Bulk Upload Purchase Invoices through Excel

Upload your Purchase Invoices into the GSTZen server in 5 quick and easy steps. This video and step-by-step instructions will help you upload your Purchase Invoices through Excel.

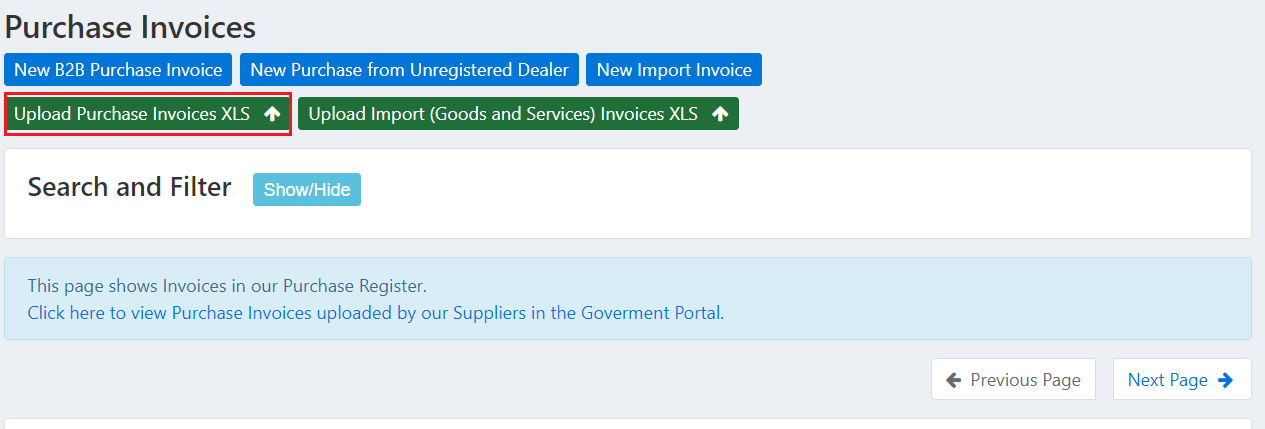

- Click on Purchase Invoices and Upload Purchase Invoices XLS

- Click on Upload Purchase Invoices XLS

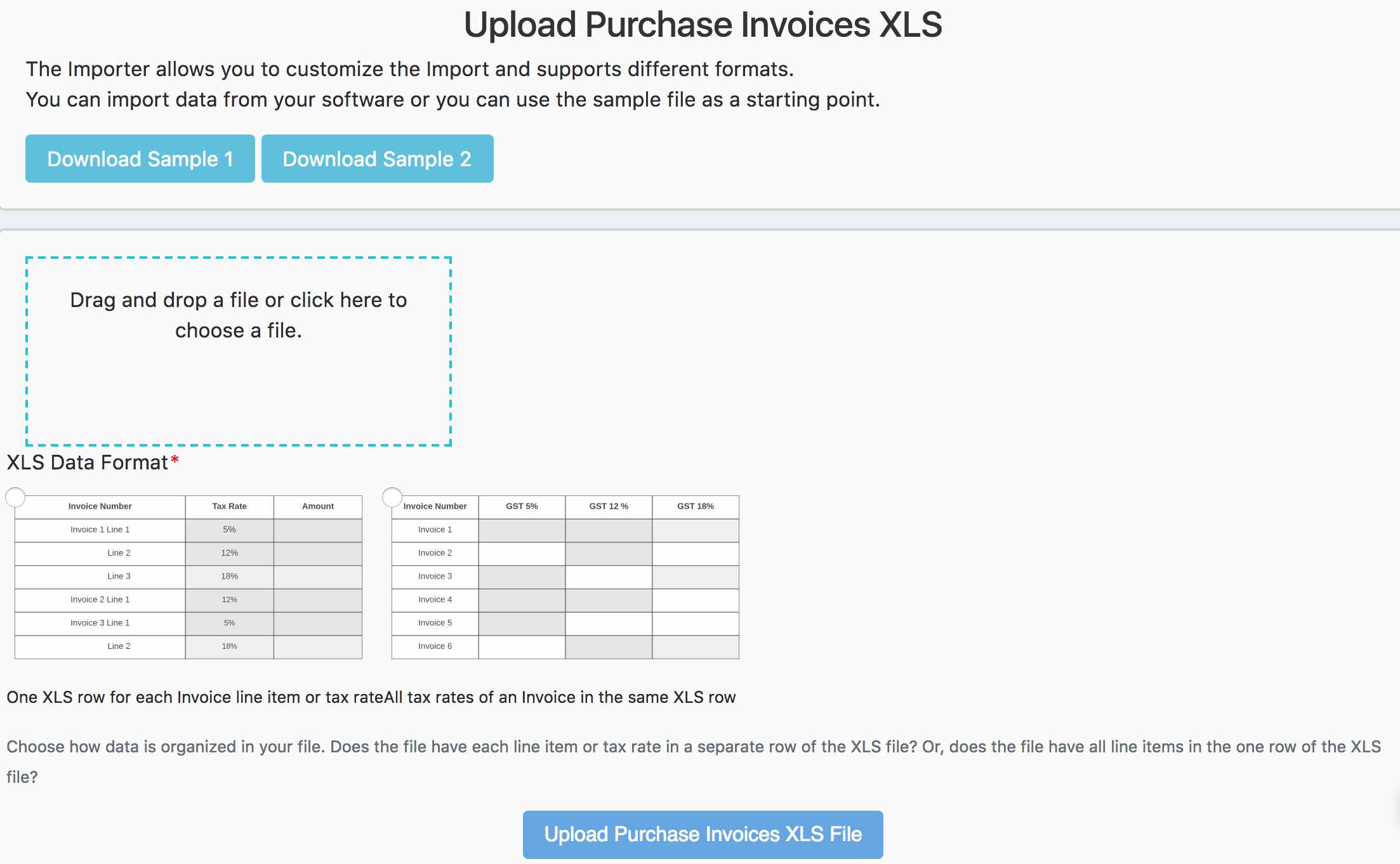

- You may either drag and drop or upload the file from your computer. Click on Drag and Drop file and choose the file of your choice.

- Note – GSTZen importer only allows you to choose XLSX file

- XLS Data Format – Choose a file type depending on your Purchase Invoice format. Either Tax rates as a single column with each row being a different tax rate (OR) Each column is a single tax rate.

- Click on Upload Purchase Invoices XLS File.

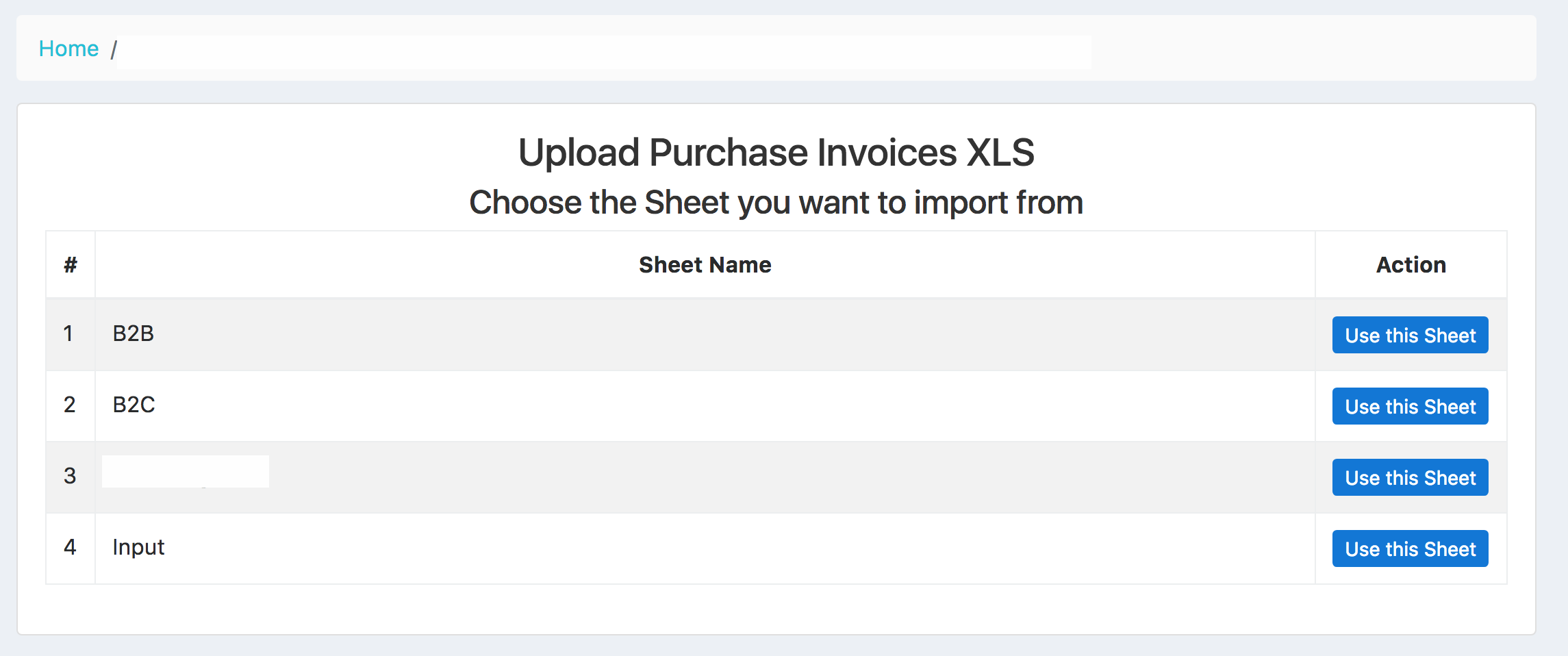

- Choose the sheet you want to upload from the list shown by clicking Use this Sheet. This will upload the sheet into GSTZen.

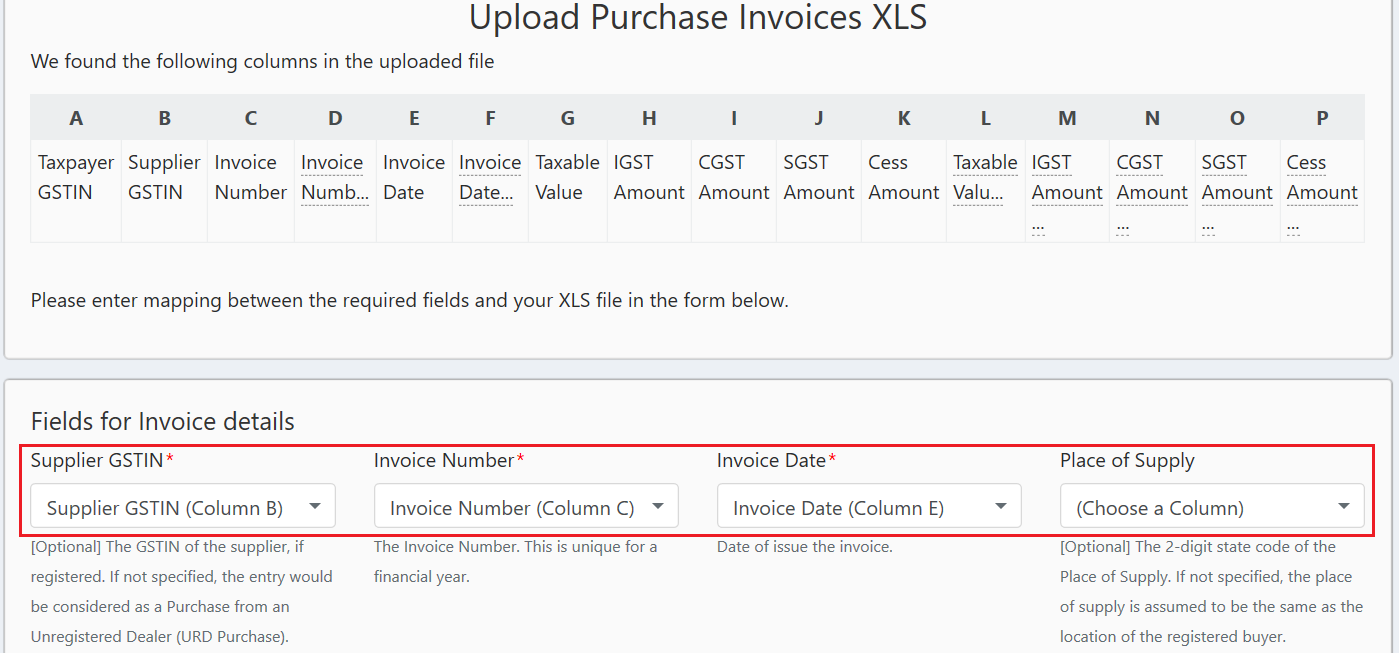

- The importer shows the columns present in your excel sheet. Map the columns to the respective fields shown in the importer.

- Note – The red * denotes mandatory fields.

- To map columns, click on the drop-down and choose the column in the sheet that matches the field. This mapping is a one-time job. GSTZen will save the mapping and will use it when you upload files later.

- Click on Process file upload

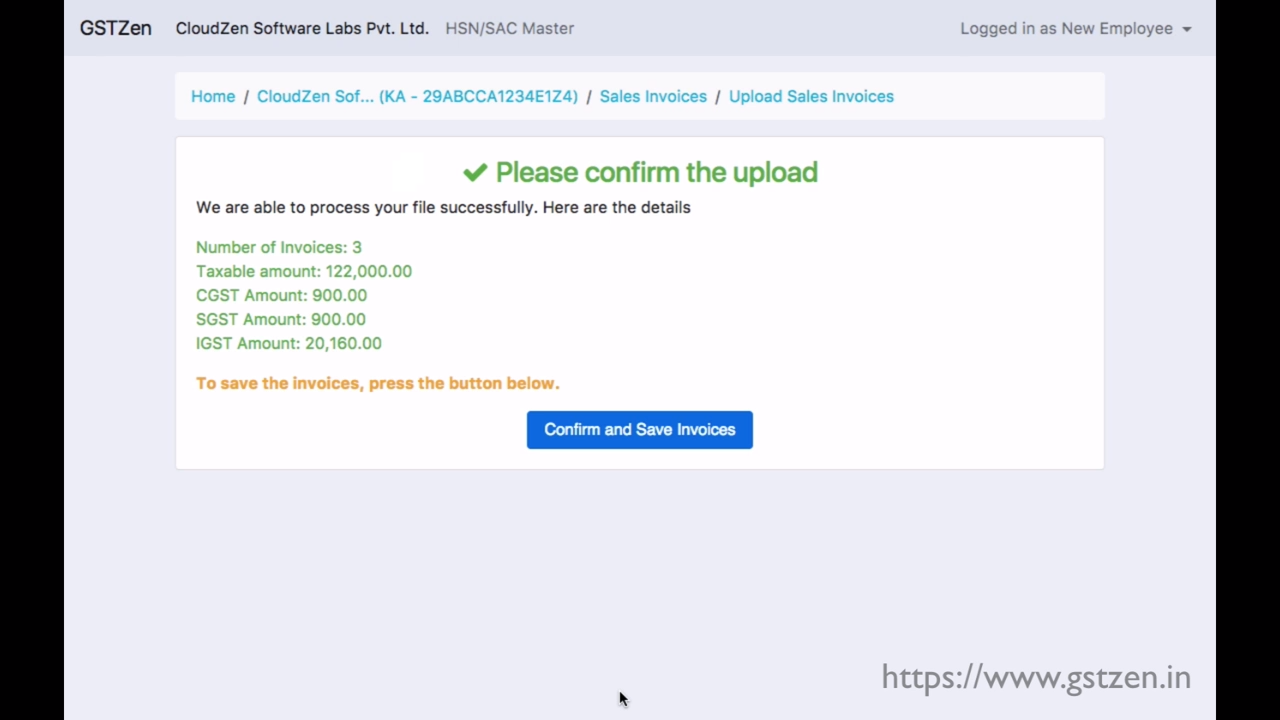

- GSTZen uploads the file and displays a summary. Click Confirm and upload after verifying if the summary matches your excel data.

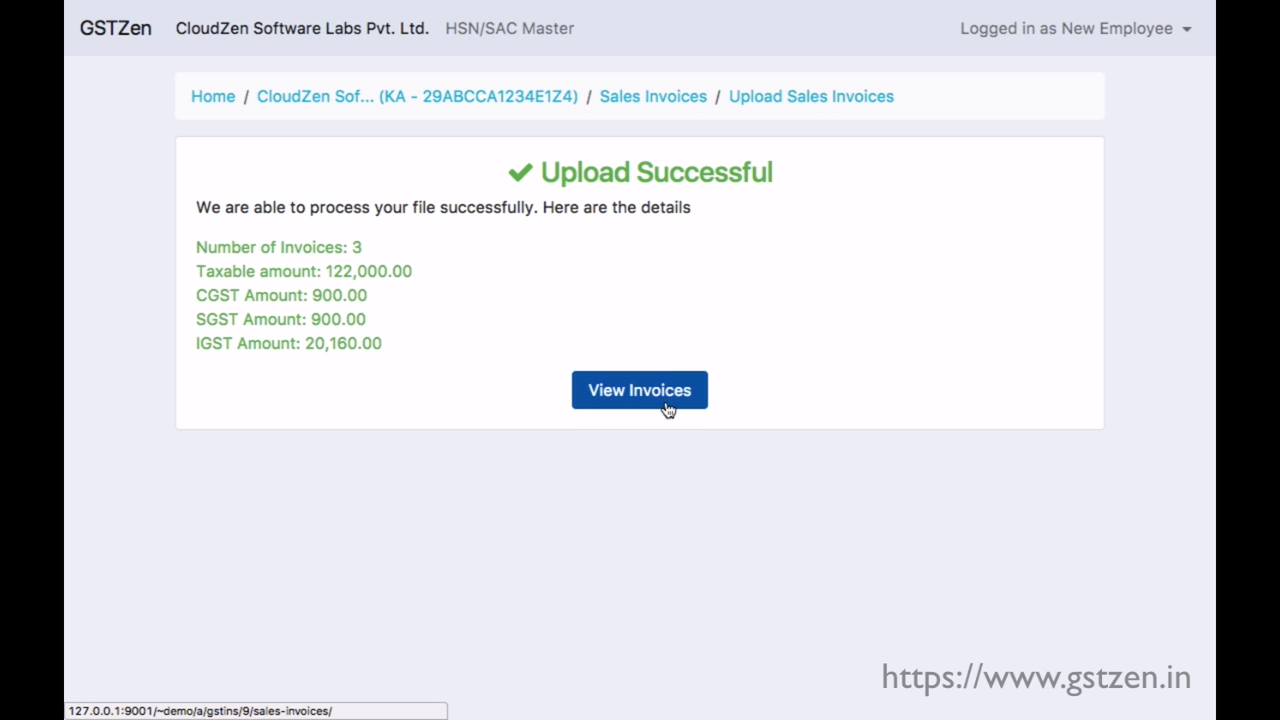

- Click on View Invoices to view the Invoices and Credit/Debit notes in the Purchase Register

To reconcile your GSTR 2A with Purchase invoices, please see the article – GSTR 2A Reconciliation with GSTZen

Upload invoices – Frequently Asked Questions

- How can I add invoices from the previous month?

You may upload invoices from any period into GSTZen. If you would like the invoices from a previous month in the current return filing, please mention the record date as the filing period.

- When I file returns, can I get the invoices from the previous month to be considered in this return?

If you would like the invoices from a previous month in the current return filing, please mention the record date as the filing period.