Filing GSTR 9 annual return through GSTZen

What is GSTR 9?

- GSTR 9 is an annual return all tax payers registered under GST should file, except for Composition Dealer and CTP/ISD/TDS/NRTP.

- GSTR 9 is a consolidated reporting of information already filed by the tax payer in GSTR 1 and GSTR 3B during the financial year.

- There is no provision to making amendments, corrections, or paying taxes in the Annual Return. Any changes will have to be made in respective GSTR 1 and GSTR 3B forms.

- Most of the details in the form can be auto-populated from details filed in a Tax Payer's GSTR 1 and GSTR 3B. Over and above the auto-populated details, the Tax Payer must provide additional information from their records to complete the form.

What are the Annual GST Returns and who must file them?

- Form GSTR 9 for Regular Registered Tax Payer, notified vide Notification 39/2018 Central Tax

- Form GSTR 9A for Composition Registered Tax Payer, notified vide Notification 39/2018 Central Tax

- Form GSTR 9C - Reconciliation Statement and Certification Format for Assessees having Aggregate Turnover exceeding Rs 2 Crores vide Section 35(5) of the CGST Act and notified vide Notification 49/2018 Central Tax.

What is GSTR 9 last date to file?

GSTR 9 due date for Financial Year 2017-18 is 31st December 2019. GSTR 9 due date for 2018-19 is extended to 31st March 2020.

What provisions in the Act and Rules concern the Annual Return?

In Section 44(1) of the CGST Act,

"Every registered person, other than

- an Input Service Distributor,

- a person paying tax under section 51 or section 52,

- a casual taxable person,

- a non-resident taxable person

shall furnish an annual return for every financial year electronically in such form and manner as may be prescribed on or before the thirtieth day of November following the end of such financial year.

Nil Annual Return: As long as person is registered under GST, even in case of nil GST liability for the year they will be required to file return."

"Every registered person, other than

- an Input Service Distributor,

- a person paying tax under section 51 or section 52,

- a casual taxable person and

- a non-resident taxable person,

shall furnish an annual return as specified under sub-section (1) of section 44 electronically in FORM GSTR 9 through the common portal either directly or through a Facilitation Centre notified by the Commissioner.

A person paying tax under section 10 (Composition taxable person) shall furnish the annual return in FORM GSTR 9A.

Every electronic commerce operator required to collect tax at source under section 52 shall furnish annual statement referred to in sub-section (5) of the said section in GSTR 9B."

What provisions in the Act and Rules concern the Annual Audit?

In Section 35(5) of the CGST Act,

"Every registered person whose turnover during a financial year exceeds the prescribed limit (2crores) shall get his accounts audited by a chartered accountant or a cost accountant and shall submit a copy of the audited annual accounts, the reconciliation statement under sub-section (2) of section 44 and such other documents in such form and manner as may be prescribed"

In Section 44(2) of the CGST Act,

"Every registered person who is required to get his accounts audited in accordance with the provisions of sub-section (5) of section 35 shall furnish, electronically, the annual return under sub-section (1) along with a copy of the audited annual accounts and a reconciliation statement, reconciling the value of supplies declared in the return furnished for the financial year with the audited annual financial statement, and such other particulars as may be prescribed."

In Rule 80(3),

"Every registered person whose aggregate turnover during a financial year exceeds two crore rupees shall get his accounts audited as specified under sub-section (5) of section 35 and he shall furnish a copy of audited annual accounts and a reconciliation statement, duly certified, in FORM GSTR 9C, electronically through the common portal either directly or through a Facilitation Centre notified by the Commissioner"

Clarification issued on GSTR 9

-

This form was amended by Notification 74

How to file GSTR 9?

-

Fill your Form GSTR 9

-

Upload and Submit return to the Government portal

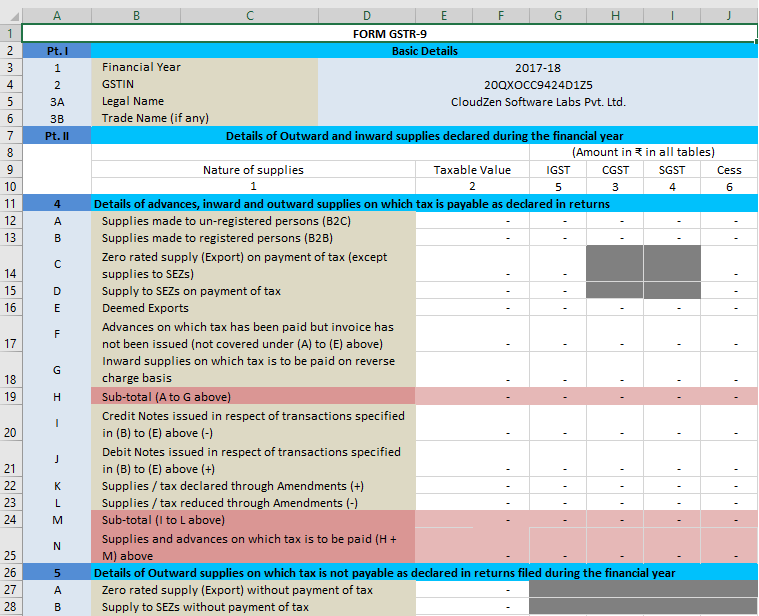

We at GSTZen provide GSTR 9 in Excel format as part of our Year-to-date GSTR-1 vs GSTR-2A vs GSTR-3B Report.

Here's a screenshot of GSTZen's GSTR 9 format in excel.

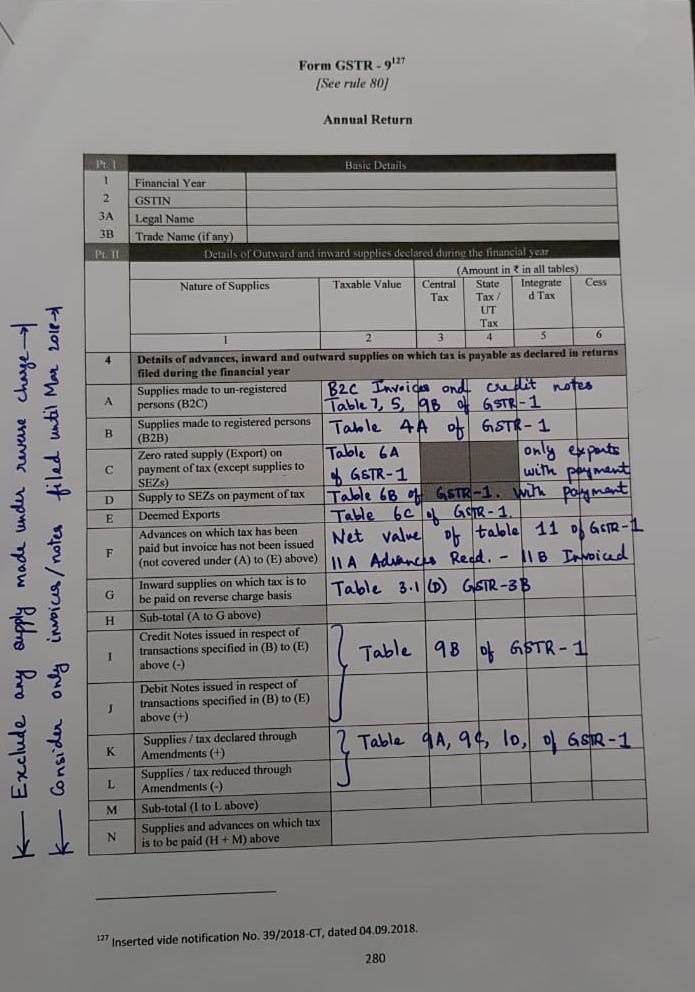

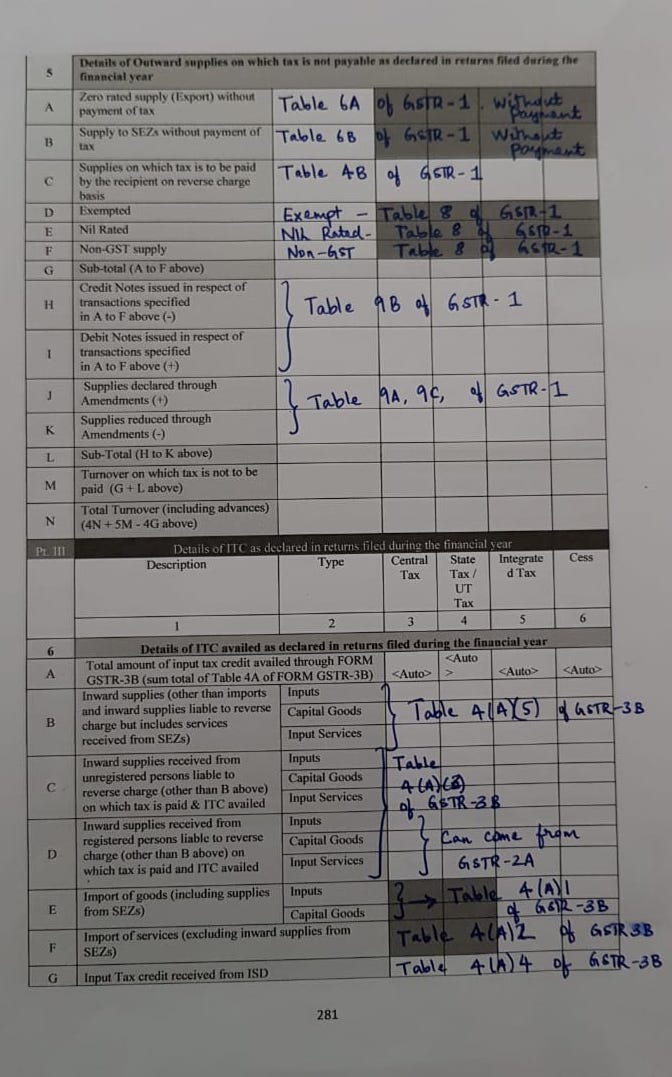

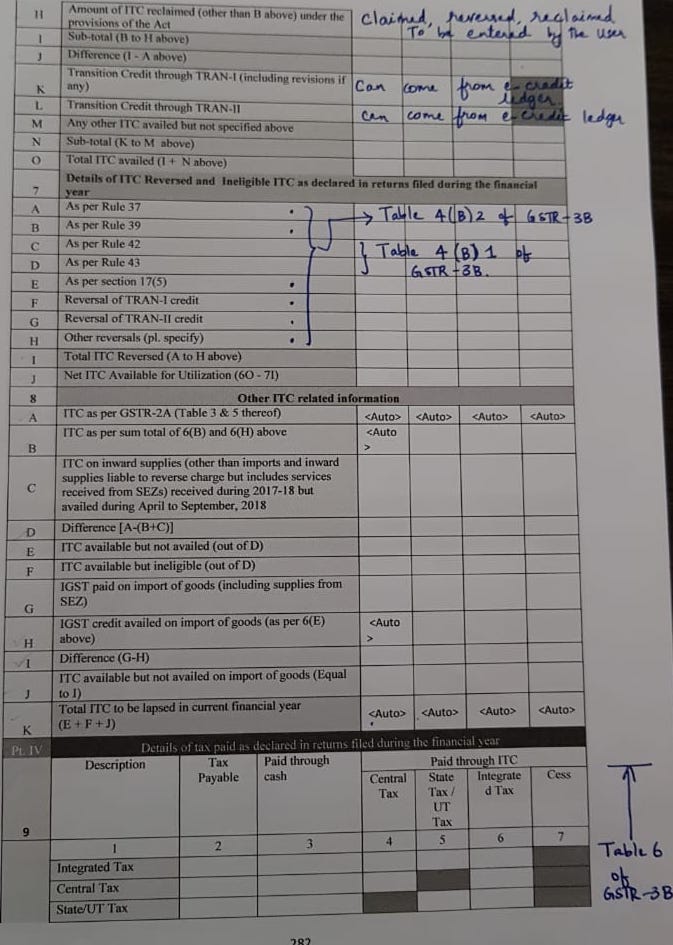

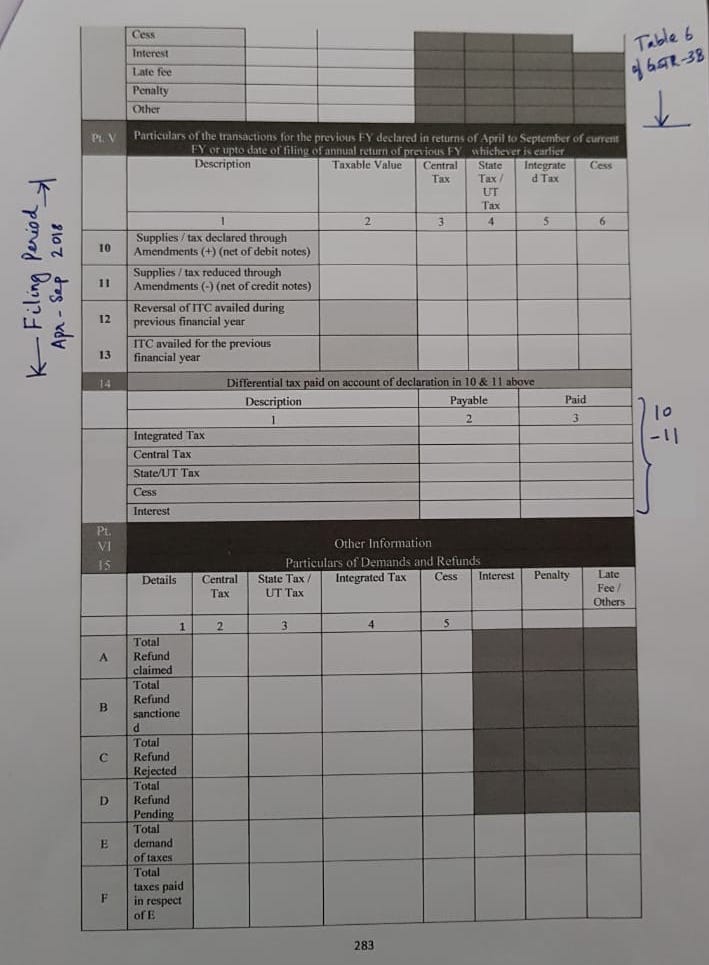

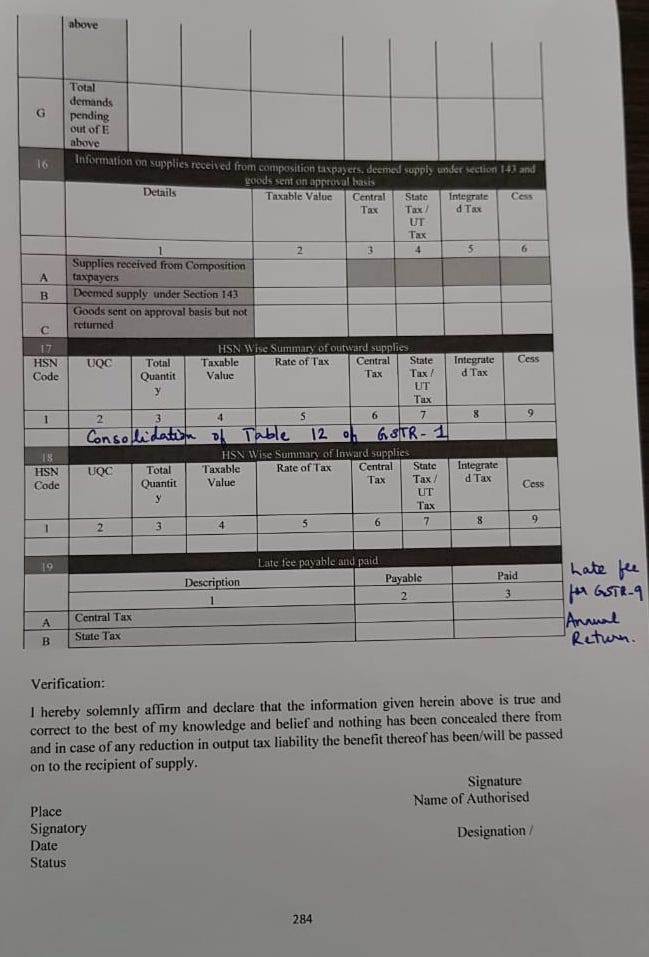

GSTR 9 format

Here is the link to download the GSTR 9 PDF

The GSTR 9 format PDF explains what information is auto-populated by GSTZen and how you may fill your GSTR 9 form.