GSTR-9C - Frequently Asked Questions

- Is additional place of business mandatory while filing GSTR-9C?

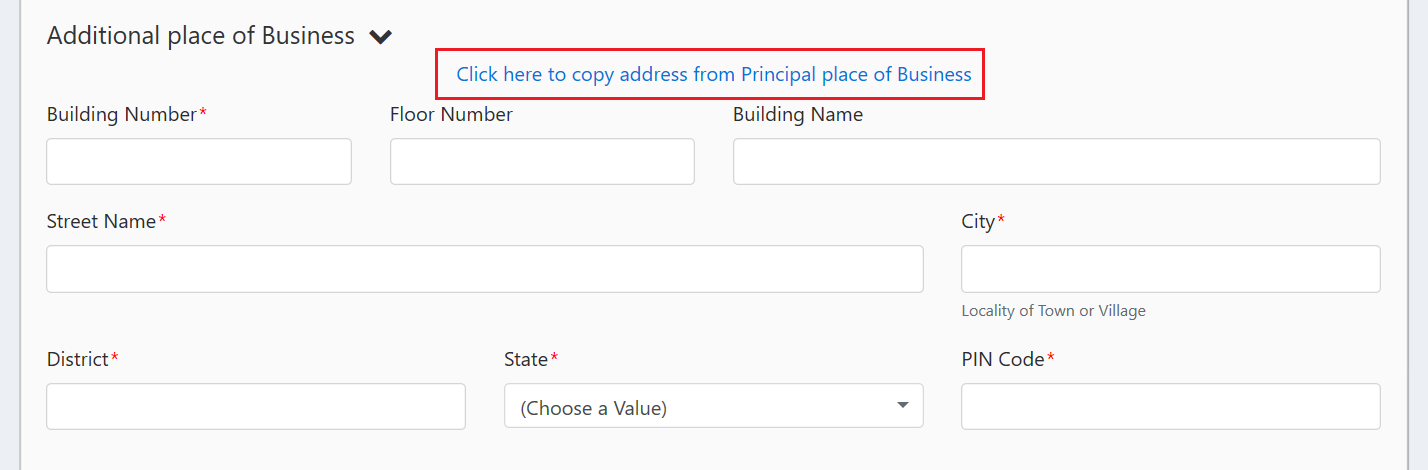

Yes, when you fill Auditor Certification for GSTR-9C form, additional place of business is a mandatory input.

If you do not have an additional place of business, you can copy your Principal place of business in place of your Additional place of business.

Click on Click here to copy address from Principal place of Business and GSTZen will fill in your additional place of business in one click.

- How to populate values from GSTR-9 Annual Return in GSTR-9C?

The Government Portal already provides values filed in GSTR-9 for the auditor to enter into form GSTR-9C. When you are using GSTZen, you will get these details in STEP 1 - Download Filed GSTR-9 Data. The table below describes values of GSTR-9C that come from GSTR-9.

| Form GSTR-9C | How to calculate from Form GSTR-9 |

|---|---|

| 5Q - Turnover as declared in Annual Return (GSTR9) |

Table 5N (Total Turnover including Advances) + Table 10 (Supplies / tax declared through Amendments, net of debit notes) - Table 11 (Supplies / tax reduced through Amendments, net of credit notes) |

| 7F - Taxable turnover as per liability declared in Annual Return (GSTR9) |

Table 4N (Supplies and Advances on which tax is to be paid) - Table 4G (Inward supplies on which tax is to be paid on reverse charge basis) + Table 10 (Supplies / tax declared through Amendments, net of debit notes) - Table 11 (Supplies / tax reduced through Amendments, net of credit notes) |

| 9Q - Total amount paid as declared in Annual Return (GSTR9) |

Table 9 Column 2 (IGST, CGST, SGST, Cess) + Table 10 (Supplies / tax declared through Amendments, net of debit notes) - Table 11 (Supplies / tax reduced through Amendments, net of credit notes) |

| 12E - ITC claimed in Annual Return (GSTR9) | Table 7J (Net ITC available for utilization - IGST + CGST + SGST + Cess) |

| 14S - ITC claimed in Annual Return (GSTR9) | Table 7J (Net ITC available for utilization - IGST + CGST + SGST + Cess) |