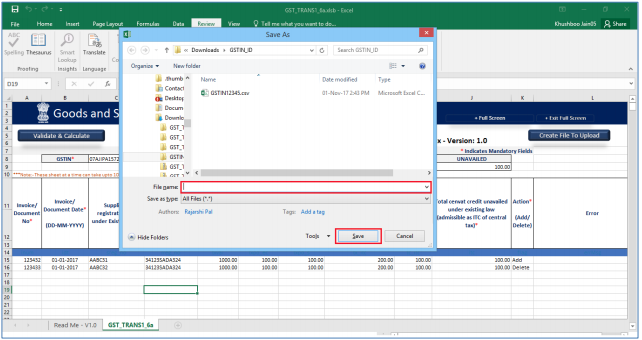

11) Navigate to the folder where you want to save the JSON file. Enter the file name and click the SAVE button.

A confirmation message is displayed that JSON file is created. Click the OK button.

Upload the generated JSON on GST Portal

12) Access the https://gst.gov.in/ URL. The GST Home page is displayed.

13) Click the Services > Returns > Transition Forms command.

The TRAN – 1 – Transitional ITC / Stock Statement page is displayed.

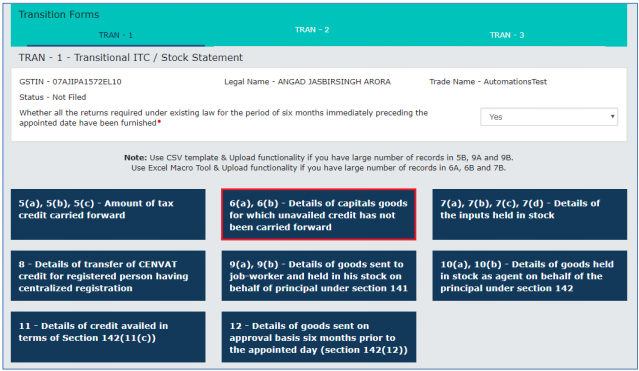

14) Click 6(a), 6(b) – Details of capitals goods for which unavailed credit has not been carried forward tile.

15) Click the Central Tax Tab.

16) Click the Choose File button.

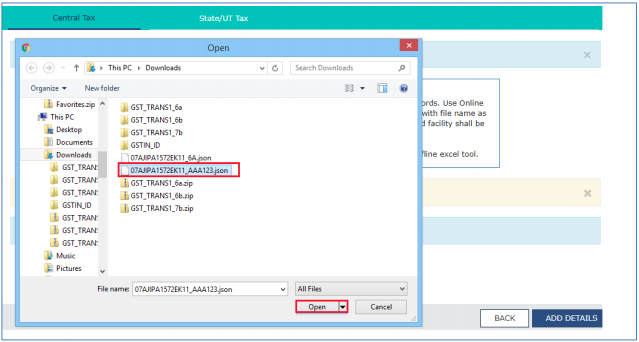

17) Browse and navigate the JSON file to be uploaded from your computer. Click the Open button.

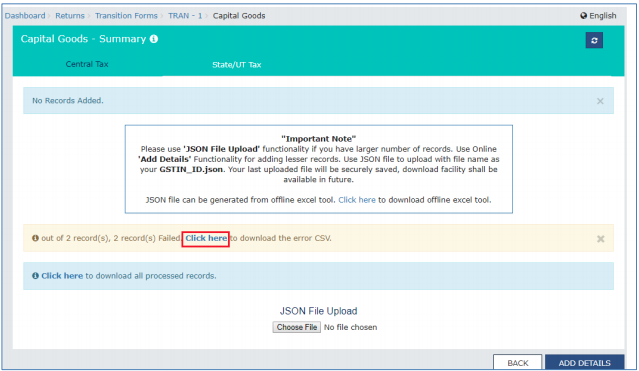

18) The uploaded CSV file would be validated and processed.

In case of validation failure upon processing; errors if any can be downloaded from the GST Portal.

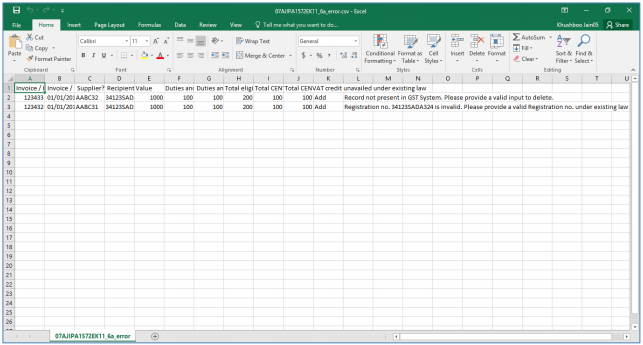

The error is shown after downloading the error file. Rectify the errors in the JSON file and upload again on the GST Portal.

Similarly, you can upload data for Tran-1 6(b) Capital Goods – State/UT Tax EXCEL template and Tran-1 7(b) Details of the inputs held in stock – Eligible Duties and taxes/VAT/[ET] EXCEL template.