Import Sales Invoices from GSTZen to Tally

Import your sales invoices from GSTZen to Tally by following the easy steps. This will help in saving time as you will not be required to create them manually in Tally.

System Requirements

Download and install the GSTZen Agent

Note: Your PC or anti virus might show that the application may be harmful. If, so add the application as an exception in your anti-virus settings.

When the application is running, the icon will be shown in your task bar.

Tally ERP 9

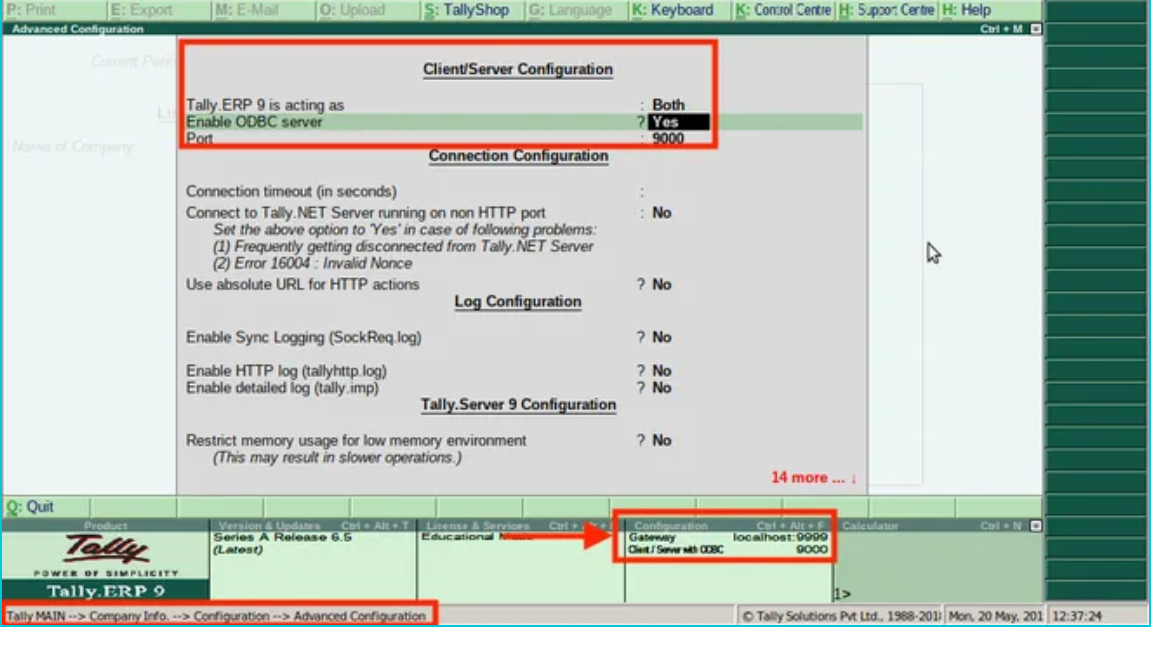

- Ensure that Tally ERP 9 is installed and running in your computer

- Tally server need to run on Port 9000 of your computer

- To configure Tally server to Port 9000, follow the path Tally Main -> Company Info -> Configuration -> Advanced Configuration.

Tally Prime

- Ensure that Tally Prime is installed and running in your computer

- Tally server need to run on Port 9000 of your computer

- To configure Tally server to Port 9000, follow the path Tally Main -> Help:F1 -> Settings -> Connectivity.

Make sure that the company to which the invoices are to be imported is open in Tally

Follow the steps for importing the sales invoices into tally

Step 1: Go to the sales register for the particular GSTIN

Step 2: Filter the invoices that need to be imported

Step 3: After filtering the invoices, click on Post Filtered Sales Register to Tally

Step 4: Confirm the upload

Step 5: Select Tally Company

Step 6: Process Ledger Details

Step 7: Select the Appropriate Ledgers and click on Post Invoices to Tally.

The Invoices will be posted to the appropriate ledgers as selected by you. A separate ledger will also be created in Tally reflecting all the invoices imported from GSTZen.

Notes :

- B2B invoices will be added to the ledger based on the buyer’s GSTIN

- If the ledger is not present for a partricular GSTIN in Tally, it will be created by GSTZen while importing the invoices

- B2C invoices will show up as Unregistered in Tally

- If you want the invoices to be imported to particular Stock/Material, filter the invoices accordingly in the GSTZen Sales Register and choose the ledger for the Stock/Material as the Income Ledger while confirming the Ledger Configuration in Step 7.

To upload sales data from Tally to GSTZen Refer to Tally Sales Integration