Filing NIL GSTR 1

A nil income tax return is filed to show the Income Tax Department that you fall below the taxable income and therefore did not pay taxes during the year. Filing nil return through GSTZen has never been easier.

If your gross income is less than the maximum amount excluded from tax, the resultant tax obligation is zero, and you don’t need to pay any taxes. As a result, a nil return is an income tax return with a tax liability of “Zero or nil.” The term “filing a nil return” refers to notifying the tax department that a taxpayer does not have any taxable income for a given fiscal year.

Steps for filing NIL GSTR-1

STEP 1 – Sign up with GSTZen

STEP 2 – Login to GSTZen

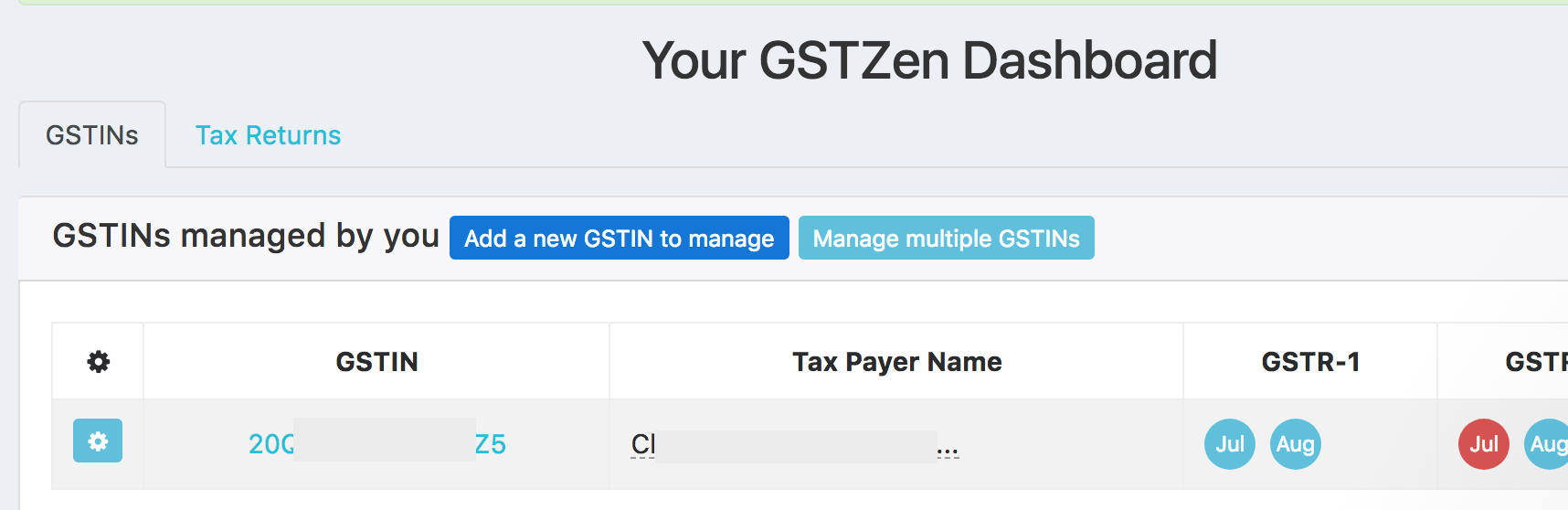

STEP 3 – Add a GSTIN in GSTZen

Click here – How to add a GSTIN to be managed by GSTZen for video presentation

Click on New GSTIN

Enter GSTIN and Save GSTIN

Click on the GSTIN you added and you will enter the software.

Click on the relevant month for which GSTR-1 return needs to be filed from the Tax Returns Matrix.

You may also select the relevant period from the quick actions menu.

STEP 4 – Click on Visit the GSTR-1 Nil Return page if you want to file a Nil Return.

STEP 5 – Login with OTP

STEP 6 – Submit your GSTR 1

STEP 7 – Download Summary

STEP 8 – File Return