How to make wallet payment

How to make a payment to your GSTZen Wallet?

How much should I pay?

You can add as little or as much as you want based on your expected usage. For example, the cost of generating report article is shown here – What is the cost of Generating the Consolidated report ?

Where should I pay?

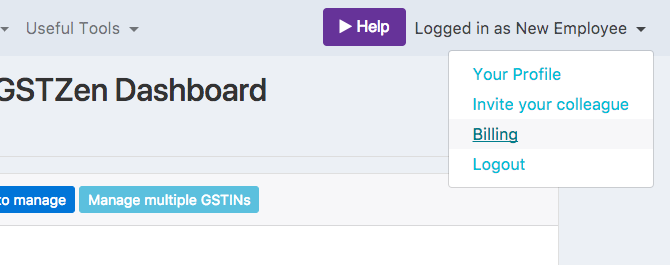

Firstly, make sure that you have created an account on GSTZen and that you have logged in into your account. After logging in, you will see your name on the top right hand corner of the page. Click on our name, and then click on Billing.

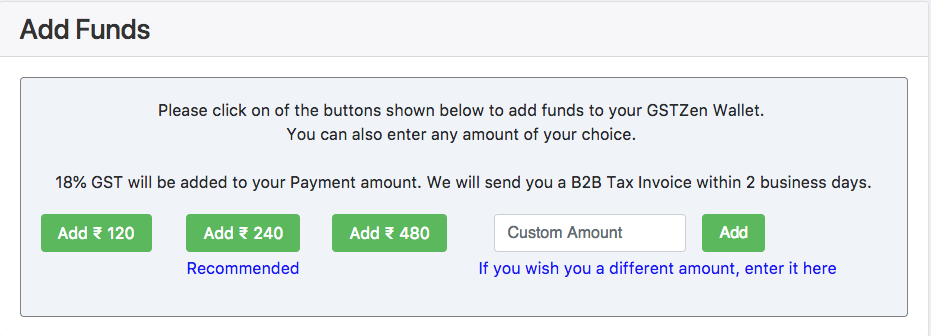

In this page, you will see details about your GSTZen Wallet balance. You can choose an amount and add funds to your Wallet.

What payment methods are supported?

We support all major Credit and Debit cards, Net banking from all Major banks, UPI, and Private Wallets. If you are not able to pay using one of these methods, please get in touch with us. We can accept NEFT/RTGS payments to our bank account.

When will I receive an Invoice for my payment?

Against each payment, we issue a GST Tax Invoice. If you have provided your GSTIN number, we will issue you a B2B Invoice. Otherwise, we will issue you a B2C Invoice. Usually, you should receive the Invoice in your email the same day you make the payment. We guarantee to send out the Invoice within 2 working days.

How long are funds added to the Wallet valid for?

Any amount added to your GSTZen Wallet is valid for 1 year.

Where can I view my GSTZen Wallet Balance?

You can view it in the your Billing page (in the same page from which you made your payment).

To know about GSTR-2A Reconciliation with GSTZen, please click here

To known about GSTR-1 vs GSTR-2A vs GSTR-3B Consolidated Comparison Report, please click here