GSTR 2A reconciliation - Frequently Asked Questions

-

How does GSTZen's reconciliation matcher work?

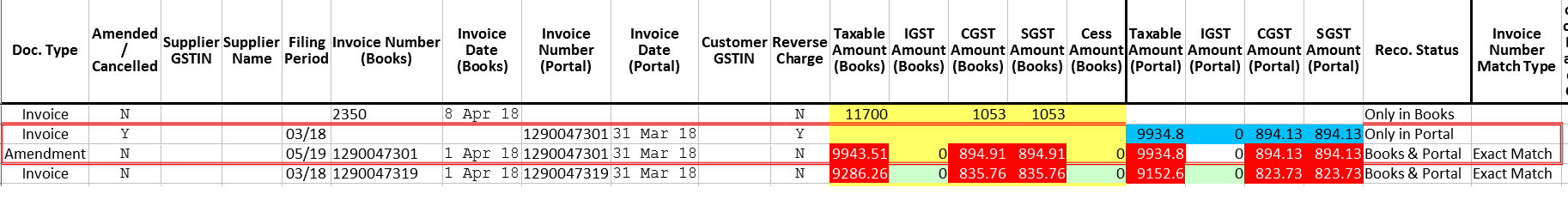

The reconciliation matcher takes into account Supplier's GSTIN, Invoice Number, Invoice Date, Invoice Amounts while trying to find the best match between Books / Purchase Register and Invoices uploaded by Suppliers in GSTR-2A. GSTZen provides the matcher's output in Excel format for you to review and analyze. Each row in the report is marked as as either

- Only in Books - This Invoice is present in your Purchase Register but could not be matched to any Invoice present in GSTR-2A.

- Only in Portal - This Invoice is present in GSTR-2A but could not be matched to any Invoice present in your Purchase Register.

- In Books and Portal - This Invoice in your Purchase Register is matched with an Invoice present in GSTR-2A.

-

The Invoice Number in our Books is different from what the Supplier uploaded in GSTR-2A. Can GSTZen match such invoices?

Yes. GSTZen goes beyond exact matching of Invoice numbers. The matcher uses Invoice numbers, dates, and amounts to find the best possible match.

-

My supplier files GSTR-1 on quarterly basis. They report Invoices dated April 2019 in their June 2019 GSTR-1 and such Invoices are visible in my June 2019 GSTR-2A. Will GSTZen match such Invoices?

Yes.

GSTZen stores all Invoices from GSTR-2A in a single database and tries to find the best match between Invoices in this database and your Purchase Register. The database will include Invoices visible in April 2019 as well as June 2019 GSTR-2A Returns and the matcher will use these invoices for reconciliation without any issue.

-

My supplier has not filed their GSTR-1 on time. They have filed their April 2018 GSTR-1 almost a year late. How does matching work in this case?

You should download your GSTR-2A after they have uploaded their GSTR-1. You can then run GSTZen's Intelligent Matcher and get the output you desire.

-

I have a Purchase Invoice dated March 2018 (FY 2017-18). I am claiming credit in April 2018 (FY 2018-19). How does reconciliation work in this case?

GSTZen's matcher uses Invoice Date in Books vs Invoice Date reported in GSTR-2A for reconciliation. When you are claiming credit for an invoice (or whether you are claiming credit at all) is a totally different matter unreleated to reconciliation. GSTZen's reconciliation report has a column called Record Date indicating the month in which you are claiming credit. You can filter using this parameter.

-

How does GSTZen handle Amendments during Reconciliation?

When a supplier amends an invoice, the original invoice is considered as cancelled or invalidated. GSTZen does not use the original invoice for reconciliation. GSTZen uses the Amendment for reconciliation.

Amendment in GSTR 2A reconciliation report

-

I see filing period as June 2017 in my Reconciliation Report. How is this possible? GST started only from July 2017, right?

In some situations where GSTZen needs a reference to an invoice and such an invoice is not available, GSTZen creates a dummy invoice with filing period June 2017. As an example, let us say that a Supplier A has originally issued an invoice to Recipient B. Later they amend the Invoice and issue it to you. In this case, when GSTZen downloads your GSTR-2A, the Amendment will be present, but the original invoice will not be present (since it was to a different recipient). In this case, GSTZen will create a dummy invoice with filing period June 2017.