FORM GSTR 4

Quarterly return for registered person opting for composition levy

- FORM GSTR 4

- Quarterly return for registered person opting for composition levy

- FORM GSTR-4 PDF link

- 4.Inward supplies including supplies on which tax is to be paid on reverse charge

- 5. Amendments to details of inward supplies furnished in returns for earlier tax periods in Table 4 [including debit notes/credit notes and their subsequent amendments]

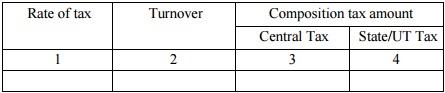

- 6. Tax on outward supplies made (Net of advance and goods returned)

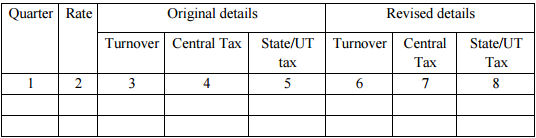

- 7. Amendments to Outward Supply details furnished in returns for earlier tax periods in Table No. 6

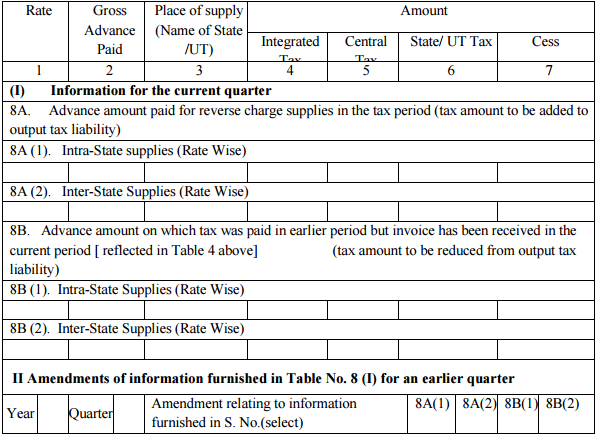

- 8. Consolidated Statement of Advances paid/Advance adjusted on account of receipt of supply

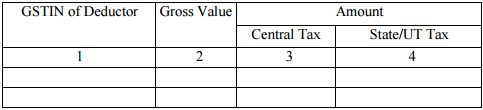

- 9. TDS Credit received

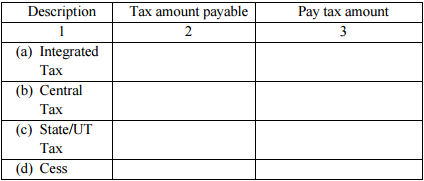

- 10. Tax payable and paid

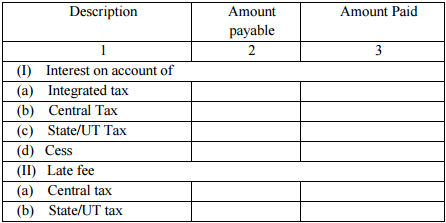

- 11. Interest, Late Fee payable and paid

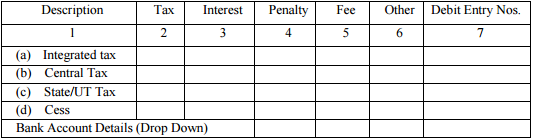

- 12. Refund claimed from Electronic cash ledger

- 13. Debit entries in cash ledger for tax /interest payment [tobe populated after payment of tax and submissions of return]

- FORM GSTR-4 PDF link

This Form was made and amended vide the following notifications.Central Tax Notification No. 60/2018 (dated 30th October 2018). Refer to GSTR-4 Return for financial year of registered person who has opted for composition levy for the current version.

FORM GSTR-4 PDF link

(1) Terms used:

(a) GSTIN: Goods and Services Tax Identification Number

(b) TDS: Tax Deducted at Source

(2) The details in GSTR-4 should be furnished between 11th and 18th of the month succeeding the relevant tax period.

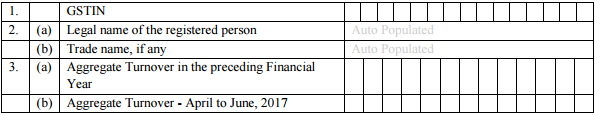

(3) Aggregate turnover of the taxpayer for the immediate preceding financial year and first quarter of the current financial year shall be reported in the preliminary information in Table 3. This information would be required to be submitted by the taxpayers only in the first year and should be autopopulated in subsequent years.

4.Inward supplies including supplies on which tax is to be paid on reverse charge

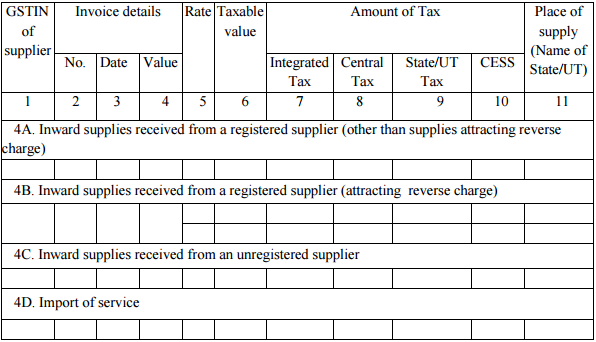

Table 4 to capture information related to inward supplies, rate-wise:

(i) Table 4A to capture inward supplies from registered supplier other than reverse charge. This information will be auto-populated from the information reported by supplier in GSTR-1and GSTR-5;

(ii) Table 4B to capture inward supplies from registered supplier attracting reverse charge. This information will be auto-populated from the information reported by supplier in GSTR-1;

(iii) Table 4C to capture supplies from unregistered supplier;

(iv) Table 4D to capture import of service;

(v) Tax recipient to have the option to accept invoices auto populated/ add invoices, pertaining to reverse charge only when the time of supply arises in terms of section 12 or 13 of the Act; and

(vi) Place of Supply (PoS) only if the same is different from the location of the recipient.

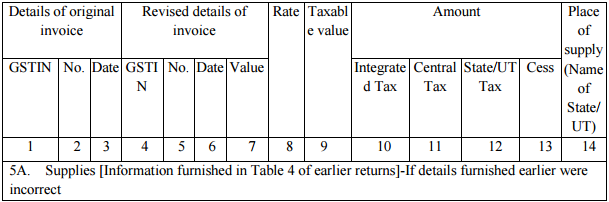

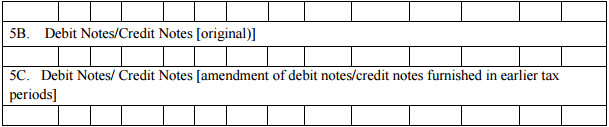

5. Amendments to details of inward supplies furnished in returns for earlier tax periods in Table 4 [including debit notes/credit notes and their subsequent amendments]

Table 5 to capture amendment of information provided in earlier tax periods as well as original/ amended information of debit or credit note received, rate-wise. Place of Supply (PoS) to be reported only if the same is different from the location of the recipient. While furnishing information the original debit /credit note, the details of invoice shall be mentioned in the first three columns, While furnishing revision of a debit note/credit note, the details of original debit /credit note shall be mentioned in the first three columns of this Table

6. Tax on outward supplies made (Net of advance and goods returned)

Table 6 to capture details of outward supplies including advance and net of goods returned during the current tax period

7. Amendments to Outward Supply details furnished in returns for earlier tax periods in Table No. 6

Table 7 to capture details of amendment of incorrect details reported in Table 6 of previous returns.

8. Consolidated Statement of Advances paid/Advance adjusted on account of receipt of supply

Information of advance paid pertaining to reverse charge supplies and the tax paid on it including adjustments against invoices issued to be reported in Table 8.

9. TDS Credit received

TDS credit would be auto-populated in a Table 9.

10. Tax payable and paid

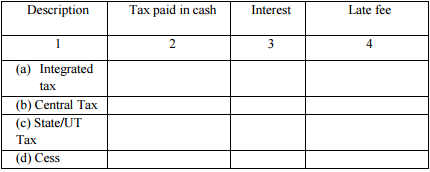

11. Interest, Late Fee payable and paid

12. Refund claimed from Electronic cash ledger

13. Debit entries in cash ledger for tax /interest payment [tobe populated after payment of tax and submissions of return]

1Information against the Serial 4A of Table 4 shall not be furnished.

1 Substituted in Central Goods and Services Tax (Thirteenth Amendment) Rules, 2018, vide Notification No. 60/2018 Central Tax (dated 30th October 2018)