How to prepare your business for eInvoicing

Overview

This article describes the legal provisions of eInvoicing, the obligations of a taxpayer, technology aspects of eInvoicing, how to be prepared to comply without any disruption to your business, and finally, how GSTZen will be a reliable partner in your eInvoicing journey.

The goal of this article is to explain the issues involved, provide solutions, and help you be prepared. To prepare yourself, we suggest that you

- Understand the eInvoicing legal provisions

- Understand the role of technology

- Analyze reliability and failure points of technology and services you use

- Get started early and be ready ahead of time

E-invoice meaning

An eInvoice is an electronic format of a Tax Invoice, with the fields organized in a well-defined official schema/format, and most importantly, is registered with a government-approved Invoice Registration Portal (IRP).

Legal Provisions and Obligations

| What are the relevant Laws/Rules? | Subsections (4) and (5) of CGST Rule 48 - Manner of issuing Invoice gives sanctity to an eInvoice. CGST Notification 70/2019 identifies taxpayers who are required to issue eInvoices. |

| Who is required to issue an eInvoice? | Taxpayers with aggregate turnover exceeding Rupees 100 Crores in a financial year |

| When do the provisions take effect? | April 1, 2020 |

| Which transactions require eInvoice? | The eInvoicing specification covers Business to Business (B2B) and Export Invoices |

| Where should eInvoices be uploaded? | Taxpayers should upload eInvoices to a Government-approved Invoice Registration Portal (IRP). CGST Notification 69/2019 announces www.einvoice1.gst.gov.in as the common portal or IRP for eInvoicing. |

| What is a taxpayer's obligation? | A taxpayer shall prepare invoices in electronic format in schema prescribed by the government and upload the invoice to an IRP and receive an acknowledgement of the same. |

Let us now take a look at the technology aspects of eInvoicing.

Technology aspects

It is very important to know that there will not be any portal set up by the Government for the taxpayer to punch in details of invoices in order to generate an eInvoice. All taxpayers will have to use some technology solution to prepare the eInvoice at their end and submit it to the IRP.

To create an eInvoice, a taxpayer should have the technology to prepare the eInvoice document as per the format/schema announced by the government, establish an encrypted session to the government-approved IRP, submit the eInvoice over this session, and receive a digitally-signed confirmation. This digital signature will serve as proof or acknowledgement that the taxpayer has uploaded their invoice as required by law.

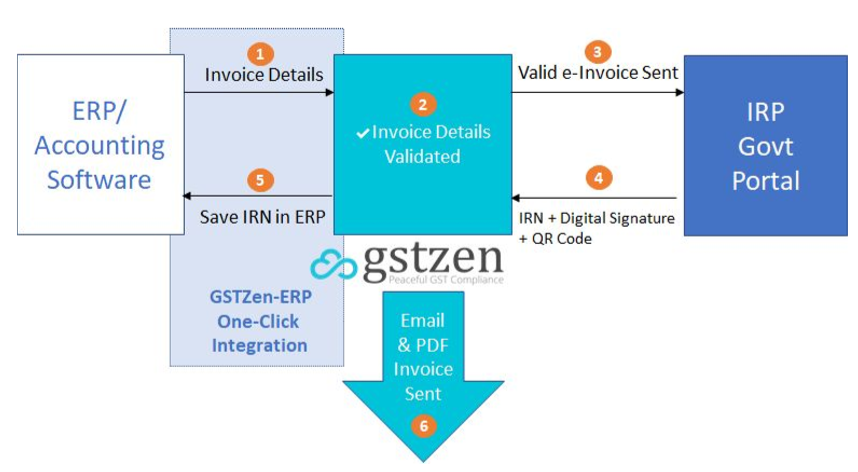

We expect businesses to use the services of software vendors to handle much of the complexity in creating and registering an eInvoice. The following image describes the workflow through a provider such as GSTZen.

E-invoicing process

User presses a button on GSTZen which initiates the eInvoicing work flowing consisting of the following steps:

- GSTZen software fetches invoice details from the user's ERP/Accounting software.

- The software validates the invoice details and prepares eInvoice in the prescribed format/schema.

- The software registers a valid eInvoice with the Government-approved Invoice Registration Portal (IRP).

- IRP replies with Invoice Reference Number (IRN), a unique number to identify the invoice, a digital signature of the Invoice's details, and a Quick Response Code (QR Code) containing key details of the Invoice.

- The software saves the acknowledgement in the ERP/Accounting application.

- The software generates PDF with QR Code and emails it to the recipient.

GSTZen's technology offering

eInvoice is a compliance requirement that stands in the critical path of making a sale and earning revenue. Keeping this in mind, GSTZen offers different solutions to meet the varied needs of businesses.

| Type of Solution | How does it work? | Whom does it fit? |

|---|---|---|

| Service | Business uploads invoice details to a secure location, and GSTZen handles every aspect of generating an eInvoice. | Works best for the service sector with high invoice volume (lakhs a month) such as software companies, banks, telcos, airlines. Invoices are usually created in batches once a month or once a day. |

| Software | Tightly integrated with ERP enabling 1-click eInvoice creation. Supported ERPs: Tally, SAP, Microsoft Dynamics. | Large corporates with invoices created as part of their day to day operations, usually related to supply of goods. eInvoices should be created in an instant and ensure no disruption to busines |

| Software | Excel-based utility to create eInvoices. Prepare Excel and generate eInvoices in 1-click. | Excel is universal in the world of finance and accounting. It is fairly easy for a user to extract a report from their ERP. Works when the number of daily invoices is about a thousand. |

| Software | Web-based utility/billing software to create one eInvoice at a time. | Works for businesses generating about tens of invoices a day. |

| Software | Mobile application to create one eInvoice at a time | Similar to the web-based application. More flexible in that it does not need a computer and can work from remote places. |

Understanding the failure modes/reliability of your technology solution

Since technology is essential to eInvoicing, it is important to fully understand the various components, identify how reliable they are, evaluate the effect of downtime, and have appropriate backup plans in place, if necessary. At GSTZen, we support the above-mentioned overlapping solutions keeping in mind various needs and the requirement of reliability.

We take a moment to highlight GSTZen's reliability. In 30 months of operations since July 1, 2017, we have never faced any period of downtime. We did have an incident on May 23, 2019, when our servers where not running fine and took longer than usual to respond to requests. This was only a partial degradation in performance lasting a few hours and our engineers identified the root cause, and resolved it quickly.

eInvoicing rollout timelines

| Date | Event |

|---|---|

| Jan 1, 2020 | Government Invoice Registration Portal (IRP) sandbox goes live for testing. Opens to taxpayers with turnover more than Rupees 500 crores in a financial year. |

| Jan 1, 2020 | GSTZen software offerings released in private testing mode to selected customers. |

| Jan 3, 2020 | GSTZen software offerings released publicly. |

| Feb 1, 2020 | Government Portal opens to taxpayers with the lower turnover threshold. |

| April 1, 2020 | eInvoicing legal provisions take effect. |

With the flip of a switch, eInvoicing will be required by law from April 1, 2020. When India moved to the GST regime on July 1, 2017, a business could function without much disruption and taxpayers made sale and issued invoices. They interacted with technology only at the time of filing returns. However, when it comes to eInvoicing, businesses that are not ready could come to a halt.

Moreover, April 1 marks the beginning of a financial year and businesses are busy with activities related to the previous year's closing. Therefore, we recommend everyone involved to be prepared much in advance and have an internal deadline of, say March 1, 2020, to be able to generate eInvoices for all transactions.

Get In touch with GSTZen

Reach out to us over the following means to help you with eInvoicing.

| Form | Click this link to fill in your details. We will get in touch with you. |

| support@gstzen.in | |

| Website | https://www.gstzen.in |

| Phone | +91 7406 441122 |

Annexure

eInvoicing preparedness checklist/template

- Name of the Entity

- Number of GST Registrations

- Number of locations that perform billing/invoicing

- Person/role responsible for eInvoicing rollout

Other people and roles whose cooperation and support is required

- Taxation Head

- IT Administrator

- ERP Vendor Contact

- eInvoicing Vendor Contact

Technology enumeration and trial

- Primary mode of preparing eInvoice (ERP Integration, Excel, etc.)

- Secondary mode of preparing eInvoice

- Backup mode of preparing eInvoice

- Observations during the trial period

- Areas that need improvement

- Contingency arrangements

Glossary of terms

An electronic format of an Invoice that is prepared as per prescribed schema and registered with the Government-approved IRP.

Invoice Registration Portal (IRP)

Website notified by the Government to receive and validate e-Invoices and issue Invoice Reference Number (IRN) and digital signature.

Invoice Reference Number (IRN)

A unique number to identify an invoice. It is a 64 digit alphanumeric string that encodes the Supplier's GSTIN, Financial Year, Document Type, and Invoice Number.

E-Invoice Quick Response Code (QRCode)

A QR code that provides key invoice parameters such as supplier, recipient, invoice number, invoice total, HSN code of the predominant line item.

E-Invoice digital signature

The contents of the eInvoice digitally signed by the government-approved IRP to indicate that an invoice is valid and has been received by the Government Portal. The taxpayer can use this as an acknowledgement.

About GSTZen

GSTZen is a user-friendly software for your GST compliance needs. You can use GSTZen to download GST and E-Way Bill Reconciliation and Reports, filing GST Returns and for complete e-Invoicing support.

We are proud to serve GST Taxpayers all over India. Budding entrepreneurs, Partnerships, Tax Consultants, Chartered Accountants, MSME companies, Corporate groups, Multinationals, Listed companies, Miniratna and Maharatna Public Sector Undertakings (PSUs), and Government entities have trusted GSTZen for their GST Compliance needs.

Here are some numbers to illustrate how we are doing

- Users from every state of India

- We process about 10 Lac Invoices each day

- More than half a lac GST Reports downloaded

- More than 10 Crore invoices saved in GSTZen

- Thousands of Annual Returns filed