[TOC]

Tutorial to File GSTR 1 Monthly Outward Supply Return.

Steps of GSTR-1 Filing Monthly Outward Supply Return

STEP 1 – Sign up with GSTZen

STEP 2 – Login to GSTZen

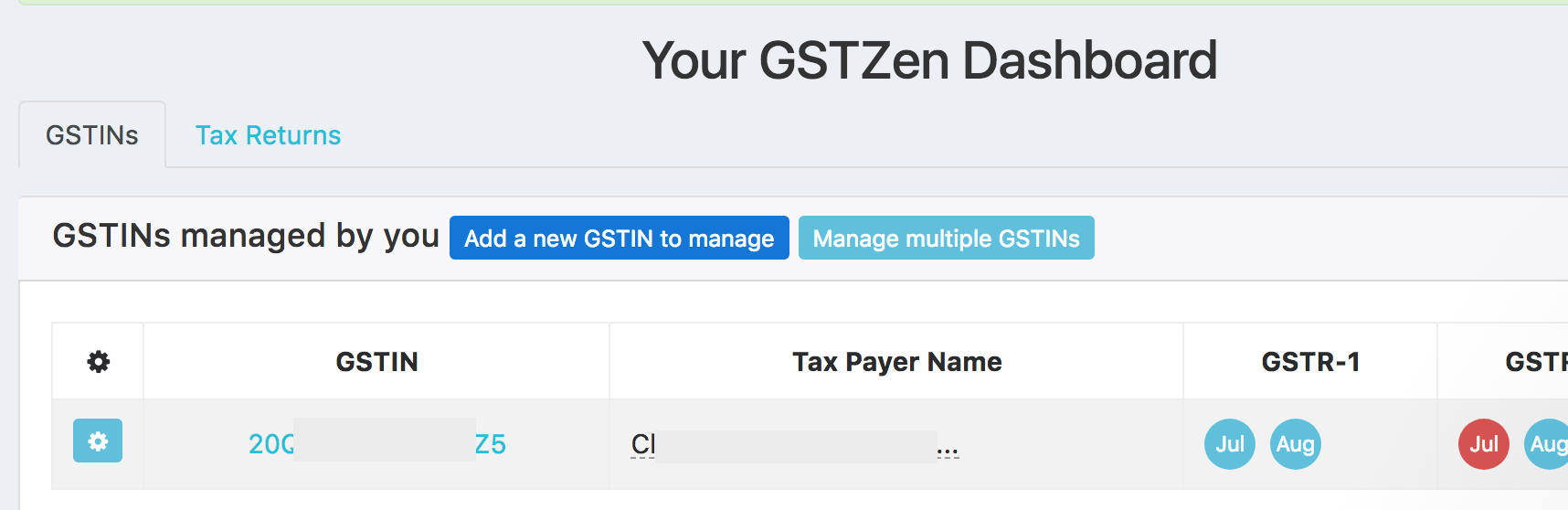

STEP 3 – Add a GSTIN in GSTZen

Click here – How to add a GSTIN to be managed by GSTZen for video presentation

Click on New GSTIN

Enter GSTIN and Save GSTIN

Click on the GSTIN you added and you will enter the software.

Click on the relevant month for which GSTR-1 return needs to be filed from the Tax Returns Matrix.

You may also select the relevant period from the quick actions menu.

For submitting IFF or GSTR 1 under QRMP, there will be an option to file under QRMP above Step 1, change it to yes. Based on the month in the quarter, GSTZen will automatically determine whether IFF or GSTR 1 needs to be filed based on the month of the quarter. To know more refer to the QRMP article

STEP 4 – Upload you Sales Register

You may upload the sales register either through XLS or through Tally

For uploading sales through tally, select the particular GSTIN from the dashboard, click on the option to upload sales register from tally below the Tax Returns Matrix

TIP : How to Bulk Upload Sales invoices

STEP 5 – Enter Documents Issued details

STEP 6 -Calculate or upload HSN/SAC Summary

This is optional. If you have provided the HSN/SAC information in the invoices while uploading the sales register, it will be automatically calculated while calculating GSTZen Summary. If you have not provided the HSN/SAC information while uploading the sales invoices, you may upload the same through Upload HSN/SAC Summary XLS option.

STEP 7 – Calculate GSTZen Summary

STEP 8 – Enable API Access for that GSTIN in the Government Portal and login to the GST Portal with OTP

TIP : How to Enable API on Government Portal

STEP 9 – Upload your GSTR 1 to GST Portal

STEP 10 – Download and Verify

STEP 11 – Submit the page

NOTE: Once submitted, it cannot be changed. So, please check once before you submit

STEP 12 – Apply digital signature and file

To know more about detail of GSTR-1 form Click here