FORM GSTR 4

- FORM GSTR 4

- Return for financial year of registered person who has opted for composition levy

- FORM GSTR-4 PDF link

- 4. Inward supplies including supplies on which tax is to be paid on reverse charge

- 5. Summary of self-assessed liability as per FORM GST CMP-08

- 6. Tax rate wise details of outward supplies / inward supplies attracting reverse charge during the year

- 7. TDS/TCS Credit received

- 8. Tax, interest, late fee payable and paid

- 9. Refund claimed from Electronic cash ledger

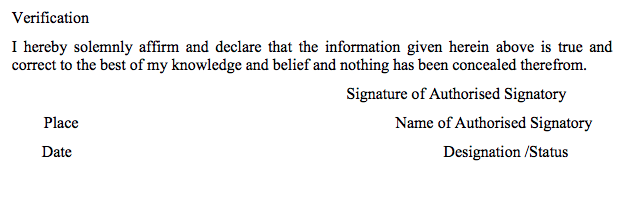

- Verification

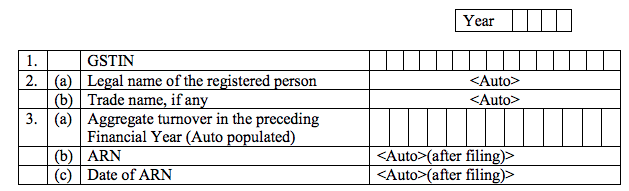

Return for financial year of registered person who has opted for composition levy

This Form was made and amended vide the following notifications. Central Tax Notification No. 31/2019 (dated 28th June 2019). The previous version is available here.

FORM GSTR-4 PDF link

1) Terms used:

(a) GSTIN: Goods and Services Tax Identification Number

(b) TDS: Tax Deducted at Source

(c) TCS : Tax Collected at Source

2) The details in FORM GSTR-4, for every financial year or part thereof, should be furnished till the thirtieth day of April following the end of such financial year.

3) Aggregate turnover of the taxpayer for the immediate preceding financial year would be auto-populated.

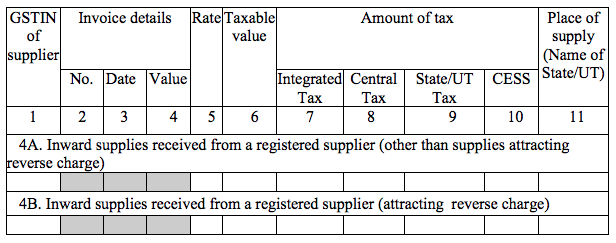

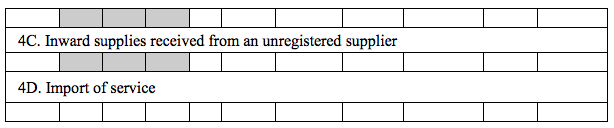

4. Inward supplies including supplies on which tax is to be paid on reverse charge

Table 4 to capture information, on a consolidated basis, related to inward supplies, rate-wise, GSTIN wise:

(i) Table 4A to capture inward supplies from registered supplier other than those attracting reverse charge;

(ii) Table 4B to capture inward supplies from registered supplier attracting reverse charge;

(iii) Table 4C to capture supplies from unregistered supplier;

(iv) Table 4D to capture import of services.

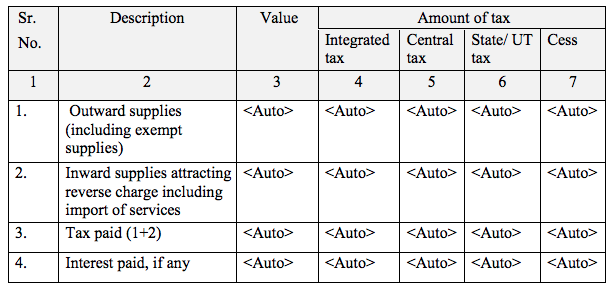

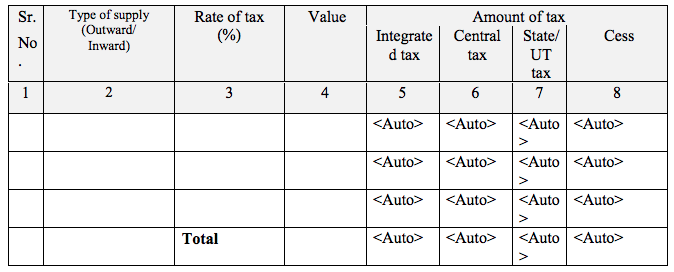

5. Summary of self-assessed liability as per FORM GST CMP-08

(Net of advances, credit and debit notes and any other adjustment due to amendments etc.)

Table 5 to capture details (and adjustments thereof) of outward supplies (including exempt supplies) and inward supplies attracting reverse charge including import of services as declared earlier in FORM GST CMP-08 during the financial year.

6. Tax rate wise details of outward supplies / inward supplies attracting reverse charge during the year

(Net of advances, credit and debit notes and any other adjustment due to amendments etc.)

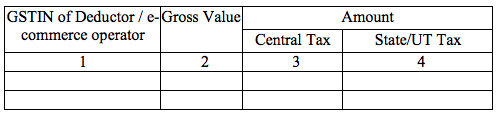

TDS/TCS credit received from deductor/e-commerce operator would be auto-populated in Table 7.

7. TDS/TCS Credit received

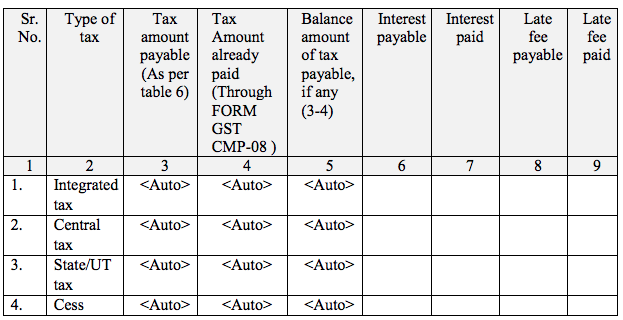

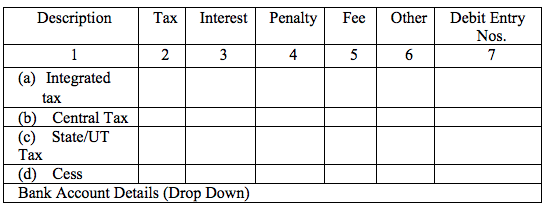

8. Tax, interest, late fee payable and paid

9. Refund claimed from Electronic cash ledger

Verification