How to Setup Tally to work with GSTZen

Choose what GSTZen should consider your invoice number as

- Once you choose the GSTIN, click on the Manage button and click on Edit

- Scroll down to the Tally Integration Settings section and choose either Reference Number or Voucher Number from the drop down

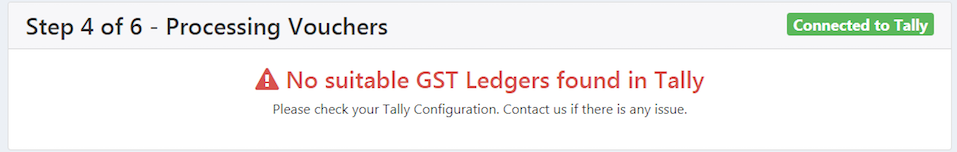

Tally Error: No suitable GST Ledgers found in Tally

Reason this error occurs - You will receive this error if the Tally Settings are not right.

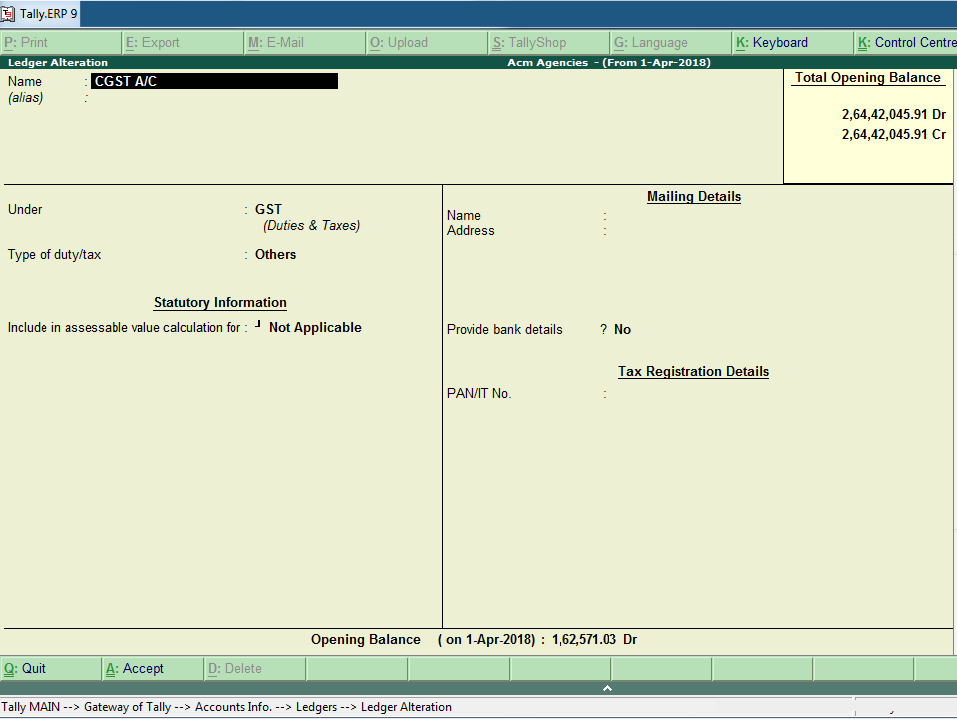

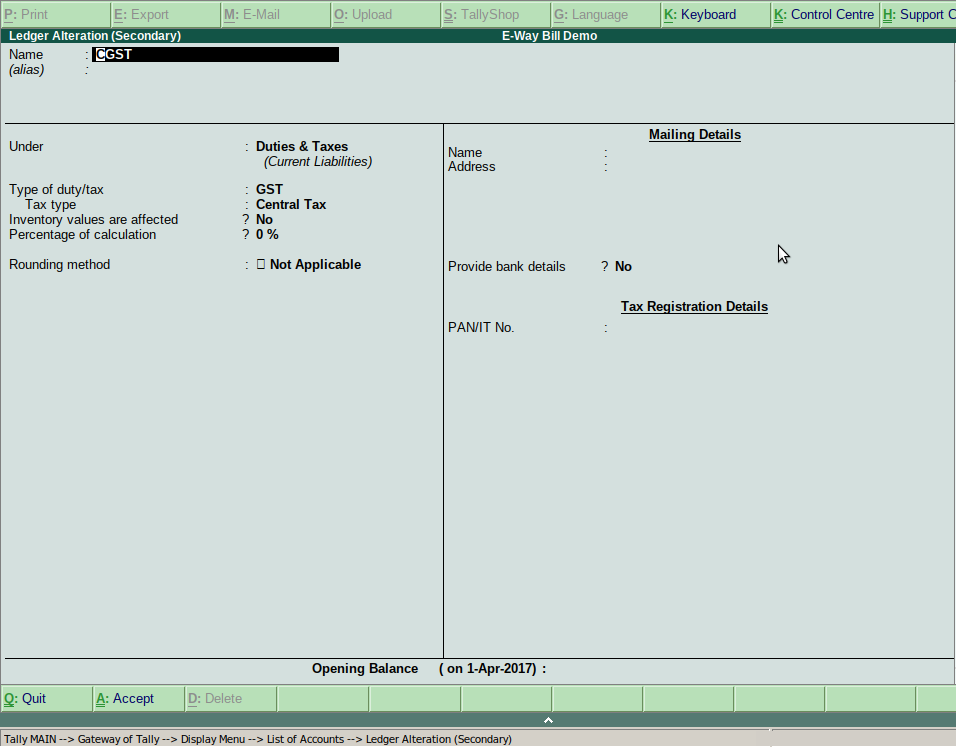

Resolution - Verify if your Tally Settings are shown as in Image 2. If yes, kindly change the settings to as shown in Image 3.

Image 2 -

Image 3 - This is the correct Tally Setting

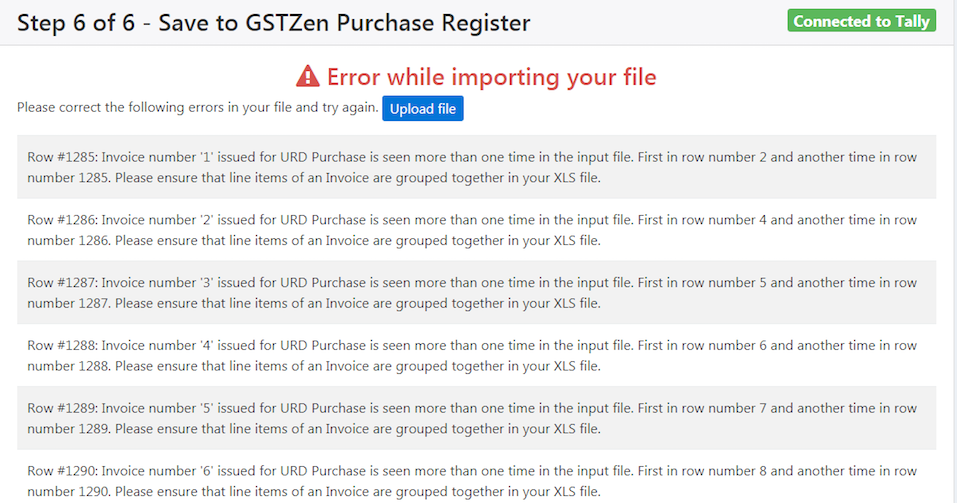

Tally Error: Error while importing your file

Reason this error occurs - You will receive this error if you choose Multiple Financial Years while downloading Tally Purchase Register.

Resolution - Please choose One financial year at a time to avoid the issue.

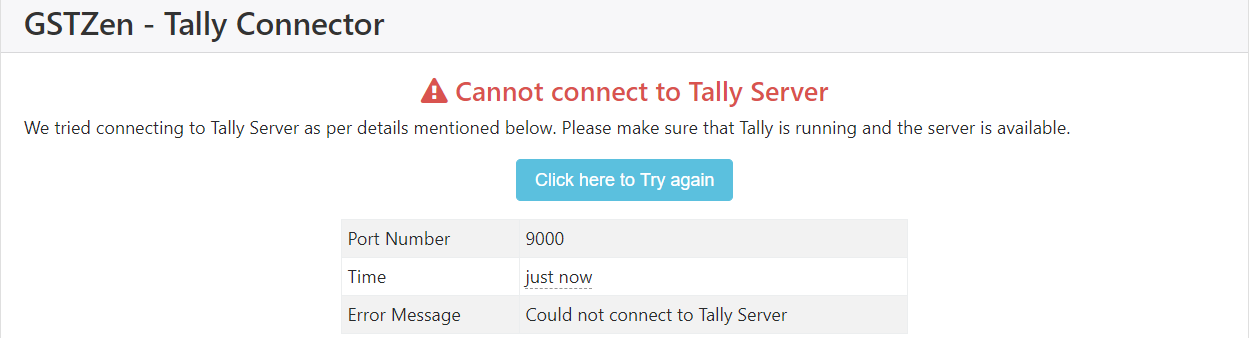

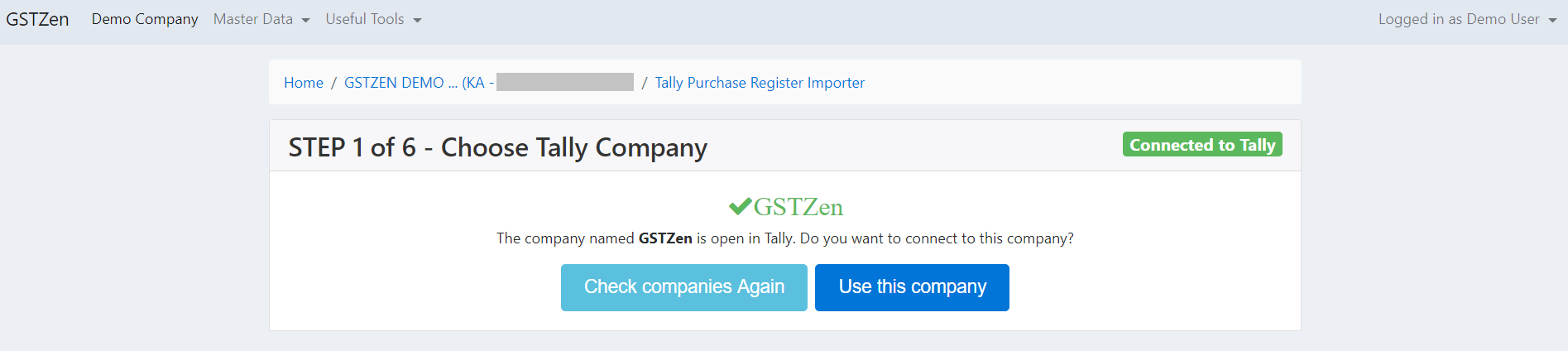

Tally Error: Cannot connect to Tally Server

Reason this error occurs - You will receive this error if you do not have Tally running in the computer.

Resolution - Install and run Tally in the system. Then, open GSTZen software and click on Use this company

Unable to upload Credit/Debit Notes to GSTZen using Tally

GSTZen's Tally Integration only uploads Purchase Register and not Credit/Debit Notes. This is because Credit/Debit notes need to be linked with the Invoice and we are currently unable to get this linking information from Tally.

You may upload Credit/Debit Notes in XLS format. Here is an article that will guide you through Credit/Debit Notes excel upload - Upload CN/DN in excel format