Quarterly Return Filing and Monthly Payment of Taxes (QRMP)

The Government introduced Quarterly Return Filing and Monthly Payment of Taxes (QRMP) scheme under Goods and Services Tax (GST) to help small taxpayers whose turnover is less than Rs.5 crores. Under the QRMP scheme the taxpayers have to file GSTR-3B on a quarterly basis and pay tax every month.

This scheme is optional and can be availed on the basis of GSTIN.

Data to be reported in the 3 months of a quarter

Invoice Furnishing Facility (IFF)

- Invoice Furnishing Facility (IFF) is an optional facility made available as per Rule-59(2) of the CGST Rules, 2017. It poses no additional compliance burden.

- This is provided for those quarterly taxpayers who want to pass on input tax credit (ITC) to their recipients (buyers/customers) in first two months of a quarter.

- The taxpayer has to submit the B2B invoice details of sale transactions (both inter-state and intra-state) along with debit and credit notes of the B2B invoices issued during the month.

- The total net value of invoices that can be uploaded is restricted to Rs.50 lakh per month.

- The details submitted in IFF will be reflected in the GSTR-2A, GSTR-2B, GSTR-4A or GSTR-6A of the recipients as the case may be.

- IFF for a month will expire after the due date of 13th of next month, and cannot be filed after this date.

Methods of making payment

The taxpayer has to deposit tax using form GST PMT-06 by the 25th of the following month, for the first and second months of the quarter. The taxpayers can pay their monthly tax liability either in the Fixed Sum Method (FSM) also known as 35% challan method, or Self Assessment Method (SAM).

- Fixed Sum Method: Portal will generate a pre-filled challan in Form GST PMT-06. The system generated pre-filled challan in this case is commonly also known as 35% challan. Under the fixed sum method, depending on the filing frequency in the previous quarter, the 35% challan is calculated by either of the following methods

| S No | Type of Taxpayer | Tax to be paid |

| 1 | Who furnished GSTR-3B quarterly for the last quarter | 35% of tax paid in cash in the preceding quarter |

| 2 | Who furnished GSTR-3B monthly during the last quarter | 100% of tax paid in cash in the last month of the immediately preceding quarter |

- Self-Assessment Method: The actual tax due is to be paid through challan, in Form GST PMT-06, by considering the tax liability on inward and outward supplies and the input tax credit available for the period as per law.

Filing through GSTZen

1.Change the frequency of return from quarterly to monthly in GSTZen (If it was quarterly earlier).

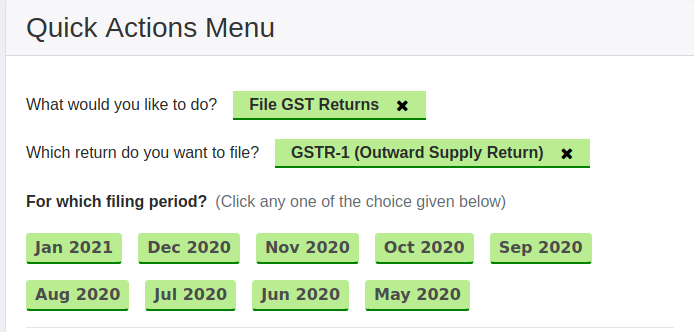

2.Open the GSTR-1 Return for the relevant period from GSTZen’s Quick Action menu.

3.There will be an option to file under QRMP there, change it to yes. Based on the month in the quarter, GSTZen will automatically determine whether IFF or GSTR 1 needs to be filed based on the month of the quarter.

Frequently Asked Questions (FAQs)

1.How to declare B2C supplies in IFF for first two month of quarter if a registered taxpayer has opted for QRMP?

Supplies made to unregistered persons (also called B2C supplies) are not required to be declared in IFF. These may be declared in FORM GSTR-1 for the quarter.

2.How to opt for QRMP scheme?

For the first quarter of the scheme i.e., for the quarter January 2021 to March, 2021, all the registered persons, whose aggregate turnover for the FY 2019-20 is up to 5 crore rupees have been auto migrated to QRMP Scheme. Only those businesses who have furnished the return in FORM GSTR-3B for October 2020 by 30th November, 2020, have been auto-selected.

3. Is it possible to opt out of QRMP scheme? If so, when?

Since the window for opting out of QRMP scheme has been closed, a registered person will not be allowed to make changes for the January-March’21 quarter.

However for the quarter of April to June 2021, taxpayers may change their filing frequency from quarterly to monthly from 1St February, 2021 to 30th April, 2021.

4. How do I claim ITC for the first two months of the quarter?

In first two months of the quarter, no declaration for ITC is required to be made. The available ITC for the entire quarter will be declared in quarterly FORM GSTR-2B. The quarterly GSTR 2B will be in addition to the to the monthly GSTR 2B, which can still be used for doing self-assessment.

5. What should I do if I have not filed IFF for the first 2 months of the Quarter?

If you have not filed IFF for the first 2 months of the Quarter, you have to report the data for the Quarter in the quarterly GSTR 1.

Note: When filing through GSTZen in such case, enter the record date for the B2B invoices as the last month of the quarter. Record date for B2C invoices is not required.

Example: An invoice dated 21 Jan 2021 has to be reported in the quarterly GSTR 1 under QRMP. The record date should belong to March 2021(Can be any date in the month).

6. Can I file IFF after 13th of the following Month?

No, IFF cannot be filed after 13th of the following month. If you have failed to file IFF, you will have to report the data in the quarterly GSTR 1.